Source: Cinda Futures Author: Cinda Futures

Strategic advice:

【Steel】

Thread RB2301 ran in shock yesterday, opening at 3660, rising at 3704, dropping at 3652, and closing at 3676. On the technical side, it went flat on the 20th, went up on the 10th, turned down on the 5th, MA5>MA10>MA20. Spot market, generally down. Shanghai thread 01 basis weakened to 79 yuan / ton (-34), RB1-5 to 82 yuan / ton.

At the industrial level, the supply and demand of threads have both dropped, and the total inventory has continued to be depleted but at a slower rate. Thread production has declined for three consecutive weeks, apparent demand has declined for two consecutive weeks, and total inventory has declined for six consecutive weeks, but the speed of inventory reduction has slowed down slightly this week. In terms of technology, blast furnaces continue to reduce production, electric furnaces continue to resume production, and the immediate profits of production are all below the profit and loss line. On 11.24, the daily trading volume of building materials was 128,000 tons, which was average.

On the whole, the supply and demand of threads have both dropped, and the total inventory has been eliminated but the speed has slowed down. Fundamental support weakened, and the market returned to calm. The minutes of the Federal Reserve meeting last night were dovish, which once again boosted market sentiment. The long-short game intensifies, the thread valuation is neutral, and the short-term trend fluctuates repeatedly.

1. Supply and demand

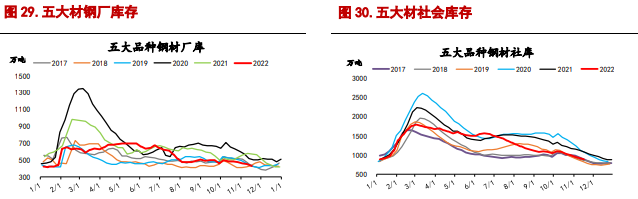

2. Inventory

3. Spot price

4. Profit

5. Compare prices

【iron ore】

The main force of iron ore I2301 rebounded slightly, opened at 723.5, tested 736.5, dropped 714.0, and closed at 722.5. On the technical side, the head turned down on the 5th, and both went up on the 10th and 20th, MA5>MA10>MA20. In the external market, as of press time, the Singapore iron ore FE main chain reported 95.00, with a range of -0.37%.

At the industry level, the shipments of overseas Australia and Pakistan increased to a high range month-on-month, while the volume of iron ore at domestic ports fell month-on-month, and the volume of port evacuation dropped slightly. The operating rate of downstream blast furnaces has continued to decline, the average daily molten iron production has continued to decline, and the demand for raw materials has weakened. In terms of inventory, the iron ore port inventory increased, and the steel mill inventory continued to be low and declined.

On the whole, the industry is driven downward, the market sentiment has fallen, and iron ore is weakly adjusted.

1. Supply and demand

2. Inventory

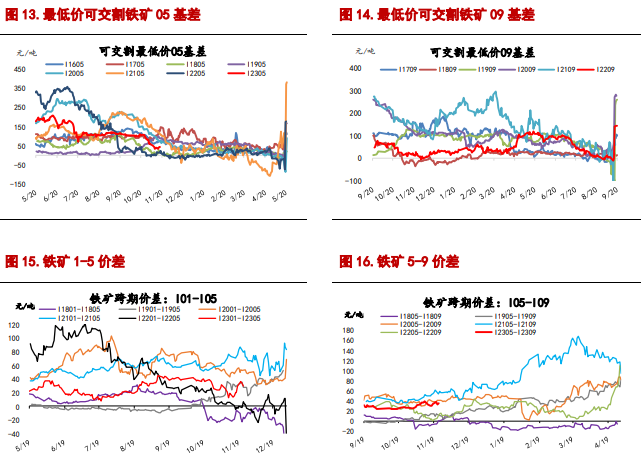

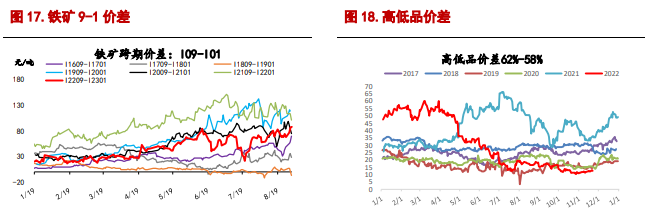

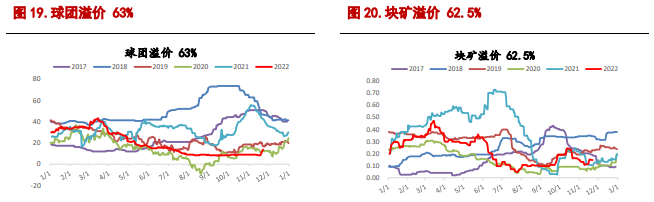

3. Spot stock and price comparison

Sina Statement: This news is reproduced from Sina’s cooperative media. Sina.com publishes this article for the purpose of conveying more information, which does not mean agreeing with its views or confirming its description. Article content is for reference only and does not constitute investment advice. Investors operate accordingly at their own risk.

Massive information, accurate interpretation, all in the Sina Finance APP