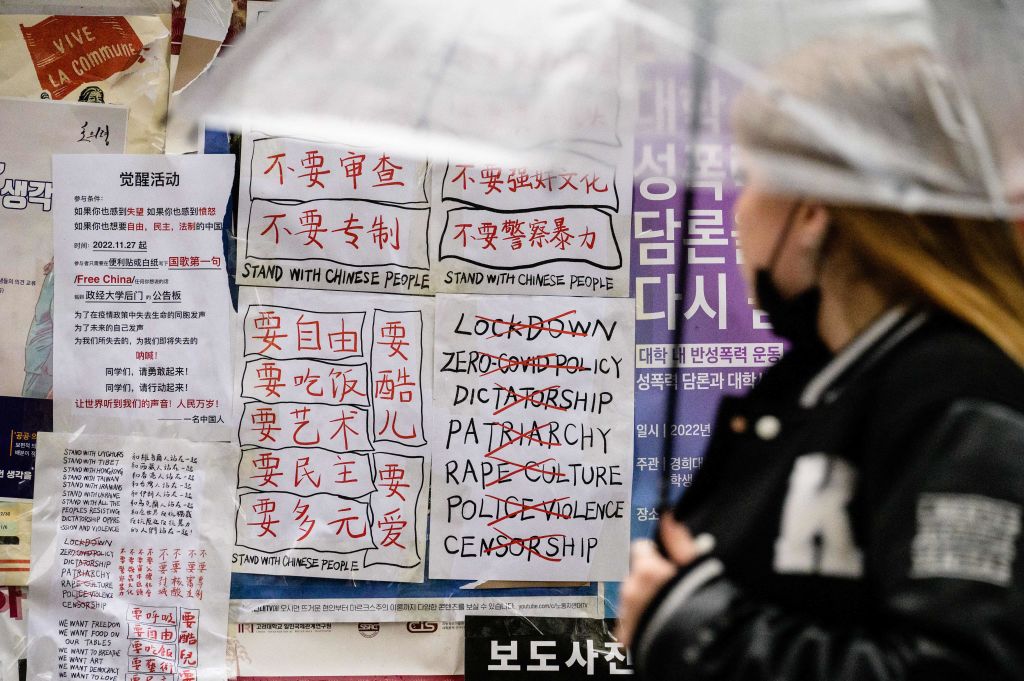

Negative US futures on Wall Street: at around 12.20 pm Italian time, futures on the Dow Jones lose 0.47%, futures on the Nasdaq fall by 0.81%, futures on the S&P 500 drop by 0.71%. The markets generally discount the news coming from China: several demonstrations by Chinese citizens exasperated by the lockdown measures and the restrictions that the Beijing government is continuing to implement to stem the new wave of Covid. In the last three days, reports an article on CNBC, several students have organized demonstrations at various universities; people poured into the streets of Beijing,

Shanghai, Wuhan, Lanzhou, and several other cities, according to videos that have been circulating on social media. The demonstrations initially started from Urumqi, in Xinjiang, last Friday, following a fire that claimed 10 lives the day before in an area that had been under lockdown for months. According to the protests, the checks launched by the local authorities to guarantee the isolation of the residents would have delayed the arrival of the firefighters, causing the death of ten people. Following the protests, local authorities have begun to loosen controls: however, the anger of the Chinese is strong, considering that the restrictions of the Zero Covid Policy are continuing to weigh down the growth of the country’s economy, which is now facing a youth unemployment rate of around 20%. Some videos show protesters calling for the resignation of Chinese President Xi Jinping and the Communist Party itself.

Returning to Wall Street, the Dow Jones rose in last Friday’s session – the day of Black Friday, in which the US stock market closed early at 1pm New York time – up 152.97 points, or 0. 45%, at 34,347.03: for the DJ it was the third consecutive session of increases; the S&P 500 fell 0.03% to 4,026.12, while the Nasdaq Composite was down 0.52% to 11,226.36.

All three indices ended the week in positive territory: the Dow Jones advanced 1.78% and the S&P 500 rose 1.53%. The Nasdaq gained 0.72% on a weekly basis.

This week, while waiting for the days when the Fomc, the monetary policy arm of the Fed, will meet (on December 13th and 14th), to announce its next anti-inflation rate hike, the wait will mainly be for the publication, Friday 2 December, of the November US employment report.

Economists expect job growth of 200,000, decelerating for the second consecutive month.

However, it must be said that, albeit at a slower pace, several economists point out that the growth in employment confirms the solidity of the US labor market, thus making further monetary tightening by Jerome Powell’s Fed necessary.

On November 2, the Fed raised US fed funds rates by 75 basis points for the fourth consecutive time, to a new range of between 3.75% and 4%, a record since 2008.

“A substantial majority of participants believed that a slowdown in the pace of (rate) hikes would soon be appropriate,” reads the Fed minutes, covering that last FOMC meeting, which were released last week. on the time required for the effects of monetary policy to manifest themselves on economic activity and on inflation and on their intensity are among the reasons cited” .