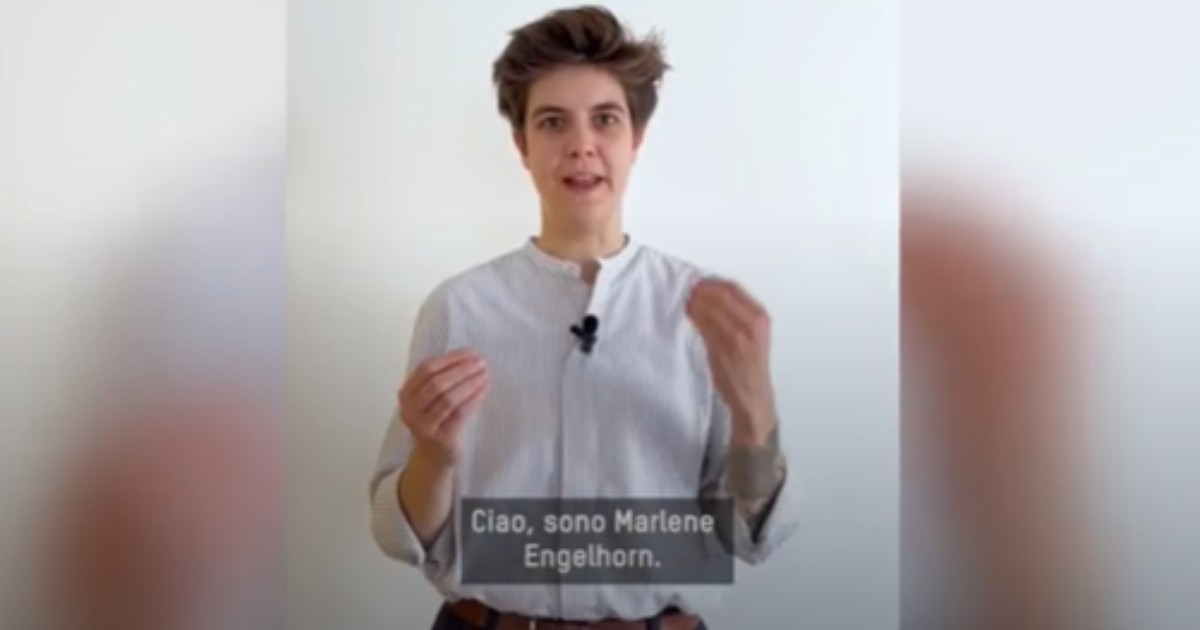

The Austrian-German multimillionairess Marlene Engelhorn wants to redistribute 25 million of his hereditary heritage and to do so he asks his compatriots for help. Around two million Austrians will receive a letter along these lines: “Do you want to participate in ‘good advice’? Do you want to contribute to divide equally 25 million?”. Fifty people will be chosen from all those who respond and will have to decide how to distribute the money.

Read Also

The collection of signatures to ask the EU to tax large fortunes begins – Great Wealth, our campaign with Oxfam

Marlene Engelhorn he is the great-grandson of the founder of the chemical giant Basf: his family heritage, however, derives above all from sale of shares in the group Boehringer-Mannheim at the Hoffmann-La Roche. The thirty-one-year-old justifies her wealth frankly: “I just won the birth lottery; I don’t believe that birth should decide my place in society. We live in a democracy.” You have been active in the international association for two years Millionaires for humanitywith other heirs of immense fortunes, founded the movement Taxmenowrecently also accompanying a campaign of Oxfam for a higher taxation of the super richalso supported by Everyday occurrence.

Read Also

“Tax us or the world’s economy at risk”. One hundred millionaires at the G20: we want to be able to pay more. Among them the Disney heir and two Italians

He writes books (he presented in April Money at the book fair Leipzig), participates in talk shows and demonstrations for the introduction of an inheritance tax e donations also in Austria, where it is not there. Many are accompanied by a big blue inflatable elephantsymbolizing the enormity of the problem ofcontributory injustice which multimillionaire heirs in his country benefit from, invisible but easy to remove by simply opening a valve. Engelhorn also spoke out for the tightening of taxes of succession existing in Germaniawhich he defines as “as full of exceptions as a Swiss cheese that it’s hard not to fall into it.” Opinions clash on money and taxes: Johannes Vogeldeputy president of the FDP liberals, in a television debate on the Zdf, for example, has vigorously defended the current principle that parents can leave a house of up to 200 square meters to their children tax-free, if they live there. In general, inheritance taxes in Germania I am definitely anyway higher than in Italy; there deductible for the spouse, for example, is 500 thousand euros, half the price in Italy, and for children it stops at 400 thousand euros. In the case of real estate, inheritance tax is then calculated on the ever-increasing value of city land and so many cannot pay it without a bank loan, or by selling to real estate companies who renovate and then raise rents, fueling a growing spiral .

See also

The heiress of the BASF group: “Tax the super rich like me more. Let’s collect 1 million signatures for the EU to act”

For Engelhorn, the Austrian state, by not requiring the payment of an inheritance tax, is instead failing in its duties, and for this reason he is looking for fifty people to indicate how to allocate his money. This autumn the Austrians will elect their 28th parliament, the National Council, and his initiative effectively aims to reopen the national debate on the tax. The General Secretary of the Austrian People’s Party, Christian Stockerrejects it flatly: “It’s an idea that comes from the mothproof trunk of the Linke: ‘We take from the rich to give to the poor’ – he says – We want to relieve the citizens, not overwhelm them”. On the other hand, the president of the socialists of the SPÖ, Andreas Babler makes it a condition for a future coalition: “We are one of the few countries that does not tax heirs. We, the workers, must pay taxesevery frankfurter sandwich is taxed, but in the case of millionaire inheritances we look the other way.”

For six weekends, in Engelhorn’s idea, the fifty chosen ones will therefore have to debate and decide on “good advice”, and will receive compensation for their efforts. They have few starting conditions, the proposals must be compatible with the Constitution and the Convention on Human Rights and do not be profit-minded. Melanie Engelhorn will have no right to interfere and by giving life to her principles of fairness she answers her doubts: “What should I do if I don’t like it? I’ll have to adapt. It’s like this in a democracy.”

“It is a fact that in a company where the ownership is in a family, there have also been an infinite number of people who have worked, in different roles, without seeing this heritage. So, How can this money return to society?” he explained again in an interview. However, you do not want to go into the merits of how an inheritance tax should be structured, but rather stimulate social debate. Her privileges bother her and she believes she is unfairly favored by the Austrian state. Marlene Engelhorn is an extreme example, she wants to give up 90 percent of her assets to the State and for society to decide how to use it, but even if not many people follow her example, she is well received and hers is not a voice completely isolated. Even in Germany, where one third of all national capital is concentrated in the hands of the richest 1 percent, and two thirds distributed only within the top 10 percent, Stefan Bachtax expert of German Institute for Economic Researchproposed the granting of a starting capital of twenty thousand euros to all eighteen-year-olds by the State, financed with higher taxes on the super rich.