U.S. stocks,Three big thighsRefers to opening high and walking high, stopping three consecutive losses.Dow rises at close1.22%the Nasdaq rose2.53%the S&P rose1.58%。the main factor of influence:Tensions between Russia and Ukraine eased, and global risk assets collectively rebounded.According to a Bank of America survey:Russia-Ukraine conflict ranks fifth in market risk, with net overweight position in tech stocks falling to2006year8lowest since a month.The U.S. Senate voted on the appointment of several senior Fed officials including Powell, and was forced to postpone it in the absence of prominent Republicans. Republicans are mainly dissatisfied with the White House nomination for the vice chairman of Wall Street financial supervision.In addition, U.S. inflation pressure continued to explode, reinforcing the market’s expectations that the Federal Reserve may raise interest rates earlier and more aggressively, which will be released on Wednesday1moonFOMCThe minutes of the meeting focus on whether the Fed believes that it is behind the curve and needs aggressive tightening.

Large tech stocks generally closed higher.Tesla closes higher5.33%。Apple rose2.32%。Microsoft rose1.85%。Google-Crise0.83%Apple and the Google Play Store will face a multibillion-euro class action lawsuit.Amazon goes up0.87%,。Metarise1.52%。

Most Chinese concept stocks closed up, Alibaba rose3.54%BridgewaterQ4Position:Increase the holdings of Pinduoduo, Ali and other Chinese stocks, and clear Amazon and Oracle;Goldman SachsQ4Position:Significantly reduce Alibaba’s holdings and build positionsNuHoldings、Rivian。Jingdong rose2.26%TemasekQ4Significantly increased positions and Pinduoduo, reduced holdings of Ali and Dell, and opened positionsUnityJingdong.Pinduoduo up3.5%Hillhouse ClearanceBStanding on Ali, greatly reducing the holdings of Pinduoduo90%。Wei Lai rose8.41%Benchmarking domestic BMWX5a new model of NIOES7will be4Released this month, it is expected to be delivered within this year;Weilai responded to the cancellation of related companies:The deregistered company has never actually operated.Xiaopeng rose8.24%Xiaopeng Motors has opened a “direct sales” in the European market+“authorized” new sales model;HillhouseQ4Position:Increase the holdings of Ideal Auto and Xpeng Motors;China’s most expensive tech executive:Annual salary of the president of Xiaopeng Motors4.35100 million, so Ali can only rank third.ideal rise5.97%Hillhouse partially overweighted new energy in the fourth quarter, and Ideal Auto ranked among the top ten holdings for the first time;ideal carCTOIt is said that he will leave the company, and the stock price has narrowed its intraday gains.(More US stock information and analysis can be movedUS Stock Research Institute, ID: glh-live)

Let’s review the market conditions of other global markets. In terms of A shares,The main indexes of the two cities rose, and the Shanghai index closed up 0.5 for the whole day% reported 3446 points, the Shenzhen Component Index rose 1.69% to 13345 points, and the ChiNext Index rose 3.09% to 2816 points.The transaction volume shrank, with a turnover of 820 billion yuan, and a net sales of 3.54 billion yuan from northbound funds.Most of the industry sectors rose, and most of the funds flowed to technology, medicine, and new energy stocks that have performed relatively weak recently.The CXO concept has risen sharply, and many stocks such as WuXi PharmaTech have reached the daily limit;Benefiting from the price recovery, the organic silicon concept stocks were strong throughout the day, and Hopson Silicon rose 7.8%;The concept of lithium batteries rose sharply, Enjie shares rose by more than 6%, and CATL rose by 3.7%;Technology topics such as chips and consumer electronics also rose sharply, with Luxshare Precision up 8% and North China Chuang up 6%;Concepts such as photovoltaics, new energy vehicles, smart grids, UHV, and 5G have risen sharply.The tourism sector, which has been rising sharply recently, has tumbled, and many stocks such as Yunnan Tourism have fallen by the limit;Sectors such as oil, coal, and transportation facilities fell sharply, and financial and real estate stocks pulled back again.

For Hong Kong stocks,The three major indexes fell weakly, the Hang Seng Index fell0.82% reported 24355 pointsthe national index fell1.05% reported 8528 pointsHang Seng Technology Index fell0.22% reported 5490 points。Net inflow of funds going south0.82100 million Hong Kong dollars, the market turnover was1141billion Hong Kong dollars.Previously strong oil stocks and gold stocks led the decline in a collective correction, and major financial stocks fell together, putting pressure on the market. Aviation stocks, telecommunications stocks, coal stocks, mainland property stocks and property management stocks fell one after another.The pharmaceutical stocks that fell earlier rebounded collectively,CXOConcept stocks led the rise, most Chinese medicine stocks and Internet medical stocks rose, and semiconductor stocks, automobile stocks, and tobacco concept stocks generally rose.Majority of heavyweight tech stocks fell, Meituan fell2.55%Alibaba and Tencent fell slightly, while Kuaishou and JD.com closed up.

European stocks closed higher across the board,Germany’s DAX30 rose 1.98%, France’s CAC40 rose 1.86%, Britain’s FTSE 100 rose 1.03%, Spain’s IBEX35 rose 1.71%, Italy’s FTSE MIB rose 2.08%, and Europe’s Stoxx 50 rose 1.95%.

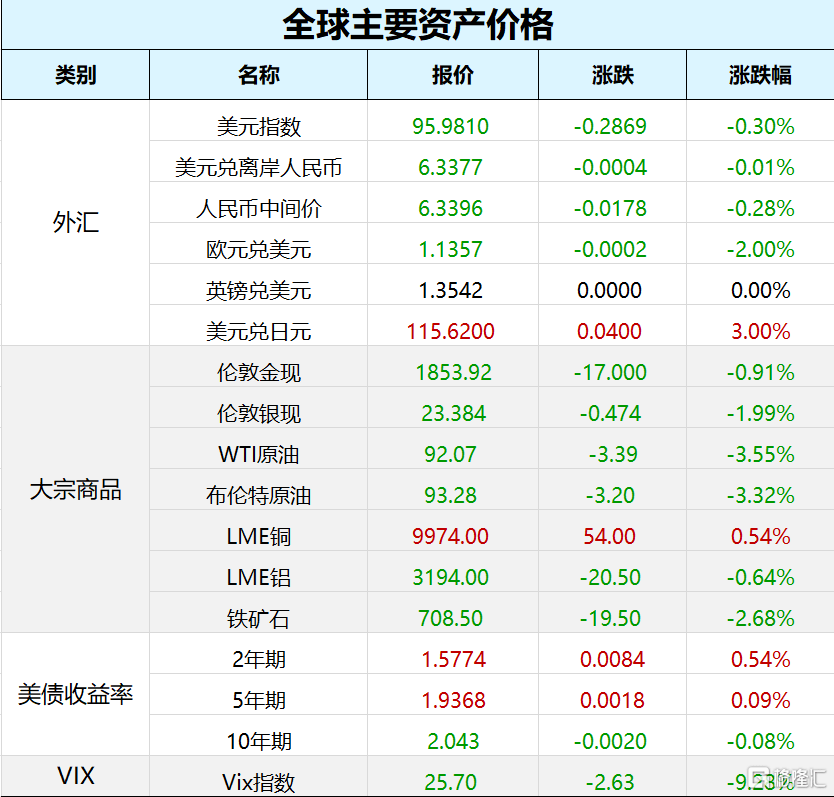

In terms of global major asset prices,Gold futures for April delivery on COMEX closed down 0.7% at $1,856.20 an ounce. WTI for March delivery fell $3.39 to settle at $92.07 a barrel, while Brent for April delivery fell $3.20 to settle at $93.28 a barrel. The yield on the 30-year U.S. Treasury note rose to 2.36%, the highest since May last year.

The latest Pythagorean big data public opinion index list is updated as follows:

The top three companies in the Hong Kong stock public opinion index:Angel of the Times, Zhaoyan New Drug, Kanglong Chemical;The top three companies in the A-share public opinion index:Neutral rock soil, Shoei Shinzo, Koryo Kasei.

What are the things worth paying attention to yesterday and this morning?Let’s take a look

1. Russia announced the withdrawal of some troops from the Ukrainian border near the Ukrainian response

The Russian Ministry of Defense stated that the troops of Russia’s western and southern military districts have completed the exercise and are returning to their bases by rail and road. In response, the Kremlin responded that it is normal and nothing new to withdraw some troops to the base after the exercise. “We will believe it only if we see it with our own eyes. If we see the withdrawal of troops, we will believe that the situation has eased,” said Ukrainian Foreign Minister Dmitro Kulba. Sergey, spokesman for Ukrainian President Volodymyr Zelensky Nikiforov also said: “Any withdrawn troops can return quickly, and we take these reports with great caution.”

U.S. President Biden delivered a public speech on the current situation in Russia and Ukraine on February 15, local time, saying that he would try his best to solve problems through diplomatic channels to avoid conflicts.

2. WuXi AppTec: Net profit in 2021 will increase by 72.19% year-on-year, exceeding the upper limit of the previous forecast range

WuXi AppTec will realize a net profit of 5.097 billion yuan in 2021, a year-on-year increase of 72.19%. The company continues to build an “integrated, end-to-end” CRDMO business, and the strong demand for orders has accelerated the growth of sales revenue in 2021; it is expected that the revenue growth rate of the chemical business segment in 2022 will nearly double that in 2021.

3. CATL: The ultimate solution for models in the range of 80,000-120,000 yuan is chocolate battery swap

CATL disclosed an announcement on the record form of investor relations activities. The chip part of the company’s BMS comes from the United States, and is currently being localized. The expansion of production by friends does not mean that competition will increase. Products with innovative material systems and structural systems are worthy of competition. The company has always provided customers with the most cost-effective products through material innovation, structural innovation and extreme manufacturing. Ningde believes that the ultimate solution for models in the 80,000-120,000-yuan range is to replace the battery with chocolate. At present, the company has both the annual recycling technology and production capacity of ternary and iron-lithium waste batteries, and the production capacity will continue to expand in the future. The short-term rise in the cost of raw materials such as lithium carbonate will have a certain impact on the company, which can be hedged in various ways; the use of copper and aluminum can be greatly reduced through new technologies.

4. Respond to “Forcing Donations”?Musk donated 5.04 million shares of about 3.6 million yuan to charity

Tesla CEO Elon Musk donated 5.044 million Tesla shares to a charity from November 19 to November 29 last year. Documents released by the charity show that Musk’s first donation, dated November 19, involved more than 2.23 million Tesla shares. The second donation was on November 22 (1.56 million shares), the third donation was on November 23 (500,000 shares), the fourth donation was on November 24 (500,000 shares), and the last donation was in November 29 (250,000 shares). According to the closing price on the day he donated the shares, the donation is worth a total of 5.74 billion US dollars (about 36 billion yuan).

5. Guangdong Hydropower: Signed a strategic cooperation framework agreement with Wuhai Municipal Government and Xingbang Technology

Guangdong Hydropower signed a strategic cooperation framework agreement with the Wuhai Municipal People’s Government of Inner Mongolia Autonomous Region and Jiangsu Xingbang Energy Technology Co., Ltd. to set up an international academician future zero-carbon hydrogen energy technology innovation center, build two carbon-neutral hydrogen power industrial parks, build There are 3 industrial clusters in the upper, middle and lower reaches. The three parties jointly established a hydrogen energy green financial service platform, and planned to invest 2 billion yuan to improve the hydrogen energy industry financial service system. The hydrogen power development plan will be closely integrated with high standards to complete the implementation of the overall industrial chain in three years. The total investment is expected to be 16.8-18.8 billion yuan. The project is expected to form 10,000 units (sets) of hydrogen fuel cell modules, hydrogen fuel cell heavy trucks and It can be used in bus sanitation vehicles and other applications, and has formed the hydrogen production and hydrogenation supply service capacity required for 10,000 hydrogen fuel cell vehicles.

6. ORA brand response: the black cat and white cat models have been discontinued

It is reported that the black cats and white cats under the ORA brand no longer accept new car orders. In response, the relevant person in charge of the ORA brand responded: “These two models have indeed been discontinued.” The relevant person in charge of the ORA brand did not disclose the reasons for the sudden discontinuation of the two models.

7. Mubang Hi-Tech: the proposed acquisition of 100% equity of Haoan Energy, the main business will increase photovoltaic silicon wafers and silicon rods

Mubang Hi-Tech announced that it plans to acquire 100% equity of Haoan Energy held by Zhang Zhongan and Yu Jumei in cash, and the transaction price is tentatively set at 1.1 billion yuan. After the transaction is completed, the company’s main business will increase the research and development, production and sales of photovoltaic silicon wafers and silicon rods. In addition, the company plans to raise no more than 2.415 billion yuan through non-public issuance of shares, which will be used to acquire 100% equity of Haoan Energy, 10,000 tons/year of intelligent silicon purification and recycling project and to supplement working capital.

8. Dongfang Cable: Won the 1.39 billion yuan offshore wind power submarine cable general contract project

Dongfang Cable announced that it has won the bid for the 220kV and 35kV submarine cable procurement and laying engineering projects of Mingyangjiang Qingzhou Four Offshore Wind Farm Project, with a total bid amount of 1.39 billion yuan.

9. On-machine CNC: Net profit in 2021 will increase by 208% year-on-year

Shanghai CNC will realize a net profit of 1.637 billion yuan in 2021, a year-on-year increase of 208.01%. The sales scale of the company’s monocrystalline silicon business continued to expand, resulting in an increase in the company’s sales revenue and a steady increase in the company’s performance. The Q3 net profit of SHNC was 556 million yuan. Based on this calculation, the Q4 net profit was 232 million yuan, a decrease of 58% from the previous month.

10. Orchid Science and Technology: Net profit in 2021 will increase by 525.12% year-on-year

Orchid’s 2021 operating income will be 12.907 billion yuan, a year-on-year increase of 94.78%; net profit will be 2.342 billion yuan, a year-on-year increase of 525.12%; basic earnings per share will be 2.05 yuan.

11. Zhongyuan Media: Net profit in 2021 will increase by 3.81% year-on-year

In 2021, Zhongyuan Media will achieve a total operating income of 9.206 billion yuan, a year-on-year decrease of 4.01%; a net profit of 963 million yuan, a year-on-year increase of 3.81%. The net profit of Zhongyuan Media in Q3 was 190 million yuan. Based on this calculation, the net profit in Q4 was 332 million yuan, a month-on-month increase of 75%.

12. China Construction Environmental Energy: Net profit in 2021 will increase by 6.13% year-on-year

In 2021, CSCEC will achieve an operating income of 1.462 billion yuan, a year-on-year increase of 17.7%; a net profit of 180 million yuan, a year-on-year increase of 6.13%.

13. CCCC: Net profit in 2021 will increase by 17.92% year-on-year

In 2021, CCCC will realize a total operating income of 5.089 billion yuan, a year-on-year increase of 26.75%; a net profit of 150 million yuan, a year-on-year increase of 17.92%.

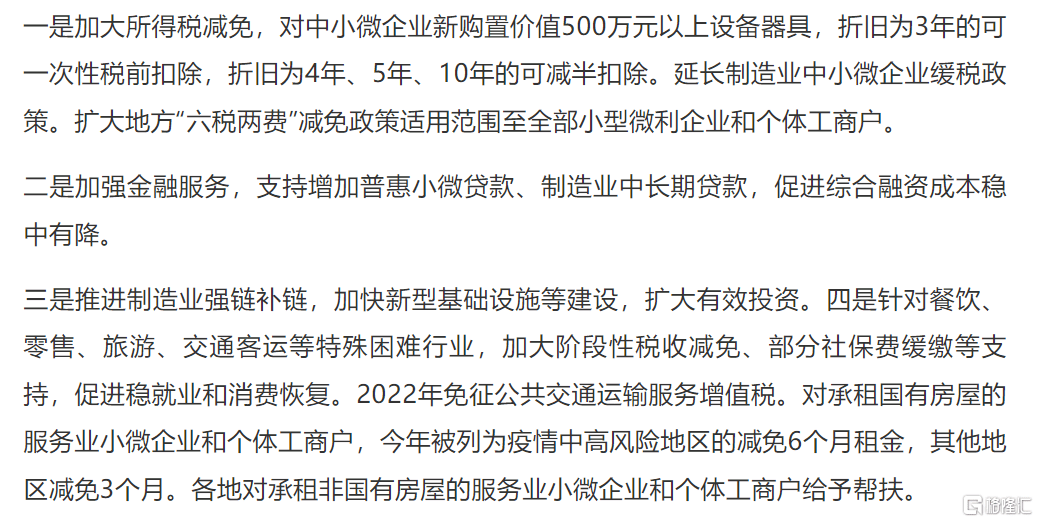

1. National regular meeting: continue to do a good job in ensuring the supply and price of bulk commodities to keep prices basically stable

The executive meeting of the State Council emphasized that it is necessary to accurately prevent and control the normalized epidemic situation, and attach great importance to solving the constraints in economic operation in the face of complex domestic and foreign situations. Continue to do a good job in securing supply and stabilizing prices of bulk commodities, and keep prices basically stable. Guarantee food and energy security, and support coal-fired power companies to make more efforts. Make preparations for further relief policies to help enterprises and enhance the impetus for economic development.

The meeting also pointed out that the current stable recovery of the industrial economy is still not solid, and the service industry has some special difficulties due to the impact of the epidemic. Measures should be introduced in the near future to increase assistance. Specifically include:

2. U.S. PPI rose 1% in January, higher than expected

The U.S. PPI rose 1% month-on-month in January, hitting a new high since July last year. It is expected to rise by 0.5%, and the previous value rose by 0.2%, which was revised to rise by 0.4%; it rose by 9.7% year-on-year. 9.8%.

3. The central bank conducts a 1-year MLF operation of 300 billion yuan and the interest rate remains unchanged

The central bank’s open market carried out 300 billion yuan of one-year MLF operations and 10 billion yuan of 7-day reverse repurchase operations, and the winning rates were 2.85% and 2.10%, respectively, the same as before. 20 billion yuan of reverse repurchase expired today, a total of 200 billion yuan of MLF expired in February, and the expiration date is February 18.

4. Hong Kong added 1,619 new cases of new crown yesterday

Yesterday, Zhang Zhujun, director of infectious diseases at the Hong Kong Center for Health Protection, announced that 1,619 new cases were confirmed on the 15th, all of which were local infections, with a total of about 5,400 preliminary positive cases. Regarding the recent epidemic in Hong Kong, Lin Zhengyue said that the SAR government has no plan to “close the city” and will insist on “dynamic clearing”, reiterating that surrendering to the virus is not an option.

5. Guangdong: High-standard construction of Guangzhou Futures Exchange

The Guangdong Provincial People’s Government issued several measures to promote the reform and innovation of trade and investment facilitation in the Guangdong Pilot Free Trade Zone, pointing out that the Guangzhou Futures Exchange should be built with high standards. Strengthen the linkage and cooperation between Guangzhou Futures Exchange, Hong Kong Stock Exchange and Shenzhen Stock Exchange, attract international investors to participate, and build an important platform to serve high-quality development, the Guangdong-Hong Kong-Macao Greater Bay Area and the “Belt and Road” construction. Further enrich the varieties of commodity futures, and promote the research and listing of featured futures varieties that meet the development needs of the Guangdong Pilot Free Trade Zone.

1. The three ministries and commissions jointly reminded and warned some iron ore trading companies: Do not maliciously hype, hoard, and drive up prices

In response to the recent abnormal fluctuations in iron ore prices, the Price Supervision and Competition Bureau of the State Administration for Market Regulation, the Price Department of the National Development and Reform Commission, and the Futures Department of the China Securities Regulatory Commission jointly held a meeting to learn more about the changes in port inventories of iron ore trading enterprises and their participation in iron ore futures. In the case of spot transactions, etc., relevant enterprises are reminded not to fabricate and publish false price information, not to maliciously hype, hoard, or drive up prices, and to call on relevant state-owned enterprises to take the initiative to assume social responsibilities and help the government ensure supply and stabilize prices. Relevant departments are highly concerned about changes in iron ore prices and will take further effective measures to effectively maintain the normal order of the market. In the next step, the State Administration for Market Regulation will pay close attention to changes in market prices, and severely crack down on illegal activities such as fabricating and disseminating information on price increases, hoarding, and driving up prices.

2. Scientists of the Chinese Academy of Sciences have discovered a super-large lithium ore resource exceeding one million tons in the Himalayas

According to the Institute of Geology and Geophysics of the Chinese Academy of Sciences, the research team of the institute’s Qinghai-Tibet Plateau scientific expedition discovered a super-large lithium deposit in the Qiongjiagang area of the Himalayas. After that, the third largest lithium mine in my country” is “the first pegmatite lithium mine with industrial value in the Himalayas”. Qin Kezhang, head of the scientific research team, said that the lithium oxide resources in the ore body can reach 1.0125 million tons. “This value is calculated based on the conservatively estimated ore body volume and lithium oxide resource content.”

3. Rare earth price index continues to hit record highs

According to the China Rare Earth Industry Association, the rare earth price index on February 15, 2022 was 426.8, an increase of 6.2 points from yesterday and a record high. In addition, the data shows that among the 7 rare earth concept stocks, the 6 companies that have disclosed their performance forecasts are all pre-increased. The North Rare Earth with the highest increase is expected to increase its net profit attributable to shareholders of listed companies by 488.58%-507.79%.

4. The situation in Ukraine may affect the supply of semiconductor gas

TrendForce issued a report stating that Ukraine is a major supplier of raw material gas for semiconductors, and the situation in Ukraine may impact the supply of inert gas in the region. The reduction in gas supply will cause prices to rise, and the cost of wafer production may rise accordingly. The report pointed out that Ukraine’s semiconductor raw material gas supply includes neon, argon, krypton, xenon, etc., of which neon gas is supplied by Ukraine for nearly 70% of the world’s production. Although the proportion of neon gas used in the semiconductor process is not as good as that of other industries, it is still a necessary factor. materials. However, at present, semiconductor factories and gas supply factories have inventories, and if there are still supplies in other regions, it is believed that production line interruptions will not affect output in the short term.Return to Sohu, see more