Actually, more apartments should be built in Germany. Since the last census in 2011, the number of inhabitants in Germany has increased by around four million, while around three million new apartments were completed during this period. This is not enough, since there is an outflow and, in addition to immigration from abroad, internal migration to the metropolitan areas also creates a need for housing. In none of the last few years has the target of 400,000 completed apartments anchored in the current coalition agreement of the federal government been reached.

As a result of this divergence, apartment rents have risen sharply, especially in metropolitan areas. In recent months, however, incoming orders and building permits in residential construction have plummeted because a cocktail of rising financing interest rates, rising construction costs, geopolitical crises and a regulatory environment that sometimes seems erratic has made residential construction more expensive and caused increased uncertainty among private and institutional investors. This will initially further aggravate the situation for apartment tenants, while at the same time this dynamic is likely to leave strong macroeconomic slowdowns (Just, 2023a; Just, 2023b).

Precisely because the construction industry accounts for more than 11% of the German gross domestic product and because the early indicators of incoming orders and building permits are only published with a time lag, it is important to map the development in real time as far as possible. In addition to the survey-based mood indicators such as the ifo business climate index, it has become established in recent years to pay attention to the search interest for certain terms via the Google search engine[1], because a property purchase is usually preceded by extensive information gathering via the Internet. In fact, numerous studies in recent years have shown that there is a leading relationship between the search volume on Google and real estate indicators (Hohenstatt et al. (2011); Wu and Brynjolfsson (2015); Dietzel (2016)).

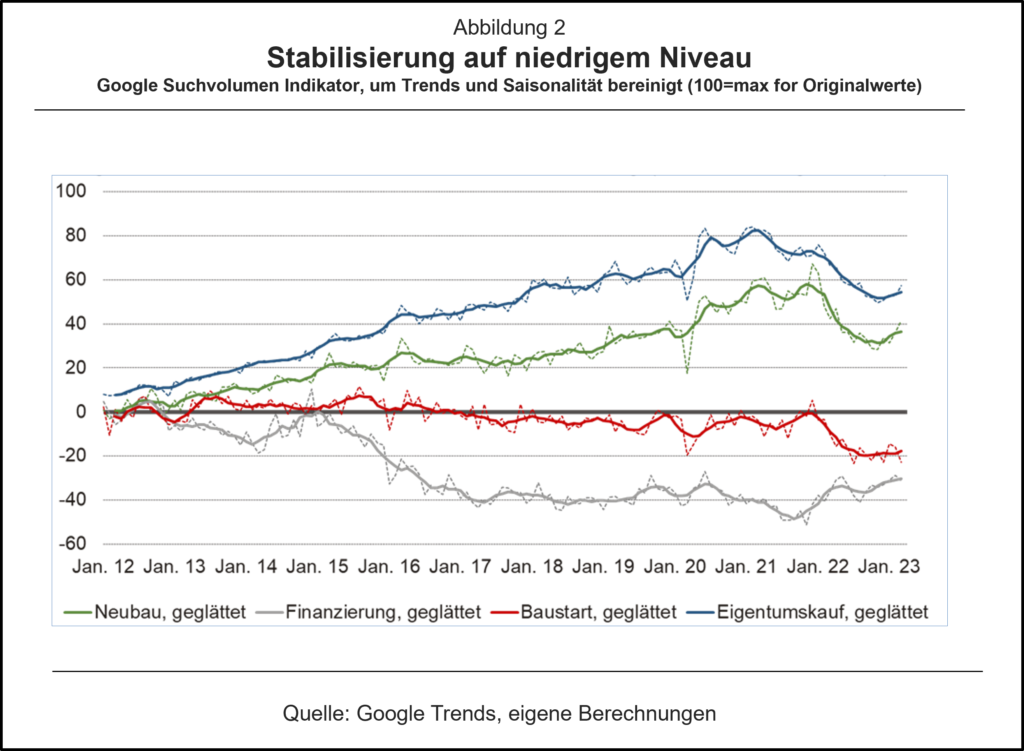

For this article we have designed four different search indices, each of which is based on a group of search terms: The “new building” index summarizes search terms on the subject of new building activity (e.g. “new building” plus “apartment”). Similarly, the “financing” index is based on typical real estate financing terms, the “start of construction” index summarizes terms that might come more from the entrepreneur’s perspective (e.g. “construction company” or “excavation”), and the last index “buying a property” contains search terms for real estate purchases (e.g. “buy a house”). The figure below illustrates the development of the four Google search volume indices. We cleaned the original data for seasonality and trend components; Deviations from the trend can then also result in negative values.

It can be seen that the decline, especially in the property purchase category, started before the interest rate turnaround, but that the downward trend in search volume continued throughout 2022. At the current edge, at least two search groups (condominium purchase and new construction) are pointing slightly upwards again; the financing category seems to have been recovering from a low level for some time.

Of course, some of the search indices are clearly correlated with one another, but at the same time it is also clear that the specific selection of search terms can lead to very different results. It is advisable not to look at a single index when looking for conclusions about the future development of construction activity.

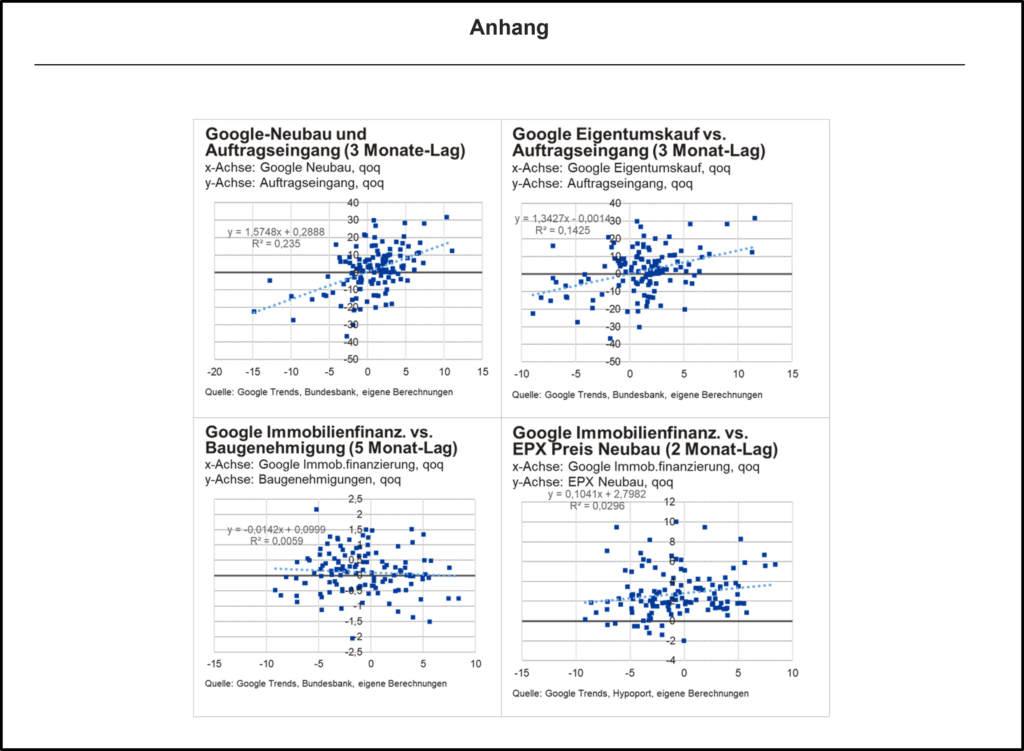

In a next step, we correlated the absolute quarterly changes in the search indices with the absolute quarterly changes in selected real estate parameters, here incoming orders, the number of building permits and the EPX price index for new apartments from Europace.[2] It shows that our index for searches for new construction, for the start of construction and our home purchase index correlate both with the changes in incoming orders and with that in the number of permits. No similarly high correlation can be found for the “Financing” index. There are even inconsistent signals from Google indicators regarding relations with real estate prices. No lags were considered for this correlation matrix; because incoming orders and approval data in particular are published with a delay, such a Nowcast currently have quasi-prognostic quality.

If lag structures are also taken into account, not only can the correlation relationship be improved, an actual lead even arises. In the appendix we have presented selected relationships between the individual variables with lag structures.

Five messages emerge from this brief analysis:

- Google search behavior can also be used for construction and real estate markets in Germany. At least for the status of the report, a certain advance can be seen.

- The slight recovery in search volumes at the moment could be understood as a weak signal that the downturn in incoming orders and in the number of approvals could soon have reached its cyclical low point – starting from a low level.

- This is especially true for the search indexes new building and property purchase. These are more likely to capture interest, so they are more likely to run ahead of the corporate and finance-related indices.

- Of course, caution is advised because the “trend reversal” is still very young and the search indices are sometimes subject to violent fluctuations. The data does not include the current discussion about forced energy-saving refurbishments of apartments.

- For this article, a simplified bivariate approach was chosen to illustrate possible relationships. Of course, for a thorough analysis and prognosis, more factors need to go into it. The point here was that Google Trends can be used as an additional leading indicator, not that it would be sufficient as the sole indicator.

Literature:

Dietzel, Marian Alexander (2016). Sentiment-based predictions of housing market turning points with Google trends. In: International Journal of Housing Markets and Analysis 9(1), S. 108-136. .

Hohenstatt, Ralf, Manuel Käsbauer, and Wolfgang Schäfers (2011). „Geco“ and its potential for real estate research: Evidence from the US housing market. In: Journal of Real Estate Research 33(4), S. 471-506.

Just, Tobias (2023a). Upswing over: Interest rates weigh heavily on residential construction. In: economic service 103(1), S. 20-23.

Just, Tobias (2023b). All building construction segments under pressure – some also in the longer term. Construction industry: Is there a risk of a crash in the construction industry? In: ifo express service 76 (1), S. 10-13.

Wu, Lynn, and Erik Brynjolfsson (2015). The future of prediction: How Google searches foreshadow housing prices and sales. In: Goldfarb, A. Shane, M. Greenstein and Catherine E. Tucker [Hrsg.]. Economic analysis of the digital economy. University of Chicago Press, S. 89-118.

Attachment: [3]

[1] This search interest can be recorded with the help of Google Trends. It is important that no absolute search volumes are published, but only a search index that shows the interest in certain search terms in relation to the entire search query via Google. The respective point in time with the highest search interest receives the value 100. The search index can therefore only accept values between zero and 100.

[2] The following data was specifically used: building permits based on the estimated costs of the structure for residential and non-residential buildings; Incoming orders in all of Germany for residential construction; incoming orders for residential construction; Europace Hedonic House Price Index EPX Composite Index

[3] Quarterly change calculated as absolute changes