Let’s continue with the analysis developed in the article Raw materials: the green transition upsets the balance of power, here are the winners of the future extending the analysis to the world of miners. In particular, we will seek to identify those listed companies that should benefit most in the long term from the clean energy megatrend and the green transition. As we extensively explained in the previous article, in fact, the energy transition towards carbon free will lead to a significant increase in the demand for some raw materials that will become increasingly strategic and in some cases even critical. We refer in particular to copper, platinum e PGM, lithium e cobalt, nickel, manganese, indio e molybdenum. It is therefore a question of understanding which extraction companies have a turnover particularly exposed to these commodities.

The analysis process: turnover and market multiples

The analysis took place in two moments. We first analyzed all the stocks belonging to the two reference indices of this sector: lo STOXX Europe 600 Basic Resources and theS&P 500 Materials, identifying the companies most exposed to strategic raw materials for the green transition. We then analyzed these companies on market multiples to see the most interesting ones in terms of valuation.

In particular, we carried out a double analysis on multiples. The first relates to the single security through the study of the P / E forward and EPS forward. In this way, the analysis is not affected by any taxation differences or accounting choices between peers. The second analysis, on the other hand, consists precisely in the analysis of the main market multiples, comparing the miners with the sector median.

European Miners: Anglo American the best European followed by KGHM Polska Miedź and Rio Tinto

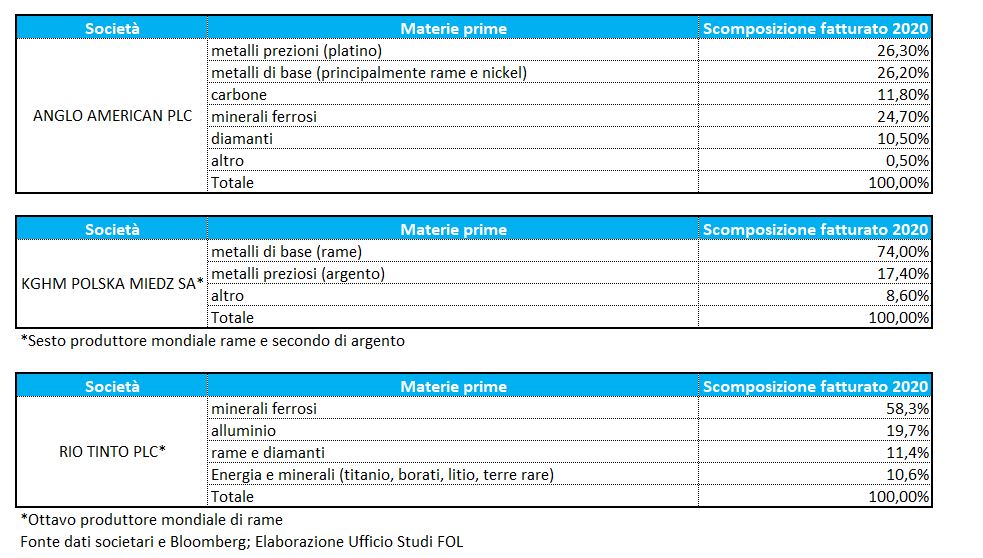

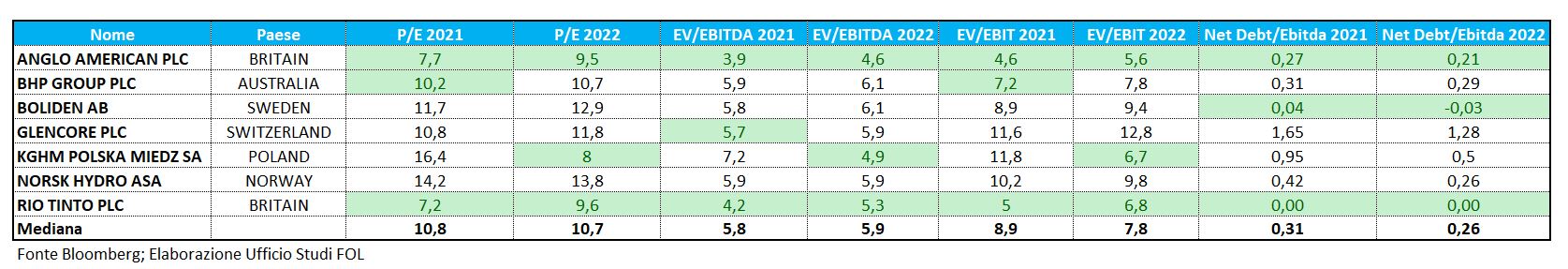

In the table we find only the index miners companies STOXX Europe 600 Basic Resources presenting a P/E forward (estimated at twelve months) at a discount on the 5-year average. Element that tells us which securities are actually cheap. For the purposes of the analysis, however, we look for those companies at a discount but with solid fundamentals. This is the reason for the “var EPS” column, which shows us the stocks on which analysts have raised their earnings estimates (EPS forward) compared to the five-year average. The stocks in the table are therefore the cheap miners, on which analysts are also predicting future earnings growth. In the table you will also find the estimated dividend yield 2021 and 2022 as additional information. Among these securities, there are two companies most exposed to strategic raw materials for achieving the targets of the Paris Agreement: Anglo American e KGHM Polska Miedź, the first is a London-based mining giant, the second is a Polish multinational. Anglo American has over 50% of its turnover linked to strategic raw materials such as copper, nickel and PGM (metals of the platinum group), KGHM 74% linked to copper.

Finally, if we analyze the main players on the market multiples estimated for this and next year, Anglo American is confirmed as the best positioned both on the asset side and equity side, as it is below the sector median (values highlighted in green) . Not only that, Anglo American also boasts the Net Debt/Ebitda estimated for 2021 and 2022 below the median of peers (important indicator of financial strength). On multiples, KGHM Polska Miedź comes out less well, with Net Debt / Ebitda clearly higher than the median and 2021 multiples at the premium. Rio Tinto on market multiples is also interesting. In fact, the title presents the same situation as Anglo American, although less exposed in terms of turnover to the raw materials that are the protagonists of our survey.

Miners USA: Freeport and First Quantum Minerals the most interesting

Same identical work also done with the miners listed in America (S&P 500 Materials to which we have added some companies listed on the American market but not present in the index).

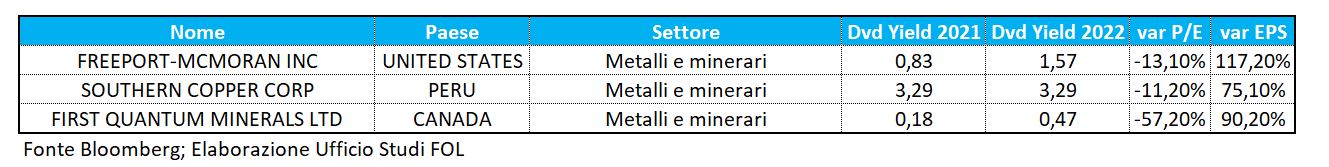

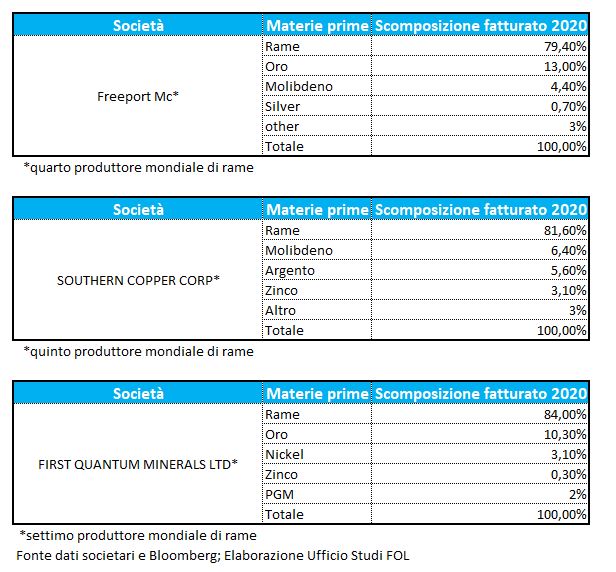

There are only three companies that pass the first test, i.e. forward P / E ratio and forward EPS of the single stock, with Freeport McMoRan e First Quantum Minerals the best placed ones. In any case, all three of these companies are extremely exposed to the raw materials essential for the green transition.

Freeport it makes up 79.4% of its turnover on copper (fourth world producer of copper) and another 4.4% on molybdenum. For Southern Copper even 81.6% of turnover derives from copper (fifth largest producer of copper in the world) and another 6.4% from molybdenum. First Quantum Minerals sees 84% of its turnover in copper, 3.1% in nickel and another 2% in the metals of the platinum group.

Even if we extend the analysis to the asset side and equity side multiples estimated by analysts for 2021 and 2022, Freeport e First Quantum Minerals are the best but the latter appears with levels of Net Debt/Ebitda estimated to be quite high compared to the median of peers. Fresnillo also comes out well but is not exposed to the raw materials subject of this analysis.

ETFs: passive diversification on strategic commodities and miners

For those wishing to invest in industrial commodities and companies linked to them, there are several ETFs, we report some of them. L’iShares MSCI Global Select Metals & Mining Producers (PICK US) reproduces the performance of the MSCI ACWI Select Metals & Mining Producers Ex Gold & Silver Investable Market Index. An index that contains the world‘s largest miners of industrial and precious commodities, with gold and silver excluded (including platinum). Generic on the miners the ETF VanEck Vectors Global Mining UCITS (GDIG IM), this diversified on companies active on all commodities.

More specific on the major companies globally that work on lithium there is for example the Global X Lithium ETF (LIT US), which reproduces the performance of the Solactive Global Lithium Index (an index which in the last year boasts a monstrous performance). Same sector also forAmplify Lithium & Battery Technology ETF (BATT US).

Sui miners del rame instead there is the Global X Copper Miners ETF (COPX US) based on the Solactive Global Copper Miners Index benchmark. Given the performance of the last year, this ETF also highlights the interest in this commodity.

Directly on commodities there are many ETFs, we point out theInvesco DB Base Metals Fund (DBB US) which follows the trend of the DBIQ Optimum Yield Industrial Metals Index, an index composed of futures contracts on some of the most liquid and widely used base metals: aluminum, zinc and copper.