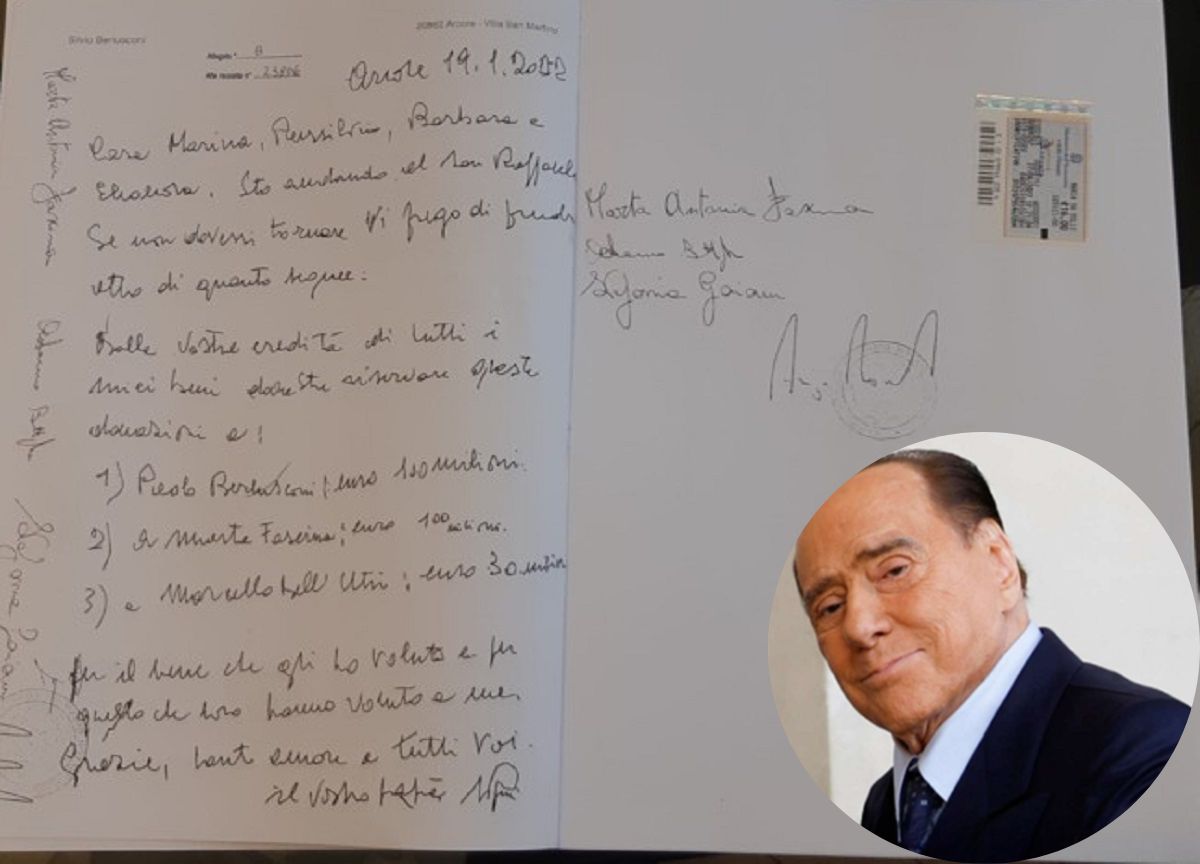

Silvio Berlusconi’s letter to his children

Berlusconi’s will: “heart attack” inheritance taxes

The will of Silvio Berlusconi provides for bequests of all kinds. In the ex-entrepreneur’s vast assets there are villas, boats and works of art. But also other properties for a value of 600 or 700 million. An inventory will be required for the division of assets. While on the boats and their use the brothers have already reached an agreement. dthey will have to share the San Maurizio (1977), the 42-metre sailboat Regina del Mare (1965) and the Magnum 70 motorboat (1990). But in case of seasickness there are also planes: a Hawker 4000, a Gulfstream V I-Deas, a Hawker 750 and a Hawker 800. And at this point it is also legitimate to ask: how much will Berlusconi’s heirs pay in taxes? How does the property tax work in these cases? What are the rules for the succession and the thresholds of the deductibles?

Corriere della Sera explains today that whoever inherits movable and immovable property is required to pay inheritance tax. And to submit the relative declaration to the Revenue Agency. The newspaper explains that law 262 of 2006 provides for taxes at 4% for transfers made in favor of the spouse or relatives in direct line (including children). The percentage is applied to the total value of the assets with a deductible of 1 million euros. Which makes most of the bequests exempt from taxation. Then the law provides for taxes at 6% for bequests in favor of brothers or sisters on the total net value. The deductible here is reduced to a tenth: 100,000 euros. 6% tax, also for transfers in favor of other relatives up to the fourth degree. And related collateral up to the third degree, this time without the application of deductibles.

Taxes are instead at 8% for all other subjects. That is, those without family ties. Among these should be Marta Fascina, which would thus have to pay 8 million in taxes for the 100 million that the former entrepreneur left her. Paolo Berlusconi, on the other hand, will have to pay the 6% tax. With a deductible that seems little compared to the amount of the bequest. The total fees should therefore amount to almost six million euros for him. And Marcello Dell’Utri? Berlusconi’s historic collaborator, who revealed he has cancer, he will have to pay a tax of 8% on the 30 million inherited. So 2.4 million euros will go to the Treasury.

Subscribe to the newsletter