On the evening of December 27, Weibo Hydraulics, the first new stock after the Beijing Stock Exchange opened, announced the results of the subscription.

The allocation ratio of new shares to be purchased this time was 0.04%, setting a new low for the previous selection ratio of new shares. This winning rate also means that if investors want to ensure at least 100 shares, they must at least ensure that there are 2.4 million yuan in cash in their account for purchase. Even if the investor freezes 3.9 million yuan in the top grid purchase, he can only get a maximum of 200 shares.

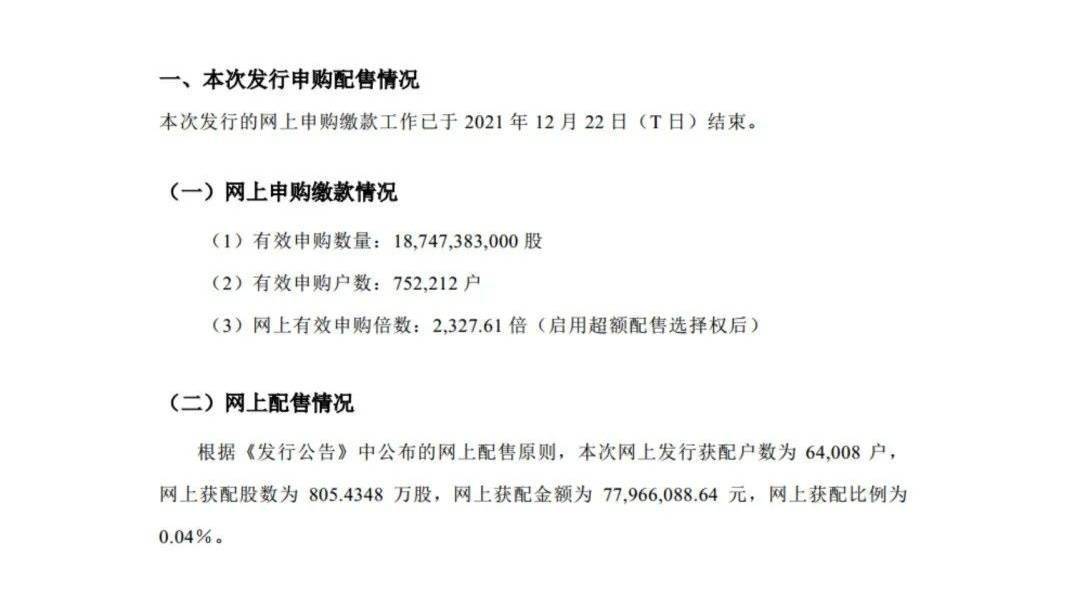

Weibo Hydraulics has approximately 750,000 subscribers, setting a new high and surpassing the forecasts of many analysts before.

Weibo Hydraulics is the first new stock after the opening of the Beijing Stock Exchange, and the first new stock after the investor threshold of the Beijing Stock Exchange is lowered to 500,000 yuan. As of the subscription, the number of investors on the Beijing Stock Exchange has expanded to 4.6 million. Of the 4.6 million investors, only 750,000 participated in the subscription. Isn’t the number a bit small? The Beijing Stock Exchange and the Science and Technology Innovation Board have the same threshold of 500,000 yuan, but the number of new stock purchasers on the Science and Technology Innovation Board is more than 5 million.

Compared with the Science and Technology Innovation Board, this data is definitely relatively small. “The science and technology innovation board is a market value subscription. The Beijing Stock Exchange needs cash. Some investors may not have that much cash, so they did not participate in the subscription.” Senior NEEQ investor Zhou Yunnan told reporters.

Compared with the previous IPO subscription data of the Beijing Stock Exchange, the 750,000 applicants have already refreshed history. The first batch of 32 IPO subscriptions of Beijing Stock Exchange (selected layer) was crazy, with about 400 billion yuan in new funds. At that time, Yingtai Biologics had 540,000 online purchasers, making it the largest online purchaser of Beijing Stock Exchange. Layer selection) new shares.

However, starting from the 33rd new stock, the number of purchasers of new stocks on the Beijing Stock Exchange (selected layer) dropped sharply to only tens of thousands. Some IPO applicants are even only 30,000 or 40,000. Some people on the New Third Board told reporters that this was mainly related to the market performance of the first batch of 32 new stocks after the listing, which fell short of expectations, resulting in lower market sentiment.

In the future, the first batch of 10 new stocks were listed on the Beijing Stock Exchange, and the number of investors who participated in the subscription of new shares rebounded to around 100,000, with a maximum of not more than 200,000. Compared with history, the number of purchasers of 750,000 is enough.

From the perspective of relative data, Weibo Hydraulics is also relatively high in terms of the number of investors participating in the subscription of new shares to the total number of qualified investors. 4.6 million qualified investors, 750,000 participated in the subscription, accounting for 16.3%. In the first batch of IPO subscriptions on the Beijing Stock Exchange, this data accounted for no more than 10%.

Liu Jing, the chief analyst of Shenwan Hongyuan’s NEEQ team, once predicted that the threshold for online single-account purchases is low. Considering the market expansion and the increase in newness and newness, it is expected that 10%-12% of qualified investors will participate in this online issuance. The number of valid online purchases is 4.6-55.2 million. The actual situation has exceeded expectations.

0.04% of the allocation ratio is low and not low

Some analysts expect Weibo Hydraulic’s allocation ratio to be 0.078%-0094%, and the actual allocation ratio is 0.04%, which is lower than expected.

From the current 82 stocks on the Beijing Stock Exchange, the 0.04% allocation ratio has also set a record low. Previously, Yongshun Biotech had a lower allocation ratio, with a allocation ratio of 0.0432%.

Zhou Yunnan said that the allocation ratio this time was lower than market expectations and hit a record low since the establishment of the selection layer, indicating that investors are actively optimistic about the Beijing Stock Exchange’s new opportunities and will also have a certain impact on the Beijing Stock Exchange’s secondary market. The stimulating effect.

The reporter noted that according to the 0.04% allotment ratio, if investors want to guarantee at least 100 shares, they need to subscribe for at least 250,000 shares. Correspondingly, investors need to guarantee at least 2.42 million yuan of subscription cash in the account.

“The threshold for more than 2.4 million in cash is still relatively high. Not many investors can get it out at once, so it is still more difficult to get 100 shares. This subscription has frozen 180 billion yuan in funds, and 750,000 households have participated. In fact, the per capita cost is only 240,000 yuan.” An investor from the New Third Board told reporters.

Weibo Hydraulics received 8.05 million shares in the online allotment, and the number of online distribution users was 64,000. It is calculated that 126 shares are allotted per capita.

“This is easy to understand. The number of shares allocated for this subscription is 100 shares less, 200 shares more, and 200 shares are already the most. It is impossible to have more than 200 shares allocated this time. The number of allotments must be more than 100 shares.” Zhou Yunnan said.

The reporter noticed that if you want to purchase 100 shares this time, you need to subscribe for at least 250,000 shares, and this time the number of top grid subscription shares is 402,700. If an investor applies for the purchase according to the top grid, the theoretical number of shares allocated will be 161 shares. Since the number of allotment shares must be an integral multiple of 100, top grid applicants can either get 200 shares allotment earlier, or only 100 shares can be allocated later in extreme cases.

What has changed in the purchase rules of the Beijing Stock Exchange

Weibo Hydraulics is the first new stock after the implementation of the new rules of the Beijing Stock Exchange. Compared with the previous new rules for the selection of layers, the distribution rules for new shares of Beijing Stock Exchange have been realized. Specifically, the first round of distribution of new shares is based on proportional distribution. However, in the second round, the Beijing Stock Exchange gave priority to the purchase quantity first, and the time of the same quantity was first; while in the previous selection layer, the priority was assigned to the time.

This move is conducive to attracting more financially capable investors to participate in the online IPO subscription of the Beijing Stock Exchange. On the other hand, previously selected investors rushed to subscribe for purchases. As long as the hands are fast enough, even if they subscribe for 100 shares, there is no longer a chance that they will win the lottery. In other words, the Beijing Stock Exchange said goodbye to the “first-hand party.”

This situation can be shown from the proportion of the number of allocated households to the number of subscription households. Weibo Hydraulics subscribed for 750,000 people, and 64,000 were allocated shares, accounting for 8.5%. That is, 8.5% of the applicants can be allocated shares. Prior to the selection layer, the number of allotted households was much dispersed, and even close to 80% of the purchasers had allotted shares.

Data shows that there have been many stocks in the select layer where more than 50% of online applicants have received at least 100 shares. The highest rate is 76% of online applicants have at least 100 shares.

Editor: Yue Yue

Original copyright prohibits commercial reprint authorization >>

For reprinting application matters and reporting illegal infringements, please contact us: 010-56807194

Hot list

Long press the QR code

Focus on great contentReturn to Sohu to see more

.