“Good news” came from the public offering industry. Huaxia China Communications Construction Expressway Closed Infrastructure Securities Investment Fund (hereinafter referred to as “China Communications Construction REIT”) was officially approved recently, becoming the 12th public offering REITs product. It has been 10 months since the first publicly offered REITs products were established and launched in June 2021. According to public data, among the 11 publicly offered REITs products that have been listed so far, the secondary market transaction prices of 9 products have risen during the year. In the context of the sound development of related products, investor demand has further increased, and the regulatory authorities have recently indicated that they are studying and formulating rules for the expansion of infrastructure REITs, and further promote the pilot of infrastructure REITs. In the eyes of industry insiders, this move is conducive to the revitalization of stock assets and the integration of industry and finance between stock assets and new investment, and to improve investment efficiency.

Public REITs add “new recruits”

The family of publicly offered REITs welcomes new members again. On March 24, China AMC released the fund contract, inquiry announcement and other information of China AMC CCCC REIT. On the evening of the previous day (i.e. March 23), China AMC also officially announced that China AMC China Communications Construction REIT was approved, becoming the 12th approved public offering REITs product.

According to the official website of the Shanghai Stock Exchange, the Huaxia China Communications Construction REIT project was accepted on November 15, 2021, and approved on March 16; and this is the second company approved by China Asset Management after the Huaxia Yuexiu Expressway REIT. Publicly offered REITs.

According to the summary of the product information of China Communications Construction REIT, the fundraising share of the product is 1 billion yuan, but the specific fundraising time has not been disclosed. In addition, according to the inquiry announcement of the product, the inquiry range of Huaxia CCCC REIT is 8.467 yuan/unit – 10.067 yuan/unit, and the subscription price of fund shares will be finally determined through offline inquiry; the inquiry time will be determined. 9:00-15:00 on March 29th. In addition, China AMC China Communications Construction REIT will be jointly managed by three fund managers. The proposed fund managers are Mo Yifan, Yu Chunchao and Wang Yue.

According to the introduction of China AMC, China AMC REIT is the first state-owned expressway REITs project in the industry, with the Wuhan-Shenzhen Expressway Jiayu-Tongcheng section in Hubei Province as the underlying asset. According to the data, the Jiatong Expressway project is generally located to the east of the Beijing-Hong Kong-Macao Expressway. It is an important traffic artery and economic corridor of the Yangtze River Economic Belt radiating southward to the Guangdong-Hong Kong-Macao Greater Bay Area. An important economic area in the Yangtze River Economic Belt; Wushen Expressway connects Wuhan City Circle, Changzhou-Zhuzhou-Tanzhou City Circle and Pearl River Delta Economic Circle. The cities along the line have a large population and developed economy, and the demand for road network traffic is strong.

Performance is still optimistic in a volatile market

Looking back, since the first batch of 9 public REITs products were established and listed in June 2021, in December 2021, the listing of CCB Zhongguancun Industrial Park REIT and Huaxia Yuexiu Expressway REIT also brought fresh “blood” to the public offering REITs team. “. In addition, according to the official websites of Shanghai and Shenzhen, three products, including Penghua Shenzhen Energy Clean REIT, Guotai Junan Lingang Dongjiu Intelligent Manufacturing Industrial Park REIT, and Guojin Railway Construction Chongqing Yusui Expressway REIT, have already submitted applications.

After a period of operation, even in the volatile market during the year, the performance of publicly offered REITs has been quite impressive. According to Flush data, on March 24, the three major A-share stock indexes all closed down, and among the 11 publicly offered REITs products that have been listed, 4 products closed up. Judging from the year-to-date data, the secondary market transaction prices of 9 products have risen during the year.

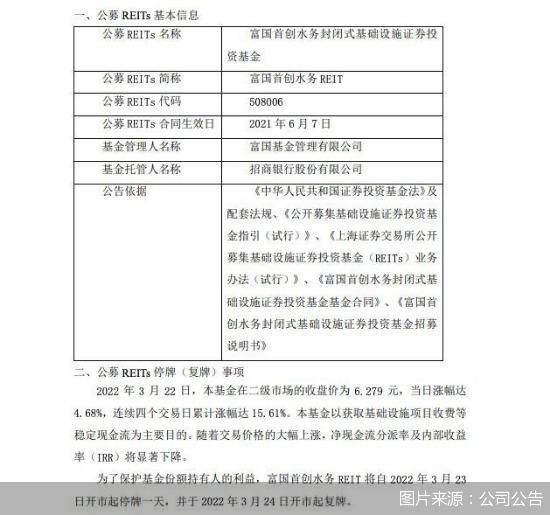

However, there may also be risks if the increase is too large. Looking back on the past week, some publicly offered REITs products have issued announcements on suspension and resumption of trading and trading risks due to the excessive premium. For example, on March 23, Fuguo Capital Water REIT and Hongtu Innovation Yantian Port Warehousing and Logistics REIT issued announcements on suspension and resumption of trading, suspension of transfers and risk warnings.

Among them, Fuguo Capital Water REIT has increased by 15.61% for four consecutive trading days as of March 22. In order to protect the interests of fund share holders, the fund manager decided to suspend trading for one day on March 23 and suspend the shares of the Fund Connect platform. Transfer business. Hongtu Innovation Yantian Port Warehousing and Logistics REIT also has a cumulative increase of 13.19% for three consecutive trading days as of March 22. The fund manager decided to suspend trading and suspend fund access between the opening of the morning market on March 23 and 10:30. Platform share transfer business. In addition to the above two products, CCB Zhongguancun Industrial Park REIT, Bosera China Merchants Shekou Industrial Park REIT, Huaan Zhangjiang Guangda Park REIT and many other products have also issued suspension and resumption announcements or premium risk warnings during the year.

Regarding the obvious increase in public offering REITs, Chen Li, director of the Chuancai Securities Research Institute, commented that public offering REITs are in their infancy and their overall scale is relatively small. As a new investment product, they are relatively scarce in the market, and there may be an imbalance between supply and demand. Triggered the public offering of REITs products to be snapped up and hyped by investors in the market. Secondly, there are some unstable factors on the periphery of the stock market. At the same time, the trend of A-shares is relatively volatile, and the market’s risk aversion is increasing. Public REITs can not only obtain long-term and reliable growth dividend income, but also obtain profits from the increase in the value of the secondary market. Therefore, it has been sought after by investors in the near future.

Supervision helps public REITs expand their offerings

“In fact, publicly offered REITs are a supplementary market-oriented product to my country’s active fiscal policy, and have a positive role in promoting economic development, especially the improvement of infrastructure”, Dean of China (Hong Kong) Financial Derivatives Investment Research Institute Wang Hongying said with emotion.

At the same time as the annual reports of public funds were disclosed, Bosera China Merchants Shekou Industrial Park REIT also recently released the first annual report of public REITs. According to the annual report data, as of the end of 2021, Bosera China Merchants Shekou Industrial Park REIT has achieved a cumulative revenue of 76.9142 million yuan, but due to the impact of the epidemic in Guangzhou and Shenzhen in the first half of the year and the national macro-policy control, the lease renewals of some customers in the park are lower than expected, and the cumulative budget completion rate for the whole year 95%. In addition, the fund distributed 24.6591 million yuan in dividends in December 2021, with a dividend of 0.274 yuan for every 10 fund shares.

It is worth mentioning that under the background of the good operation of related products, the China Securities Regulatory Commission also recently stated that it will further promote the pilot project of infrastructure REITs, improve the system and mechanism, expand the scope of the pilot, and accelerate the implementation of the pilot project of public offering REITs for affordable rental housing. At the same time, the China Securities Regulatory Commission is also studying and formulating rules for the expansion of infrastructure REITs.

What impact will the expansion of public REITs have? In Chen Li’s view, the expansion of public REITs is of great significance for innovating investment and financing mechanisms, broadening equity financing channels, and enhancing the capital market’s ability to serve the real economy. It is conducive to the revitalization of stock assets and the integration of stock assets and new investments. , improve investment efficiency.

Wang Hongying also mentioned that, judging from the pilot situation of public REITs in the early stage, the overall operation is good, but this has also led to more and more funds being sought after, making the supply and demand imbalance, and there is a certain bubble in the market. In this context, increasing the supply of high-quality public fund products to maintain market balance can make the public REITs market operate steadily. At the same time, it is also of sustainable significance for the improvement of infrastructure and the stable growth of China’s economy.

Beijing Business Daily reporter Liu Yuyang Li HaiyuanReturn to Sohu, see more

Editor:

Disclaimer: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.