Tax, here are all the deadlines for May 2023: from the pre-compiled 730 to the VAT return

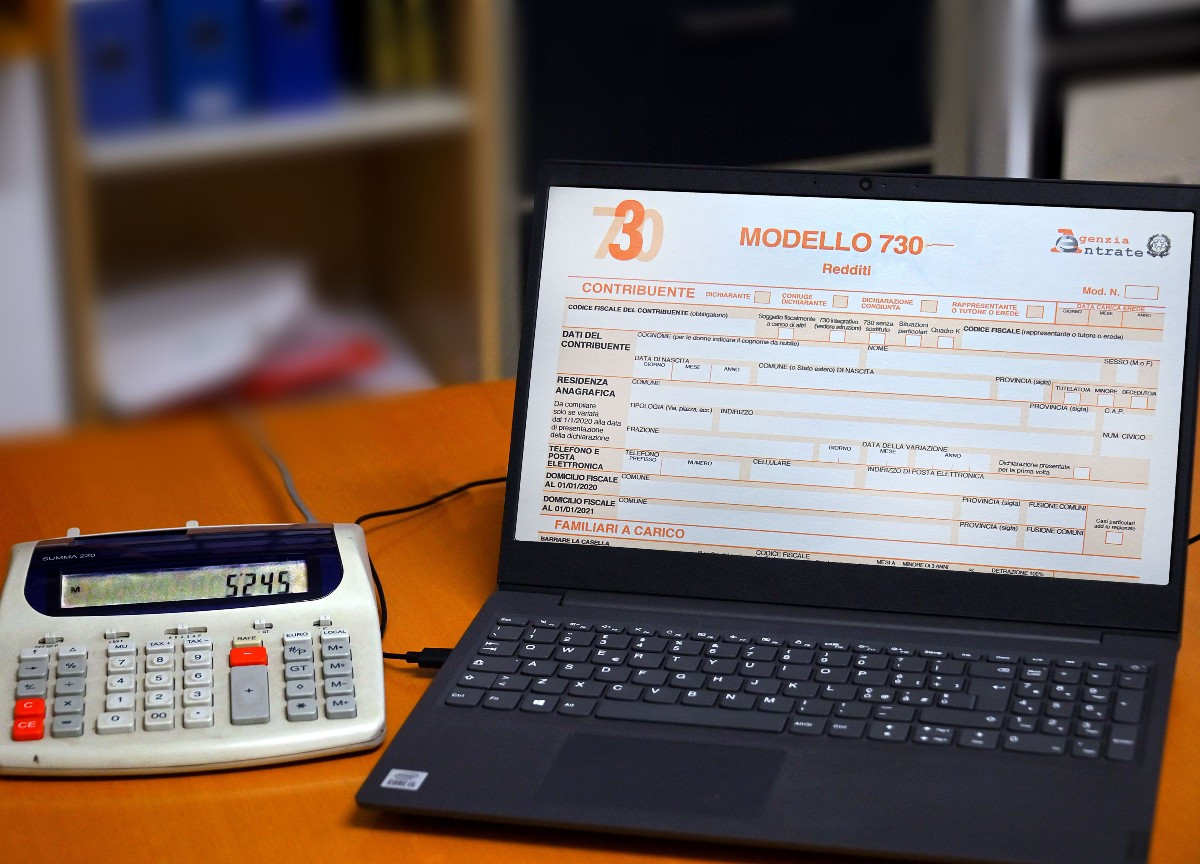

The dense network of tax deadlines of the month Of maggio, roughly concentrated in three periods: at the beginning, in the middle and at the end of the month. From today, May 2, in particular it is possible to consult the pre-filled declaration That regard i incomes they charges of the taxpayer per the tax year 2022. Only from 11 May, however “will it be possible to accept, modify e send il 730 and the income model”.

Furthermore, again from today, the subjects required will have to provide: al payment of the tax Of stamp on books, registers and other IT documents relevant for tax purposes issued or used in the previous year, al payment of the tax on insuranceal Rai fee payment for subjects for whom it is not possible to charge the invoices issued by the electricity companies; and again to the presentation of the self-declaration for the exemption from the Rai license fee for the over seventy-five year olds; the presentation of the Intra 12 form for non-commercial entities and farmers concerning the purchase of goods and services from subjects not established in the territory of the State.

The declaratory season will close on 2 October for those who send the 730 directly via the web application and on 30 November for those who use the pre-compiled Income form. Declarations this year will be even easier to use, thanks also to the possibility of delegating a trusted person both online and via videocall. The data transmitted to the Agency is growing further, exceeding 1 billion and 300 million this year (+8% compared to 2022). Of these, over one billion (80% of the total) relate to health care costs. This is followed by insurance premiums (99 million), single certifications for employees and self-employed workers (73 million), transfers for restructuring (11 million), data relating to interest expense on mortgages (8.5 million) and school expenses (6.5 millions).

Subscribe to the newsletter