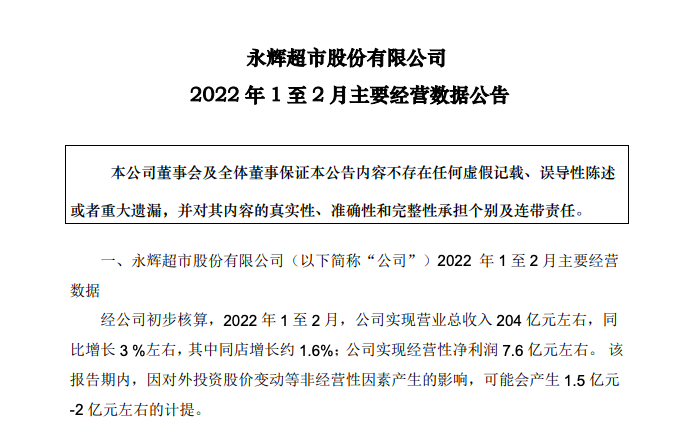

March 8th,Yonghui SupermarketThe main operating data for January-February 2022 was released. The company achieved a total operating income of about 20.4 billion yuan, a year-on-year increase of about 3%, of which the same store increased by about 1.6%;net profitAbout 760 million yuan.

Yonghui SupermarketSaid that during the reporting period, due to the impact of non-operating factors such as changes in the stock price of foreign investment, there may be a provision of about 150 million yuan to 200 million yuan.

on the secondary market,Yonghui SupermarketToday’s daily limit bucked the trend. As of today’s close, Yonghui Supermarket closed up 9.91% at 3.66 yuan per share, with a total market value of 33.2 billion yuan.

performanceThe notice shows that the company expects a net loss of 3.93 billion yuan in 2021, a decrease of 5.72 billion yuan compared with the same period last year; it is expected to be attributable to listed companies in 2021shareholderNet loss after deducting non-recurring gains and losses was 3.89 billion yuan, a decrease of 4.47 billion yuan compared with the same period of the previous year.

Regarding the reasons for the pre-loss in performance, Yonghui Supermarket said that in the face of changes in the external environment such as the normalization of new crown epidemic prevention and control and fierce market competition, the company took the initiative to adopt the strategy of adjusting the structure, reducing inventory and maintaining the market.Operating incomedown 3.8% year-on-year, grossinterest rateA year-on-year decrease of 2.4%; around the core strategy of “fresh food-based, customer-centric omni-channel digital retail”, the company invested 670 million yuan in technology throughout the year, and its online business lost 840 million yuan.

(Article source: CDC Finance)