Summary

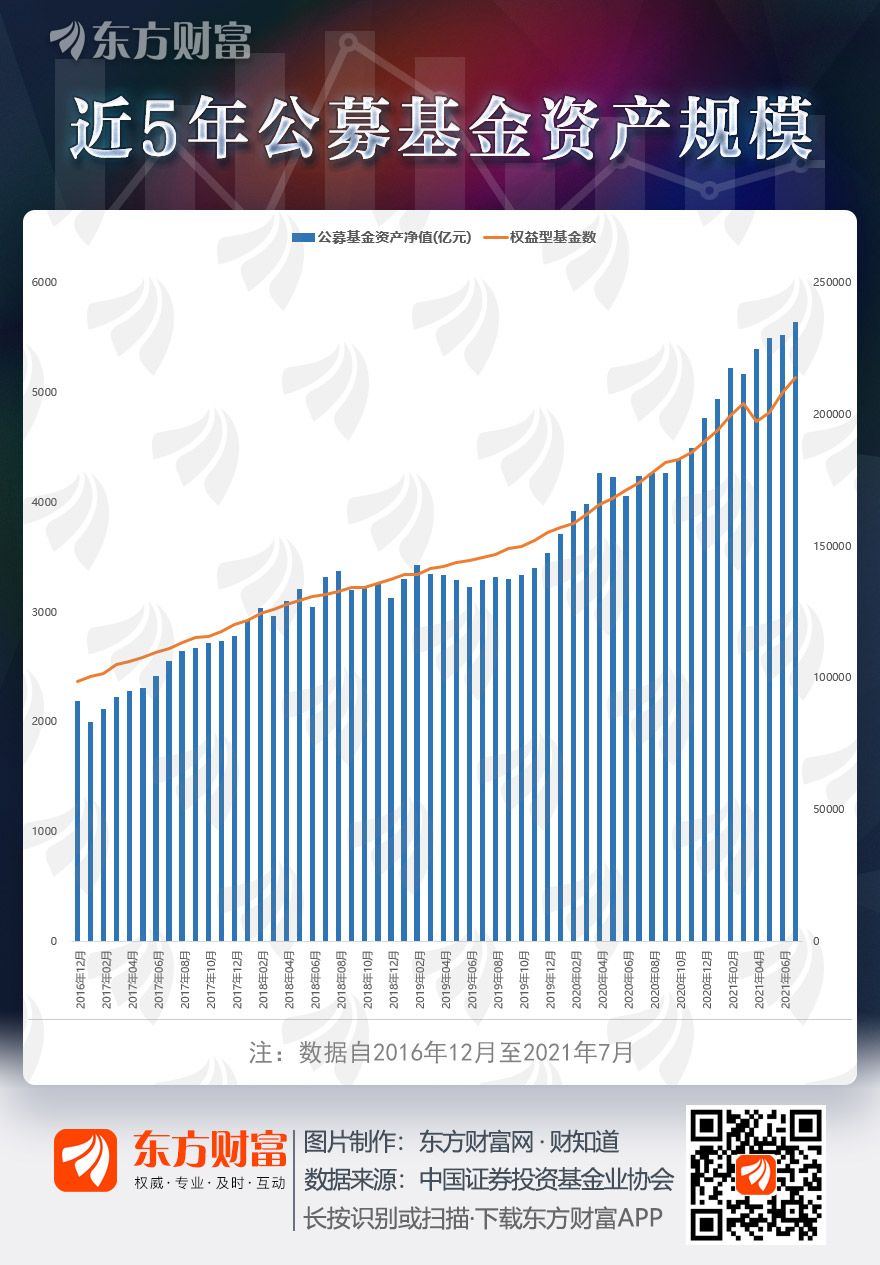

[23.5 trillion! my country’s public fund asset management scale ranks fourth in the world]Today (August 30), Yi Huiman, chairman of the China Securities Regulatory Commission, delivered a speech at the third member representative meeting of the Fund Industry Association and said that the overall asset management scale of the fund industry has reached 60 trillion yuan. Among them, in terms of public funds, as of the end of July this year, the scale of assets under management in the industry reached 23.5 trillion yuan, an increase of 1.6 times from the end of 2016, from the ninth in the world to the current fourth in the world.

Today (August 30), Yi Huiman, Chairman of the China Securities Regulatory CommissionfundThe third member representative conference of the industry association delivered a speech and stated that the overall asset management scale of the fund industry reached 60 trillion yuan. Among them, in terms of public funds, as of the end of July this year, the scale of assets under management in the industry reached 23.5 trillion yuan, an increase of 1.6 times from the end of 2016, from the ninth in the world to the current fourth in the world.

Yi Huiman said that in the past four years or so, my country’s fund industry has grown through reforms, improved through opening up, and progressed through regulations, with remarkable achievements. Among them, as of the end of July this year, the number of equity fund products and the scale of management reached 5,140 and 7.7 trillion yuan, respectively. Compared with the number and scale of 2,368 and 2.7 trillion yuan at the end of 2016, they increased by 1.2 times and 1.8 times, respectively. A record high.

At the same time, Yi Huiman put forward the “five salient”, pointing out that the problem of making money for funds and not making money for the citizens still exists. It is necessary to resolutely correct the unreasonable assessment mechanism of some institutions, guarantee income from droughts and floods, excessive incentives, and some institutions.Fund salesOver-entertainment, the act of wiping the ball for the eyeball.

(Article Source:Oriental wealthResearch center)

.