On June 20, Junshi Bio-U (SH688180, stock price 80.37 yuan, market value 73.2 billion yuan) announced a reply to the Shanghai Stock Exchange’s review inquiry letter for its 3.969 billion yuan fixed increase plan.

In the review inquiry letter, the Shanghai Stock Exchange focused on requiring Junshi Bio to provide supplementary explanations on five aspects, including the operation situation, the fundraising project, the scale of financing, and the financial investment.

Among them, the core product of PD-1 toripalimab has attracted the attention of the Shanghai Stock Exchange. Junshi Bio was asked to explain the reasons for the decline in the product’s revenue last year, as well as the company’s R&D pipeline layout and R&D investment in key projects. .

In the reply letter, Junshi Biotech also explained the reasons for the decline in sales of the company’s core product PD-1 toripalimab in 2021, and stated that the impact of related unfavorable factors will gradually decrease. Domestic sales will gradually improve.

At the beginning of March this year, Junshi Bio released the “2022 A-Share Issuance Plan to Specific Objects”, which plans to raise no more than 3.98 billion yuan for innovative drug research and development projects, Shanghai Junshi Biotechnology Headquarters and research and development base projects. Compared with the preplan, in the application draft of the fixed increase prospectus released on June 20, the amount of funds raised was slightly adjusted, from not more than 3.98 billion yuan to not more than 3.969 billion yuan.

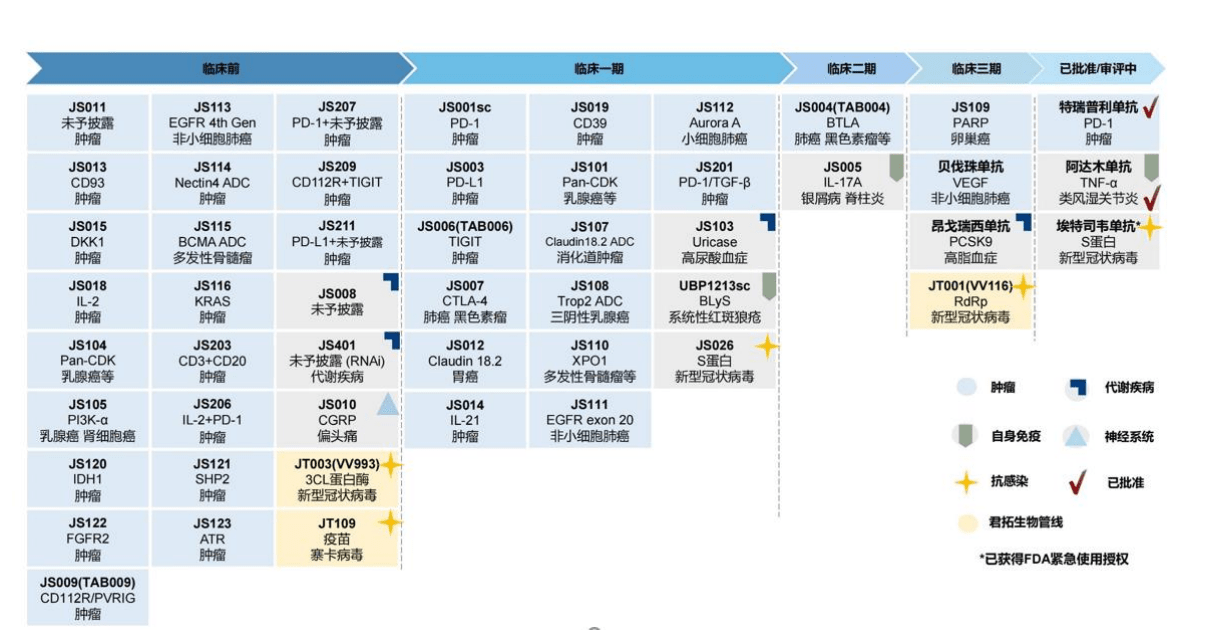

Image source: Screenshot of Junshi Biotech’s prospectus

According to the information disclosed by Junshi Bio, the company plans to use the raised funds of 3.671 billion yuan for clinical research and pre-clinical research of innovative drugs. (BTLA monoclonal antibody) domestic and overseas phase III clinical research and development projects, JS111 (targeted small molecule inhibitor) domestic and overseas clinical research and development projects, etc.

Photo source of the research and development progress of Junshi Bio’s products under research: Junshi Bio’s reply to the inquiry letter

It is worth noting that among these key R&D pipelines, Junshi Biosciences has planned international multi-center clinical research. The Shanghai Stock Exchange therefore requires the company to explain the feasibility and necessity of planning international multi-center clinical research.

In response, Junshi Bio responded that the competition in the domestic tumor immune drug market is becoming more and more intense, the market space in Europe and the United States is vast, and there are also huge unmet clinical needs in the global market. It is necessary for the company to seek innovative drug products.” out to sea”. Junshi Bio also stated that the company plans international multi-center clinical research and submits a drug marketing application to the FDA based on this relevant research, which is the most secure and economical way to apply.

In the audit inquiry letter, the Shanghai Stock Exchange also focused on Junshi Bio’s business status of “burning money and lacking gold”: as of the end of the first quarter of 2022, Junshi Bio has not yet achieved profitability and has accumulated unrecovered losses of 4.785 billion yuan. At the same time, the company’s R&D investment continued to increase, and the annual investment in R&D was 2.069 billion yuan, a year-on-year increase of 16.35%.

The Shanghai Stock Exchange requires Junshi Bio: “Combining the company’s overall consideration of R&D progress and R&D layout, the sharp decline in sales of major products after the listing, the huge investment in research projects, and the continued large losses, it shows that this fundraising project has more plans at the same time. Reasons and rationality for an early R&D pipeline and some new R&D pipelines compared to the previous fundraising project.”

In response, Junshi Bio responded that although high-intensity R&D investment will lead to large losses in the early stage of development, it is the key to maintaining the company’s core competitiveness. The company will benefit as more and more products under development are approved by the State Food and Drug Administration and the FDA. Other listed companies in the same industry, such as BeiGene and Cinda Bio, have maintained high-intensity R&D investment in multiple R&D pipelines despite continuous large losses. If the company fails to plan multiple early R&D pipelines in advance and enrich the depth and breadth of the company’s pipeline of products under development, it will gradually lead to a disadvantage in the market competition in the domestic innovative drug industry.

Funds raised will still focus on PD-1

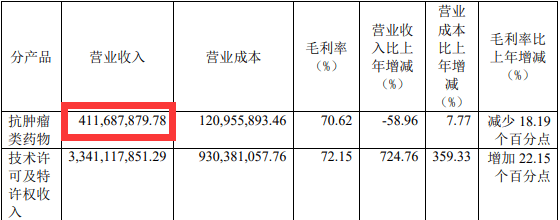

As the only drug currently approved by Junshi Bio, PD-1 toripalimab had a total operating income of 412 million yuan last year, a year-on-year decrease of 58.96%, a decrease of nearly 600 million yuan from 1.003 billion yuan in 2020. Toripalimab had its lowest annual sales since its approval in late 2018.

Image source: Junshi Biological Annual Report

Junshi Bio attributes the decline in Toripalimab’s revenue to three factors. First, the price of Toripalimab was reduced by more than 60% after it entered the medical insurance system; second, the head of the company’s commercialization team and internal marketing staff Several rounds of adjustments have been made; third, the commercialization of PD-1 products in the domestic market is becoming increasingly competitive.

The decline in revenue from the core product Toripalimab has also attracted the attention of the Shanghai Stock Exchange, and Junshi Bio has been required to “combined with the factors that lead to the decline of Toripalimab’s revenue in 2021, to analyze whether the revenue of related products will continue to exist. Downward trend”.

Junshi Bio disclosed in the announcement that in the first quarter of 2022, the company’s toripalimab sales revenue increased by 211.69% from the fourth quarter of 2021, and increased by 34.05% from the first quarter of 2021. The sales activities in the domestic market gradually came out of the trough. In response to the future sales revenue trend of Toripalimab, Junshi Bio said that in the context of the year-by-year expansion of the PD-1 market, with the gradual stabilization of the company’s commercialization team, Toripalimab will continue to be included in the National Medical Insurance The price reduction in the catalogue has slowed down significantly compared with the initial inclusion, and in the future, more major indications will complete Phase III registration clinical studies and enter the commercialization approval stage. The situation gradually improved.

The announcement shows that Junshi Bio plans to use the raised funds of 860 million yuan to invest in the follow-up domestic and overseas clinical research and development of JS001 (PD-1 toripalimab). One of the R&D pipelines invested by Junshi Bio.

In the inquiry letter, the Shanghai Stock Exchange also asked Junshi to explain the company’s consideration of the R&D pipeline layout and key projects of R&D investment. In this regard, Junshi Bio believes that given that PD-1 monoclonal antibody is the cornerstone drug of tumor immunotherapy, the company’s strategy in the R&D pipeline layout of other anti-tumor products is mainly macromolecular drugs centered on toripalimab , supplemented by small molecule drugs, and actively explore combination drugs, in order to achieve synergistic anti-tumor effect.

First of all, in order to solve the problem of drug resistance after PD-1 treatment, the company actively explores the design of reasonable combination therapy strategies according to the characteristics of the patient’s immune microenvironment, such as the company’s research products JS004, JS006, JS009 and other combination therapy with toripalimab.

Secondly, in order to solve the problem of cold tumors in tumor immunotherapy, the company has developed a number of projects for the normalization of microcirculation blood vessels in the immune microenvironment, such as JS013, JS019 and other products that target high expression of microenvironmental microvessels.

Third, in order to solve the source problem of tumor immunotherapy, that is, many patients lack or have less tumor-specific T cells and cannot respond to immunotherapy. In this regard, JS014, JS018 and other products in the company’s pipeline can activate T cells from the source. JS014 has a good synergistic effect with toripalimab, which can increase lymphocyte infiltration in the tumor microenvironment.

daily economic news

daily economic newsReturn to Sohu, see more