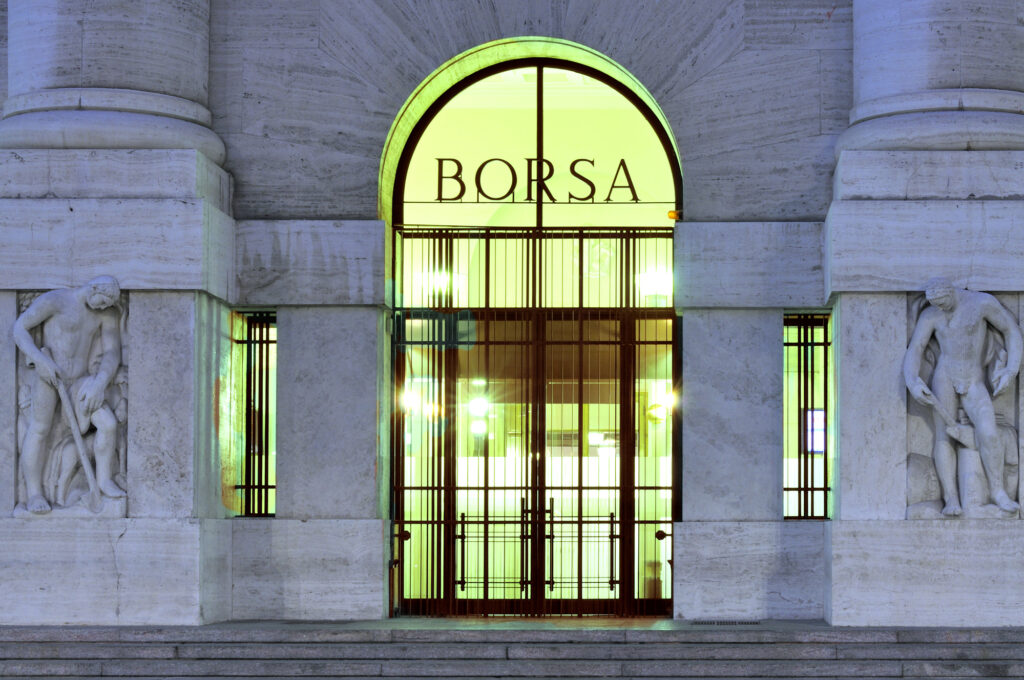

Recovery in the final

The European Stock Exchanges raised their heads in the final which, after a faded session, all closed in positive territory, despite the doubts about the future moves of the central banks. In fact, the key meetings will be held next week and the destinies of the USA and Europe no longer seem aligned: if the ECB will in all probability raise the cost of money again after Christine Lagarde’s words, the market expects a stop from the Fed, while there was a surprise rate hike by the Reserve Bank of Australia. A sign that the decisions of the central institutions are still shrouded in uncertainty.

Banking risk

Giving gas to the Milanese price list, with the Ftse Mib (+0.67%) the best index of the Old Continent, is banking risk, back in the limelight thanks to the merger hypotheses involving MPS which continues its rally with a further gain in 5%. The market on Bper is colder (+0.2%) which, according to rumors, could look right at Rocca Salimbeni with a view to M&A. Purchases also on Fineco (+2.8%) and Recordati (+2.6%). After all, the weakness of crude oil, due to doubts about global energy demand, weighs on Eni (-0.9%) and the rest of the sector. Off the main list, Safilo stands out with +5.3% thanks to the early renewal of the Kate Spade New York license and +3.8% for Rai Way supported by the return of the aggregation scenarios with EiTowers.

Oil down

In terms of exchange rates, the drop in inflation expectations of EU citizens, certified by the ECB, affects the euro which returns below 1.07 dollars and is worth 1.0689 (from 1.0713 at the close yesterday). The single currency is indicated at 149.34 yen (149.60), with the dollar/yen ratio at 139.70 (139.63). Sharp reverse for gas at 24.8 euros per MWh (-17%) after the run on the eve. The price of oil was flat towards the end of trading: the July future on the Wti recorded +0.1% at 72.3 dollars a barrel, while the August delivery on Brent was stable at 76.7 dollars.