Since last year, the ultimate style interpretation of a few popular industries and tracks has become more and more intense in the market.

For example, the liquor market has run through the whole year of last year, so that no matter what individual stocks “increases with liquor,” major funds have also become “A-share wineries.” At the beginning of this year, market volatility increased and the style switched to traditional value stocks. It seems that various institutions are talking about cycles and banks.andRecently, almost all institutions have been paying attention to the new energy, semiconductor and other high-prosperity and high-growth tracks. It seems that apart from these tracks, other industries have no investment value.

Under this style of interpretation,Recently, many fund managers who adhere to the traditional valuation framework have been under pressure from customers and the market to “choose” new energy, semiconductor, military and other current hottest tracks.For example, it has recently been reported that a fund manager with a recent underperformance in net worth has been under tremendous pressure from channels and large customers to increase the configuration of these current popular tracks.

So,How hot is the “Ning Index” that has made fund managers scrambling to “choose hands” recently?“Daily Economic News” reporters decode the capital signals behind the boom in track stocks from the four dimensions of the northward capital dynamics, the proportion of the transaction amount, the increase or decrease of important shareholders’ holdings, and the performance of the balance of the two financials.

Northbound funds also chase “track stocks” this year

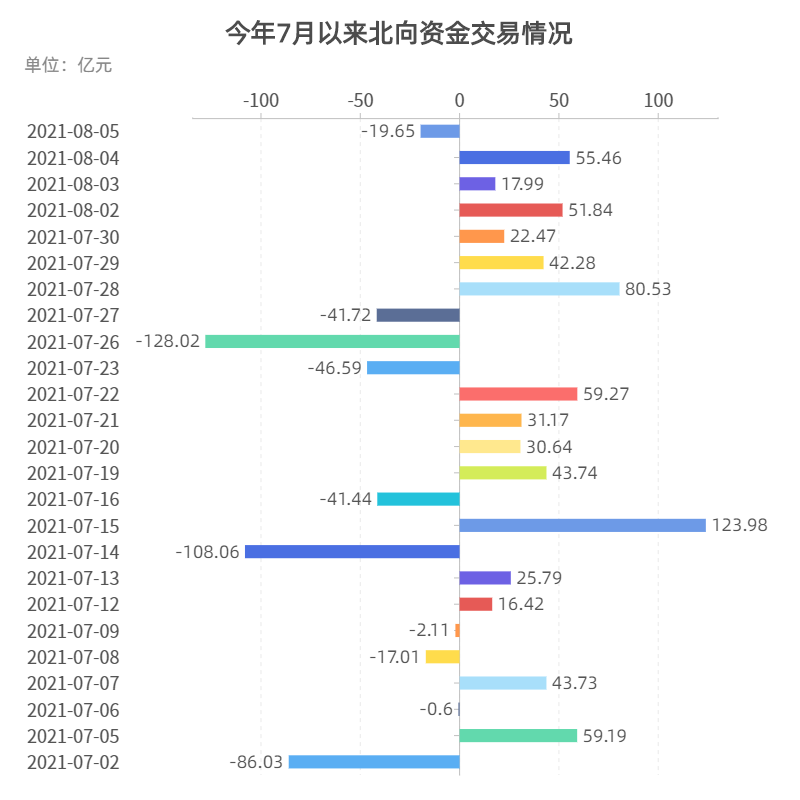

In the last week of July, due to market sentiment disturbances, Northbound funds once withdrew from A-shares for a short time, but soon afterwards, Northbound funds began to cover their A-share positions.

According to statistics, on August 4 this year, Northbound funds bought 5.546 billion yuan in net purchases throughout the day, which has been net purchases for 6 consecutive days, the first time since April 29.

On the whole, although the market volatility in July was relatively large, the overall Northbound funds still flowed into A-shares. According to statistics from Choice, in July, the net inflow of northbound funds into A shares was 10.762 billion yuan, and the net inflow of northbound funds into A shares exceeded 10 billion yuan for 9 consecutive months.

According to statistics from Shenwan Hongyuan’s financial engineering team, the top six industries for Northbound capital increase in July were non-ferrous metals, computers, communications, home appliances, light industry manufacturing, and food and beverages.

At the same time, in July, the top six industries for the reduction of northbound funds were general, automotive, military, banking, real estate, and electrical equipment.

Image source: Guosheng Securities

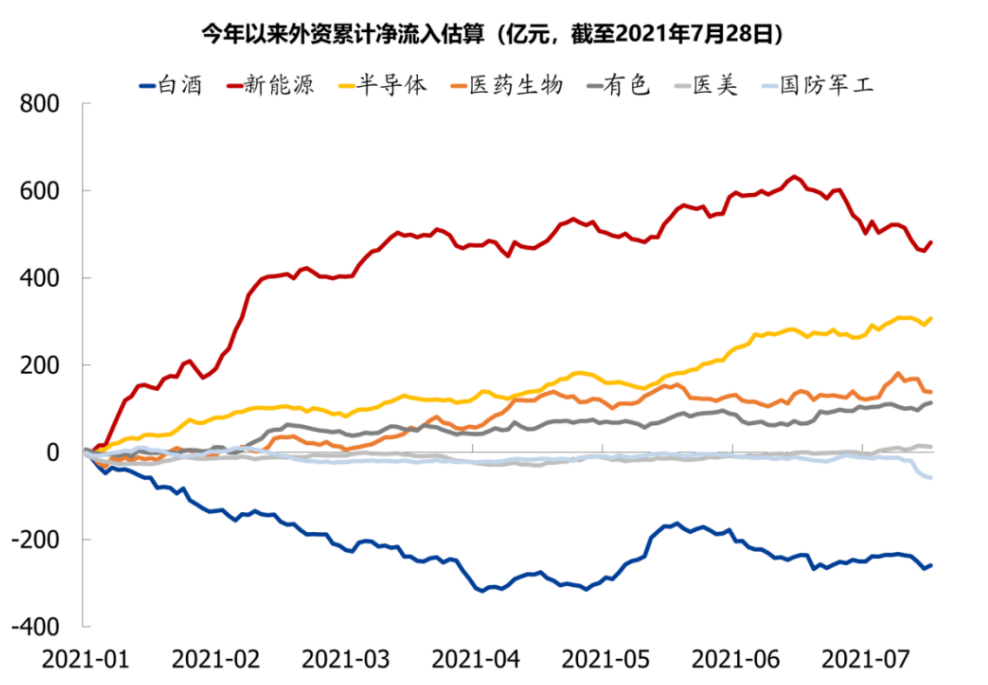

It is worth noting that according to the statistics of Guosheng Securities’ strategy team,As of the end of July this year, the net inflow of northbound funds into A-shares this year has exceeded 230 billion yuan, of which as much as 40% of the funds have flowed into new energy, semiconductors, biomedicine and other popular A-share tracks this year. The net inflows are respectively. It was 48.1 billion yuan, 30.7 billion yuan, and 13.8 billion yuan. On the other hand, the northbound funds have taken a different attitude towards the liquor sector this year. As of the end of July, the net outflow of northbound funds from the liquor sector was 25.9 billion yuan.

However, on the other hand, although the Northbound funds have substantially increased their positions in new energy, semiconductors, etc. this year, they have not chosen the tactics to withdraw significantly from the leaders in other industries, such as some consumption, which they have always preferred.

According to statistics from the financial engineering team of Shenwan Hongyuan, as of the end of July this year, the top 5 industries with the shareholding ratio of Shanghai-Shenzhen Stock Connect funds are household appliances, leisure services, food and beverages, electrical equipment, and construction materials. The total shareholding ratio of the three major beverage industries is 24%.

According to relevant regulations, the total proportion of A-shares held by all foreign investors in a single listed company shall not exceed 30% of the total number of shares of the listed company. In actual operation, 26% of foreign shareholding is regarded as a warning point, and when it reaches 28%, foreign purchases will be suspended.

Before the opening of the market on August 6, the official website of the Shenzhen Stock Exchange disclosed the list of Shenzhen companies with a foreign shareholding ratio of more than 24% as of August 5.

The reporter noticed that in this list, as many as 11 companies are included, including “old faces” such as Midea Group, Gree Electric, China Test Testing, Venus Star, and Glodon, as well as Qiaqia Foods. “Rookie” just shortlisted. On the whole, despite the recent outflow of foreign capital from traditional consumer leaders such as Gree Electric, the consumer sector is still the target of foreign capital.

UBS Securities A-share strategy analyst Meng Lei released a China Equity Strategy Report on Monday, stating that the recent decline in the A-share market was mainly driven by sentiment in overseas markets. Investors were concerned about the withdrawal of foreign capital, which led to a decline in stocks with a relatively high proportion of northbound funds. . We noticed that the P/E ratio of the Shanghai and Shenzhen 300 Index has fallen to 13.2 times, which is close to 12.8 times the 5-year average. But in fact, the fundamentals of A-share companies and overall market liquidity have not changed significantly. We believe,Short-term volatility has brought good allocation opportunities for long-term investors.After domestic credit growth has bottomed out (we expect it to be around October this year), the A-share market is expected to resume its upward trend and outperform MSCI China. Long-term investors can gradually increase their holdings of “high-quality growth” consumer stocks when valuations become more attractive.

It is worth mentioning that some A-share industries, such as the military industry, have continued to improve their market performance even in the context of continuous outflow of foreign capital.

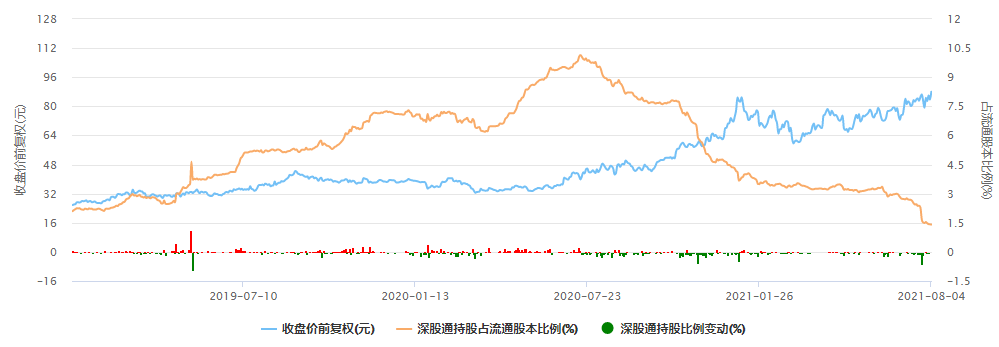

The military industry team of AVIC Securities recently issued a research report saying that with the opening of the Shanghai-Shenzhen-Hong Kong Stock Connect and the continuous expansion of MSCI, northbound funds continued to increase their holdings in the military industry, but the Sino-US relationship ended this growth trend. Since the second half of last year The proportion of foreign shareholding in the military industry has shown a downward trend as a whole. From the peak, the free-circulation market value of the military industry holdings of northbound funds accounted for 2.69%, to 1.81% currently, and the total market value currently accounts for less than 1%.

The reverse trend of the shareholding ratio of the northbound capital of AVIC Optoelectronics and the stock price

Screenshot from: Choice data

The military industry team of AVIC Securities pointed out that for individual stocks, the stock price performance is more related to its fundamentals in the long term. , Although the northbound funds have been reduced all the way, but it does not hurt its stock price to continue to new highs.

In the view of the military industry team of AVIC Securities,The military industry is different from some other industries, and the pricing power is currently mainly in the hands of domestic investors.

“Sports stocks” crowded trading characteristics gradually appear

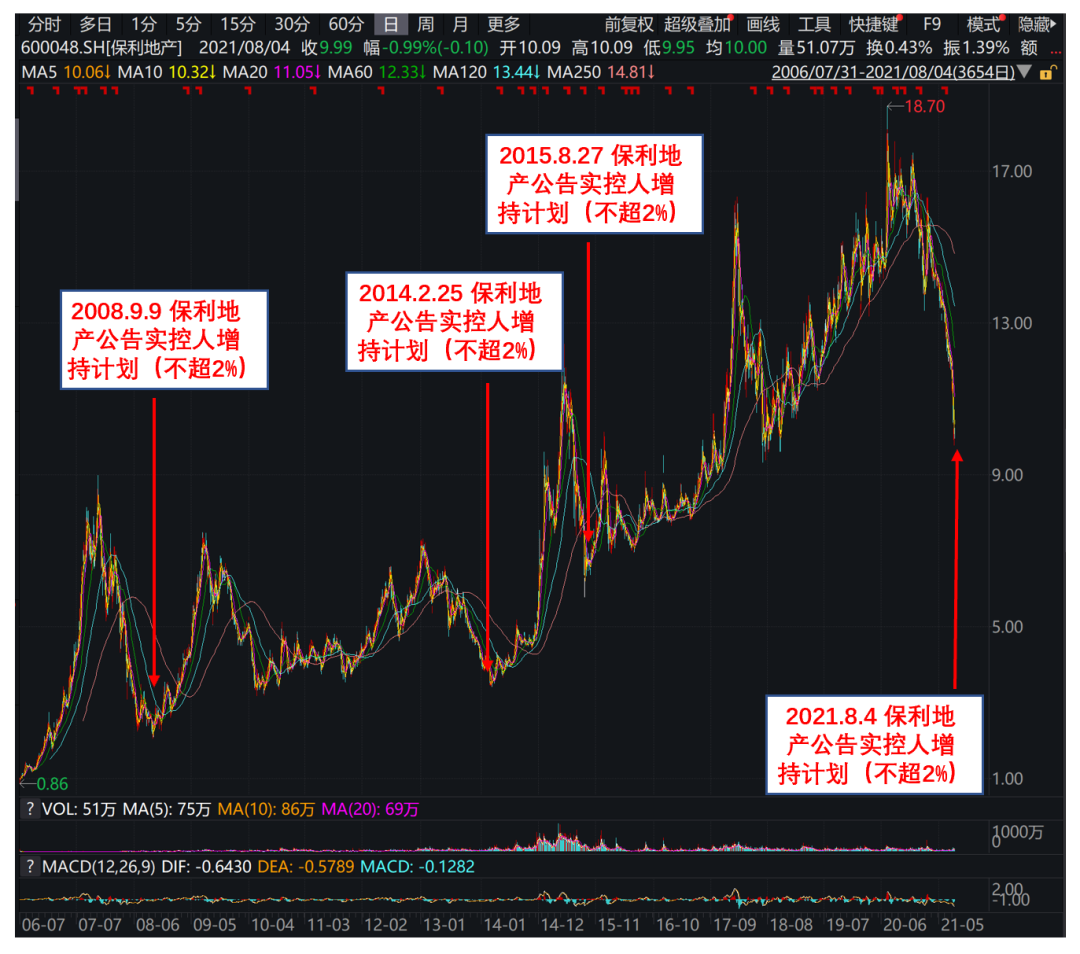

In terms of funds, as of the close of August 5, the turnover of Shanghai and Shenzhen stocks reached 1.29 trillion, and here is the scale of the two cities reaching trillions for 12 consecutive trading days.

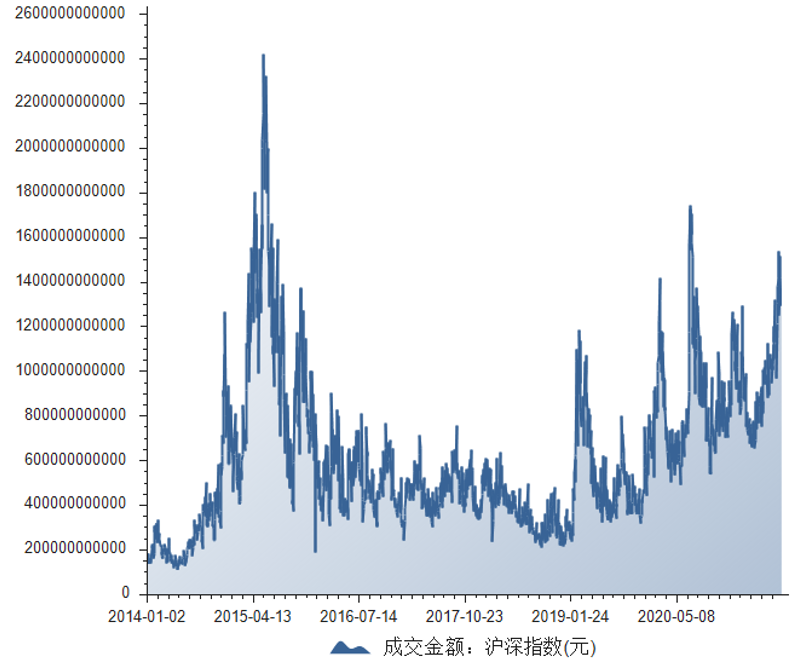

The previous heavy volume of A shares since 2014

Screenshot from: Choice data

In fact, since April this year, the turnover of A-shares has continued to enlarge, especially after entering July, the enlargement of turnover has become more obvious.

According to observations, since 2014, the A-share market has experienced multiple rounds of such continuous heavy volume, such as June to December 2014, February to June 2015, October to November 2015, February 2019 To March, December 2019 to February 2020, May to July 2020.

In almost every round of heavy volume, several major A-share indexes (such as the Shanghai Composite Index, Shenzhen Component Index, CSI 300, etc.) will show a wave of market trends. However, the trading volume in the past four months has continued to increase, but the major A-share indexes have not risen significantly, which is quite similar to the scenario from December 2019 to February 2020.

At that time, along with the continuous enlargement of trading volume, although the Shanghai Composite Index had stagnated, the ChiNext Index, which represented the growth style, had seen a significant increase in volume. At that time, the interpretation of the market style also appeared to be more extreme. Except for the electronics industry, which is driven by wireless headsets, and a few industries in the market such as computers and biomedicine, which are sought after by funds, the performance of most of the other industries is in line with the Shanghai Stock Index. The stagflation behaves similarly.

Since last year, this kind of extreme style interpretation of individual industry “dominant” has become more and more intense in the market. For example, a round of super liquor market has run through the whole year of last year, so that no matter what stock “drinks and rises”, major funds have also They have become “A-share wineries”; at the beginning of this year, the market volatility has increased and the style has switched to traditional value stocks. It seems that various institutions are talking about cycles and banks; and recently, almost all institutions are Pay attention to high-prosperity and high-growth tracks such as new energy and semiconductors.

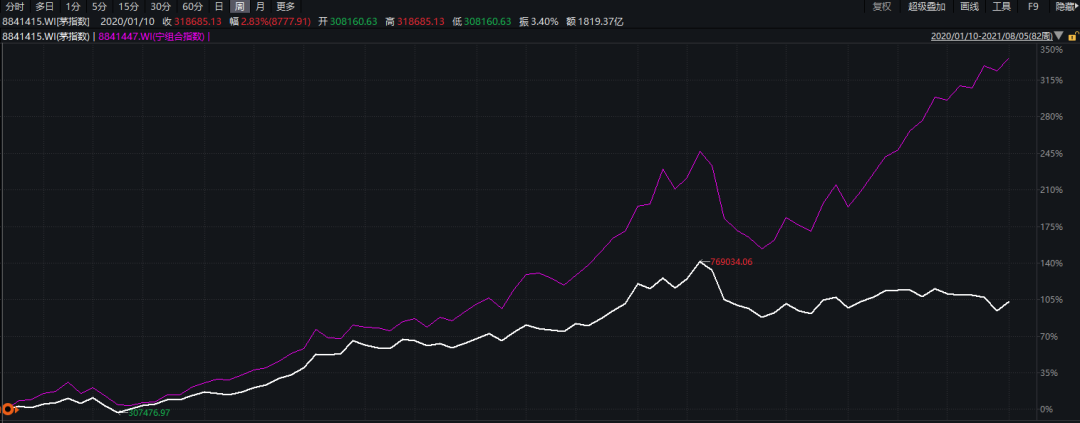

According to Wind Information, the trend of the “Mao Index” representing traditional consumption and financial leaders and the “Ning Index” representing high-prosperity circuits such as new energy and semiconductors began to diverge from mid-April this year, and the divergence tends to become obvious in mid-May. Today, the style differentiation of “Ning Index” and “Mao Index” has reached its extreme.

In fact, judging from the history of A-shares for more than 20 years, there are many precedents for the interpretation of extreme styles similar to today’s new energy and semiconductors. For example, the steel sector in the “Five Golden Flowers” quotation in 2005, the banking sector at the peak of the bull market in 2007, the “coal dancing” quotations in the third and fourth quarters of 2010, and the unilateral quotations of brokerage firms at the end of 2014, and so on.

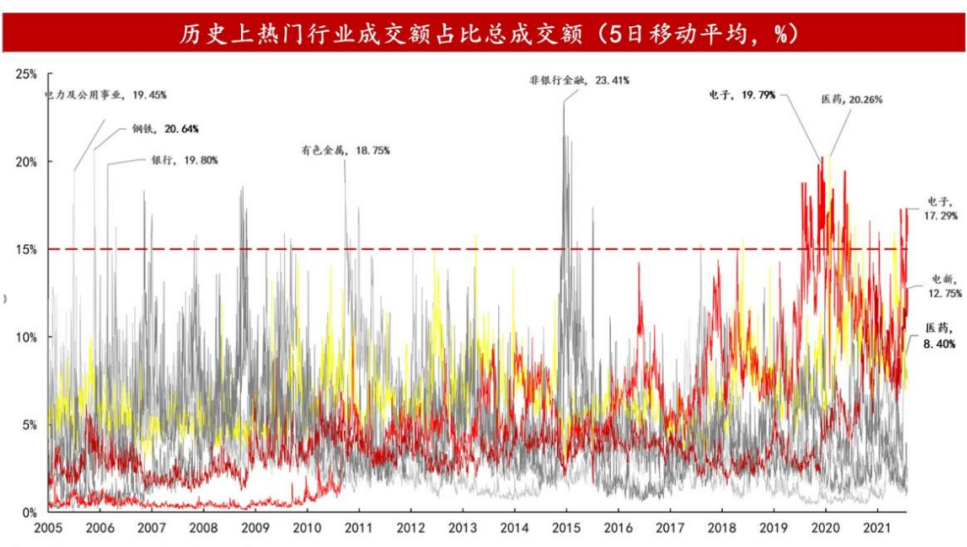

SoComparing history horizontally, to what extent has the popularity of the “Ning Index” reached?

Image source: East Asia Qianhai Securities

According to recent statistics from the East Asia Qianhai Securities Strategy Team,The current electronic (semiconductor) and electric new (new energy) industries accounted for 17.3% and 12.75% of all A-share transactions (5-day moving average), setting new highs since 2021.Historically, the turnover of a single industry accounted for about 20% of the total turnover, which often means that the industry’s popularity has reached its limit.Whether it is the public utilities in the “Five Golden Flowers” in 2005 (the highest proportion of A-share turnover is 19.45%) and steel (the highest proportion of A-share turnover is 20.64%), or Banks in 2007 (19.8% of the total turnover of A-shares), and the non-ferrous market in 2009 and 2011 (18.75% of the total turnover of A-shares), the end of 2014 The non-bank situation (the highest ratio of turnover to the total turnover of A-shares is 23.4%), both are the same.

Although in late July this year, the “Ning Index” also experienced a rapid decline, but from the current point of view, the “high fever” of track stocks and growth stocks still has no obvious signs of retreat, and the characteristics of crowded trading are still more significant. According to recent statistics from the macro team of Tianfeng Securities, in the last week of July this year, short-term trading congestion in growth stocks fell slightly to 78% from the 81% quintile of the previous week (July 19-23). , Is still relatively crowded, and the rapid mid-week decline did not fully release the risk. The current short-term congestion in consumer and financial transactions has dropped by 10% and 4% respectively compared with the previous week, and is currently at a low level around the 12% quintile; the cyclical congestion is the same as the previous week, at a mid-to-high level.

Picture source: each city

Judging from the August gold stock portfolio released by various securities firms, current popular tracks such as electronics (semiconductors) and electrical equipment (new energy) are still the first choices recommended by major securities firms. Among them, the electronics industry successfully squeezed out the chemical industry, which had been ranked first in the monthly gold stock portfolios of various securities companies for nearly 10 consecutive months, and became the industry with the most recommendations of the securities companies’ gold stock portfolios in August (recommendations accounted for 13.33%). , Electrical equipment (new energy) ranked second and third respectively.

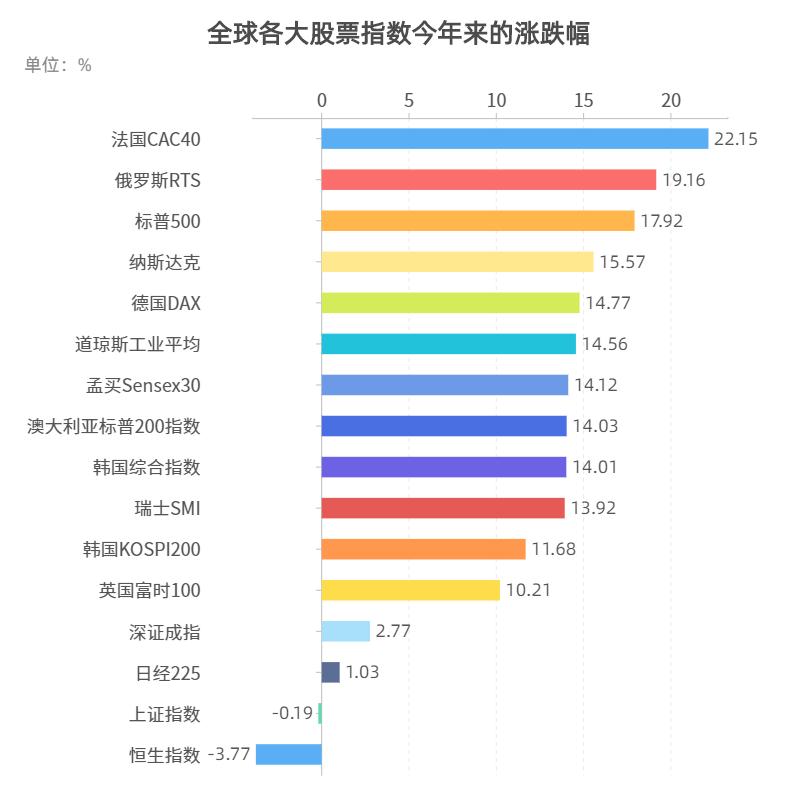

In fact, although a few of the A-share tracks have been able to “attract gold” this year, the performance of the major A-share indexes on a global scale has actually lagged behind this year. In addition, according to statistics from UBS Securities, the price-earnings ratio of the Shanghai and Shenzhen 300 Index has recently fallen to 13.2 times, which is close to 12.8 times the 5-year average. It is already more attractive to some foreign institutions.butAt present, there is still a view in the market that the A-share market can no longer simply look at the level of valuation. Some industries and companies may have fallen into the “undervaluation trap”, and those prosperous tracks may have more expensive valuations.

In this regard,Zhu Bin, the chief analyst of Southwest Securities, believes that although in the short term, the crowded trading of these popular tracks may continue, if it is extended for a long time, for example, from a two-year perspective, the probability that foreign investors’ views are correct is higher.

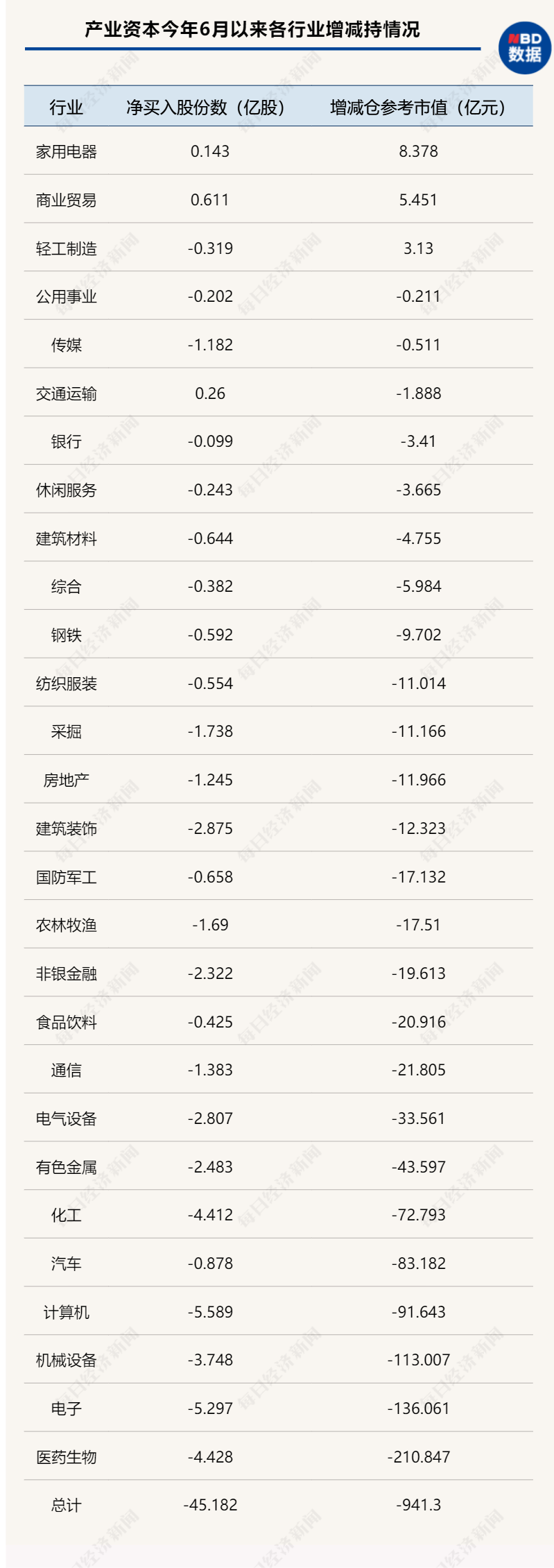

Industrial Capital Trends: The net reduction of the three major industries since June has exceeded 10 billion

The release of the fund’s second quarterly report brought the confrontation between the “Mao Index” and the “Ning Index” to its peak. The second quarterly report showed that fund managers have adjusted their positions from the “Mao Index” to the “Ning Index”.

According to statistics from Haitong Securities, in the second quarter of this year, among the heavy holdings of fund stocks, the share of stock market value held by the “Ning Index” component stocks increased by 7.9 percentage points from the previous month to 22.9%, and the percentage of the “Mao Index” component stocks decreased by 2.8 percentage points to 44.9%. From an industry perspective, in the second quarter of this year, the market value of electrical equipment, electronics, and chemical stocks in the second quarter of this year has increased significantly, while the market value of household appliances, banks, and liquor has decreased significantly.

As a result, fund managers, led by consumer and pharmaceuticals, are under great pressure. Not only have star fund managers with heavy warehouses of white wine been criticized publicly, but it has also been reported that a large client is dissatisfied with the recent net worth and asked the fund manager to adjust the position to new energy, otherwise Just redeem. On the contrary, fund managers who deployed lithium batteries, new energy, medical beauty, CXO, and semiconductors were ecstatic.

So, at the moment when the “Mao Index” and the “Ning Index” are differentiated, what actions have the important shareholders of listed companies represented by industrial capital doing recently?

Wind information display,During the epidemic, the core assets represented by the “Mao Index” obtained significant excess returns, which is one of the strongest main lines in 2020. However, since September 2020, it has been found that the “Ning Index” has performed better than the “Mao Index”. Although the retreat was larger in February this year, the subsequent rebound momentum was also stronger, and it had already returned to the previous period in May. High point level. In mid-May this year, the trend of “Mao Index” and “Ning Index” became more and more divergent. Therefore, the reporter used the increase and decrease of major shareholders’ holdings in the secondary market of listed companies from June to August 4 to observe the industrial capital’s influence on the “Mao Index” and “Ning Index” attitude.

Since 2020, the division of “Mao Index” and “Ning Index” in “weeks” as a unit

(White: Mao Index; Purple: Ning Index)

Calculated based on the change deadline, from June 2021 to August 4, the net reduction of shares held by important shareholders in the secondary market represented by industrial capital reached 4.518 billion shares, and the reference market value of the net reduction reached 94.130 billion yuan in June. , July is equivalent to an average monthly net reduction of about 47 billion yuan, and statistics show that since the implementation of the new regulation on reduction in June 2017, the average monthly net reduction of industrial capital is about 24.5 billion yuan.

From an industry perspective, since June this year, pharmaceutical and biological industries have suffered the largest net reduction of industrial capital, with a reference market value of 21.085 billion yuan for the net reduction, followed by electronics and mechanical equipment, with a reference market value of 13.606 billion yuan and 11.301 billion yuan respectively. . In addition, the reference market value of net reductions in industries such as computers, automobiles, and chemicals also exceeded 5 billion yuan. The reference market value of the net reduction of non-ferrous metals, electrical equipment, communications and food and beverages also exceeded 2 billion yuan.

On the contrary, there are three major industries showing net holdings, namely household appliances, commercial trade and light industry manufacturing. The reference market value of net holdings during the above period was 838 million yuan, 545 million yuan and 313 million yuan.

It is not difficult to see that the electrical equipment, electronics, pharmaceutical and biological, and chemical industries, which accounted for a significant increase in the market value of fund stocks in the second quarter, have recently suffered reductions in industrial capital. On the contrary, household appliances whose market value has dropped significantly in the second quarter have been affected by industrial capital. Add positions.

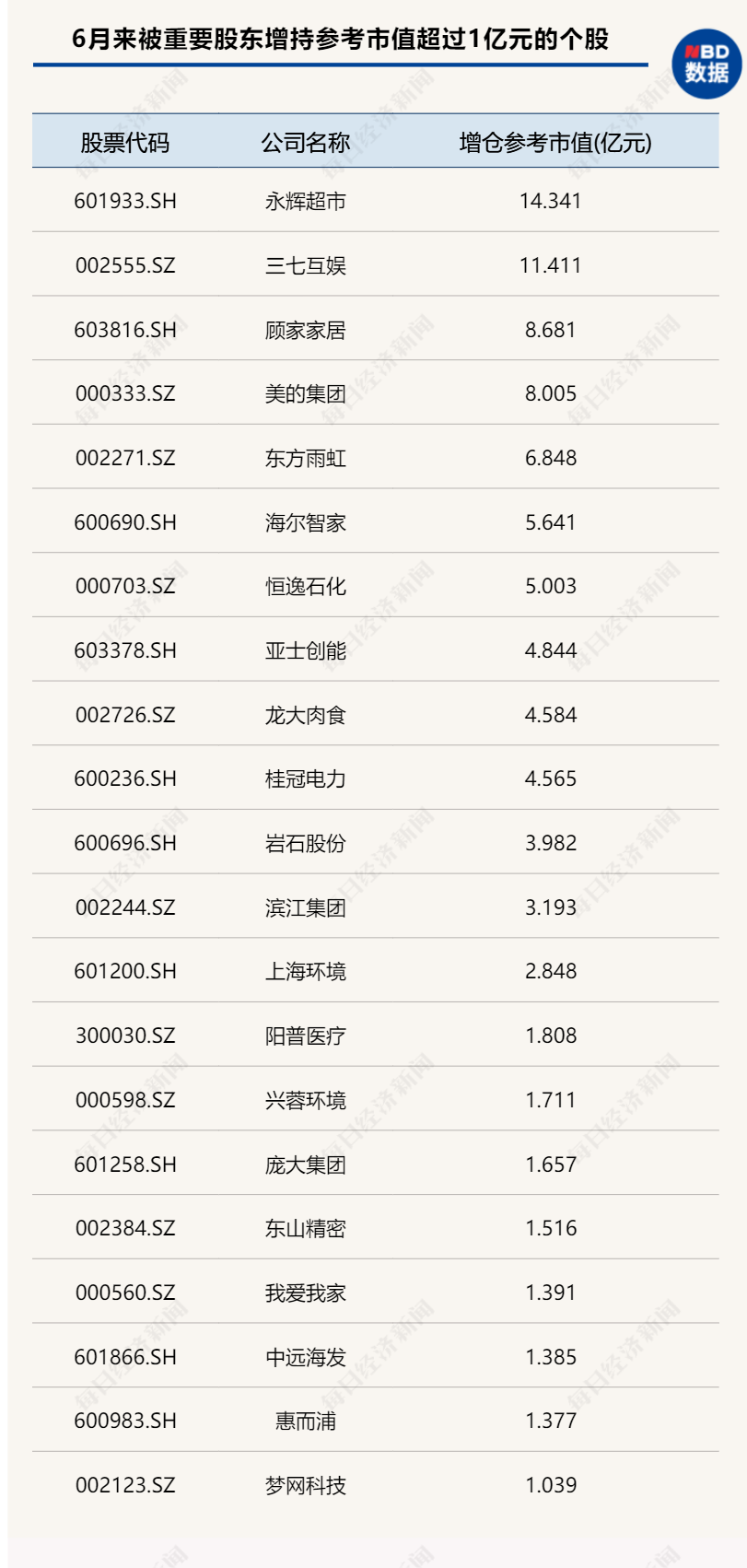

Many constituent stocks of the “Ningbo Index” were reduced by major shareholders

From the perspective of individual stocks, a total of 22 stocks have been increased by important shareholders since June (calculated based on the change deadline). The reference market value exceeds 100 million yuan. Among them, Yonghui Supermarket and Sanqi Interactive Entertainment have been continuously increased by important shareholders since June. , The two were increased by 1.434 billion yuan and 1.141 billion yuan respectively. In addition, Gujia Home Furnishing, Midea Group, Oriental Yuhong, Haier Zhijia and Hengyi Petrochemical have also increased their holdings by more than 500 million yuan.

On the contrary, 217 stocks have been reduced by important shareholders with a reference market value of more than 100 million yuan since June. Among them, BYD has been reduced with a reference market value of 5.851 billion yuan, the largest amount of reduction. Data show that since June, BYD has been reduced 6 times, of which Xia Zuoquan, the director of the company, reduced his holdings 5 times in July, reducing his holdings of about 9.65 million shares in total and cashing out about 2.420 billion yuan.

Next is Kanglong Chemical, whose reference market value is 3.547 billion yuan. In addition, WuXi AppTec, Huaxi Biotech, 360 and Stone Technology have all been reduced by more than 2 billion yuan.

The reporter noticed that among the stocks with a large amount of reduction, there are many Ning Index constituent stocks. In addition to the aforementioned BYD, WuXi AppTec, Huaxi Biological and Stone Technology, they also include China Micro and Star. Semi-guided, Cobos, Zhaoyan New Drug, etc.

In addition, on the evening of August 2nd, the Ning Index constituent stocks-the domestic semiconductor equipment company North China Chuang’s announcement of a share reduction plan caused a sensation. The actual controller of the company, Beijing Electronics Holdings Co., Ltd., intends to reduce its holdings within 6 months. 4.9652 million shares, if calculated based on the closing price on August 2, the above-mentioned reduction of shares will cash out nearly 2 billion yuan. Affected by this news, North China Huachuang reached its limit on August 3.

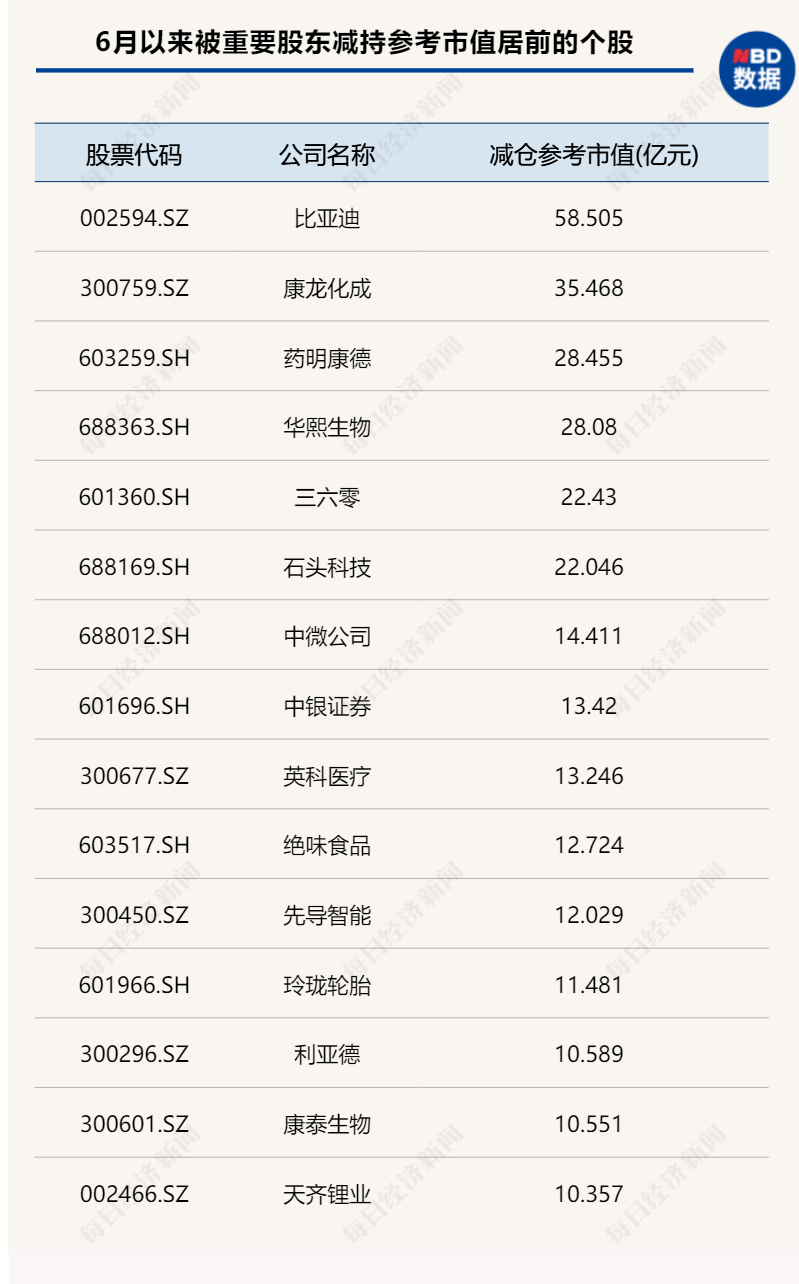

Also attracting market attention is Poly Real Estate, which announced an increase in holdings on the evening of August 4. It is reported that the actual controller of the company, Poly Group, increased its holdings of Poly Real Estate shares by a total of 500,000 shares on the same day, and the reference market value of the increased holdings was about 5,001,600 yuan. In addition, Poly Group also promised to continue to increase its holdings of no more than 2% of the company’s total share capital (including this time) in the next 6 months.

Along with the actual controller’s shareholding increase announcement, the company’s chairman, general manager Mr. Liu Ping and all senior management plan to increase their shareholding in the company within 6 months from August 4, 2021. The total increase in holdings is not low. At RMB 8 million and no more than RMB 15 million, the increase in holding price shall not exceed RMB 15.06 per share. Affected by this, Poly Real Estate rose nearly 5% on August 5.

Image source: Shenwan Hongyuan Real Estate Team

On the day Poly Real Estate issued the above announcement, Shenwan Hongyuan issued a report stating that it maintains its target price of 18.86 yuan and maintains its buy rating. According to analysts from the Shenwan Hongyuan real estate team, Poly Real Estate has announced the actual controller Poly Group’s shareholding increase plan three times on September 9, 2008, February 25, 2014, and August 27, 2015, and three times have been increased. The holding plan is no more than 2% (same as the holding increase plan), and each time I bought 400,000 to 800,000 shares at the beginning (same as the initial purchase), and the time of the three announcements of holdings was finally It has become the bottom of each Poly Real Estate’s stock price (almost the bottom of the sector).

Financing customers prefer “track stocks” in June

Let us observe the recent contest between the “Mao Index” and the “Ning Index” from the perspective of the two parties. Wind statistics show that as of August 4, the Shanghai and Shenzhen financing balances were about 1.83 trillion yuan, of which the financing balance was about 1.67 trillion yuan, and the securities lending balance was 116.547 billion yuan.

From an industry perspective, as of August 4, there were 4 companies with a balance of over 100 billion yuan in the two financings, namely, pharmaceutical and biological, electronics, non-bank financial and chemical industries, which were about 173.7 billion yuan, 173 billion yuan, 1,599 yuan and 1,059 yuan respectively. 100 million yuan. In addition, the balance of the two financings in the electrical equipment, computer, and non-ferrous metal industries also exceeded 90 billion yuan.

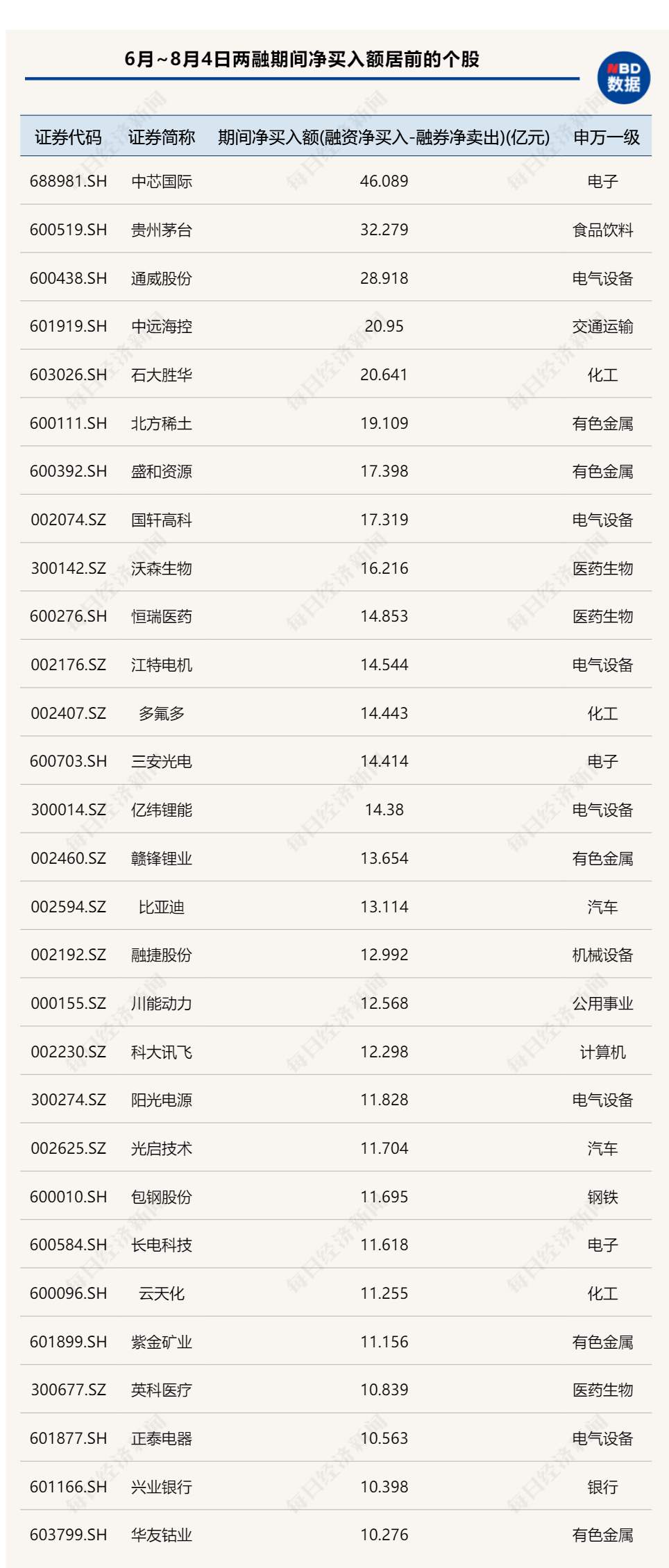

From June to August 4, during the period, net purchases (net financing-net securities lending) exceeded 10 billion yuan, there are four major industries, namely electronics, electrical equipment, chemicals and non-ferrous metals. Among them, electronics During the industry, net purchases reached 22.131 billion yuan. In addition, the net purchases of medical biology, computers, automobiles and machinery equipment during the period also exceeded 5 billion yuan.

On the contrary, the non-bank financial and agriculture, forestry, animal husbandry and fishery industries were “abandoned” by financing customers, showing a state of net sales. The net sales of the two major industries during the period were 7.971 billion yuan and 7.501 billion yuan. In addition, real estate and media were also net sold by financing customers, and the two were net sold 1.779 billion yuan and 1.062 billion yuan respectively.

In terms of individual stocks, from June to August 4, there were 29 stocks with net purchases of more than 1 billion during the period. Among them, SMIC ranked first, with net purchases of 4.609 billion yuan during the period, followed by Kweichow Moutai and Tongwei shares, net purchases during the period were 3.228 billion yuan and 2.892 billion yuan. In addition, the net purchases of COSCO SHIPPING Holdings and Shi Dashenghua during the period also exceeded 2 billion yuan. It is worth mentioning that since June, BYD, which has the largest reference market value reduced by important shareholders, has been favored by financing customers, with a net purchase amount of 1.311 billion yuan during the period.

On the whole, the reporter found that although financing customers have preferred track stocks since June, they have not given up on the “Mao Index” constituent stocks. For example, in addition to Kweichow Moutai mentioned above, there are Hengrui Medicine and Inovance Technology , CDF, Gree Electric, Wuliangye, Pien Tze Huang, China Merchants Bank, Aier Ophthalmology, Luzhou Laojiao, Jinshan Office, Yangtze River Power, Oriental Yuhong and Hikvision, etc., the above-mentioned “Mao Index” constituent stocks were net purchases during the period The amount exceeds 300 million yuan.

Guosen Securities Research stated that the “Ning Index” is generally a growth attribute (the ROE continues to rise). In the process of accelerating the upward profitability cycle, both profit and valuation are made. The upward ROE itself will push the valuation upward; The “Mao Index” is generally a value attribute (high ROE but basically flat). In this case, generally only earning performance money does not earn valuation money, and ROE flat valuation lacks the profit logic to continue to rise. Last year, the global currency was released, and the valuations of both the “Mao Index” and the “Ning Index” rose significantly. This is the logic of the denominator. This year the logic of the market denominator is gone, and the “Ning Index” can still make profits and accelerate its upward valuation. The story tells that the “Mao Index” has lost the logic of continuing to increase its valuation, and even the pressure of valuation to fall from a high level.Looking forward, we believe that the clearest investment direction in the market is the industrial upgrading of China’s economy. The “Ning Index” with stronger growth attributes (with higher valuation) may be stronger than the “Mao Index” with stronger value attributes (valuation). Also lower), the chance is greater.

Reporter: Wang Haiyun and Chen Chen

Editor: Wu Yongjiu

Vision: Chen Guanyu

Typesetting: Wu Yongjiu Ma Yuan