Original title: Focus on the outlet | Important nodes and popular main lines in 2022 are here! Thank you for taking this A-share investment guide!

In 2021, the A-share market successfully concluded. The Shanghai Stock Exchange, Shenzhen Component Index, and ChiNext Index rose 4.8%, 2.67%, and 12%, respectively, for three consecutive years. Three consecutive years of the Shanghai Composite Index’s annual line even broke the 28-year record of dust in the A-share market. Looking back at the A-share market this year, it is indeed very willful. From the group carnival at the beginning of the year to the style reversal at the end of the year, from institutions to individuals, several companies are happy and some are worried. After the holiday, how will the market style be interpreted in 2022? Can the new energy track continue to be strong? Can consumption and medicine start the valuation restoration market? Send you a copy of A-share investment guide for 2022, thank you for taking it away!

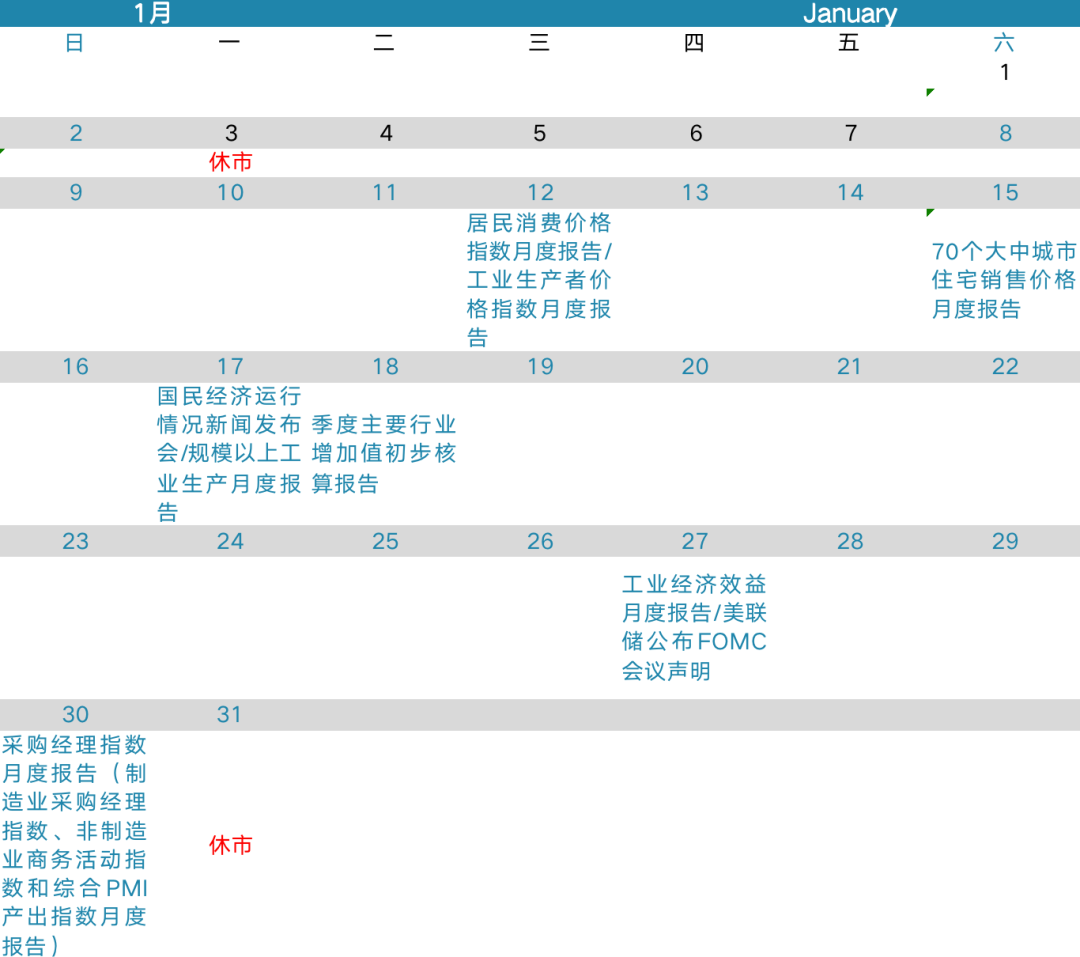

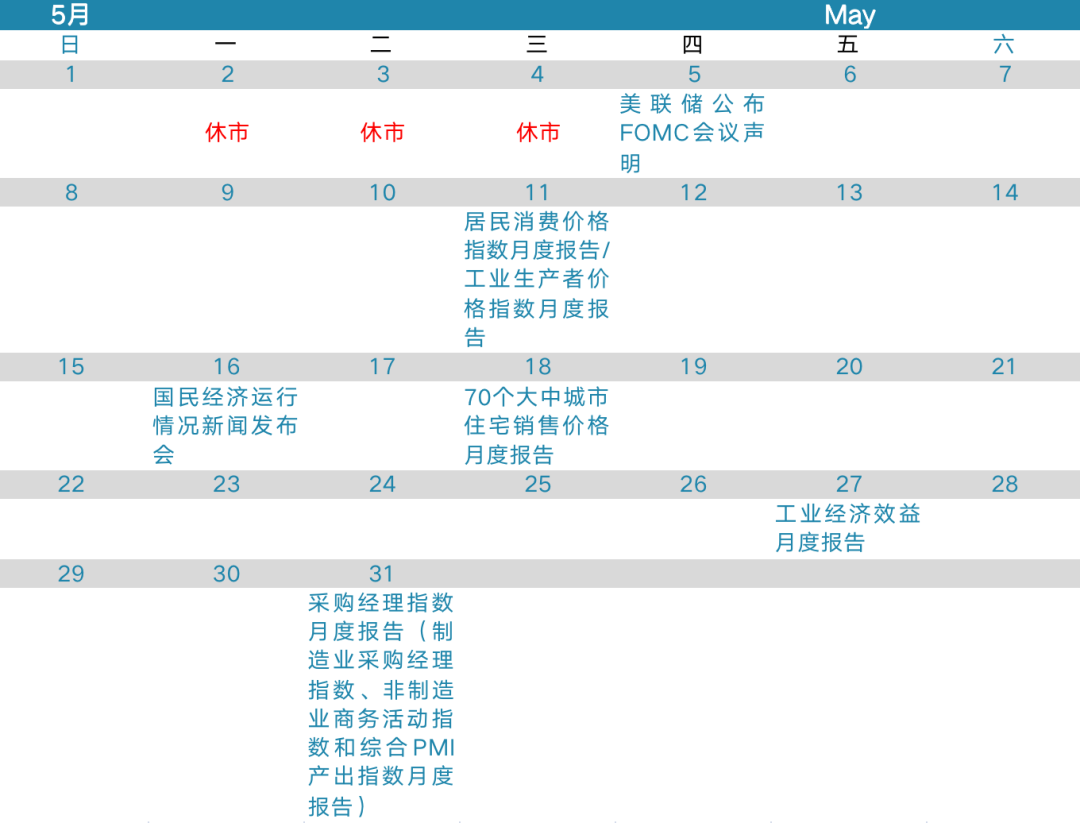

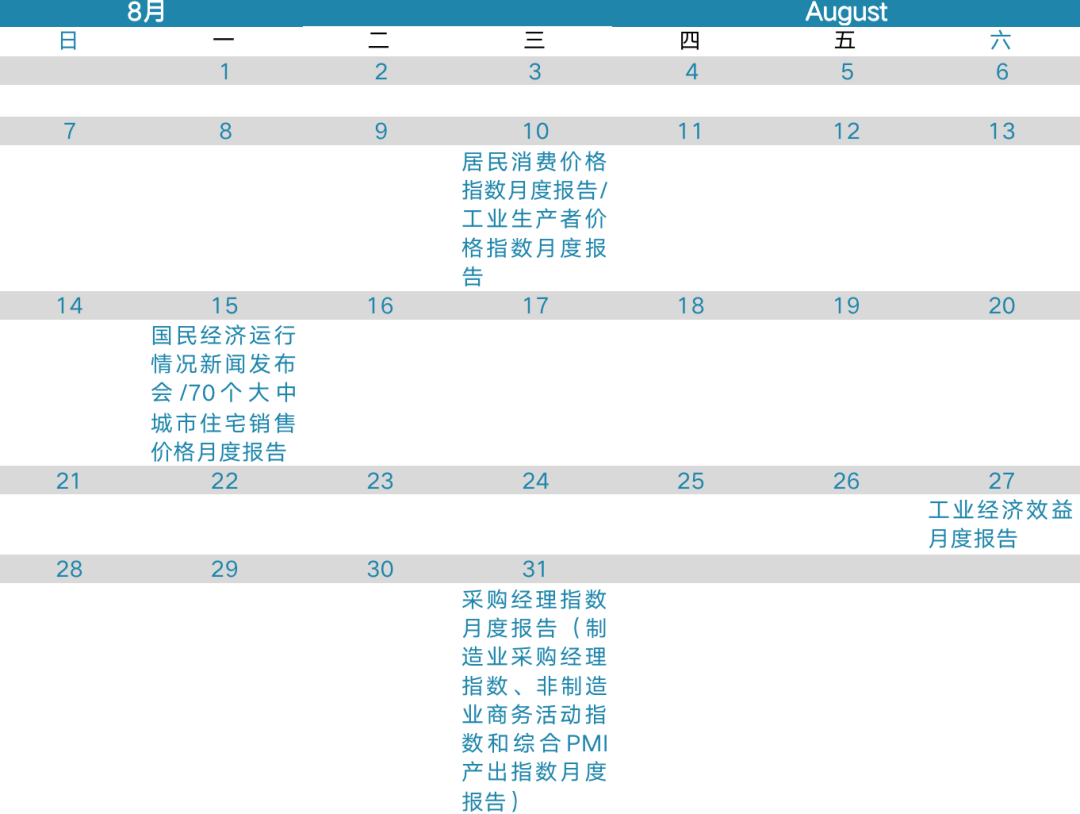

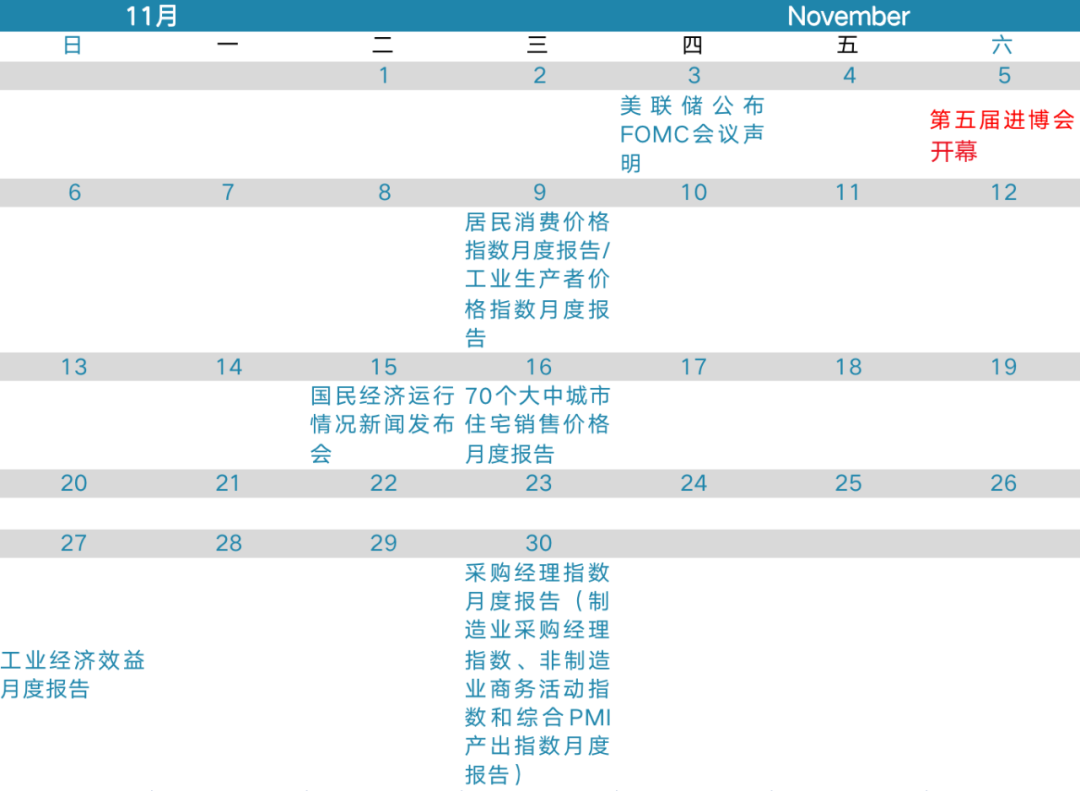

Grasp this year’s important nodes

The trend of the capital market in 2022 is also worth looking forward to. Investors can assist decision-making by paying attention to regularly announced economic data, important conferences, and major industrial events. Please check this economic calendar↓↓

(The data release time and meeting time may still be adjusted, please pay attention to the news of related parties, and the actual situation shall prevail)

Is there a good start after New Year’s Day?

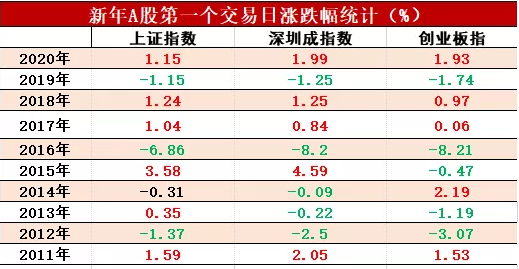

In the new year, the A-share market will usher in the first trading day of 2022 after the New Year’s Day holiday. How will A-shares perform on the first trading day after the New Year’s Day? From the perspective of market resumption in recent years, the overall performance has risen and fallen less. On the first trading day after New Year’s Day, the probability of A-share opening is about 60%, the probability of decline is 30%, and the rate of flat is 10%. Only in 2016 there was a sharp decline (fuse mechanism).

According to the data of Tianfeng Securities’ resumption of trading, the spring turmoil is also divided into multiple stages. During the period from New Year’s Day to the Spring Festival, each index showed a trend of mutual fluctuations, and the period from the Spring Festival to the two sessions is of various types. The probability of index rise has increased significantly, especially in February.

Wanhe Securities believes that the signal for steady growth is clear, and the new year’s market is evolving to “spring turmoil”. The Spring Festival of the Year of the Tiger is relatively early. After entering 2022, it is expected that there will be a round of liquidity release, which is relatively good news for the market.

Haitong Securities said that from the review of the restless market at the end of the year and the New Year, the New Year’s Eve market usually occurs every year. The reason behind this is that the end of the year and the New Year are often the time window for major meetings, and the fundamentals of A shares from November to March Data disclosure is small, and the interest rate of funds at the beginning of the year usually drops, and the risk appetite of investors in the beginning of the year is relatively higher.

Haitong Securities is optimistic about the spring market after the holiday: First, the macro policy is loose, from a wide currency to a wide credit, and the real estate policy is actively fine-tuned. Second, the current ROE is still in the recovery cycle, and it is expected that the increase in ROE will continue until the first quarter of 2022, supporting the continued bull market. Third, looking back in history, November of the previous year to March of the current year has always been a window period for restless markets.

In 2022, A shares may have these investment opportunities

Standing at the beginning of 2022, many institutions have released 2022 A-share investment strategies.

Guotai Junan Securities pointed out that, looking forward to 2022, if it is advanced and defensive, it will be extremely peaceful. In terms of general trend research and judgment, in the first half of 2022, the first half of 2022 will be advanced and defensive, and the spring restlessness will take over the new year’s market. In the second half of the year, with the gradual recovery of the economy and the decline in policy uncertainty, the market will gradually recover. In terms of style comparison, in the general trend of slowing growth, the market will shift from the pursuit of profitability in 2021 to deterministic profit growth. In terms of industry configuration, under the consensus that the market has reached a consensus on the “ground-breaking” economic characteristics, CPI’s exceeding expectations or contributing to the strongest excess revenue space under mispricing: mass consumption sets the world.

Huatai Bai Rui Fund believes that in the first quarter of 2022, the market is expected to usher in a spring turmoil, and the small market value style will continue to be strong. In the first quarter, it is optimistic about new infrastructure, technology, and securities companies; in the second quarter, in the context of wide credit and overseas inflation, A Stock performance is expected to usher in an inflection point, and the time window for the overall blue-chip layout is approaching.

Li Xiaoxing, managing director of Yinhua Fund, pointed out that at present, we have not seen a particularly large risk in the market in 2022. Generally speaking, the market index will be a very stable year. In addition, with the continuous strengthening of capital market construction, the market will become more and more stable. Only when the liquidity margin changes, some small and medium-sized market capitalization stocks that are not backed by fundamentals may be at risk of returning to a reasonable valuation range.

Shibo Shibo, deputy general manager and chief investment officer (equity) of China Southern Fund, is mainly optimistic about three types of investment opportunities.The first is the low-carbon sector and hard-core technology sector dominated by new energy vehicles and semiconductors, These areas have a lot of room for growth in the long-term, but the short-term valuation of related companies is not low, so it is necessary to actively explore new investment targets and look for proliferation opportunities;The second is a stable growth sector led by consumer medicine, These industries will undergo major adjustments in 2021, and the valuations of related companies are reasonable, and they can already be deployed on the left;The third type is a low-value sector dominated by finance and traditional energy, These industries have small downside risks, but there is not much room for growth, and they are suitable for low-risk investors to obtain certain absolute returns.

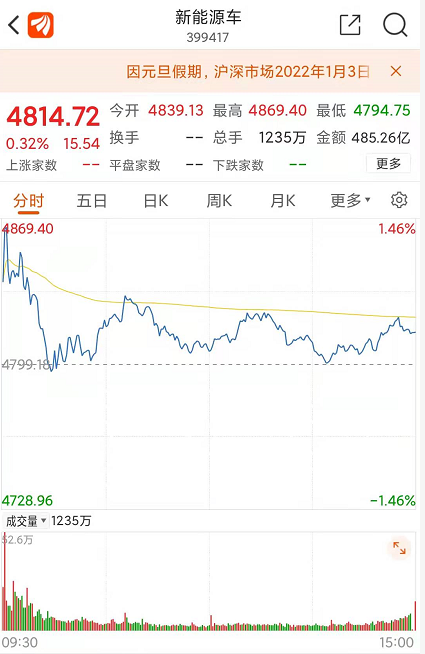

New Energy Vehicle Index

Du Haitao, deputy general manager of ICBC Credit Suisse Fund, is mainly optimistic about the following three directions:The first is to select new energy power generation, consumer electronics, new energy vehicles and other sectors that match the valuation and performance growth in the medium and long-term growth direction, and at the same time pay attention to the spread of opportunities in the new energy field to power grid investment and smart grid; the second is to pay attention The allocation value of ROE stable sectors such as food and beverages and pharmaceuticals; the third is to pay attention to the phased valuation restoration opportunities of the financial real estate and real estate industry chain.

Wanjia Fund believes that the short-term spring turmoil is expected, and the market index center is expected to rise further; in the medium term, in the first half of 2022, “economic expectations + loose liquidity”, the market tends to continue to rise, but most of the increase may be in The first quarter is completed, and the second quarter tends to fluctuate; while the main pressure in the second half of 2022 will be the overseas and domestic economies, which may put pressure on the market, but the downward pressure is expected to be mainly in the third quarter, and the fourth quarter is expected to return to stabilization.

For the whole year, Wanjia Fund believes that in 2022, the economy will weaken and stabilize, and the marginal liquidity will become looser, and the major market indexes may achieve positive returns.Rhythmically or overall presents an “N-shaped” trend.

Military industry sector index.

Wanjia Fund pointed out that in terms of plate allocation, it mainly explores three main investment lines.The first is the long-term configuration dimension, and continue to be firmly optimistic about the high-prosperity track where policies and industry trends coexist., Such as: new energy, military industry, high-end manufacturing, etc.

The second is the medium-term rotation dimension. The whole year is optimistic about the allocation opportunities of mandatory consumption under the transmission of annual inflation to the downstream, such as food and beverage, medicine, agriculture, forestry, animal husbandry and fishery. The third is the short-term game dimension. Steady growth” main line, Such as: steel, construction, building materials, coal, etc.

Fengkou Finance and Economics is comprehensively organized. Sources of materials: Financial Associated Press, China Securities News, Tiantian Fund News, China Fund News, Shanghai Securities News, Securities Times, etc.

(The opinions in this article are for reference only and do not constitute investment advice. Investment is risky, so be cautious when entering the market!)

.