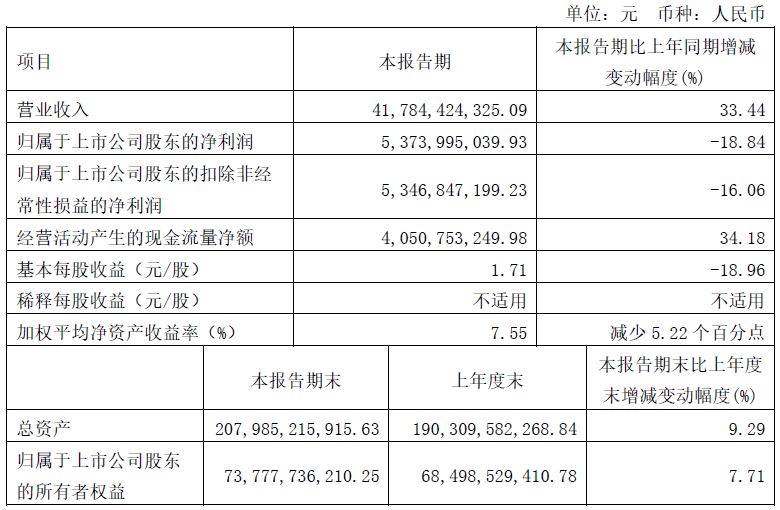

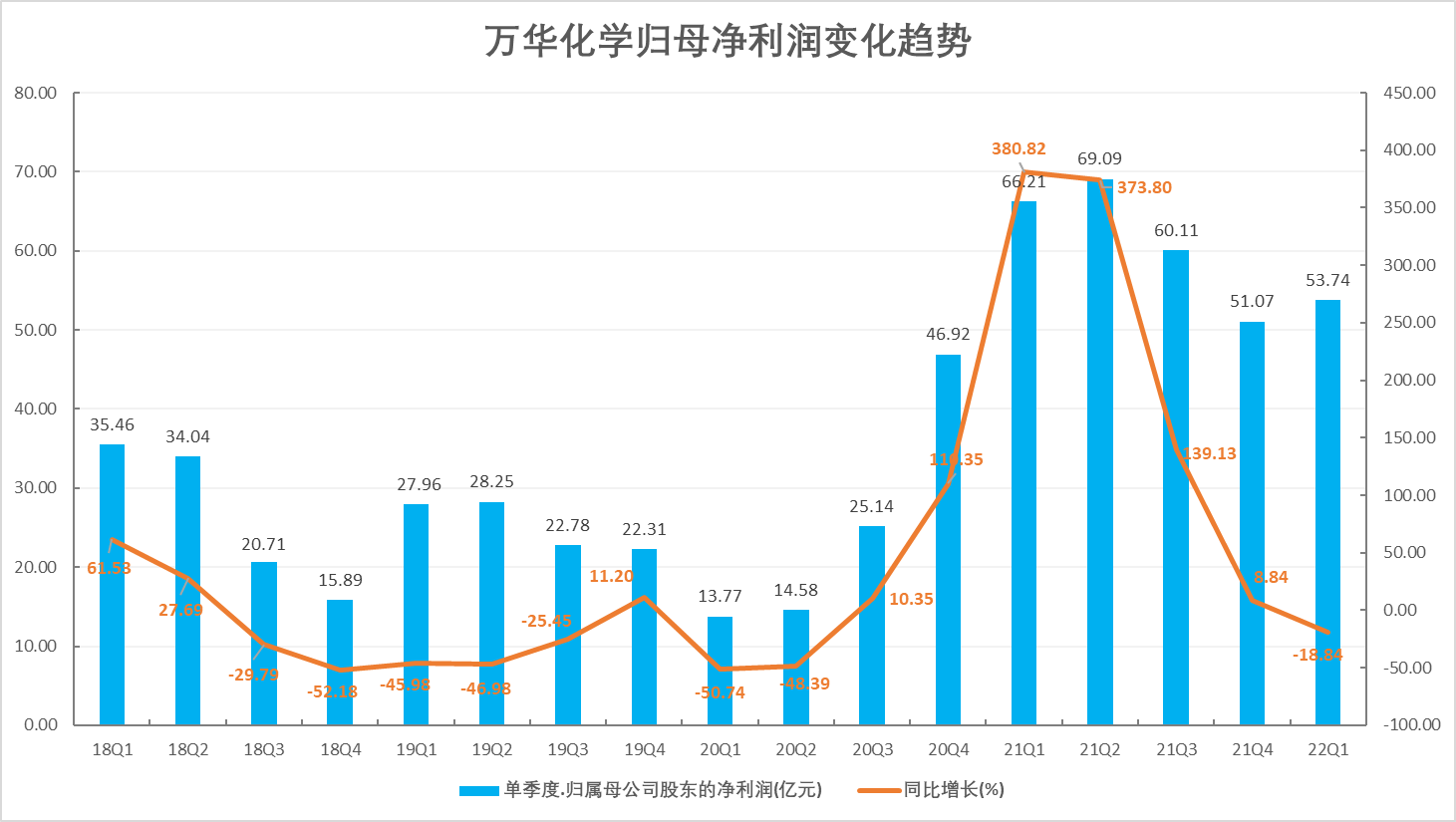

On the evening of April 25, Wanhua Chemical disclosed the first quarter. During the reporting period, the company achieved operating income of 41.784 billion yuan, a year-on-year increase of 33.44%; net profit attributable to the parent was 5.374 billion yuan, a year-on-year decrease of 18.84%; basic earnings per share was 1.71 yuan, a year-on-year decrease of 18.96%.

Overview of the company’s main performance, source: company announcement

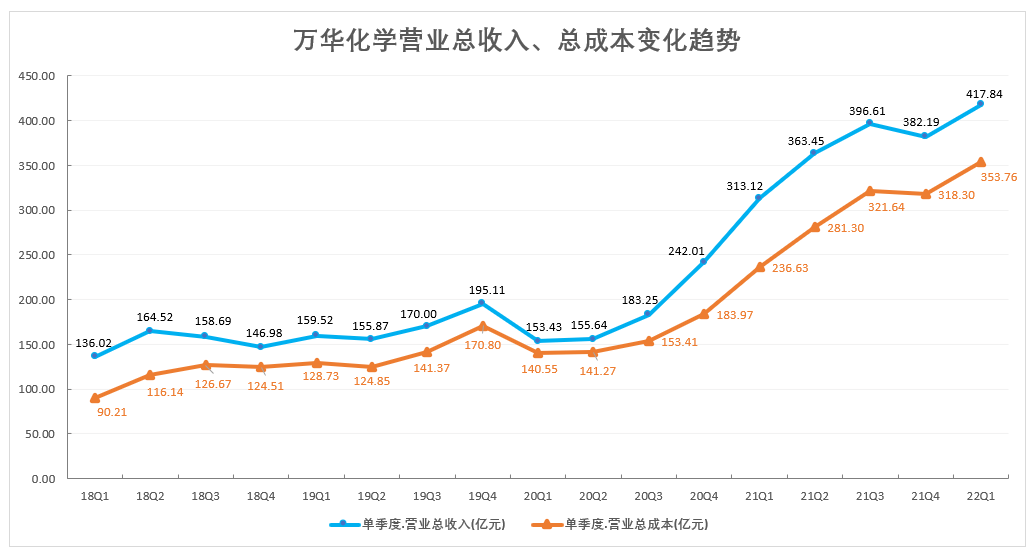

In the quarterly report, the company stated that the increase in operating income was mainly contributed by the increase in product prices and sales during the reporting period; the decrease in net profit was mainly due to the increase in raw material prices and the increase in operating costs. From the data point of view, the company’s total operating cost during the reporting period was 35.376 billion yuan, a year-on-year increase of 49.50%, 16 percentage points higher than the revenue growth rate. Among them, the operating cost was 3.197 billion yuan, a year-on-year increase of 51.30%.

The main business “volume and price rise”, the petrochemical sector remains strong

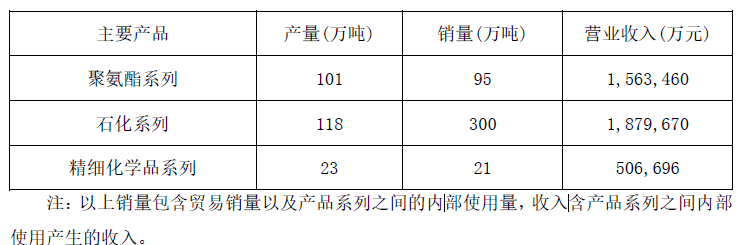

After more than 40 years of ups and downs, Wanhua Chemical has now established three major business segments: polyurethane-petrochemical-fine chemistry and new materials. The production, sales and revenue realization of main products are as follows:

In terms of specific business segments, in 22Q1, the company’s three major segments of polyurethane, petrochemicals, fine chemicals and new materials increased production and sales year-on-year, and the revenue growth rate was faster than the growth rate of production and sales, achieving “both volume and price”:

- In Q1 of 2022, the company’s polyurethane series output was 1.01 million tons, a year-on-year increase of 5.4%; the sales volume was 950,000 tons, a year-on-year increase of 2.8%, the revenue was 15.6 billion yuan, and the polyurethane business increased by 13.6% year-on-year. The listed prices of the company’s MDI products in the domestic market in the first quarter are shown in the figure below:

- The petrochemical series continued to increase volume, with an output of 1.18 million tons, a year-on-year increase of 5.4%; sales of 3 million tons, a year-on-year increase of 27.7%, and revenue of 18.8 billion yuan, exceeding the polyurethane business, a year-on-year increase of 55.9%;

- The output of fine chemical series was 230,000 tons, a year-on-year increase of 31.6%; the sales volume was 210,000 tons, a year-on-year increase of 27.7%, and the revenue was 5.07 billion yuan, a year-on-year increase of 68.0%;

- In Q1 of 2022, the company’s polyurethane series output was 1.01 million tons, a year-on-year increase of 5.4%; the sales volume was 950,000 tons, a year-on-year increase of 2.8%, the revenue was 15.6 billion yuan, and the polyurethane business increased by 13.6% year-on-year. The listed prices of the company’s MDI products in the domestic market in the first quarter are shown in the figure below:

- The petrochemical series continued to increase volume, with an output of 1.18 million tons, a year-on-year increase of 5.4%; sales of 3 million tons, a year-on-year increase of 27.7%, and revenue of 18.8 billion yuan, exceeding the polyurethane business, a year-on-year increase of 55.9%;

- The output of fine chemical series was 230,000 tons, a year-on-year increase of 31.6%; the sales volume was 210,000 tons, a year-on-year increase of 27.7%, and the revenue was 5.07 billion yuan, a year-on-year increase of 68.0%;

The price of main raw materials has risen, and the cost side has risen sharply, affecting the company’s profitability

Since the second half of last year, soaring raw material prices have brought great challenges to the company’s profitability. In Q1 2022, the continued rise in cost is still the “culprit” for the decline in the company’s profitability.

In terms of data, the company’s main raw materials, pure benzene, coal, propane, and butane, rose by 42.83%, 70%, 35%, and 41% year-on-year, respectively, and the average prices reached 7947 yuan/ton, 1104 yuan/ton, 803 US dollars/ton and 802 US dollars / ton, brought about a rapid rise in the cost side. In this regard, Wanhua Chemical explained in its quarterly report:

“Affected by the sharp rise in global crude oil, natural gas and other basic energy prices, the company’s main chemical raw materials and the energy costs of European companies have risen sharply year-on-year.”

“Affected by the sharp rise in global crude oil, natural gas and other basic energy prices, the company’s main chemical raw materials and the energy costs of European companies have risen sharply year-on-year.”

Return to Sohu, see more

Return to Sohu, see more

Editor:

Disclaimer: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.