According to the analysis of the comparison engine Osservatorio MutuiSupermarket.it, from January 2022 to today the capital obtainable as a mortgage has fallen by 27% with the same installment. It is no coincidence that in March the weight of the demand for purchase mortgages fell below 50% while the share of subrogation requests continues to grow. Here are the simulations (and what those with the variable can do)

With the increase of rates continues to drop real estate purchasing power of the Italians who need to light a mutual. The increase in the cost of money starting from the beginning of 2022, as a result of the monetary policy decisions of the Bcehas pushed up rates on home buying loans by almost 3 percentage pointsconsequently reducing the cipher that would-be buyers (especially the younger ones) can afford to ask the bank. According to the analysis of the comparison engine MutuiSupermarket.it Observatoryfrom January 2022 to today the capital obtainable as a mortgage is collapsed by 27% with the same installment. Not by chance in March the weight of the demand for mortgages purchase has decreased below 50% while the share of requests for substitute by those who in the past had taken out a variable rate mortgage and saw the installment explode. Meanwhile the under 36 they saw their weight drop by 4 percentage points from February, to 42% of new buyers.

What happens to those with a variable rate – The number one of the European Central Bank Christine Lagarde at the beginning of the month he defined as “probable” that a new increase in the cost of money will arrive on March 16th by another 50 points. If this were confirmed, despite the financial storm triggered by crack of some US banks that could calm down the next hikes at least by the Fed, according to facile.it would translate – for a an adjustable rate mortgage from 126.000 euro over 25 years subscribed in January 2022 – in a increase of 35 euros on the loan installment. Which, added to the previous increases, would bring the inflation to 237 euros per month: il 52% more compared to the original rate. What to do? “You can choose to subrogate the loan, switching to a more convenient fixed or variable rate”, advises the comparator, “or, if you are eligible, renegotiate the loan with your bank taking advantage of the new rules introduced by the government“.

Simulations without and with Consap guarantee – At the moment, recalls the MutuiSupermarket.it Observatory, the new inflation estimates predict that it will settle at around 6% in 2023, a sharp decline but still well above the ECB’s target (2%). Analyzing the Futures curve, the markets consequently expect further increases in the cost of money which should exceed the 4% threshold by September 2023. In this context, aspiring borrowers must decide whether fall back on a fixed rate that is already much higher than in the past (3.5% for 30-year terms and around 4% for shorter terms) or risk the variable, hoping that theEuribor from 2024 it can stop.

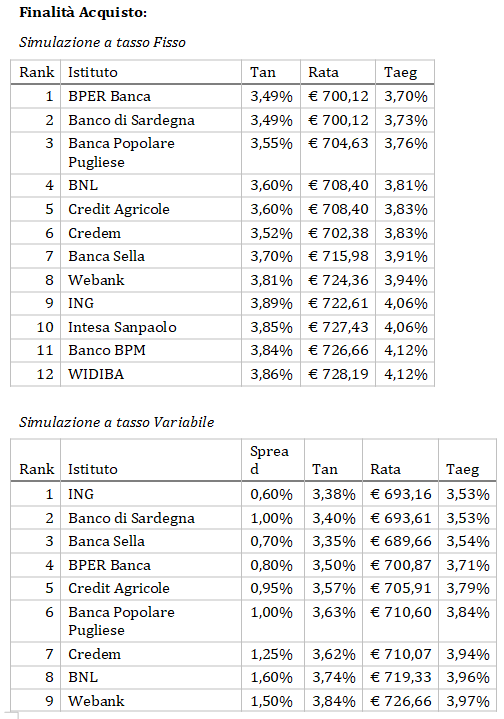

But what are the conditions now offered by the main banks? BPM Bank e Webank they reduced the spread on fixed-rate mortgages from 10 to 15 basis points, according to the observatory. Intesa Sanpaolo raised fixed rates between 25 and 45 basis points, Bnl between 15 and 20 basis points e Sella bank between 20 and 25 basis points. Below are the simulations on a fixed-rate mortgage of 140 thousand euros for 25 years for the purchase of a property worth 220 thousand with an applicant and on a mortgage of 200 thousand euros for a house again worth 220 thousand but with the guarantee of Fondo Prima Casa Consap reserved for under 36s with Isee under 40 thousand euros.