For stock trading, you can look at the research report of Jin Qilin analysts. It is authoritative, professional, timely and comprehensive, helping you tap potential opportunities!

Source: Securities Daily

Our reporter Liu Huan

Following *ST Kaile,*ST Jinzhou(rights protection),*ST XiyuanFinally, another delisted stock with a face value was settled.

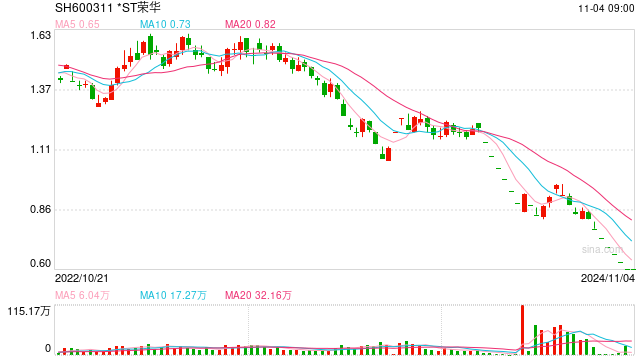

March 2,*ST RonghuaIt closed at 0.61 yuan per share, a drop of 4.69%, and the total market value fell to 406 million yuan. On the evening of the same day, *ST Ronghua announced that the company had received the “Prior Notice” issued by the Shanghai Stock Exchange, because the company’s stock has been below 1 yuan for 20 consecutive trading days from February 3 to March 2, 2023. Termination of listing conditions, the company’s stock has been suspended since the market opened on March 3. The Shanghai Stock Exchange will make a decision to terminate the listing of the company’s shares in accordance with relevant regulations.

Behind the continued decline in stock prices, it may be inseparable from *ST Ronghua’s performance.

According to *ST Ronghua’s previously disclosed performance loss announcement, the company expects that the net profit attributable to shareholders of listed companies in 2022 will be about -380 million yuan, and the net assets at the end of the period will be about -436 million yuan. If the audited net assets at the end of the period continue to be negative in 2022, the company will hit the financial indicators for mandatory delisting, and the company’s stock may be terminated from listing.

Since the announcement of the pre-loss performance for 2022, the stock price of *ST Ronghua has continuously dropped by the limit, and soon fell below the “warning line” of 1 yuan.

“Under the new delisting regulations, investors pay more attention to the company’s operation and financial status. Listed companies facing delisting risks such as financial and major violations are more likely to cause investors to ‘vote with their feet’.” An industry insider who wished to be named said in an interview with a reporter from the Securities Daily.

Since the beginning of this year, the stock prices of *ST Kaile, *ST Jinzhou, and *ST Xiyuan have been lower than 1 yuan for 20 consecutive trading days, touching the “1 yuan delisting” standard. Among them, *ST Kaile was terminated by the exchange on February 8, and its stock was delisted on February 15.

In 2021, *ST Ronghua’s net assets will be -80.4218 million yuan. In 2022, *ST Ronghua’s net assets at the end of the period are expected to be approximately -436 million yuan. Leasing the coke production line of the controlling shareholder Ronghua Industry and Trade to carry out the coke business is a major reason for the “drag” *ST Ronghua’s net asset index.

*ST Ronghua’s main business is gold mining, metallurgy, processing and sales of Jinshan Gold Mine and Jingxin Gold Mine under Zheshang Mining. Due to the low ore grade and low output rate, the performance continued to suffer losses in 2018 and 2019. In order to seek new profit growth points, *ST Ronghua rented a coke production line with an annual output of 1.5 million tons from Ronghua Industry and Trade in 2019 at a rent of 24 million yuan per year to develop the dual main business of coke and gold.

At the initial stage of leasing, *ST Ronghua invested 203 million yuan to upgrade the coke production line. However, it has been in a state of loss since it was put into production. In reply to the information disclosure supervision work letter for the third quarter of 2022 issued by the Shanghai Stock Exchange, the company stated that from the start of production in April 2020 to the third quarter of 2022, the cumulative loss of the above-mentioned production lines was 414 million yuan.

Lou Xiaoyun, a lawyer from Shanghai Haihui Law Firm, said in an interview with a reporter from Securities Daily: “*ST Ronghua’s coke production line is almost costly every year, but the listed company has to pay the controlling shareholder for lease fees and maintenance costs. This is already serious. Infringed upon the interests of small and medium shareholders.”

It is worth noting that in the risk warning announcement issued by *ST Ronghua on March 2, the company stated that it will no longer lease the coke production line with an annual output of 1.5 million tons of Ronghua Industry and Trade from January 1, 2023. During the lease period, the assets formed by the company’s investment in the transformation of the coke production line will have a net asset value of approximately 164 million yuan as of December 31, 2022, which will be repurchased by Ronghua Industry and Trade. There is great uncertainty about whether Ronghua Industry and Trade can pay the asset repurchase funds on time, and the asset repurchase cannot increase the company’s net assets at the end of 2022.

“Providing three joint liability guarantees for Ronghua Industry and Trade and its related parties’ borrowing violations is also a major factor in reducing the net assets of *ST Ronghua.” Lou Xiaoyun told reporters.

In 2017, *ST Ronghua provided three joint liability guarantees for Ronghua Industry and Trade and its related party Ronghua Agriculture’s financial lease and loan matters, with a total guarantee amount of 450 million yuan. The company stated in its reply to the 2021 annual report information disclosure regulatory inquiry letter that since the court’s judgment, the company has accrued an estimated loss of 442 million yuan.

Massive information, accurate interpretation, all in the Sina Finance APP

Editor in charge: He Songlin