Original title: Second entry into the public offering industry! Centaline Securities announced a big move and intends to absolutely control this fund!

Summary

[Secondentryintothepublicofferingindustry!CentalineSecuritiesannouncedamajormovetoabsolutelycontrolthisfund!】Thepublicfundindustryhasexperiencedrapiddevelopmentinrecentyearswiththetotalscaleoftheindustrybreakingthroughthe22trillionintegermarksettinganewrecordhighForvariousreasonssomefundcompanyshareholderswhowithdrewfromtheirequityparticipationinfundcompanieshavesprungupthemeaningof”secondentry”intendingtoregroupandenterthefundindustryagainCentalineSecuritiesisthelatestexampleofthisOntheeveningofJune9CentalineSecuritiesannouncedthatitintendstobecomeacontrollingshareholderofHexuZhiyuanthroughcapitalincreaseandothermeansandintendstoholdmorethan50%ofthesharesofHexuZhiyuan(ChinaFundNews)

Public offeringfundThe industry has experienced rapid development in recent years, and the total scale of the industry has broken through the 22 trillion integer threshold, setting a new record high.Some previously withdrew from the shareholding due to various reasonsfund companyFund companyshareholderInitiated the meaning of “second entry into the palace”, intending to regroup and enter the fund industry again,Centaline SecuritiesThis is the latest example.

In the evening of June 9,Centaline SecuritiesreleaseannouncementSaid that it intends to become the controlling shareholder of Hexu Zhiyuan through capital increase and other means, and intends to hold more than 50% of the shares of Hexu Zhiyuan.

As early as 2013,Centaline SecuritiesAs a controlling shareholder, he initiated the establishment of Zhongyuan Yingshi Fund, but the development of Zhongyuan Yingshi Fund has not been satisfactory. Zhongyuan Securities has successively increasedEquity transferTo Taiping Assets, it will completely withdraw from the list of shareholders of the fund company until the beginning of 2020.

Second entry into the mutual fund industry

As a benchmark in the major asset management industry, public offering funds have accelerated the return of various talents and capital in recent years, and some shareholders who had withdrawn from the fund industry earlier have rekindled the “dream” of public offerings.

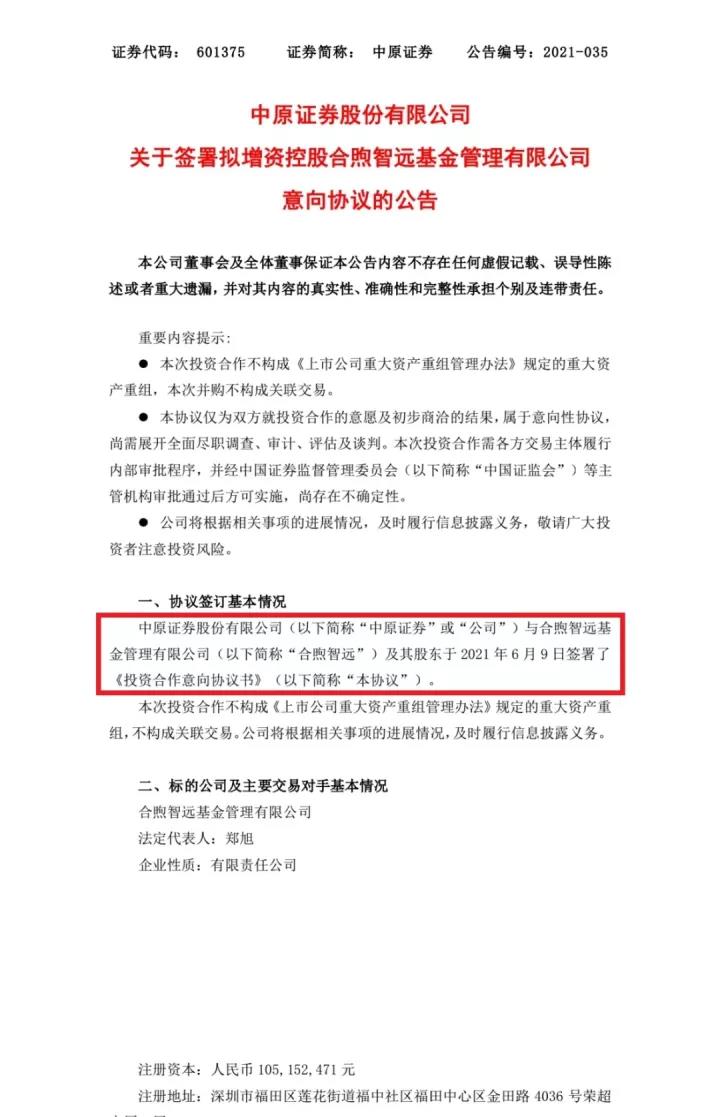

Centaline Securities issued the “Announcement on the Signing of the Intention Agreement to Increase Capital and Holding Hexu Zhiyuan Fund Management Co., Ltd.”. The announcement stated that Centaline Securities and Hexu Zhiyuan Fund Management Co., Ltd. and their shareholders signed the agreement on June 9, 2021. In the “Intention Agreement on Investment Cooperation”, Zhongyuan Securities intends to become the controlling shareholder of Hexue Zhiyuan through capital increase and other means, and intends to hold more than 50% of the shares of Hexue Zhiyuan.

In order to complete the proposed capital increase, Centaline Securities may hire relevant professionals or other designated personnel to conduct legal, financial, asset value due diligence and audits on Hexue Zhiyuan. Hexue Zhiyuan and its existing shareholders shall cooperate and have Obligation to provide true and detailed information and be responsible for the authenticity of the information provided. The parties agree to communicate on the proposed capital increase and sign another formal capital increase agreement on the basis of agreement reached by all parties.

Centaline Securities stated that this investment is conducive to extending the company’s business scope, enhancing the company’s wealth management capabilities, promoting the development of core businesses such as asset management, providing better services and products to the company’s customers, and significantly enhancing the company’s market influence and overall profitability. ability.Centaline Securities has not signed a capital increase agreement with the counterparty. This intentional agreement will not affect the company in 2021.PerformanceConstitute a significant impact.

The announcement also reminded that this agreement is only the result of the willingness of the two parties to invest and cooperate and the result of preliminary negotiations. It is an agreement of intent and requires full due diligence, audit, evaluation and negotiation. This investment cooperation requires all parties to perform internal examination and approval procedures, and can be implemented after approval by the China Securities Regulatory Commission and other competent authorities, and there is still uncertainty.

The current investment management business of Centaline Securities includes asset management business, private equity fund management business and alternative investment business.

The 2020 annual report shows that as of the end of 2020, the total asset management scale of Centaline Securities was RMB 6.298 billion, including 11 collective asset management plans with a management scale of RMB 4.570 billion, and 4 single asset management plans with a management scale of RMB 1.102 billion, special projects. 2 asset management plans, with a management scale of RMB 626 million

In the early years, he withdrew from the Zhongyuan Yingshi Fund

In fact, a few years ago, Centaline Securities also tried to deploy public fund business.

More than 8 years ago, Centaline Securities and Ashinstone Assets jointly initiated the establishment of Centaline Stone Fund. Public information shows that Centaline Stone Fund was established on January 23, 2013 and registered in Shanghai. At the beginning of its establishment, the company’s registered capital was RMB 200 million, of which Zhongyuan Securities Co., Ltd. contributed 51% of the registered capital, and Anshi Investment Management Co., Ltd. contributed 49% of the registered capital.

However, in the following years, the development of Zhongyuan Yingshi Fund was dismal. The company has issued Zhongyuan Yingshi Flexible Configuration and Zhongyuan Yingshi successively.currencyTwo public offering funds, among them, Zhongyuan Yingshi was established on September 11, 2014Monetary Fund, It was formally liquidated after only a year of operation, and the scale of the other fund has been difficult to show up. The asset scale was once less than 10 million yuan.

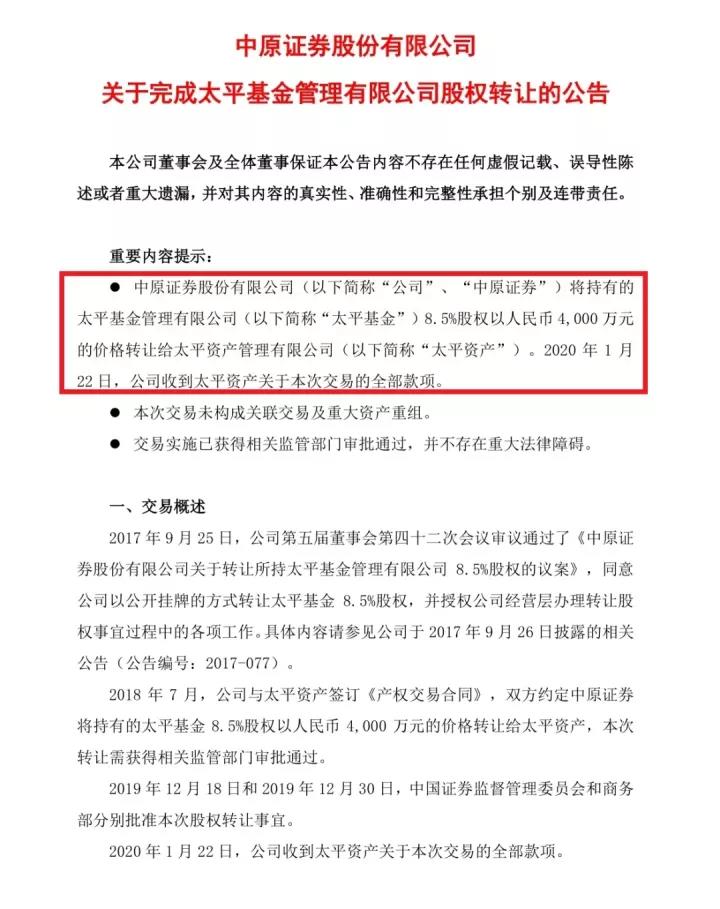

Centaline Securities ultimately chose to transfer its equity in the fund company. On July 26, 2016, the China Securities Regulatory Commission approved Zhongyuan Securities to transfer its 34% stake, and Anshi Investment to transfer its 32% stake to Taiping Assets.China TaipingInsuranceThe group became the actual controller of Zhongyuan Yingshi, and Zhongyuan Yingshi Fund officially changed its name to Taiping Fund.

In July 2017, Taiping Assets made a substantial increase in the capital of Taiping Fund. The registered capital of Taiping Fund increased from 227 million yuan to 400 million yuan. Taiping Assets’ equity in Taiping Fund increased from 66% to 83%, and the equity held by Centaline Securities fell by 8.5%.

At the end of 2019, the China Securities Regulatory Commission issued the “Approval on Approving the Change of Equity of Taiping Fund Management Co., Ltd.”, approving Zhongyuan Securities Co., Ltd. to transfer 8.5% of its equity in Taiping Fund to Taiping Asset Management Co., Ltd., and this transaction was issued in early 2020 The equity change was approved by the Taiping Fund’s shareholders meeting, and Centaline Securities finally withdrew completely and no longer held the equity of the Taiping Fund.

Hexue Zhiyuan Fund may welcome the second equity change

The eagerness to change or the target of Zhongyuan Securities’ plan to buy shares this time-the introduction of Hexu Zhiyuan FundNew crotchOne of the reasons for the East.

The name of Hexue Zhiyuan Fund was the Green Pine Fund at the beginning of its establishment. On August 1, 2017, the Green Pine Fund was formally approved by the China Securities Regulatory Commission for its establishment. The Green Pine Fund is a fund company initiated and established by professionals and holds shares.

Public information shows that Qingsong Fund has an initial registered capital of 100 million yuan, registered in Shenzhen, and initiated by five natural persons. Among them, Zheng Xu holds 32.9% and is the company’s largest shareholder; Zhao Xinyu holds 29.1% and is the company’s second largest shareholder; Lin Qi holds 28.1% and serves as the company’s third largest shareholder; Wu Wei and Liang Tao hold respectively There is another 4.95% ratio. The five natural-person shareholders are all veterans in the fund industry, with experience in various fields including product design, e-commerce, and compliance.

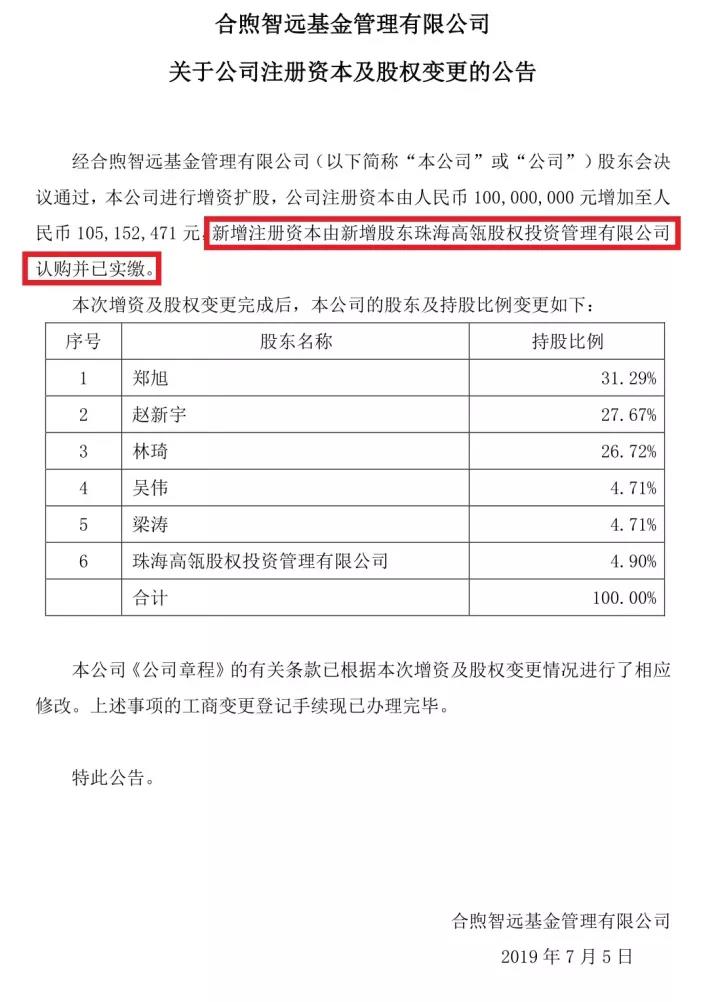

In 2018, Qingsong Fund was renamed as Hexu Zhiyuan Fund. The following year (2019), Hexu Zhiyuan introduced Hillhouse to invest in shares. Zhuhai Hillhouse Equity Investment Management Co., Ltd. subscribed 5,152,500 yuan in new registered capital, accounting for the registered capital. With a capital ratio of 4.90%, it became the fourth largest shareholder of Hexu Zhiyuan Fund.

If Centaline Securities successfully acquires shares, Hexu Zhiyuan Fund will usher in the second equity change since the establishment of the company, and transform from the original “individual” fund company with a natural person as the major shareholder to a “individual” fund company.BrokerageDepartment” fund company.

However, due to fierce competition in the fund industry, it is also difficult for new fund companies to quickly grow bigger and stronger.

According to the data, the Hexue Zhiyuan Fund currently has three funds including Hexue Zhiyuan Jiaxuan, Hexue Zhiyuan Consumer Theme, and Hexue Zhiyuan National Securities Xiangmihu Financial Technology Index. The product types cover stocks, There are three types of mixed and index. As of the end of the first quarter of 2021, the scale of non-monetary assets managed by Hexue Zhiyuan Fund was 242 million yuan, ranking 139th in the industry.

(Source: China Fund News)

(Editor in charge: DF407)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.

.