General trend research and judgment: market differentiation is slightly closed, and structural nuggets continue

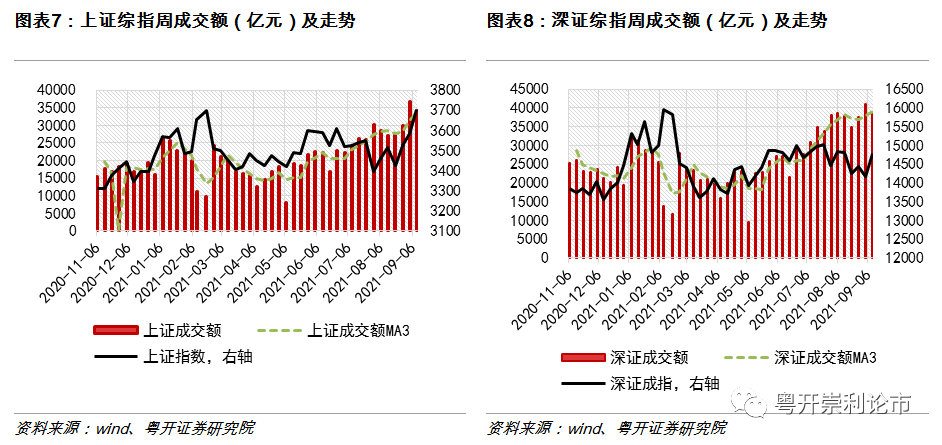

The differentiation is slightly closed, but it is still deep.Since July 21, the turnover of the two cities has exceeded one trillion for 38 consecutive trading days. This week, the turnover of the two cities both exceeded 1.4 trillion. The turnover has converged slightly compared to last week, but the ups and downs have diverged compared with last week (The Shanghai Composite IndexUp 1.69%,Shenzhen Component Index1.78% callback,Growth Enterprise Market IndexIn the case of a pullback of 4.76%), the major indexes have experienced general gains this week (the Shanghai Composite Index, the Shenzhen Component Index, and the ChiNext Index rose 3.39%, 4.17%, and 4.19% respectively), and the market differentiation was slightly closed.

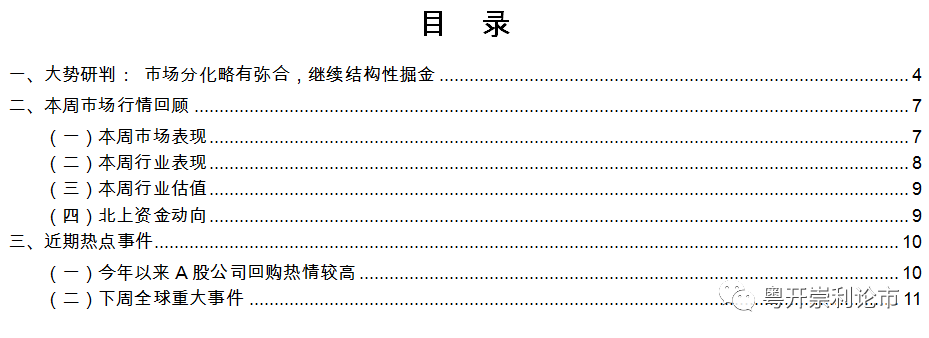

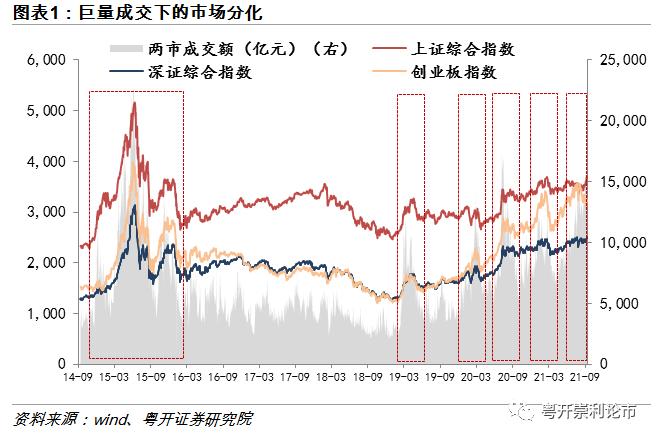

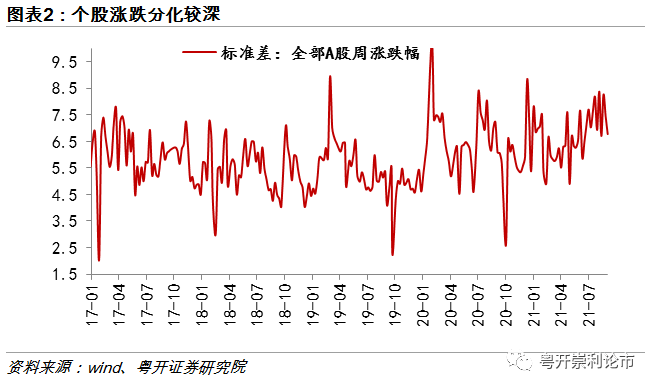

The market differentiation under this huge transaction is outstanding.Looking back on the historical market, many times since 19 yearsIn the case of a significant increase in turnover, it is often accompanied by a general rise in the three major indexes, The turnover is basically the same as the index trend. However, under this huge volume of transactions, the rise and fall of the three major indexes have diverged. The previous transaction increased to push the ChiNext index higher, and then the ChiNext index pulled back, the Shanghai Composite Index turned upward, and the Shenzhen Component Index remained volatile.USUse the standard deviation of the weekly rise and fall of A shares to measure the degree of dispersion of individual stocks’ rise and fall, and use the standard deviation of the weekly turnover of A shares to measure the degree of dispersion of individual stock’s trading activity.The two standard deviations this week have been lowered compared to last week, confirmingConvergence of market differentiation, But the two standard deviations are both at a historically high level, especially when the turnover of individual stocks is extremely differentiated.Market differentiation is still deep。

Behind the market differentiation is the differentiation game expected by investors.One is the level of economic expectations, The economic slowdown in the second half of the year has become a basic consensus. PPIUncertainties such as turning points, export divergence, real estate investment, etc. still exist, but at the same time, the macro economy is still in a stable and positive recovery phase in terms of stocks, and investment opportunities continue to be created during the recovery of consumption and manufacturing.The second is the liquidity level, Overseas Taper is expected to disturb external funds, domesticcurrencyPolicies have also returned to the normalized range. However, with the slowdown in economic growth and risks that have not yet been completely eliminated, currency liquidity is expected to achieve marginal easing under controllable risks in the second half of the year. At the same time, the move of household wealth under real estate regulation will still provide the stock market. The potential for incremental funds is confirmed by a year-on-year increase in residential mortgage loans in August and an increase of 360.5 billion yuan in non-bank deposits year-on-year.The third is the valuation levelBefore the Spring Festival, the valuation of some sectors has been “overdrawn”, but after the shock adjustment in the first half of the year, the valuation space of some sectors has expanded again.Fourth, the risks in various aspects have not yet been resolved. Superimposed on the volatility in the first half of the year, investor confidence is relatively “fragile”. The current risks include the uncertainty of overseas Taper, the uncertainty of the macro economy, the spot-like outbreak of credit risk, the rebound of the epidemic in some regions, and the strengthening of supervision of some industries, etc.

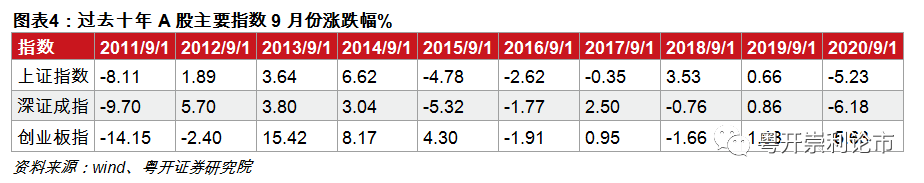

We believe that the enthusiasm for trading in September is expected to remain, and market differentiation is expected to be further bridged.The growth rate of social finance and M2 continued to decline in August, and the marginal easing of monetary liquidity is expected to continue.In August, the growth rate of M2 and social financing decreased by 0.1% and 0.4% compared with the previous month. Long-term loans to residents and companies increased year-on-year, reflecting the decline in housing loans and the decline in production due to the August epidemic and weather. The issuance of local bonds in August is still slow, and the issuance of local bonds in September may accelerate. 600 billion yuan of MLF will be withdrawn from circulation on September 15. The expansion of the fiscal balance in September is expected to partially offset the large-scale maturity of MLF, the acceleration of government bond issuance, and the seasonal increase in M0. Marginal easing is expected to continue.In terms of calendar effect, the major A-share indexes in the past ten years have a 50% rise probability in September. However, after excluding the impact of the September 2020 market crash data, the A-shares still have a higher probability of rising in September.Specific to the industry, the sectors with a higher probability of rising in September in the past ten years includeLeisure services, household appliances, electrical equipment and automobiles, The probability of rising is more than 70%. Among them, the leisure service and automotive sectors have averaged 2.19% and 1.76% in September in the past ten years. This is mainly due to the peak season of electronic products in September, and industry chain companies may react in advance, superimposing the Mid-Autumn Festival and National Day holiday. , Is the traditional peak season for consumption, which directly benefits the big consumption sector.

Under market differentiation, even huge transactions cannot be swept up, and we should continue to look for structural investment opportunities. Configuration direction:

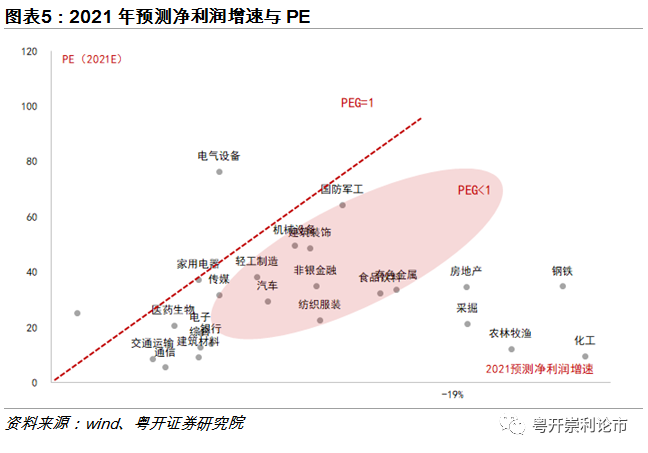

1. CertaintyPerformanceIt is also expected to enjoy a certain premium, and the high-prosperity sector still has a higher winning rate.The long-term benefits of the growth track depend on industry trends, and the short- and medium-term rhythms are affected by liquidity and market sentiment. In the near future, the overall market style of the growth sector tends to be balanced. However, under the expectations of liquidity and policy support in the second half of the year, we believe that the high-growth and sustainable sectors are still worthy of deployment, and the market for smart manufacturing and science and technology sectors is expected to continue.According to Wind’s consensus, 2021-2022Net profitHigh-growth sectors includeElectronics, communications, automobiles, electrical equipment, chemicals, non-ferrous metalsWait.

Under market differentiation, the sector needs to further explore structural investment opportunities in sub-sectors.for exampleThe middle and upper reaches of the lithium battery in the new energy vehicle sector, the power semiconductor/VR industry chain in the electronic sector, the high-end machine tools of mechanical equipment, the large consumer sector, the Chinese Mid-Autumn Festival holiday benefit sector, photovoltaic and wind power equipment, the electrolytic aluminum and new energy metals in the non-ferrous sector, The building materials industry has benefited from the accelerated issuance of special bonds and the heating up of infrastructure investment, 5G infrastructure/green IDC/optical modules in the cement/glass fiber and communications sectorsand many more.

2. Pay attention to the investment opportunities of small and medium-sized enterprises with market value, and look for “supporting experts” and “single champions” targets specializing in special new China.The establishment of the Beijing Stock Exchange will comprehensively enhance the NEEQ’s ability to serve small and medium-sized enterprises. The legal status of the NEEQ selected layer will be significantly improved. Selected layer companies will be treated as listed companies. The threshold for investors is expected to be further lowered and the NEEQ will welcome Come more incremental funds. As the focus of recent policy support and market focus, specialized and special new enterprises have the advantages of relatively concentrated core business, horizontal leadership in profitability, healthy cash flow and strong R&D driving force. It is recommended to pay attention to the “supporting experts” of specialized and special new China. And the “single champion” target.

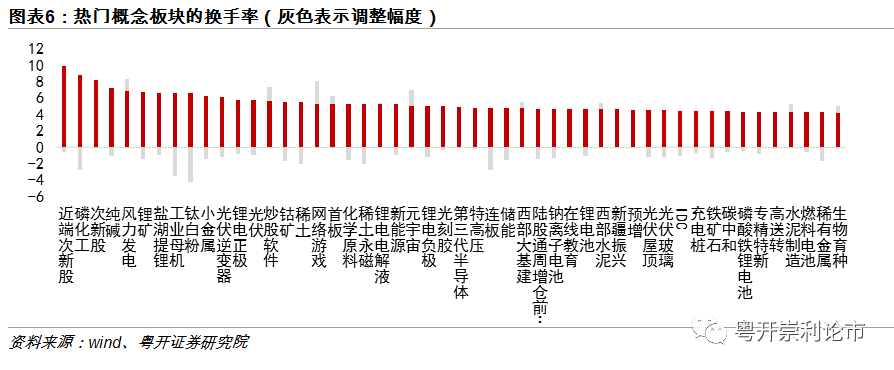

3. Under the market differentiation, the sectors are moving faster, and the popular concept sector may have a higher winning rate.Popular concept sectors may benefit from excellent performance flexibility, or benefit from policies and performance expectations. Under the rotation of the sector, the adjustment of popular concept sectors can also provide short-term structural investment opportunities.

Risk warning: policy implementation falls short of expectations, economic recovery falls short of expectations, and epidemic prevention and control fall short of expectations

1. General trend research and judgment: market differentiation will be slightly closed, and structural nuggets will continue

The differentiation is slightly closed, but it is still deep.Since July 21, the turnover of the two cities has exceeded one trillion for 38 consecutive trading days. This week, the turnover of the two cities both exceeded 1.4 trillion. The turnover has converged slightly compared to last week, but compared with the ups and downs of last week (the Shanghai Composite Index rose by 1.69%, the Shenzhen Component Index pulled back 1.78%, and the ChiNext Index pulled back 4.76%), the major indexes appeared this week. The general rise (the Shanghai Composite Index, the Shenzhen Component Index and the ChiNext Index rose 3.39%, 4.17%, and 4.19% respectively), and the market differentiation was slightly closed.

The market differentiation under this huge transaction is outstanding.Looking back on the historical market, many times since 19 yearsIn the case of a significant increase in turnover, it is often accompanied by a general rise in the three major indexes, The turnover is basically the same as the index trend. However, under this huge volume of transactions, the rise and fall of the three major indexes have diverged. The previous transaction increased to push the ChiNext index higher, and then the ChiNext index pulled back, the Shanghai Composite Index turned upward, and the Shenzhen Component Index remained volatile.USUse the standard deviation of the weekly rise and fall of A shares to measure the degree of dispersion of individual stocks’ rise and fall, and use the standard deviation of the weekly turnover of A shares to measure the degree of dispersion of individual stock’s trading activity.The two standard deviations this week have been lowered compared to last week, confirmingConvergence of market differentiation, But the two standard deviations are both at a historically high level, especially when the turnover of individual stocks is extremely differentiated.Market differentiation is still deep。

Behind the market differentiation is the differentiation game expected by investors.One is the level of economic expectationsThe slowdown in economic growth in the second half of the year is the basic consensus. PPI inflection point, export divergence, real estate investment and other uncertainties still exist, but at the same time, the macro-economy is still in a stable and positive recovery stage in terms of stock, consumption, manufacturing During the recovery of the industry, investment opportunities continue to be created.The second is the liquidity level, Overseas Taper is expected to disturb external funds, and domestic monetary policy will return to the normalized range. However, in the case of slowing economic growth and risks that have not been completely eliminated, monetary liquidity is expected to achieve marginal easing under risk control in the second half of the year. Resident wealth moving under real estate regulation still provides the stock market with the potential for incremental funds. In August, residential mortgages decreased year-on-year and non-bank deposits increased by 360.5 billion yuan year-on-year.The third is the valuation levelBefore the Spring Festival, the valuation of some sectors has been “overdrawn”, but after the shock adjustment in the first half of the year, the valuation space of some sectors has expanded again.Fourth, the risks in various aspects have not yet been resolved. Superimposed on the volatility in the first half of the year, investor confidence is relatively “fragile”. The current risks include the uncertainty of overseas Taper, the uncertainty of the macro economy, the spot-like outbreak of credit risk, the rebound of the epidemic in some regions, and the strengthening of supervision of some industries, etc.

We believe that the enthusiasm for trading in September is expected to remain, and market differentiation is expected to be further bridged.The growth rate of social finance and M2 continued to decline in August, and the marginal easing of monetary liquidity is expected to continue.In August, the growth rate of M2 and social financing decreased by 0.1% and 0.4% compared with the previous month. Long-term loans to residents and companies increased year-on-year, reflecting the decline in housing loans and the decline in production due to the August epidemic and weather. The issuance of local bonds in August is still slow, and the issuance of local bonds in September may accelerate. 600 billion yuan of MLF will be withdrawn from circulation on September 15. The expansion of the fiscal balance in September is expected to partially offset the large-scale maturity of MLF, the acceleration of government bond issuance, and the seasonal increase in M0. Marginal easing is expected to continue.In terms of calendar effect, the major A-share indexes in the past ten years have a 50% rise probability in September. However, after excluding the impact of the September 2020 market crash data, the A-shares still have a higher probability of rising in September.Specific to the industry, the sectors with a higher probability of rising in September in the past ten years includeLeisure services, household appliances, electrical equipment and automobiles, The probability of rising is more than 70%. Among them, the leisure service and automotive sectors have averaged 2.19% and 1.76% in September in the past ten years. This is mainly due to the peak season of electronic products in September, and industry chain companies may react in advance, superimposing the Mid-Autumn Festival and National Day holiday. , Is the traditional peak season for consumption, which directly benefits the big consumption sector.

Under market differentiation, even huge transactions cannot be swept up, and we should continue to look for structural investment opportunities. Configuration direction:

1. Deterministic performance is more likely to enjoy a deterministic premium, and the high-prosperity sector still has a higher winning rate.The long-term benefits of the growth track depend on industry trends, and the short- and medium-term rhythms are affected by liquidity and market sentiment. In the near future, the overall market style of the growth sector tends to be balanced. However, under the expectations of liquidity and policy support in the second half of the year, we believe that the high-growth and sustainable sectors are still worthy of deployment, and the market for smart manufacturing and science and technology sectors is expected to continue.According to Wind’s consensus, the sectors with high growth in net profit growth from 2021 to 2022 includeElectronics, communications, automobiles, electrical equipment, chemicals, non-ferrous metalsWait.

Under market differentiation, the sector needs to further explore structural investment opportunities in sub-sectors.for exampleThe middle and upper reaches of the lithium battery in the new energy vehicle sector, the power semiconductor/VR industry chain in the electronic sector, the high-end machine tools of mechanical equipment, the large consumer sector, the Chinese Mid-Autumn Festival holiday benefit sector, photovoltaic and wind power equipment, the electrolytic aluminum and new energy metals in the non-ferrous sector, The building materials industry has benefited from the accelerated issuance of special bonds and the heating up of infrastructure investment, 5G infrastructure/green IDC/optical modules in the cement/glass fiber and communications sectorsand many more.

2. Pay attention to the investment opportunities of small and medium-sized enterprises with market value, and look for “supporting experts” and “single champions” targets specializing in special new China.The establishment of the Beijing Stock Exchange will comprehensively enhance the NEEQ’s ability to serve small and medium-sized enterprises. The legal status of the NEEQ selected layer will be significantly improved. Selected layer companies will be treated as listed companies. The threshold for investors is expected to be further lowered and the NEEQ will welcome Come more incremental funds. As the focus of recent policy support and market focus, specialized and special new enterprises have the advantages of relatively concentrated core business, horizontal leadership in profitability, healthy cash flow and strong R&D driving force. It is recommended to pay attention to the “supporting experts” of specialized and special new China. And the “single champion” target.

3. Under the market differentiation, the sectors are moving faster, and the popular concept sector may have a higher winning rate.Popular concept sectors may benefit from excellent performance flexibility, or benefit from policies and performance expectations. Under the rotation of the sector, the adjustment of popular concept sectors can also provide short-term structural investment opportunities.

2. Market review this week

(1) Market performance this week

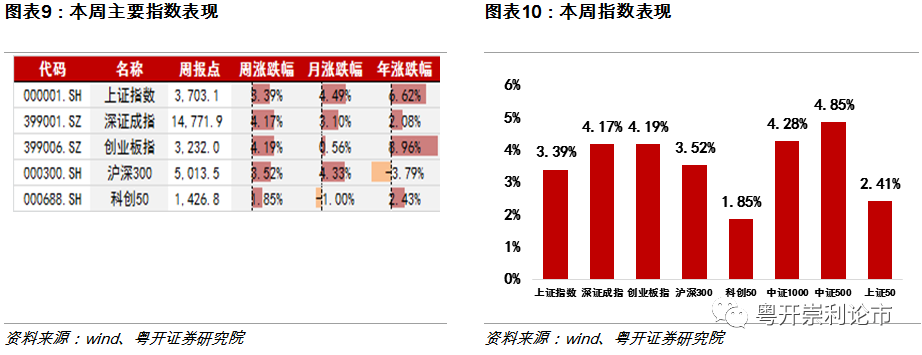

This week (2021/9/6-2021/9/10) the two cities continued to increase in volume.This week, the Shanghai Composite Index, Shenzhen Component Index, and ChiNext Index rose 3.39%, 4.17%, and 4.19% respectively. The weekly turnover of the two cities was 7.28 trillion yuan, and the turnover continued to be at a high level during the year.

This week (2021/9/6-2021/9/10) the main indexes have risen.CSI 500 rose the most, and the index rose and fell: CSI 500 (+4.85%)> CSI 1000 (+4.28%)>SSE 50(+2.41%)>Technology 50 (+1.85%).

(2) Industry performance this week

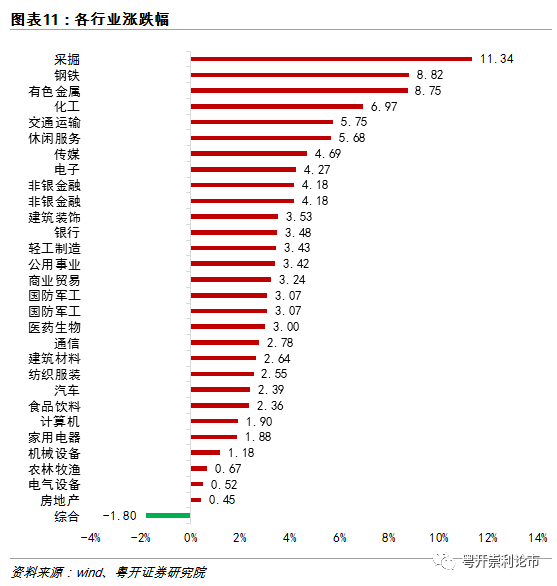

In terms of industries, among the first-tier industries of Shenwan this week, mining (11.34%), steel (8.82%), and non-ferrous metals (8.75%) performed better, and the overall (-1.8%) declined.

(3) Industry valuation this week

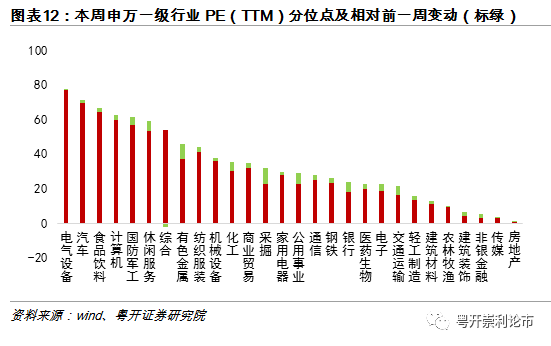

In terms of industry valuation this week, judging from the current quantile of PE (TTM) in the past ten years, electrical equipment (77.76%), automotive (71.23%),food and drink(66.45%) ranked top three;real estate(0.80%), media (3.46%), non-silver (5.31%) PE (TTM) quantile ranked the bottom three.

(Four)Northward capitaltrend

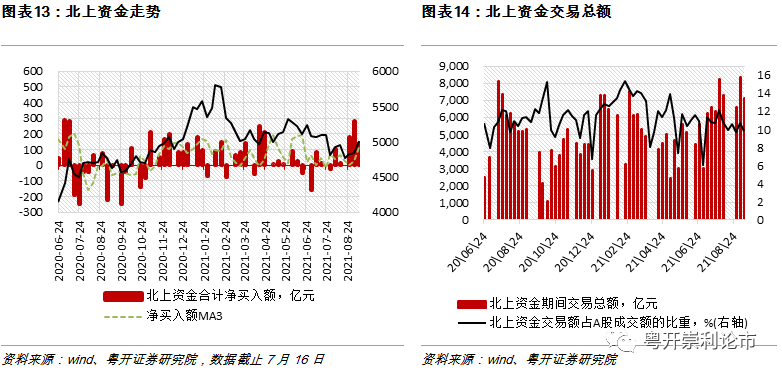

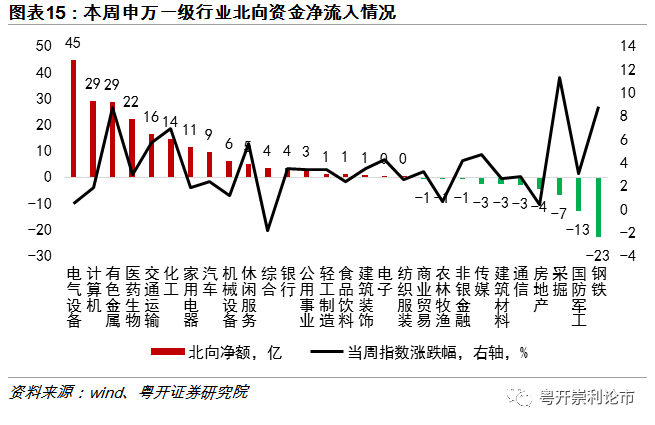

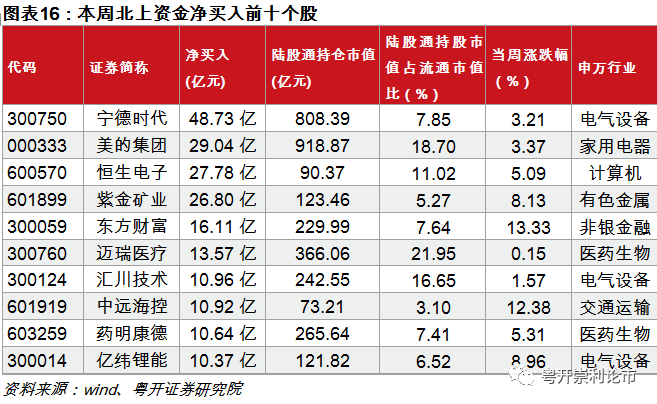

This week, Beijing Capital continued to increase its volume to 714 billion yuan. At the same time, the capital from the north has increased significantly in the electrical equipment, computer, and non-ferrous sectors; the capital from the north has largely flowed out of the steel, military and other sectors.

3. Recent hot events

(1) A-share companies this yearRepurchaseHigher enthusiasm

As of September 11, 414 A-share companies had implemented a total of 94.573 billion yuan of repurchases. Among them, 40 companies have launched more than two repurchases,Gree Electric、HeungKong Holdings、HeungKong HoldingsThe third round of repurchase has been opened.Gree Electric、Midea GroupThe amount of repurchase implemented exceeded 10 billion yuan, which was 21.712 billion yuan and 13.664 billion yuan respectively. Since the beginning of this year, the valuations of some sectors and individual stocks have been lowered significantly, and many companies have initiated repurchases. The starting point is to help stabilize the company’s stock price, hoping to enhance investor confidence and slow down investors’ selling speed by sending signals that are optimistic about the company’s future development. ; The second is to increase the earnings per share and reduce the tax burden; the third is to help improve the efficiency of capital utilization, optimize the capital structure, maintain control, and so on.

From an industry perspective, companies in the household appliances, computers, and pharmaceutical and biological industries have relatively high repurchase amounts, with 38.435 billion yuan, 6.241 billion yuan and 5.879 billion yuan respectively. The growth rates of these three major sectors in 2020 are 31.1, 9.8, and 51.1 respectively. The declines this year are 19.9%, 3.7%, and 7.9%, which basically belong to the relatively large increase in 20 years. The higher amount is due to factors such as boosting the company’s stock price and the larger scale of some companies in the sector. Besides,food and drinkThe repurchase amount of the electronic sector is also relatively high.

Many companies have raised the upper limit of repurchase prices and continued to implement repurchases. In addition to boosting stock prices, it also reflects the company’s management’s optimism about future development prospects and operating conditions. The market performance has been divergent since the beginning of the year, and the stock prices of some companies have not performed satisfactorily. The active repurchase of listed companies shows that the management hopes to stabilize the stock price, increase investment confidence, and reduce the room for a sharp drop in the stock price.

(2) Major global events next week

(Source: Guangdong Development Chongli Lunshi)

.