The government’s plan to speed up the payment of public employee severance pay is already on the technical table. And in a few days it will be the object… Already a subscriber? Login here!

SPECIAL OFFER

BEST OFFER

ANNUAL

79,99€

19€

For 1 year

CHOOSE NOW

MONTHLY

6,99€

€1 PER MONTH

For 6 months

CHOOSE NOW

SPECIAL OFFER

BEST OFFER

ANNUAL

79,99€

11,99€

For 1 year

CHOOSE NOW

MONTHLY

6,99€

€2 PER MONTH

For 12 months

CHOOSE NOW

SPECIAL OFFER

Read the article and the entire website ilmessaggero.it

1 Year for €9.99 €89.99

Subscribe with Google

or

€1 per month for 6 months

Automatic Renewal. Turn off whenever you want.

Unlimited access to articles on the site and app The Good Morning newsletter at 7:30 The 18 o’clock newsletter for updates of the day The podcasts of our signatures In-depth analysis and live updates

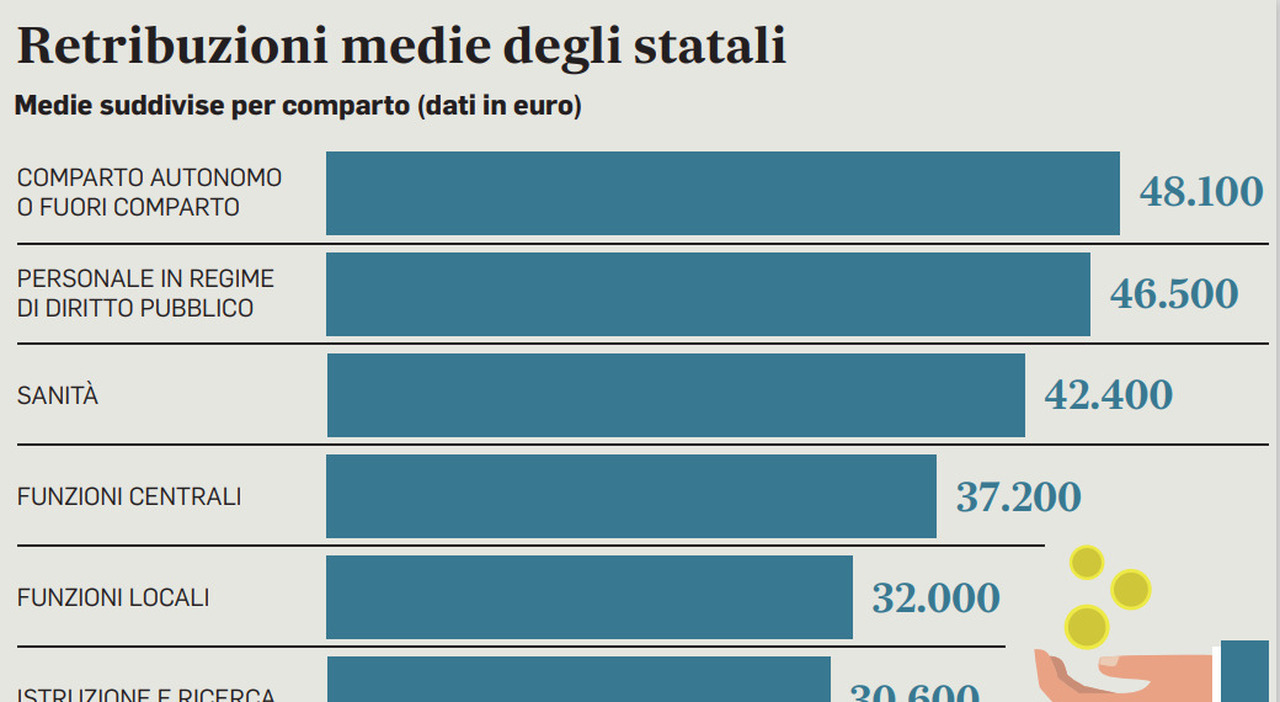

The plan of government to expedite payment liquidations of the civil servants it’s already on the technical table. And in a few days it will be the subject of political confrontation in view of the next budget manoeuvre. The solution, once again, should go through the banking system. The idea would be to confirm to some extent the current mechanism of the advance payment of end-of-service payments by banks, but making sure that the State bears the interest. But let’s go in order. A little less than a month ago, the Constitutional Court declared “inadmissible” the appeals presented against the delay in payment of severance pay for civil servants which, in the event of early retirement, can last up to 5 years after leaving work. Despite this, however, the Consulta has strongly censured the rules that allow postponement of the payment of severance pay to state employees, judging them to be in contrast with the constitutional principles of “fair remuneration”, which must not only be adequate, but also “timely” . And for this the Constitutional Court he asked the government and Parliament to intervene to ensure that state workers receive their severance money immediately starting, the judges said, from those with a low-medium salary.

State liquidations, INPS releases the TFS advance but charges interest. First payments in July

THE PASSAGE

For the government, this is not a simple intervention. Pay immediately Tfs to all state employees, according to INPS counts, would have a cost of 14 billion euros. Difficult to sustain, especially with the return from next year of the constraints of the European Stability Pact. But between Palazzo Chigi and the Treasury they also know that an answer must be given to civil servants. So we began to study a bank advance payment along the lines of what already exists today, thanks to an agreement with the ABI, but making it “free” for the state. How? The solutions are different in the study. The first would consist in ensuring employees an increase in TFS linked to late payment. Let’s take an example. If the worker has accrued 50,000 euros in liquidation, he would be recognized (just to give an example) a 4 percent increase. In short, the liquidation would rise to 52 thousand euros. The bank would immediately pay the employee the 50,000 euros and would then receive the 52,000 euros from INPS once the time for the payment of the TFS has elapsed. The other hypothesis would be to recognize the possibility of deducting 100 per cent of the interest paid to the banks from income.

MEETINGS

The discussion will come alive the week starting Monday July 24, when the Treasury Minister Giancarlo Giorgetti he will meet his government colleagues, starting with the head of the public function Paolo Zangrillo and the head of Marina work Cauldron, to draw up the program for the next budget manoeuvre. In reality, the Constitutional Court had judged the bank advance of the TFS not decisive. But for the government it would be an initial bridging solution in sight then, waiting for better times, a structural solution. It is also probable that the zeroing of interest is limited only to the lowest incomes and not to all civil servants. Already today there is a limit to the bank advance of the liquidation. According to the agreement with the banks, the limit of 45,000 euros cannot be exceeded.

Meanwhile, however, the legal war on the End of service treatment could continue. Confsal-Unsa, the trade union which has been fighting for the immediate payment of the liquidation for years and which has twice brought the matter before the Consulta, has announced that it will also present an appeal to the European Court of Justice. «This», says general secretary Massimo Battaglia to Messaggero, «unless the government finds a solution capable of allowing immediate payment of the end-of-service benefits to all employees». And for Battaglia, the advance by the banks of the sums, provided that the workers do not have to pay any interest, could be a “satisfactory” solution.

Read the full article

on The Messenger