A week before the Spring Festival, 70 stocks faced lifting the ban, with a total market value of over 190 billion yuan.

70 shares face lifting of ban

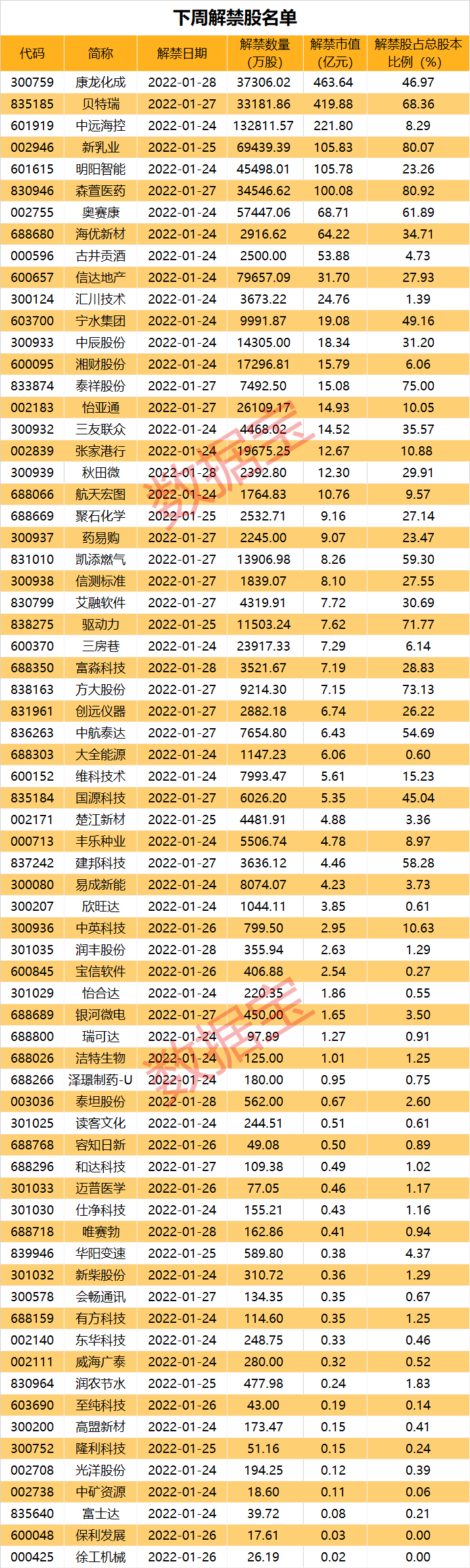

Next week is the last trading day before the Spring Festival. According to statistics from Databao, 70 stocks will be lifted from the ban. According to the latest closing price, the total lifted market value is 193.922 billion yuan.

There are 6 shares with a market value of over 10 billion that have been lifted, namelyPharmaron, Berterry,COSCO SHIPPING Holdings、New Dairy、Mingyang Intelligence, Senxuan Medicine.The largest lifting of the ban isPharmaron, 373 million shares will be listed and circulated next week, mainly the first originalshareholderRestricted sharesThe market value of the lifting of the ban reached 46.364 billion yuan.

There are 23 stocks with less pressure to lift the ban, and the market value of the lift is less than 100 million yuan.Xugong MachineryThe market value of the lifting of the ban is the smallest, and there will be a market value of 1.5769 million yuan facing the lifting of the ban.

fromUnbanned sharesIn terms of the proportion of the number to the total share capital, the market value of 10 shares lifted from the ban exceeds 50%.North Exchange stocksSenxuan MedicineThe proportion of lifting the ban ranks first, reaching 80.92%,New Dairy, Taixiang Co., Ltd., Fangda Co., Ltd., Driving Force, BeteruiThe proportion of lifting the ban on the other 9 shares is greater than 50%.

There are 20 shares with the number of lifted shares accounting for less than 1% of the total share capital.Pure Technology、China Mining Resources、Xugong Machinery、Poly DevelopmentThe proportion of unbanned is small.

On the eve of the lifting of the ban, multiple shares were releasedperformancenotice

Data treasure statistics show that the stock price of the 70 stocks to be lifted next week has fallen by an average of 5.41% since January. Since January, the cumulative increase of 5 stocks has exceeded 10%.

Senxuan MedicineShares topped the list with a cumulative gain of 64.6%.Senxuan Pharmaceutical has been injected into the market by the market because it can produce and sell ritonavir series of pharmaceutical intermediates.PfizerExpectations related to the formulation of “new crown medicine”, the stock price has risen sharply recently.However, when the stock price was high, came the companyexecutiveThe news of the proposed reduction. On the evening of January 20, Senxuan MedicineannouncementSaid that director Cheng Jian, director Jiang Chunjuan, and senior executive Zhu Shizhang planned to reduce their holdings by no more than 75,000 shares, and the planned reduction ratio did not exceed 0.0177%. The reduction period is from February 18, 2022 to August 17, 2022. The reasons for the proposed reduction are all personal capital needs. According to the above announcement, the three executives currently hold a total of 300,000 Senxuan Pharmaceutical shares, with a total shareholding ratio of 0.0702%, all of which were obtained before the listed company entered the Beijing Stock Exchange.

also,AVIC TEDA,Runfeng shares, Ai Rong Software,Zhangjiagang Bank‘s share price rose. There are 26 stocks whose stock prices have fallen by more than 10%.polychemistry、Haiyou New MaterialsShares fell by more than 20%.

At present, 13 of the 70 stocks that have been lifted from the ban have released their 2021 performance forecasts or express reports. According to the forecast median,BerterryThe profit is expected to be the highest, and the announcement stated that the company is expected to return to its parent in 2021.net profit1.35 billion yuan to 1.55 billion yuan, compared with 495 million yuan in the same period last year, a year-on-year increase of 173%-213.44%. also,Eternal Asia、Fengle Seed Industry、China Mining Resources, Berterry,Galaxy Microelectronics、Chujiang New MaterialsIts 2021 results are expected to double year-over-year.

CurrentlyZhangjiagang BankandPoly DevelopmentThe 2021 performance bulletin has been released.Zhangjiagang BankIn 2021, the total operating income is 4.646 billion yuan, an increase of 10.75% year-on-year, and the net profit is 1.299 billion yuan, an increase of 29.77% year-on-year.

Poly DevelopmentIn 2021, the total operating income will be 285.048 billion yuan, a year-on-year increase of 17.2%, and the net profit will be 27.577 billion yuan, a year-on-year decrease of 4.74%.

(Article source: Data Treasure)