recently,Wantai Bio(603392.SH) disclosed the 2021 annual report, the listed company achieved revenue of 5.750 billion yuan, a year-on-year increase of 144.25%;net profitIt was 2.021 billion yuan, a year-on-year increase of 198.59%.

The bivalent HPV vaccine isWantai BioThe current core product. At the end of 2019,Wantai BioThe bivalent HPV vaccine Xinkening obtained the drug registration approval from the State Food and Drug Administration, and was officially launched into the market in May 2020, becoming the first domestic and the fourth vaccine product for cervical cancer prevention in the world. At present, the HPV vaccine research and development track has long been a red sea. How much room is left for Wantai Bio’s bivalent HPV vaccine?

Net profit attributable to the parent increased by 198.59% year-on-year

On the evening of March 17, Wantai Bio disclosed its 2021 annual report. The listed company achieved revenue of 5.75 billion yuan, a year-on-year increase of 144.25%; net profit attributable to the parent was 2.021 billion yuan, a year-on-year increase of 198.59%. In addition, the net cash flow from operating activities of listed companies was 1.682 billion yuan, a year-on-year increase of 259.23%.

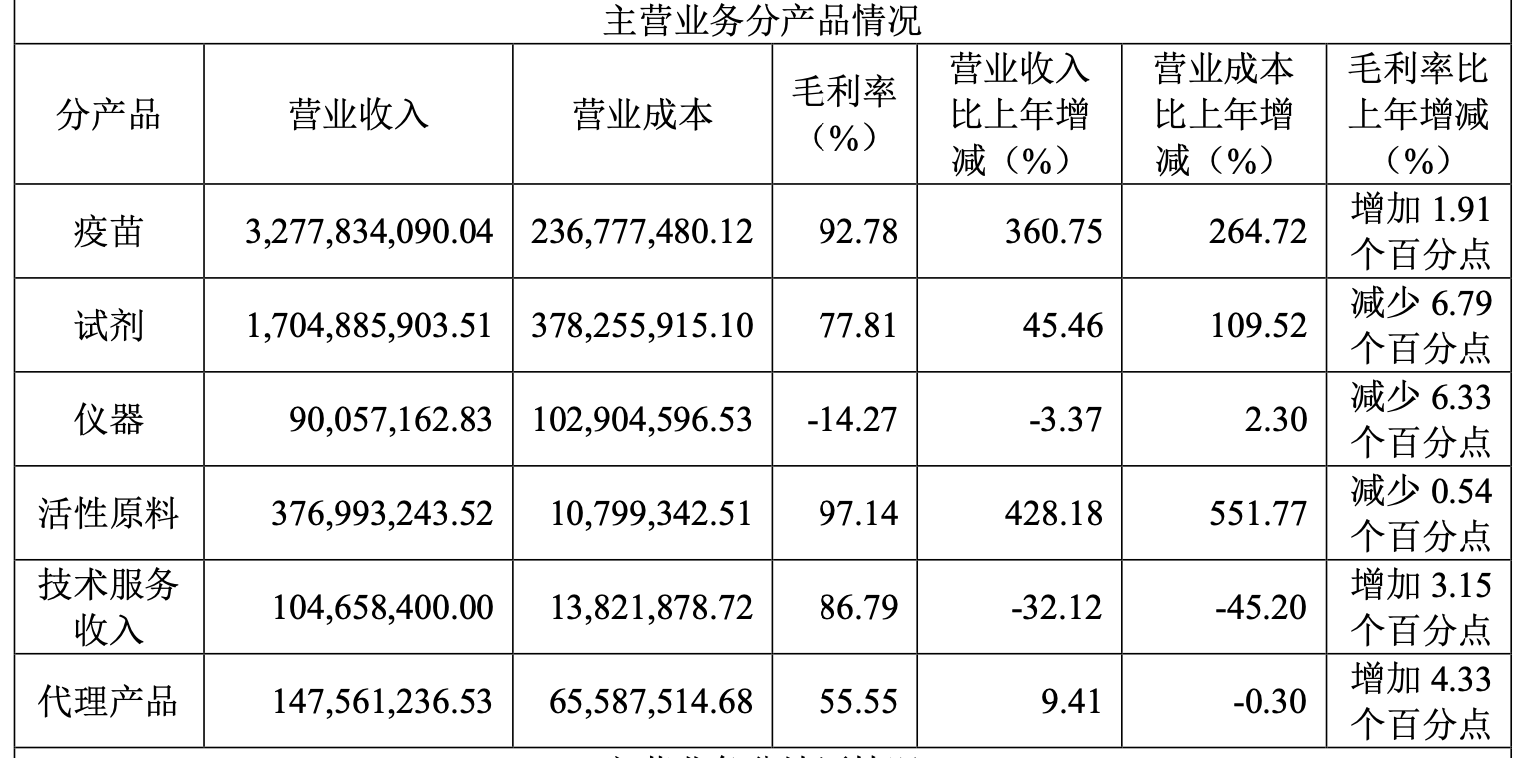

In terms of products, the listed company’s vaccine products achieved revenue of 3.278 billion yuan, a year-on-year increase of 360.75%.interest ratewas 92.78%; the revenue of reagent products was 1.705 billion yuan, a year-on-year increase of 45.46%.interest rateThe revenue of active raw materials was 377 million yuan, a year-on-year increase of 428.18%, and the gross profit margin was 97.14%. From the perspective of domestic and overseas income, the domestic income of listed companies is 5.261 billion yuan, and the overseas income is 441 million yuan. At present, domestic income still occupies an absolute advantage.

Wantai Bio’s revenue by product in 2021 Image source: Screenshot of the annual report

forperformanceGrowth, Wantai Bio said that it was mainly due to the increase in the revenue of bivalent cervical cancer vaccines, reagents and active raw materials, and because the new crown pneumonia epidemic has not been effectively controlled, the overseas testing demand has increased significantly, and the company’s new crown raw material sales and overseas testing reagent export revenue has achieved rapid increase.

2021 is the 30th anniversary of the establishment of Wantai Bio. At present, the company has deployed two major business sectors: vaccines and in vitro diagnostics (IVD).

In the field of vaccines, the bivalent HPV vaccine is the core product of Wantai Bio, which has passed the WHO pre-certification. In addition, the company said that the phase III clinical trial of the nine-valent HPV vaccine is progressing smoothly, and the main clinical trial has completed enrollment and vaccination. ; Wantai Bio’s traditional freeze-dried live attenuated varicella vaccine, new freeze-dried live attenuated varicella vaccine (VZV-7D), nasal spray new crown vaccine and other vaccine products are all in Phase III or Phase II clinical trials.

In the field of in vitro diagnostics, the IVD business is the company’s traditional strength. After the outbreak of the new crown epidemic, Wantai Bio quickly launched detection reagents with different detection methods such as enzyme-linked immunosorbent assay, POCT detection, chemiluminescence, and nucleic acid diagnosis.Zheshang Securitiesone servingResearch reportIt is pointed out that according to the batch issuance data of the Central Inspection Institute, the company has a leading market share of antibody diagnostic kits for hepatitis C virus, syphilis, hepatitis B virus, and HIV all year round.

HPV vaccine track research and development competition is fierce

The penetration rate of HPV vaccine in China is increasing. On November 17, 2020, the World Health Organization released the “Global Strategy to Accelerate the Elimination of Cervical Cancer”, and 194 member states, including China, jointly committed to eliminating cervical cancer. Since last year,Ordos, Xiamen, Jinan and other places have successively piloted free HPV vaccine vaccination, and Guangdong Province has also decided to vaccinate school-age girls with domestic bivalent HPV vaccine free of charge from September this year. It is foreseeable that in the future, more cities will implement government procurement of HPV vaccine projects.

At present, the domestic HPV vaccine market scale is far from reaching its peak, and the penetration rate still has a lot of room for improvement.West China SecuritiesA research report pointed out that according to the HPV vaccine batches issued by the Central Inspection Institute and the number of domestic female groups of school age, by the end of 2021, the penetration rate of domestic HPV vaccination among school-age women is only about 7%; according to 30%/45%/ Based on the 60% penetration rate, 2.8/4.5/620 million HPV vaccines are still needed in China, far from reaching the peak.

Under the huge market demand, Wantai Bio is also stepping up the expansion of production capacity. The company’s annual report revealed that the annual production capacity of the bivalent HPV vaccine has increased to 30 million through the addition of a new pre-filled syringe production line and the scale expansion of vials, and the annual cumulative sales volume of the company’s bivalent HPV vaccine will exceed 10 million in 2021. branch.

There are not a few companies interested in the big pie of the HPV vaccine market. Under the huge gap between supply and demand, domestic pharmaceutical companies are also stepping up the development of high-priced vaccines, and the HPV vaccine development track has long been a red sea. Currently,Watson BioThe bivalent HPV vaccine of (300142.SZ) has been approved and is expected to be put into production this year. Wantai Bio will usher in an important competitor in the bivalent HPV vaccine market. For high-priced HPV vaccines with better protective effects, the nine-valent HPV vaccines of many companies including Wantai Bio are already in Phase III clinical stage. After more and more players flock to the HPV vaccine track, Wantai Bio will also face more intense market competition.

(Article source: Daily Economic News)