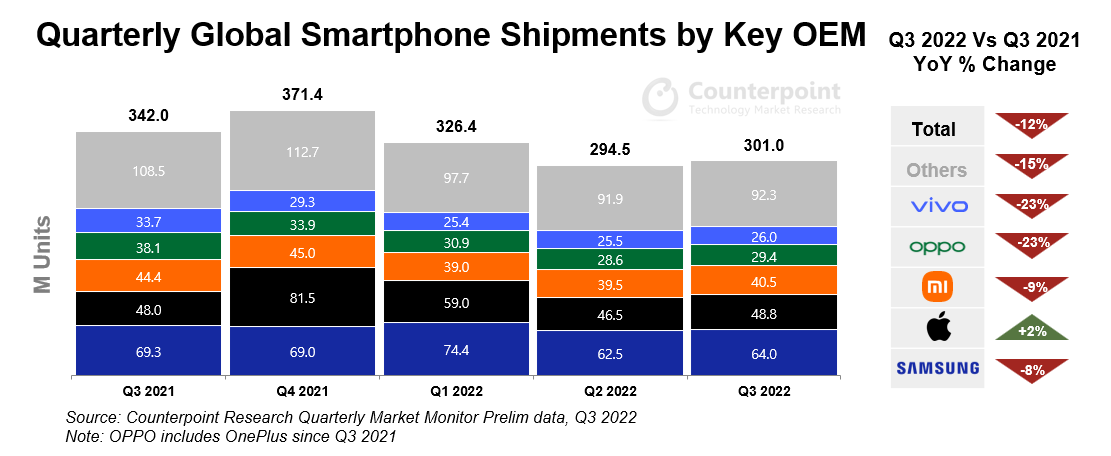

Q3 2022 Global Smartphone Market Status: Down 12% YoY, although Q3 2022 grew 2% QoQ to 301 million units. While quarterly growth from Apple and Samsung pushed the global smartphone market above 300 million units, it failed to reach that level last quarter, but political and economic instability contributed to negative consumer sentiment. Apple was the only top-five smartphone brand with year-over-year growth, with shipments up 2% year-over-year and market share up 2 percentage points to 16%. Samsung’s shipments fell 8% year over year but rose 5% sequentially to 64 million units. Xiaomi, OPPO* and vivo recovered slightly in the second quarter after being battered by China’s lockdown, as they captured more of the market vacated by Apple and Samsung’s exit from Russia.

The global smartphone market remains under pressure due to deteriorating economic conditions, with shipments falling 12% year over year to reach 301 million units in the third quarter of 2022, according to new research from Counterpoint’s market monitoring service. Economic uncertainty caused by ongoing international political tensions has hit the smartphone market, although it reversed its slide below the 300 million-unit mark last quarter as shipments from Apple and Samsung edged up in the quarter.

Commenting on overall market dynamics, senior analyst Harmeet Singh Walia said: “Most major suppliers continued to experience annual shipment declines in Q3 2022. Russia’s war in Ukraine escalated, U.S.-China political distrust and tensions persisted , rising inflationary pressures across regions, growing fears of a recession and weaker domestic currencies have further dented consumer confidence, hitting already weak demand. This has also been exacerbated as smartphones become more durable and technological progress slows. A slow but consistent extension of the smartphone replacement cycle. This was accompanied by a decline in mid- to low-end smartphone shipments, and to a lesser extent, driving the decline, even as the high-end market weathered the economic storm better. With the launch of the latest iPhone lineup earlier this year, Apple became the only top-five smartphone vendor to manage annual shipment growth during the quarter.”

While Samsung saw quarter-on-quarter growth in the third quarter of 2022, thanks to record pre-sales of its high-end folding and clamshell smartphones, its shipments fell 8% year-over-year compared to the same period last year. This was mainly due to subdued consumer sentiment in several of its key markets. It also affects top Chinese brands, whose shipments remain low compared to last year as they shed excess inventories while coping with a slowdown in their home market in China. However, they were able to take advantage of the exit of Apple and Samsung from the Russian market, and their share of the Russian market increased significantly.

Deputy Director Jan Stryjak noted: “With the full force of the latest iPhone launch in Q4, we expect further improvement in the next quarter, although central bank efforts to control inflation will further reduce consumer demand. Channel inventories remain high and OEMs also The focus will be on addressing excess inventory in the fourth quarter. As a result, shipments are unlikely to reach last year’s levels, let alone the pre-pandemic level of over 400 million units in the fourth quarter. Looking ahead to 2023, we expect weaker demand and longer replacement rates , especially in the first half of this year.”