Steampunk shooting game is free for a limited time INDUSTRIA + Lisa: Definitive Edition[with redemption link]- ezone.hk – Game Anime – Popular Games

Limited this week! Epic Games Store is giving away two critically acclaimed independent games, “INDUSTRIA” and “Lisa:

Emilia Romagna Italian leader in open innovation — Businesses

It has been published online and can be downloaded on Report 2023 Open innovation in Emilia-Romagna by

Jürgen Klinsmann: “It was a fiasco for me” – Hertha protocols, barrel kick, tear

Jürgen Klinsmann has experienced a lot in his footballing life. World Cup title in 1990 in Rome,

Popular Stories

Han Xue’s Behavior on ‘Sister Lang 5’ Sparks Heated Discussions Online

Han Xue Faces Criticism for Behavior on “Sister Lang 5” Recently, Han Xue, a participant on the

![Steampunk shooting game is free for a limited time INDUSTRIA + Lisa: Definitive Edition[with redemption link]- ezone.hk – Game Anime – Popular Games](https://resource02.ulifestyle.com.hk/ulcms/content/article/ogimage/2024/04/20240426181118_f19da54c1b0a575f2a363ead027137166342d43f.jpg)

Steampunk shooting game is free for a limited time INDUSTRIA + Lisa: Definitive Edition[with redemption link]- ezone.hk – Game Anime – Popular Games

Limited this week! Epic Games Store is giving away two critically acclaimed independent games, “INDUSTRIA” and “Lisa:

Emilia Romagna Italian leader in open innovation — Businesses

It has been published online and can be downloaded on Report 2023 Open innovation in Emilia-Romagna by

Jürgen Klinsmann: “It was a fiasco for me” – Hertha protocols, barrel kick, tear

Jürgen Klinsmann has experienced a lot in his footballing life. World Cup title in 1990 in Rome,

Travel & Explore the world

Han Xue’s Behavior on ‘Sister Lang 5’ Sparks Heated Discussions Online

Han Xue Faces Criticism for Behavior on “Sister Lang 5” Recently, Han Xue, a participant on the

![Steampunk shooting game is free for a limited time INDUSTRIA + Lisa: Definitive Edition[with redemption link]- ezone.hk – Game Anime – Popular Games](https://resource02.ulifestyle.com.hk/ulcms/content/article/ogimage/2024/04/20240426181118_f19da54c1b0a575f2a363ead027137166342d43f.jpg)

Steampunk shooting game is free for a limited time INDUSTRIA + Lisa: Definitive Edition[with redemption link]- ezone.hk – Game Anime – Popular Games

Limited this week! Epic Games Store is giving away two critically acclaimed independent games, “INDUSTRIA” and “Lisa:

Emilia Romagna Italian leader in open innovation — Businesses

It has been published online and can be downloaded on Report 2023 Open innovation in Emilia-Romagna by

Jürgen Klinsmann: “It was a fiasco for me” – Hertha protocols, barrel kick, tear

Jürgen Klinsmann has experienced a lot in his footballing life. World Cup title in 1990 in Rome,

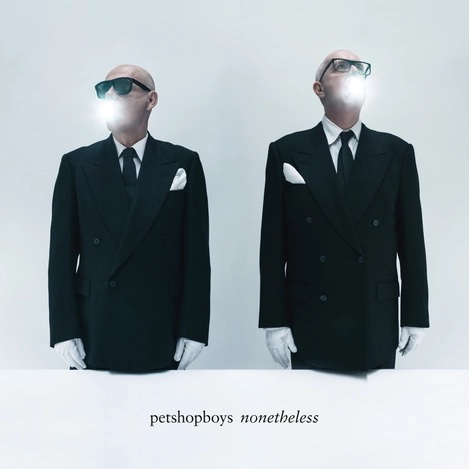

Pet Shop Boys, review of their album Nonetheless (2024)

We all know how misplaced certain stars of legendary make and vivid journey can seem to us

The nuclear power issue is not over

Was the end of the always available and inexpensive power source without CO2 emissions an economic imposition?

«With gymnastics and pilates I said goodbye to hernia»

I was only 15 when I started my modeling career. I was a teenager who already felt

Explore and travel the world

Filenna | Profile

New Tariff Manual has been socialized for public comments