July 7,Jintuo shares(300400) opened the daily limit, the stock price reported 23.23 yuan / share, a two-day increase of nearly 30%.

Behind the daily limit

It is a news of cooperation with HiSilicon

Public information display,Jintuo sharesIs mainly engaged inProfessional settingThe research and development, production, sales and service of the company, the main products are divided into electronic complete machine assembly equipment, photoelectric flat panel display module production professionalProfessional settingWait. The company was listed on the Shenzhen Stock Exchange in 2014.

On the news, in the evening of July 6, there were media reportsJintuo sharesSigned a memorandum of cooperation with Shenzhen HiSilicon Semiconductor Co., Ltd.In addition, Jintuo shares recently mentioned in the reply of Huiyi that the company and Huawei are engaged in electronic thermal production.Professional settingAnd there are different degrees of cooperation in special equipment for semiconductor thermal production.

In addition, the quarterly report for 2021 shows that Jintuo has achievedOperating income215 million yuan, an increase of 11.70% year-on-year;Net profit34,882,800 yuan, a year-on-year increase of 2.06%; earnings per share were 0.14 yuan.

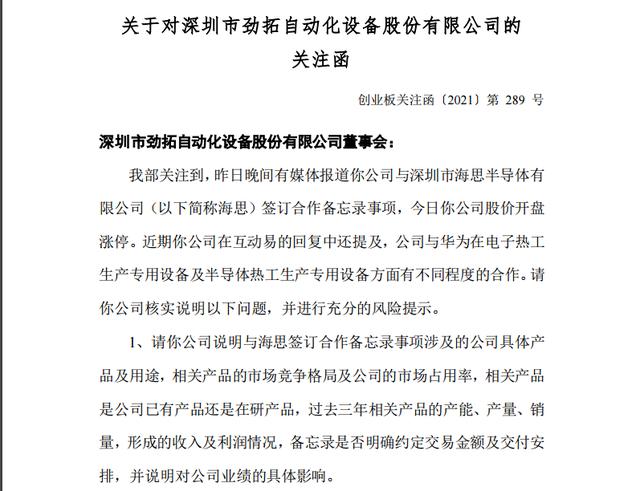

The Shenzhen Stock Exchange urgently issued a letter of concern

At noon today, a letter of concern from the Shenzhen Stock Exchange also came hurriedly, requesting the company to explain the specific cooperation content with Huawei, and to the company.PerformanceWhether there is a situation that actively caters to market hotspots and speculates on stock prices.

The Shenzhen Stock Exchange requires the company to verify and explain relevant issues and provide adequate risk warnings.

The Shenzhen Stock Exchange stated that the company should explain the company’s specific products and uses involved in the signing of the memorandum of cooperation with HiSilicon, the market competition pattern of related products and the company’s market occupancy rate, and whether the related products are the company’s existing products or products under development. In the past three years The production capacity, output and sales volume of related products, the income and profit formed, whether the memorandum clearly stipulates the transaction amount and delivery arrangement, and explains the specific impact on the company’s performance.

On the other hand, Jintuo shares also need to explain the legal effect of the memorandum, whether the company has signed a formal cooperation agreement with HiSilicon. If not, please explain whether your company needs to reach a formal cooperation with HiSilicon and whether it still needs to meet the requirements of HiSilicon related products. Whether the company is the only partner of HiSilicon for related products, such as testing and review procedures.

Regarding Jintuo’s mention in the Yihuiyi that the company and Huawei have different degrees of cooperation in electronic thermal production equipment and semiconductor thermal production equipment, the Shenzhen Stock Exchange requires that the specific cooperation content with Huawei be explained, and the income and revenue formed Profit, whether it is related to the signing of a memorandum with HiSilicon, and the specific impact on the company’s performance.

In addition, on June 24, Jintuo sharesannouncementIndicates that the company holdsshareholder, The actual controller and chairman Wu Xian received the “Administrative Punishment and Market Prohibition Advance Notice” due to securities market manipulation. The Shenzhen Stock Exchange requires the company to self-examine whether there is any violation of information disclosure, whether there is a situation in which it actively caters to market hotspots and speculates on the company’s stock price.

At the same time, the company should conduct self-examination on the trading of the company’s stocks in the past month by controlling shareholders, shareholders holding more than 5% of shares, directors, supervisors, senior executives and their immediate family members, whether there is a reduction plan in the next three months, and whether there is inside information. Transactions and other illegal transactions, and report to insiders.

(Source: 21st Century Business Herald)

.