Nvidia, the Big Tech US chip maker, has reached a new historical record. The stock closed yesterday’s session at $379.80, surpassing the previous record set in November 2021, when shares finished the session above $333. The wild rally brings the chip maker to approach the club of American giants which boast a market capitalization of at least $1 trillion, such as Apple, Microsoft, Alphabet and Amazon.

What triggered the purchases

It was the company that made the prices of the American giant fly publication of a quarterly report and an outlook for the quarter current that have beaten the estimates. Nvidia ended its fiscal first quarter (ended at the end of April) with overall sales down 13%, even as net income hovered above $2 billion ($0.82 a share), up compared to the 1.62 billion realized in the same period of the previous year.

What triggered the buying spree were forecasts from the company, which now expects revenues of about $11 billion in the current quarter, more than 50% higher than previous estimates of $7.15 billion. dollars. Nvidia has benefited extensively from record sales of data centers for 4.28 billion, an increase of 14% and this driven by the growing demand for generative AI and language models.

The demand for artificial intelligence is growing

Nvidia is benefiting from the AI fever and betting on the role the company will play in the sector, through the production of ad hoc chip to be developed for the artificial intelligence market.

Earlier this year, the Nvidia CEO, Jensen Huang, described artificial intelligence as the fastest developing technology in the world. Nvidia’s platform enables enterprise customers to access AI-related technology through cloud computing providers such as Microsoft and Oracle, thus creating a new market for “AI-as-a-service” for thousands of companies worldwide .

“Nvidia could be in a unique position in a rapidly expanding market,” comments analyst Stacy Rasgon, according to whom “investors have in fact identified Nvidia as one of the big potential winners in artificial intelligence, following the viral success of ChatGPT and other popular instruments”.

However, if we compare Nvidia’s performance with its main competitors (such as Intel and AMD), Nvidia has largely surpassed both of them, taking over the leadership within three years among chip makers.

Nvidia makes big techs tremble

“The transformational surge in AI spending is paying off much sooner than expected.” The Santa Clara-based company is already doing extensively outperforming the major US indices and stocksapproaching the circle of the largest companies in the world by market capitalization.

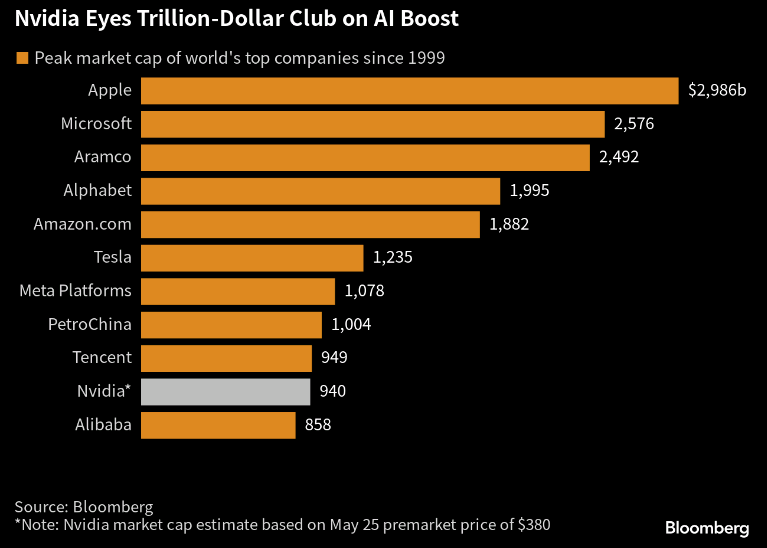

In fact, let’s keep in mind that at the moment Nvidia shows a market capitalization of 940 billion dollars, more than 8 times higher than the capitalization of Intel (114 billion) which last year realized more than double Nvidia’s annual revenues. Thanks to yesterday’s increase, Nvidia’s market capitalization rose by 189 billion, thus approaching 1,000 billion. That’s if Nvidia were to reach this market cap, the company it would be only the ninth company in history to reach this goal.

Cash Collect with attractive short-term returns

An alternative way of investing in the mentioned security is to use investment certificates, such as i Memory Cash Collect no Autocall recently issued by BNP Paribas on the SeDeX of Borsa Italiana. This range completes the Cash Collect offer of the French issuer, until now more concentrated on baskets of shares rather than on a single underlying which can be a European or American security.

The new Certifiers allow you to gain exposure to individual companies and to enjoy the possibility of receiving rewards on a monthly basis, thanks to the fact that there is no possibility of early recall of the certificate on intermediate evaluation dates. This aspect, combined with the 12-month time horizon, makes these products particularly suitable for investors looking for attractive short-term potential returns.

Monthly reward of over 1 euro for the Certificate on Nvidia

Within the new range of Memory Cash Collect no Autocall we find the Certificate (ISIN NLBNPIT1PL18) on the Nvidia stock. The product offers a monthly premium with a memory effect of 1.03 euros (equal to 12.36% per year). To collect the coupon, it is sufficient for Nvidia to be equal to or greater than the premium barrier, set at 60% of the initial value of the underlying.

In particular, starting from the month of July, thememory effect which on each monthly valuation date allows the investor to receive any premiums not collected on the previous dates. During the various observation dates, in fact, the premiums are paid if the underlying is above the Barrier level. Otherwise it will be put “in memory”. Subsequently, in the event that the underlying should go back to subsequent observation dates, the investor will receive the premium including all previously unpaid memory premiums.

The Certificate stands out for being a product no Autocall: this means that on the intermediate observation dates, the certificate does not expire, regardless of the performance of the underlying. Furthermore, these Certificates have a shorter maturity (one year) than the average Cash Collect (two to three years).

Upon expiry (May 15, 2024), they are expected two possible scenarios: if the Nvidia stock quotes at a level higher than or equal to the barrier at maturity (60% of the initial value), the Certificate pays the notional amount (100 euro) plus the premium plus any previously unpaid coupons. Otherwise, the product pays an amount commensurate with the security’s performance (lower than the barrier at maturity), resulting in a loss on invested capital.

Rain of Buy by analysts

With yesterday’s rise (+24.4%) Nvidia has caught up new all-time highs, bringing the performance from the beginning of the year to an increase of almost 160%, +250% approximately from the low of last October 13th. Nvidia had bottomed just above $100 that day and then reversed the trend into a solid uptrend.

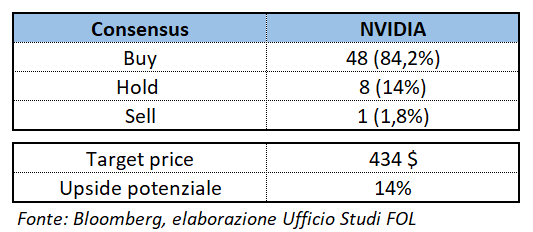

Among analysts there is one clear prevalence of positive reviews on the Nvidia stock, with 84.2% of those monitored by Bloomberg who have a purchase recommendation (buy), 14% say hold (keep the shares in their portfolio) and only 1.8% recommend selling ( sell). The average target price listed is $434, about 14% above Nvidia’s Wall Street levels.

Every Tuesday, “The opportunities on the stock market” is available, the weekly newsletter dedicated to financial advisors and stock market experts. To read the latest issue visit the link: https://investimenti.bnpparibas.it/news-e-formazione/le-opportunita-in-borsa/

WARNING

This publication has been prepared by T-Finance business unit of T-Mediahouse Srl (the Publisher), with registered office in Viale Sarca, 336 (building sixteen), 20126, Milan, in complete autonomy and therefore exclusively reflects the opinions and Editor’s ratings. The information and opinions contained in this publication have been obtained or extracted from sources believed by the Publisher to be reliable; however, the Publisher makes no representations or warranties as to their accuracy, adequacy or completeness. BNP Paribas and the companies of the BNP Paribas group assume no responsibility for its content. Scenarios, calculation assumptions, data and past performance, estimated prices, examples of potential revenues or evaluations are for illustrative/informative purposes only, with no guarantee that such scenarios or potential revenues will occur or be achieved. In any case, the Publisher is not responsible for any loss or damage, direct or indirect, which may arise from the use of the contents of this publication.

For information on T-Finance business unit of T-Mediahouse Srl, as producer of the recommendations, on the presentation of the recommendations and on the positions and conflicts of interest of the producer, please click on this link.