Disc roundup:

On April 12, A-shares opened lower and fluctuated, and violently rose in the afternoon. The Shanghai index quickly rose and turned red and returned to 3,200 points, and the ChiNext index rose by more than 2%. The A-share market showed a general upward trend, with more than 3,800 individual stocks in the red, and 108 individual stocks at the daily limit. The total market value of A-shares on that day increased by 1,265.393 billion yuan. The turnover of Shanghai and Shenzhen stock markets was 916.5 billion today, a decrease of 47.2 billion from the previous trading day.

As of the close, the Shanghai Composite Index rose 1.46%, the Shenzhen Component Index rose 2.05%, and the ChiNext Index rose 2.5%. Northbound funds entered the market aggressively to scavenge goods, with net purchases of 9.137 billion yuan throughout the day, ending the previous 4 consecutive days of net sales, including 4.227 billion yuan in Shanghai Stock Connect and 4.91 billion in Shenzhen Stock Connect.

Disk point of view, financial stocks changed in the afternoon. The “bull market standard bearer” brokerage stocks stormed in the afternoon, among which Hongta Securities and Bank of China Securities had their daily limit. In terms of banking stocks, Ruifeng Bank rose more than 5%, and Chengdu Bank rose more than 4%.

The “epidemic-suppressed stocks” catering, travel, transportation, and retail-related concept stocks broke out collectively.

The catering and tourism index soared by nearly 10%, leading all thematic industry indexes to rise, the attractions and tourism soft index rose by more than 8%, and the port and shipping sector continued to strengthen. Xiamen Port, Strait, Nanjing Port, Ningbo Shipping, Lianyungang daily limit, Chongqing Port Up more than 8%, Nanjing Port, Antong Holdings, China Merchants Steamship, etc. followed suit.

The coal sector was also more active in the afternoon. In terms of constituent stocks, China Coal Energy has a rare “one” daily limit, and the total market value has returned to 100 billion yuan, reaching 103 billion yuan, Yuncoal Energy has risen by more than 6%, and Shanxi Coking has risen by more than 5%.

In terms of decline, the real estate sector fell into adjustment, with nearly 10 stocks in the sector falling by the limit, and Tianbao Infrastructure was fried at the end of the session, directly to the sky! Sectors such as glyphosate, fertilizers and agriculture were among the top losers.

In terms of new stocks, the new stocks listed today did not perform well. N Haichuang (Haichuang Pharmaceutical) and N Weijie (Weijie Chuangxin) fell by nearly 29.9% and 36% respectively, while N Reed (Reed Intelligence) was the only one. Floating red, an increase of nearly 5%. Weijie Chuangxin fell 36.04% on the first day. If it is calculated by signing 500 shares in China, the loss amounted to 12,000 yuan.

Spotlight:

The top ten in the industry

Top ten industry decliners

Top 10 increase in concept index

Top 10 decliners in the concept index

Main capital:

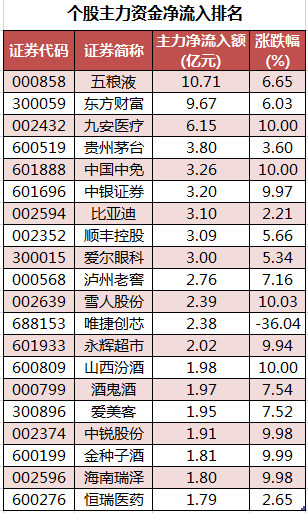

The net outflow of major funds in Shanghai and Shenzhen stock markets today was 10.698 billion yuan. The net inflow of main funds into 9 industry sectors, of which the net inflow of the food and beverage industry sector was up to 3.118 billion yuan, and the net outflow of main funds in the chemical industry sector was up to 4.211 billion yuan.

47 shares received the main capital net inflow of over 100 million yuan. The top three major net inflows of funds are Wuliangye, Dongfang Fortune, and Jiu’an Medical, with net inflows of 1.071 billion yuan, 967 million yuan, and 615 million yuan respectively.

73 shares were sold by the main funds for more than 100 million yuan. The top three net outflows of the main funds are Yiling Pharmaceutical, Beixin Road and Bridge, and Yanhu Co., Ltd., with net outflows of 813 million yuan, 651 million yuan, and 422 million yuan respectively.

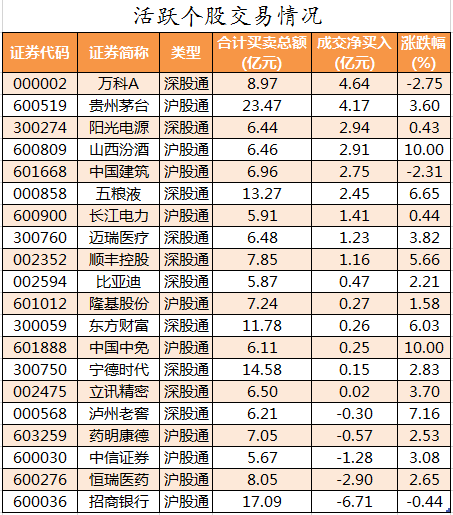

Northbound funds

Northbound funds bought a net 9.137 billion yuan today. The top three net purchases are Vanke A, Kweichow Moutai, and Sungrow, with net purchases of 464 million yuan, 417 million yuan, and 294 million yuan respectively; the top three net sales are China Merchants Bank, Hengrui Medicine, and CITIC Securities. The sales amounts were 671 million yuan, 290 million yuan, and 128 million yuan respectively.

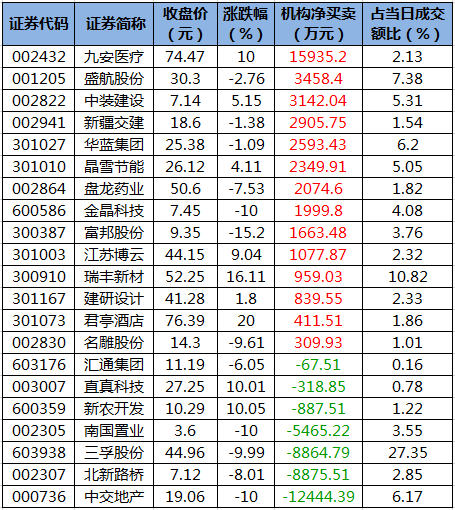

3. Funding trends of Longhu list institutions

After-hours Longhu list data shows that the total net purchase of institutional seat funds today is about 27.9672 million yuan. Among them, 14 stocks were net bought and 7 stocks were net sold. The stock with the most net purchases by institutions is Jiu’an Medical, with a net purchase amount of about 159 million yuan; the top net purchases by institutions are Shenghang shares, China Construction Construction and other stocks. The stock with the most net sales by institutions is China Communications Real Estate, with a net sales amount of about 124 million yuan. The top net sales of institutions are Beixin Road and Bridge, Sanfu shares and other stocks.

Limit up and down stocks

Market outlook judgment

Zhao Liang, an investment advisor of Hualong Securities, pointed out that the market rebounded sharply in the afternoon, driven by securities companies, and the Shanghai Stock Exchange Index successfully returned to above 3,200 points. There was a substantial net inflow of northbound funds in the afternoon, with a net inflow of 9.1 billion yuan as of the close.

Judging from the performance of the afternoon disk, there is no doubt that the capital will release heavy news in the evening of the game. From the current situation, the most likely announcement is the announcement of the RRR cut and interest rate cuts. If the RRR cut and interest rate cuts are announced, then the short-term market There will be a rebound.

Yesterday’s large transaction in the Ningde era also shows that the institution has begun to take action, so the follow-up market trend can be expected, but from the perspective of operation, it is still necessary to wait for the news to land before making plans. From the follow-up direction of attention, After the RRR cut and the interest rate cut, the growth stocks that have suffered a large decline in the early stage will get the opportunity of capital attention. At the same time, the epidemic reversal varieties with strong performance today are also the direction worthy of periodic attention.Return to Sohu, see more

Editor:

Disclaimer: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.