George Mallory’s correspondence with his wife published

The University of Cambridge publishes the correspondence between Everest pioneer George Mallory and his wife Ruth. Mallory

“Elas Brilham” at the Teatro Oficina do Estudante at Iguatemi Campinas – MONDO MODA

The musical spectacle “They Shine” will be on two weekends (from April 26th to 28th and from

“The traffic lights will not affect the Soli”

Everything has a price, especially things that don’t cost anything. Art van Rheyn You have activated an

Popular Stories

EOS Drops 14% Down From Investing.com

Investing.com – EOS was trading at $0.8090 at 03:46 (01:46 GMT) on the Investing.com Index on Friday,

George Mallory’s correspondence with his wife published

The University of Cambridge publishes the correspondence between Everest pioneer George Mallory and his wife Ruth. Mallory

“Elas Brilham” at the Teatro Oficina do Estudante at Iguatemi Campinas – MONDO MODA

The musical spectacle “They Shine” will be on two weekends (from April 26th to 28th and from

“The traffic lights will not affect the Soli”

Everything has a price, especially things that don’t cost anything. Art van Rheyn You have activated an

Travel & Explore the world

EOS Drops 14% Down From Investing.com

Investing.com – EOS was trading at $0.8090 at 03:46 (01:46 GMT) on the Investing.com Index on Friday,

George Mallory’s correspondence with his wife published

The University of Cambridge publishes the correspondence between Everest pioneer George Mallory and his wife Ruth. Mallory

“Elas Brilham” at the Teatro Oficina do Estudante at Iguatemi Campinas – MONDO MODA

The musical spectacle “They Shine” will be on two weekends (from April 26th to 28th and from

“The traffic lights will not affect the Soli”

Everything has a price, especially things that don’t cost anything. Art van Rheyn You have activated an

Dances, quizzes, raffles and more

50 years full of ups and downs – a happiness that definitely needs to be celebrated! If

Nacon House Milan, where technology and sociality come together…

Milanowith its vibrant energy and constant innovative spirit, has seen emergence during the Design Week this year

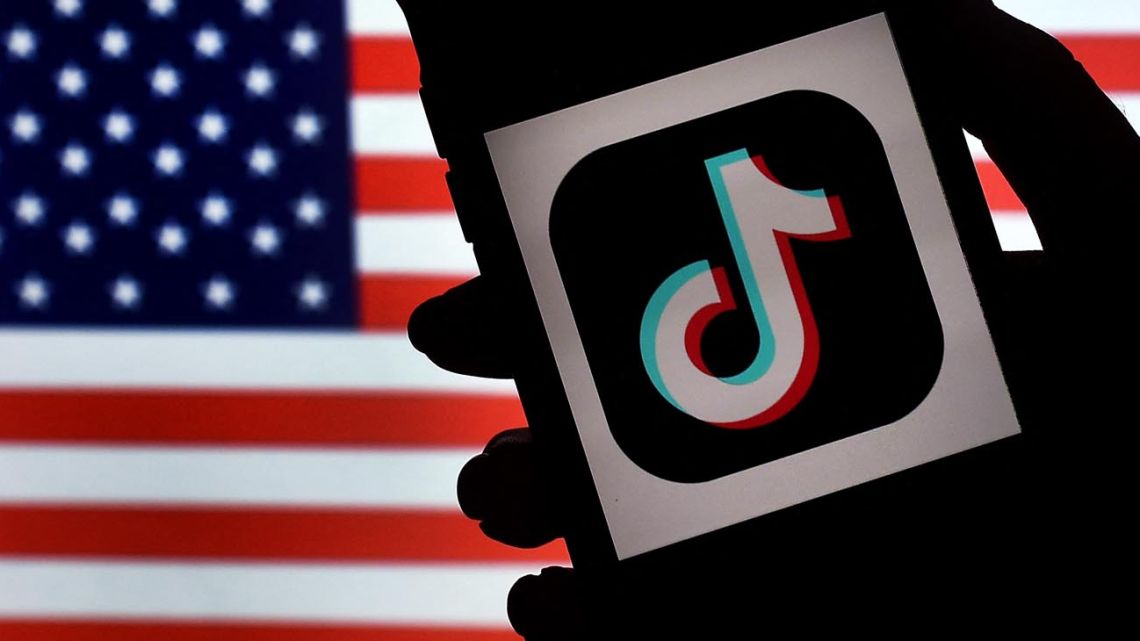

‘We’re not planning to sell’: TikTok’s parent company defies US ban threats

The Chinese parent company of TikTokByteDance, clarified that it has no plans to sell the prestigious content

Explore and travel the world

“It is not the first, and it will not be the last”

one fruit can kill 20 people

El navegador web no es compatible | CNN