Yamanat – Special

Demonstrations of depositors towards the World Bank of Yemen in Sana’a proceed, towards the background of its suspension of the withdrawal of the so-called “previous” accounts.

Demonstrations

Dozens of depositors stage protests nearly day-after-day in entrance of the financial institution’s headquarters on Al-Zubairy Street within the coronary heart of the capital, Sana’a.

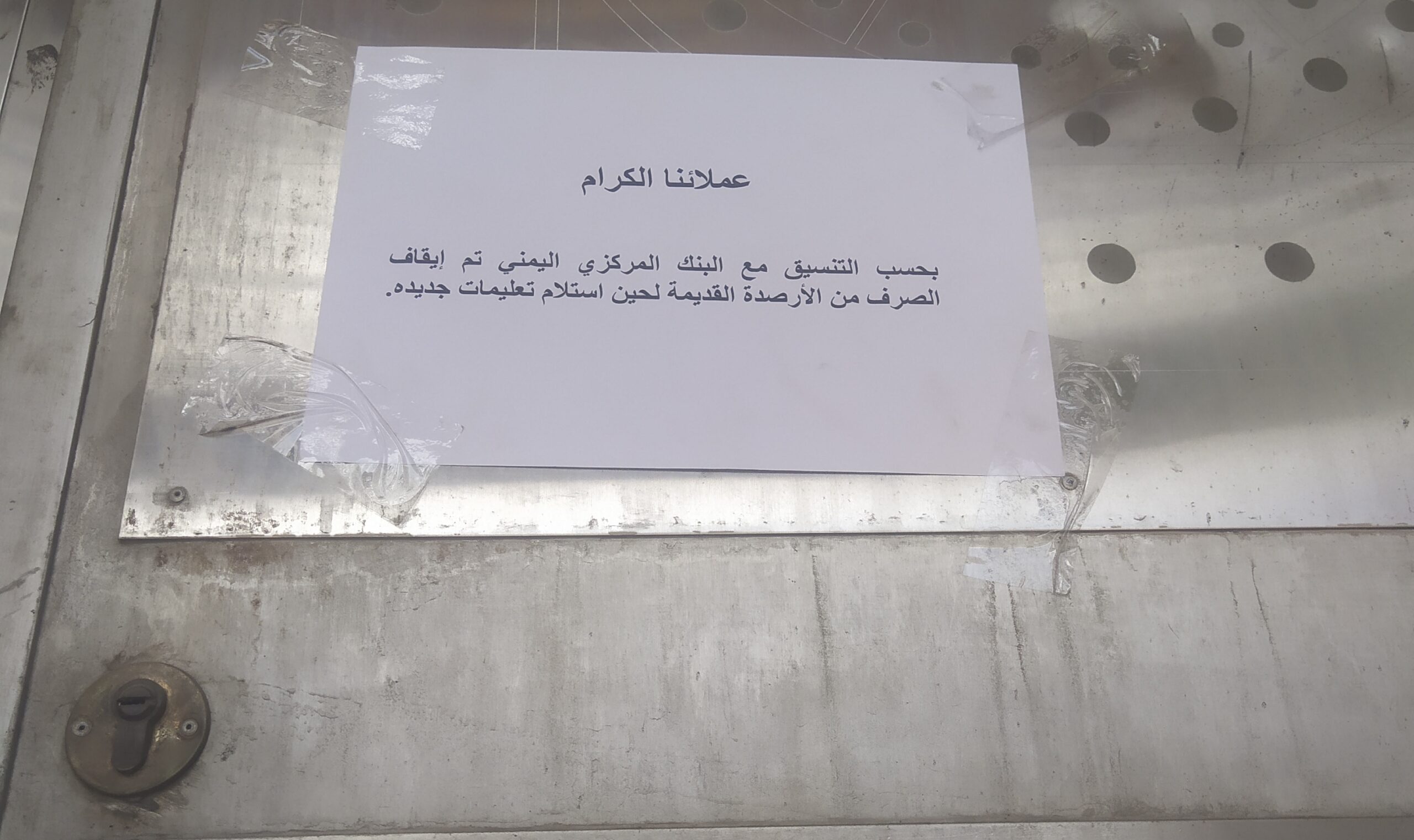

The financial institution was withdrawing cash from those that had massive sums of cash deposited in it earlier than the conflict, the quantities reaching between (20.-30) thousand riyals, with out explaining to them the explanation for this, with out an announcement posted on the financial institution’s web site. that the withdrawal of previous accounts was stopped in cooperation with the Central Bank.

Rumors of chapter

In the previous few days, rumors have unfold that this financial institution is about to announce that it’s lifeless, which made the financial institution rush to reply and finish the concern of its prospects. He emphasised in a press release printed on his Facebook account on Wednesday, May 22, 2024, that it’s regrettable that false information and rumors are being printed on different pages and private accounts on social media, which include false info, the aim of which is to impress and drag some individuals to pursue particular objectives with the purpose of defaming them and the place of the financial institution.

The financial institution discloses its monetary place

The financial institution famous in its assertion that it was capable of stand up to all of the troublesome financial situations that Yemen has been going by way of since 2015 AD and labored to serve its prospects and attain them in essentially the most troublesome and darkest conditions.

The financial institution confirmed that it has been finishing up its work with excessive professionalism for greater than 45 years in accordance with the authorized methods and rules and orders issued by the Central Bank of Yemen and the competent authorities, which reveals that it makes use of the perfect worldwide requirements. in banking, which has earned it the belief of many worldwide organizations and huge worldwide and home corporations.

The financial institution famous that it does its job transparently, because it publishes its monetary statements which were reviewed by chartered accountants and authorised by the Central Bank of Yemen yearly, which reveals the monetary situation of the financial institution and the power of its place as the biggest firm it operates. financial institution within the Republic of Yemen.

The financial institution defined that it has greater than a billion and a half property, and its capital reaches 46 billion riyals, the biggest capital amongst banks working within the Republic of Yemen.

The financial institution has confirmed that it reserves its full authorized proper to sue any individual or entity that has printed false information that will defame the repute of the financial institution or the Yemeni banking sector.

The financial institution asks its prospects to not be drawn to false information and rumours, assuring them that the financial institution takes all the required measures and ensures to make sure the preservation of their cash and to make sure the achievement of its obligations in these funds.

Why..?

In its assertion, the financial institution didn’t point out the suspension of withdrawals from previous accounts, and plainly it’s happy with the adjustment of communication with the Central Bank, which was talked about in its brief announcement posted on its portal.

Despite the protests made by the purchasers of the World Bank of Yemen, the Central Bank in Sana’a stays silent about this, though that is one in all its strengths as a banking establishment.

Long time period issues

Banks stopped issuing deposits to their depositors within the months after the outbreak of conflict in late March 2015, citing a scarcity of liquidity. executed in collaboration with the Central Bank in Sana’a.

The International Bank of Yemen reported that stopping the withdrawal of cash in cooperation with the Central Bank is a sign of the existence of a banking disaster, which can be associated to the shortage of cash or the choice of the Aden Central Bank to maneuver the primary banking headquarters to Aden, and possibly one other drawback, however the query stays why to cease Withdrawal began in Yemen World Bank .?!

The House of Representatives in Sana’a had authorised a legislation prohibiting worthwhile transactions, the Sana’a authorities compelled it to be handed in March 2023, regardless of the opposition of the Yemeni Banking Association and quite a lot of companies, together with the Ministry of Finance and the Central Bank, whose officers refused to return within the Council throughout the dialogue of the legislation.

Since the adoption of this legislation, banks have confronted a significant drawback that has affected their operations.

The newest disaster, which erupted after the Central Bank of Sanaa issued a 100 riyal coin, led to a banking disaster, after the Central Bank in Aden determined to maneuver the primary banking headquarters from Sanaa to Aden, which gave these. banks for a interval ending at the start of subsequent June.

While Aden Central Bank pressures banks to maneuver their headquarters to Aden, Sanaa Central Bank requires banks to supply cash to their depositors in the event that they need to transfer their headquarters to Aden, and all of those are troublesome selections for banks.

It is evident that Sanaa sees a banking drawback, as remittances in {dollars} aren’t despatched to those that have the proper to obtain them besides in Yemeni or Saudi riyals, which presents a liquidity drawback within the greenback.

Copy the hyperlink