Over the years I have spoken many times with people who, despite following us for a long time and participating in many of our free events, when becoming our customers raised a question about the costs.

According to someone, in fact, our services would be expensive.

I thought that, after years of dissemination, certain concepts were known to most but I had to change my mind: some things need to be explained better and better and, above all in your interest, it is good that you read the following.

You may not become our customer but, trust me, if you take home these concepts you will earn tens of thousands of euros in your life regardless of our help.

Let’s start from a basic assumption: the vast majority of Italian private investors lose money because, as illustrated on several occasions in Affari Miei, they often do the opposite of what they should.

The idea of someone telling us for free what to do with our money is so tempting that many come to think that it is almost their “right”. Too bad it’s not like that!

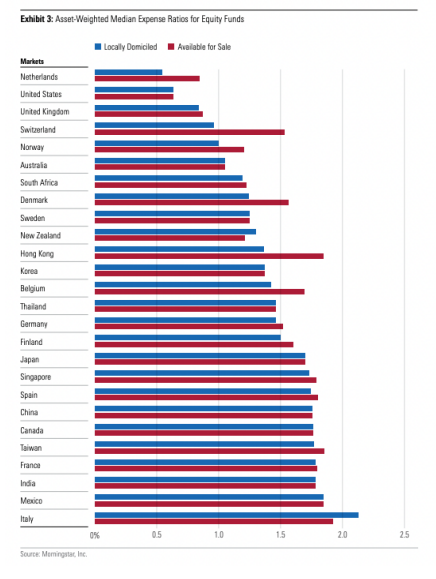

According to a recent Morningstar report, Italy is the most expensive country in the world for investors together with Mexico and India.

But why does investing in Italy cost so much?

First we need to understand why investing costs money.

There are costs that the issuer retains to physically manage the resources: they are usually lower for ETFs where the manager “limits” himself to replicating a stock market index while they are higher when the manager is “active”, as in case of funds, and aims to guarantee an extra return to the client with a strategy that obviously involves a greater commitment of men and resources.

Then we have the costs that we can define as “commercial”: someone, in practice, has to sell the funds created by the asset management companies (asset management companies). In Italy most of the market is in the hands of the banks which make use of thousands of consultants in charge of proposing investments to customers.

In this case it is necessary to pay the entire supply chain and the funds placed by the banks usually have:

- Entrance fees: sometimes they even reach 5% of the invested capital and are a sort of “premium” only one which, ready-go, is paid to the bank. Invest €100,000? €5,000 goes straight to the bank;

- Management fees: usually they are paid to the manager but when the fund is sold by the bank they rise up to 2.5-3% per annum because, in this way, the manager retrocedes a sales commission to the seller, i.e. to the bank and, consequently, to the consultant who physically places the product. Is your annual value of €100,000? Each year the bank keeps between €2,500 and €3,000;

- Exit fees: often, to discourage disinvestment, the funds provide for exit commissions which are equivalent to entry commissions. If you exit within a certain time, you pay a percentage amount (e.g. 1-2% of the value), increasing the margins of the placing bank. Again to stick to the previous example: you disinvest €100,000, you pay between 1,000 and 2,000 to the bank.

All these commissions are not paid “separately” but are deducted from the capital: you don’t see them but you pay for them.

To understand this, the bank does not issue a fee as an accountant, a lawyer or a consultancy company can do but proposes to provide “free” consultancy in exchange for this complex mechanism which “attacks” the invested capital without the customer having to materially pay someone.

At the end of the chain, investing in Italy costs on average, over several years, 2.13% on funds domiciled by us (those preferred by banks) and 1.92% on those domiciled abroad.

2% on an investment isn’t like 2% off a bag of cookies at the grocery store, let me tell you why.

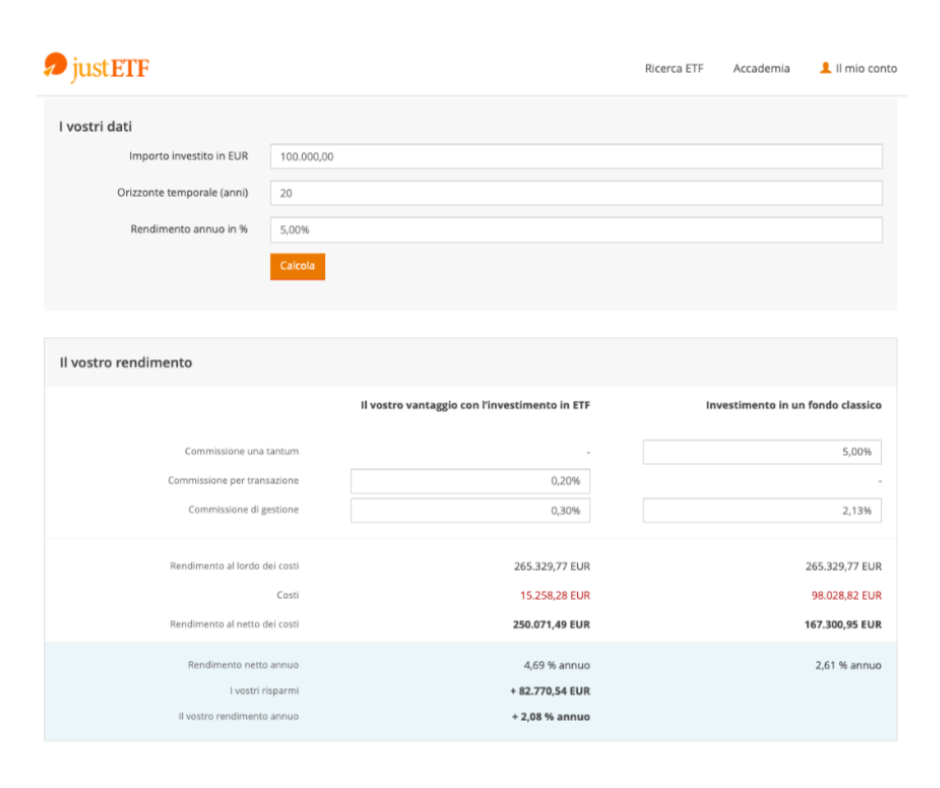

Using the JustETF simulator, we can immediately create this comparison between fund management and ETF management, which is on average more efficient.

Let’s assume we invest €100,000 over a 20-year period considering the entry costs of mutual funds and the average annual cost of 2.13% shown by Morningstar.

Let’s assume in both cases an estimated market return of 5% per annum.

On the left, however, let’s assume management in ETFs which provides for a cost per transaction (since we have to buy, we have to pay a small sum to the broker we buy from) and an annual management cost of 0.30% (it can be done much better, we round up).

As can be seen, in 20 years they dance €82,770.54 difference which weigh very significantly. In the first case, net of costs, we earn 4.69% per annum while in the second case just 2.61%.

I am limiting myself to an analysis of €100,000 of capital to explain that we don’t have to be millionaires to reap the benefits we want to offer you and I am aware that many of the people who will read this message have much more money.

Let’s go back to our previous example and the fact that, according to some, our services are expensive.

For each 100 thousand euros of capital you invest, you are paying an average of 2.13%, i.e. €2,130 a year to receive NOTHING in terms of information or financial education. In ten years, you pay your bank €21,300.

Perhaps you have a counter value of more than 100 thousand euros, let’s make two further small payments.

For each 200 thousand euros of capital you invest pay double, that is €4,260 per year which becomes €42,600 in ten years.

For each 500 thousand euros of capital you invest pay €10,650 a year, that is €106,500 over ten years.

Now I don’t know on what parameters you are evaluating the cost of our services but doing nothing and staying with your bank will certainly cost you much more than what we sell, including training.

Someone might say: “But I don’t want to train because knowing what to do doesn’t have a direct and immediate impact”.

Too bad that, unfortunately, if you’ve come this far it’s precisely because you found something in previous managements that didn’t fully convince you and you started looking for more information online.

If everything were clear to you and if you were 100% satisfied, you wouldn’t even know Affari Miei so, I can put it in writing, there is something wrong both in your previous asset management and, probably, in your general knowledge of the subject.

You can also close this page and continue to put your head in the sand, I more than offer you a solution that costs infinitely less than the tens of thousands of euros that you will pay your bank for the rest of your life and, above all, more than facing you the opportunity to finally take control of your money without having to trust the first one who passes I don’t know what to tell you.

In the end, the money is yours, not mine?

I know very well what I have to do with my assets to the point that I am professionally involved in teaching others how to manage their finances efficiently.

So, getting back to us, sorry if I’m going too far but no, it’s not a money issue.

If you keep repeating this thing you are lying to your conscience before us.

But it’s not just a cost issue, there’s more

Investing with the bank 9 times out of 10 you end up buying things that you don’t even understand and that aren’t even explained to you, often you are not followed by anyone and/or your advisor is changed every two years.

The new consultant who comes to you usually does so by immediately offering you other products so as to continue to fatten the bank to make a career and leave his place for the next consultant. If you are here, you probably understood that something is wrong this process.

With us, however, it is completely different because:

- we don’t just give you a list of tools but we provide you with the theoretical tools to understand our analyses;

- we give you all the practical tools on an operational level to do what we say: how to understand which platform to choose, how to manage everything fiscally, etc.;

- we provide you with a private club where you can ask practical questions and/or we give you individual coaching in the most advanced version;

- we release general monthly updates that give you the information you need to understand how your investments are doing;

- you have UNLIMITED access to all our in-depth online events. In the last year we talked about: war, inflation, bonds, China, real estate and we will obviously continue to do so in the future.

You understand that you are buying a service that no bank and no capital manager will ever make available to you and, assuming that you don’t really have a few thousand euros (in which case, forget about investments and concentrate on increasing your assets), the cost problem does not exist.

And it doesn’t even exist if you have the money tied up elsewhere and you’re maybe only thinking about a residual part of the capital: once you enter Affari Miei you’ll touch the difference and you can’t wait to move on to the new way of managing your assets.

Therefore, if the problem is economics, I am convinced that I have overcome all misunderstandings: it is a problem that does not exist.

It’s different if you don’t trust us

I can understand it, trust is a serious thing that is conquered over time and I too, like you, want to take some time before entrusting myself to someone.

We do our best to show you our reliability, if you are here you have known us through the contents.

However, I think it is right that you know that:

- Our company exists since 2014: do you think that if we were unreliable people we would still be here after all this time?

- our company is based in Italy, in Turin, not in strange places: the data about us is public, from the address to the composition of the company structure or financial statement data;

- Affari Miei is registered in the Register of independent financial consultancy companies as a guarantee towards customers: being part of a professional register involves dozens of hours a year to fulfill bureaucratic procedures and controls and costs tens of thousands of euros. If we were not serious people we wouldn’t take on all this, don’t you think?

- in February we were at Casa Sanremo Invest, official hospitality of the Festival, as organizers of the event. If we were disreputable people, in your opinion, would they let us participate in Sanremo lightly?

All this net of the fact that we have been doing this professionally for years, we train ourselves and make sure we always offer the best to our customers.

That’s all, I wanted to clarify these issues aware of the fact that only the most intelligent and thoughtful people will read everything and, above all, will understand that everything I have illustrated is primarily in their interest.

Then you can decide not to become our customer: friends as before, God forbid.

But I would like to be sure that the message has passed and that this information is generally useful for you to make any decision in this area.

To learn more about our services, book a free session to speak with our team.

See you soon.