After the market rebounded in May, the Shanghai Index stood at 3,600 points. In June, the long and short sides competed repeatedly at the 3,600 point mark of the Shanghai Index. Investors have certain expectations for the market’s further upward development. So when the A-share Zhengda fights offensive and defensive battles, how will the market go in June? Which sector will be the pioneer? Which targets are in the minds of institutional bosses? Since the market entered a period of financial report disclosure in May, the research activities of institutions have slowed down, but institutional investors are still exploring the growth value of potential stocks. With the sorting out by reporters of “Daily Economic News”, the organization’s layout direction in the second half of the year will become more clear.

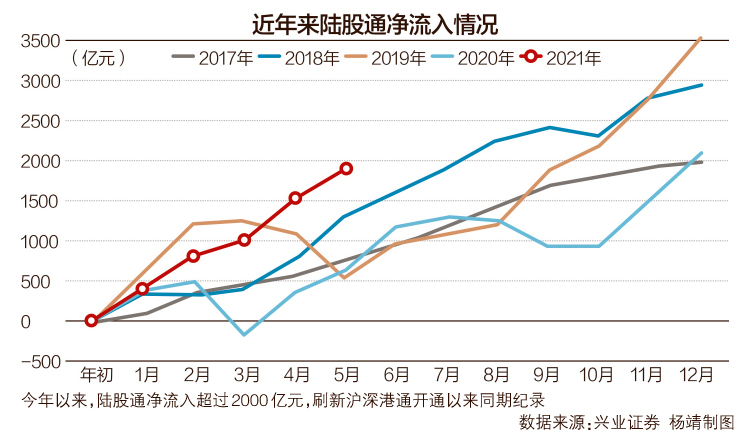

According to statistics, in May, Northbound funds set two historical records. The first is that Northbound funds purchased 21.723 billion yuan of A shares on May 25, setting a record high in the amount of net purchases of A shares in a single day by Northbound funds; As of the end of May, the net inflow of northbound funds into A shares has exceeded 200 billion yuan this year, setting a new record for the same period since the opening of the Shanghai-Shenzhen-Hong Kong Stock Connect.

Then, in the recent stage, the rate of northbound capital flowing into A shares has continued to increase. In specific industries and individual stocks, which industries and individual stocks are northbound funds more favored?

It is not difficult for investors from northbound funds to think of the social security fund and QFII, the two major institutions with relatively longer holding styles. What changes have occurred in their layout actions?

The portfolio of gold stocks released by securities firms every month is also worthy of high attention. Some industries that had been relatively neglected before re-entered the securities firms’ vision in June. There is an industry that has dominated the brokerage gold stock recommendation list for 10 consecutive months. In addition, a leader in the communications industry was jointly recommended by more than five brokerages for the first time this year.

Visual China Map

May Northbound funds set a single-day net inflow record

This year’s A-share market ushered in the “red May”, during which time Northbound funds continued the net purchases that began in October last year.

According to statistics from Choice, in May this year, the total amount of net purchases of A shares by Northbound funds reached 55.776 billion yuan, a new high this year. Since the opening of the Shanghai-Hong Kong Stock Connect in 2014, the monthly net purchase amount of northbound funds in May this year has ranked eighth in history. The first seven single-month net purchases before May of this year all occurred in the bull market from 2019 to 2020.

It is worth mentioning that at the same time, on May 25, 2021, Northbound funds purchased a substantial net A-shares of 21.723 billion yuan, setting a record high in the amount of single-day net purchases of A-shares by Northbound funds. According to statistics from Choice, most of the top 20 trading days for the amount of net purchases of A shares in a single day by northbound funds occurred between 2019 and 2020, and two trading days occurred in 2018.

In addition, according to the statistics of Industrial Securities, as of the end of May, the net inflow of northward capital into A shares has exceeded 200 billion yuan this year, setting a new record for the same period since the opening of the Shanghai-Shenzhen-Hong Kong Stock Connect. The annual net inflow is comparable.

Regarding the firm buying of A-shares by northbound funds in the recent phase, Guosheng Securities’ strategy team recently released a view that this may be due to three factors: First, the RMB exchange rate index has broken through the previous high again since May, and the RMB exchange rate against the US dollar was offshored on May 25. The onshore exchange rate both hit new highs since the Sino-US trade friction in June 2018. On that day, the net inflow of northbound funds into A shares was 21.7 billion yuan, setting the largest single-day inflow since the opening of mainland stocks; secondly, overseas currencies continued to exceed The severe excess liquidity caused spillover effects. Finally, as internal and external volatility slows down, the rebound in risk appetite drives foreign investment to increase their holdings of A shares.

So, which industries and individual stocks are Northbound funds more favored?

According to statistics from Guosheng Securities’ strategy team, from the perspective of the inflow structure, all sectors received foreign capital inflows in May this year. Among them, the large consumer and financial real estate sectors had the largest inflows, with net inflows of approximately 23.19 billion yuan and 17.11 billion yuan. The net inflow of 13.56 billion yuan and 2.407 billion yuan in other parts of technology growth was significantly slower than the net inflow in April.

In terms of specific industries, in May, northbound funds mainly flowed into the food and beverage, banking and household appliances industries; at the same time, the automobile, mechanical equipment and electronics industries mostly flowed out, with net outflows of 3.133 billion yuan, 3.08 billion yuan and 2.522 billion yuan respectively.

From the overall situation in the first five months of this year, the three major A-share industries with the largest increase in Northbound funds are electrical equipment, chemicals, and banks. According to statistics from the strategy team of Southwest Securities, from an industry perspective, foreign investors have paid the most attention to the allocation of A shares in the most competitive industry in the world at the moment. Since 2021, the industries that have significantly increased the allocation of northbound funds are electrical equipment, banking, and chemicals, with net inflows of 42.7 billion, 40.3 billion, and 36.7 billion respectively, while the food and beverage, automotive, and leisure service industries, which saw huge increases last year, have shown varying degrees The net outflow of funds, including food and beverages, and automobiles, respectively, net outflows of 7.9 billion and 6.55 billion yuan. Electrical equipment (new energy), chemical industry, etc. are among the most world-class competitive industries emerging in China.

However, the Southwest Securities strategy team also found that while Northbound funds are betting on China’s advantageous industries, they will change at any time based on the industry’s callback situation and new performance expectations. For example, since May, Northbound funds have substantially increased the allocation of food and beverages and banks, with net inflows of 24.4 billion and 10.7 billion respectively, significantly reducing the allocation of the automobile and machinery equipment industries. It is worth mentioning that from January to April this year, northbound funds have been net outflows to the food and beverage industry for 4 consecutive months.

Although the A-share institutional Baotuan stock has experienced greater volatility this year, the Northbound Fund is still a firm holder of the Baotuan stock. According to statistics, as of May 31, the top ten major stocks of northbound funds were Kweichow Moutai, Midea Group, China Merchants Bank, Wuliangye, CATL, China Freedom, Ping An, Gree Electric, Hengrui Pharmaceuticals, and Ping An Bank. The stock market value is 214.148 billion yuan, 91.758 billion yuan, 78.424 billion yuan, 70.339 billion yuan, 69.285 billion yuan, 63.609 billion yuan, 60.5 billion yuan, 57.747 billion yuan, 57.57 billion yuan, and 53.675 billion yuan.

According to statistics from Guosheng Securities, the A-shares with the largest net inflow of northbound funds in May this year include Kweichow Moutai, Midea Group, Wuliangye, China Merchants Bank, Industrial Bank, Jiuguijiu, Oriental Yuhong, Shanxi Fenjiu, Ningde Times, Industrial Securities, etc. Among them, the net inflows to Kweichow Moutai and Midea Group both exceeded 5 billion yuan. On the other hand, the top stocks in the net outflow of northbound funds in May were Sany Heavy Industry, BOE A, Weichai Power, Ganfeng Lithium, GoerTek, BYD, Watson Bio, Ping An of China, Han’s Laser, It can be seen from this that the electronics industry is the target of concentrated sales of northbound funds in May.

At the moment when the market is further improving, the position adjustment actions of some important institutions have certain reference value. Among them, the layout actions of the social security funds and QFII institutions with relatively longer-term holding styles are worthy of attention.

According to statistics from Choice, as of the end of the first quarter of this year, the social security fund has a total of 422 stocks, accounting for only 10% of the total number of A-share companies. Among them, 24 social security funds hold more than 5%. Half of these 24 stocks come from the Sci-tech Innovation Board and ChiNext (there are 7 Sci-tech Innovation Board companies), and 11 of them were newly added to the Social Security Fund in the first quarter of this year.

The “Daily Business News” reporter noticed that among the 24 stocks mentioned above, some of them were listed in the social security fund in the first quarter of their new listing. Among them, Sifang Optoelectronics, which was listed in February this year, was listed in March this year. Allon Technology, these two stocks are from the Science and Technology Innovation Board. From the follow-up point of view, these two stocks have good market performance. In addition, at the end of the first quarter of this year, the top two A-share companies in terms of the proportion of shares held by social security funds in the outstanding shares were all companies on the Science and Technology Innovation Board.

At the same time, as of the end of the first quarter, there were 16 QFII stocks that accounted for more than 10% of the outstanding shares. QFII also holds heavy positions in some Sci-tech Innovation Board companies. The top two stocks in the first quarter’s shareholding ratio are all from the Sci-Tech Innovation Board. QFII’s total shareholding in the Sci-Tech Innovation Board company OPT even exceeds its outstanding share capital. 50% of it. In the first quarter of this year, among the top 10 tradable shareholders of Optoelectronics, a group of internationally renowned institutions such as Goldman Sachs, Morgan Stanley, JP Morgan Chase, UBS, and Singapore Government Investment Co., Ltd. were concentrated.

Among the 16 stocks held by QFII, 3 of them were also held by the social security fund in the first quarter. These three stocks are Huaxi Biology, Richen, and Foxit Software.

Private equity such as Gaoyi Assets frequently appeared on the research list

Institutional research has always been the “wind vane” of the market. From the survey of private equity institutions, in May, tens of billions of private equity leaders such as Gaoyi Assets, Danshuiquan, and Xingshi Investment frequently appeared on the research list, looking for potential products in the later market. . Among them, Gaoyi Assets participated in a total of 29 listed companies’ survey activities in May, including Microcolumn, Chujiang New Materials, and Changying Precision. Beijing Xingshi Investment investigated 13 listed companies in May, including recent bull stocks such as Lanxiao Technology, Chuanneng Power, Zhongke Chuangda, and Changying Precision. In May, Freshwater Investment investigated 15 listed companies in total, among which Changying Precision, Aoyuan Meigu, and Ruipu Biotech are also recent bull stocks.

The biomedicine sector in 2021 will continue to be booming due to the impact of the spillover of the epidemic in India. The recent medical white horse stocks have been investigated by many institutions. For example, Yunnan Baiyao has received two surveys from institutional investors in the near future. Among them, May On the 25th, a total of 112 institutional and individual investors were received, including well-known investors such as Lin Yuan, Chairman of Linyuan Investment, Deng Shifeng of Cathay Pacific Fund, Jiang Xiulei of Rongtong Fund, and Yunnan Baiyao’s share price rose more than 16% in May.

In addition, on May 21st, the pharmaceutical company Changchun High-tech received surveys from a total of 304 institutions including Shanghai Harmony Huiyi Assets and Shanghai Panjing Investment. During the event, the company responded to the issue of bulk reduction and long-term growth hormone collection. The problem of mining. The medical beauty concept of the medical sector branch performed strongly as a new consumption. Its concept stock Aoyuan Meigu rose 36.99% in May, and the stock rose 90% in April. On May 10, Aoyuan Meigu received surveys from 240 institutional investors. Institutional investors are mainly concerned with issues such as its layout in the field of medical beauty.

According to Choice data, there were 12,756 institutional surveys in May, a decrease of 15,187 from the previous month. Among them, the main board company’s surveys were 6,863, a decrease of 9,447. There were 4160 surveys conducted by GEM companies, a decrease of 2709.

From the perspective of the number of listed companies surveyed by reception institutions, in May, the institutions surveyed 568, an increase of 9 from the previous period. Among them, 333 listed companies on the main board received institutional surveys, an increase of 31 from the previous month. In May, 168 companies on the Growth Enterprise Market received institutional surveys. From the perspective of institutional research, computer software ranks first in institutional research, followed by medical devices in second, and biomedicine in third.

From the perspective of market factors, in May, the Huawei Hongmeng system affected the nerves of the capital market. Institutional investors also conducted research first. In the computer software sector, Zhongke Chuangda received surveys from 288 institutions in May. Chuangda’s stock price rose by more than 12% in May, and Zhongke Chuangda has long-term cooperation with Huawei to provide artificial intelligence IP and software solutions for its first artificial intelligence mobile phone chip, Kirin 970.

In addition, the spillover effect after the outbreak in India has led to the acceleration of the new crown vaccination rate, which has also brought the entire medical device and biomedical sector to the attention of institutions, ranking second and third in the institutional survey in May. For example, Mindray Medical has received research from 424 institutions, Changchun High-tech has received research from 298 institutions, Anke Biological has received research from 238 institutions; in addition, Glodon has received research from 267 institutions, and Transsion Holdings has received After conducting surveys from 252 institutions, Aoyuan Meigu received surveys from 239 institutions.

According to statistics, a total of 44 securities research institutes released June gold stock portfolios. Excluding duplicates, there are a total of 321 targets, including 101 ChiNext stocks, 44 Sci-tech Innovation Board stocks, and 22 Hong Kong stocks, covering 28 stocks. Shenwan first-level industry.

In addition, the electronics industry ranked second in the gold stock portfolio of various brokerages in June, while food and beverages rebounded to third with a total of 36 recommendations, and pharmaceuticals and biotechnology fell to fifth with a total of 27 recommendations; The three industries of agriculture, forestry, animal husbandry and fishery, and architectural decoration have been recommended 5 times in total, and continue to be the bottom.

Judging from the month-on-month change of industry recommendation, the recommendation of the gold stock portfolio of brokerage firms in the military industry increased the most in June, with an increase of 172.91% month-on-month, and the recommendation of the communications industry increased by 121.74% month-on-month, becoming a new bright spot. In addition, the non-banking industry’s recommendation by various securities firms’ gold stock portfolios has also increased by 104.68%, but half of the recommendations are concentrated in Eastern Fortune.

On the other hand, in June, the recommendation of various securities firms’ gold stock portfolios for leisure services, steel, machinery, non-ferrous metals and other industries dropped significantly. Among them, the recommendation for leisure services dropped by 71.57% from the previous month, and the recommendation for the steel industry was lower than the previous month. Decrease by 48.83%.

In terms of individual stocks, in the June gold stock portfolio of various brokerages, as many as 13 brokerages jointly recommended Oriental Fortune, 8 brokers recommended Yanghe shares, 7 brokers recommended ZTE, and 6 brokers recommended After Wuliangye, five brokerages recommended China Merchants Bank and Ningde Times.

Dongfang Fortune, Wuliangye, and Ningde Times are all frequently recommended by securities companies this year. It is worth mentioning that ZTE is also recommended by more than 5 securities companies for the first time this year.

The rising channel of the A-share market hasn’t finished yet?

After the stock market rebounded in May, the Shanghai Index stood at 3,600 points. Recently, both the long and the short have repeatedly competed at the 3,600 point mark of the Shanghai Index. The number of institutions that are bullish on the A-share market is also increasing. In the current market environment, will the stock index develop further upwards?

Judging from the current fundamentals and market environment, the upward shock of A-shares is a high probability event. In an interview with the “Daily Economic News” reporter, Star Stone Investment said that the market’s concerns about inflation have eased, as the upstream commodity prices Cooling down, the market’s concerns about the continued upward inflation and the upstream squeezing of mid- and downstream profits have been eased; secondly, the pressure of liquidity tightening expectations has also eased, and the growth rate of social financial stocks has fallen to 11.7% in April, the fastest decline. The stage may have passed, and it may be relatively stable for some time in the future.

“In 2021, the macro economy and the earnings of listed companies are expected to continue to improve. This is the core factor supporting the market. At present, the market has divergent views on economic recovery and corporate profitability, but we are still optimistic about subsequent economic growth and corporate earnings. We have found that observing the real economic growth from the perspective of the’two-year compound growth rate’ will show a trend of quarterly recovery, which is the core factor supporting the market.” CEIBS also holds similar views. It is believed that this round of adjustment is over with high probability, and it is only a matter of time before the upward breakthrough. Zhongou Ruibo stated that this round of market adjustment that started in February should be over. The main theme of the short and medium-term market is the upward trend. In the short term, the market will regain the upward channel and continue the previous slow-moving and step-by-step scripts. .

However, not everyone is so optimistic. In the view of Niu Xiaotao of Qiaogeli Capital, he is cautious and conservative towards the upward impact of higher points. Although A-shares are significantly affected by liquidity, they will balance inflation and liquidity brought about by commodity price increases in the second quarter. The A-share stock index needs to stand on a higher important point only to rely on the improvement of corporate profitability. It also needs the abundant liquidity of the market as a support.

Shicheng Investment Chen Jialin told the “Daily Economic News” reporter, “The recent RMB exchange rate has boosted the recent performance of A-shares, but we do not believe that the stock market driven by the exchange rate can be sustained in the short term. In addition to the recent appreciation of the RMB, the factors supporting the recent market It also includes the weakening of inflation expectations, valuation restoration, lower interest rates, and foreign investment in large numbers. However, in our view, these factors, like the exchange rate, are also difficult to further deepen the market immediately.”

Chen Jialin said that the overall liquidity is conducive to the continuation of the market, but there are also short-term ups and downs, and will not always let the market “hold high”. June ushered in an important window period, and the market generally expected that the short-term market could continue into the middle and late months of this month. Such highly consistent expectations have quickly formed, which means that the market will only move forward significantly during the window period. The core demand of the window period is not to go fast, but to be steady. This is the best choice at the moment, so the rising market will usher in a short rest period. Of course, this is just a rest, and the uptrend of the A-share market has not yet finished.

For the sectors with opportunities in June, Yihu Investment Yu Dingheng believed in an interview with the “Daily Business News” reporter that first of all, in the context of rising upstream resources and raw materials, it can use various means such as price increases, scale expansion, high-end, raw material reserves, etc. Passing on costs to maintain a stable gross profit and at the same time have a stable market demand, there are opportunities for sectors that meet these two factors. “We are optimistic about products that have bottomed out valuations, stable gross profit and marginal improvement, such as technology stocks (semiconductors), which are the main line of price increases. The current integrated circuit exports are booming, and the components and semiconductor industries may still benefit. Under the background of strong external demand, the leader Investment opportunities for manufacturing high-end overseas markets are still promising.” The so-called technology stocks are mainly concentrated in two areas. One is the new energy automobile industry. The logic is that downstream demand is relatively strong, resulting in production capacity planning that cannot keep up, and supply exceeds demand; especially when there are bottlenecks. The links are like lithium hexafluorophosphate and diaphragm and battery links. The other is the equipment and materials upstream of semiconductors. Due to the shortage of semiconductors and the imbalance of semiconductor supply and demand, semiconductor supply chain companies are expected to maintain a high degree of prosperity. The opportunities for technology stocks are mainly concentrated in these two areas. Yu Dingheng said so.

Chongyang Investment proposes to weaken its judgment on the direction of the market and focus on exploring structural opportunities. Maintaining both offensive and defensive strategies in investment strategy, on the one hand, dig deeper into small and medium-sized companies that have been neglected by the market, especially those companies that have been suppressed by exchange rates and raw materials since the second half of last year. For core assets with excellent quality, if the valuation and performance match well after the stock price pulls back, and the performance may exceed expectations, it is also worth configuring. In addition, in order to cope with the complex factors faced by internal and external factors, some high-dividend-yielding stocks have been deployed as a defense.

The research department of Jinxin Fund believes that in terms of investment direction, new technologies, new consumption, new materials and other fields deserve special attention. For some emerging industries, whether it is the forecast of growth space, the evolution of business models, and competition The evolution of the pattern and the competition of technical routes have not yet been finalized, and there are often opportunities to obtain huge excess returns. There will be many investment opportunities worth exploring in these areas in the future. For example, the medical aesthetics sector that has performed very well this year belongs to new consumption, and there are many such opportunities waiting to be explored in the future. There are many investment opportunities in innovative medicines, high-end medical equipment, pet industry, intelligent driving, and new generation semiconductor materials.

Real-time query of global new pneumonia epidemic