Inflation slowed Christmas business. The luxury goods group LVMH also felt this. However, the share price recently jumped.

British retail is struggling with inflation. The crucial Christmas shopping season was weaker than expected and the British Rail Consortium said on Tuesday that store prices in January were 2.9 percent higher than last year. This is the lowest level since May 2022, but that is mainly because retailers are using high discounts to woo missing customers. High interest rates and expensive living costs are dampening consumer sentiment, but major players such as Marks & Spencer and Next were able to record sales increases.

Things have been going so well at Next recently that CEO Simon Wolfson raised the profit forecast for the current financial year for the fifth time in seven months. For the 2023/24 financial year, the group now expects an increase in pre-tax profit to 905 million pounds (1.05 billion euros), compared to the previously targeted 885 million pounds. In the last financial year the profit was 870 million pounds. For 2024/25, the group forecasts a six percent increase in sales and a five percent increase in profits.

However, restricted shipping traffic through the Red Sea could dampen expectations. Next was one of the first companies to raise concerns about this. The group sources most of its fashion and household products from Asia.

crisis in the Red Sea

Given the crisis in the Red Sea, it is only a matter of time before the rising costs and strains in the supply chains show up in corporate profits, said Wolfson. The supermarket chain Marks & Spencer has also already announced that consumers will have to expect rising prices in the future.

According to analysts at RBC Capital Markets, companies that source their goods from Asia and are therefore highly dependent on sea freight volumes are particularly affected. The French furniture retailer Maisons du Monde is particularly vulnerable: the company sources 75 percent of its goods from Asia and transports almost all of its goods by sea. However, investors on the stock market were not yet worried: Since the beginning of the year, Next’s shares have risen by more than six percent.

Luxury market is slowing down

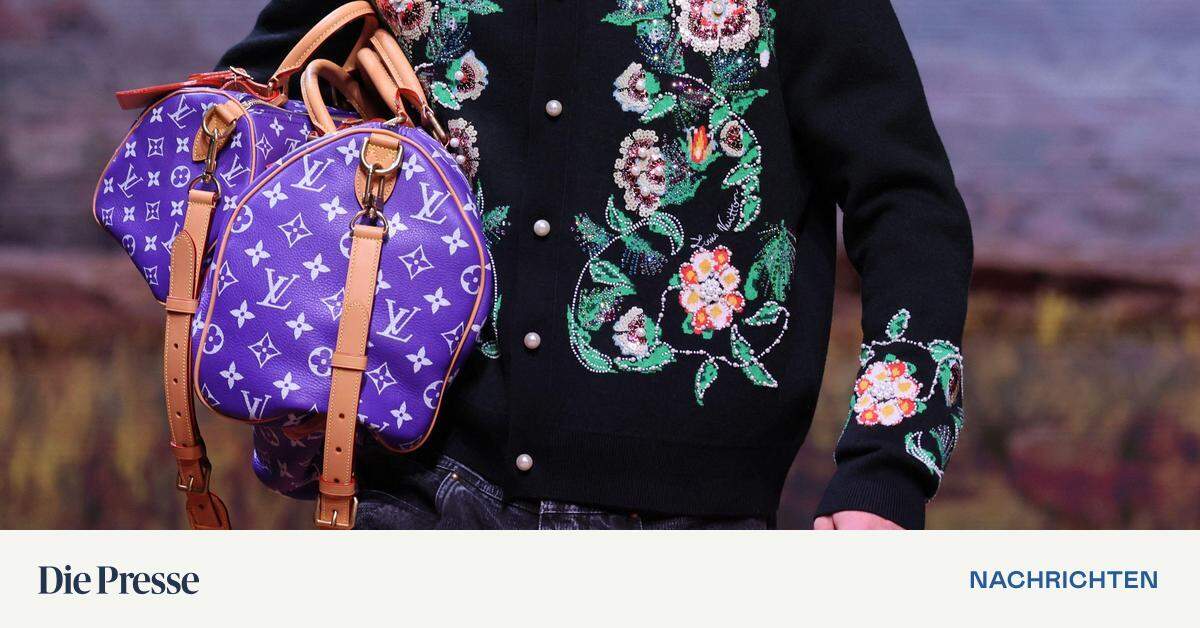

The consumer reluctance is also reflected in luxury companies. After the pandemic, the value of the French luxury goods group LVMH shot to the top of the most valuable European companies. LVMH managed to achieve a market value of 500 billion dollars with fashion from Louis Vuitton and Christian Dior, champagne from Moët & Chandon and watches from TAG Heuer and Hublot – at least for a short time. In the second half of the year, the company lost again under the leadership of billionaire Bernard Arnault. In the past year, LVMH increased sales by nine percent compared to 2022 to more than 86 billion euros. But there are still some difficult months ahead for the stock. At the end of last year, concerns about declining demand grew.

This caused the share price to temporarily plummet by 20 percent in the second half of 2023. The boom in demand from the period after the corona pandemic is over and business is returning to normal, said CFO Jean-Jacques Guiony when presenting the annual figures. While sales in the first half of the year rose by 17 percent after adjusting for currency effects, the increase in the second half of the year was just under ten percent. CEO Arnault expects further growth in 2024 – despite the economic and political uncertainties in the world.

The news was well received on the stock market and caused the biggest jump in LVMH shares in 15 years. Since last Friday, the value of the share has risen by around 15 percent. (ag./red.)

Read more about these topics: