China.com Finance and Economics News on December 1. China.com Finance learned that Huafang Group will issue shares from November 30 to December 5. Huafang Group plans to issue 46 million shares, 10% of which will be publicly offered in Hong Kong, raising a maximum of 166 million Hong Kong dollars. The offering price is between 2.8 Hong Kong dollars and 3.6 Hong Kong dollars. Each lot is 1,000 shares, and the admission fee for each lot is 3636.29 Hong Kong dollars. Huafang Group is expected to be listed on December 12. Haitong International and CCB International are the joint sponsors.

Huafang Group provides users with audio and video live broadcast entertainment and social networking services, and operates platforms such as Huajiao, Huazhi, and Liujianfang. In the first five months of this year, the revenue was 2.087 billion yuan, an increase of 15.86% year-on-year, and the profit attributable to the company’s equity shareholders was 1.78 billion yuan, up 30.63%.

According to the prospectus, Huafang Group is a Chinese Internet company that provides users with audio and video live broadcast entertainment and social networking services. Huafang Group operates one of the leading online entertainment live streaming platforms in China. According to the iResearch report, in terms of monthly active users and monthly paying users of mobile and PC applications and websites, as well as WeChat applets and monthly usage time of mobile and PC terminals in 2021, it ranks among China’s online entertainment live streaming platforms top two. According to the same source, in terms of revenue from mobile and PC-side applications and websites and WeChat Mini Programs in 2021, it will rank third among all online entertainment live streaming platforms in China, accounting for approximately 13.1% of the total revenue of entertainment live streaming platforms in China.

Huafang Group focuses on the field of online social entertainment, and has a business portfolio ranging from live broadcasting to a series of diversified audio and video social networking products and services. Huafang Group believes that carefully crafting a platform to meet the needs and interests of users in China and selected overseas markets is especially popular with Generation Z users.

As of May 31, 2022, Huafang Group had 415 million registered users. According to the information provided by users, for the five months ended May 31, 2022, Generation Z users accounted for approximately 61.3% of Huajiao’s average monthly active users.

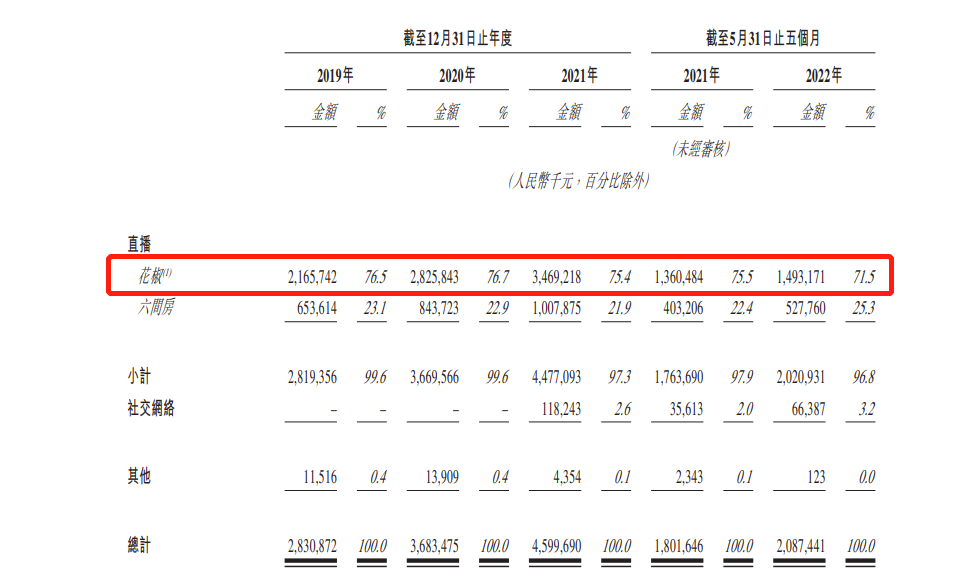

According to the prospectus, in 2019, 2020 and 2021 and the five months ended May 31, 2021 and 2022, the revenue generated by Zanthoxylum bungeanum will be 2.166 billion yuan, 2.826 billion yuan, 3.469 billion yuan, 1.36 billion yuan and 1.36 billion yuan respectively. 1.493 billion yuan, accounting for 76.5%, 76.7%, 75.4%, 75.5% and 71.5% of the total revenue of Huafang Group in the same period.

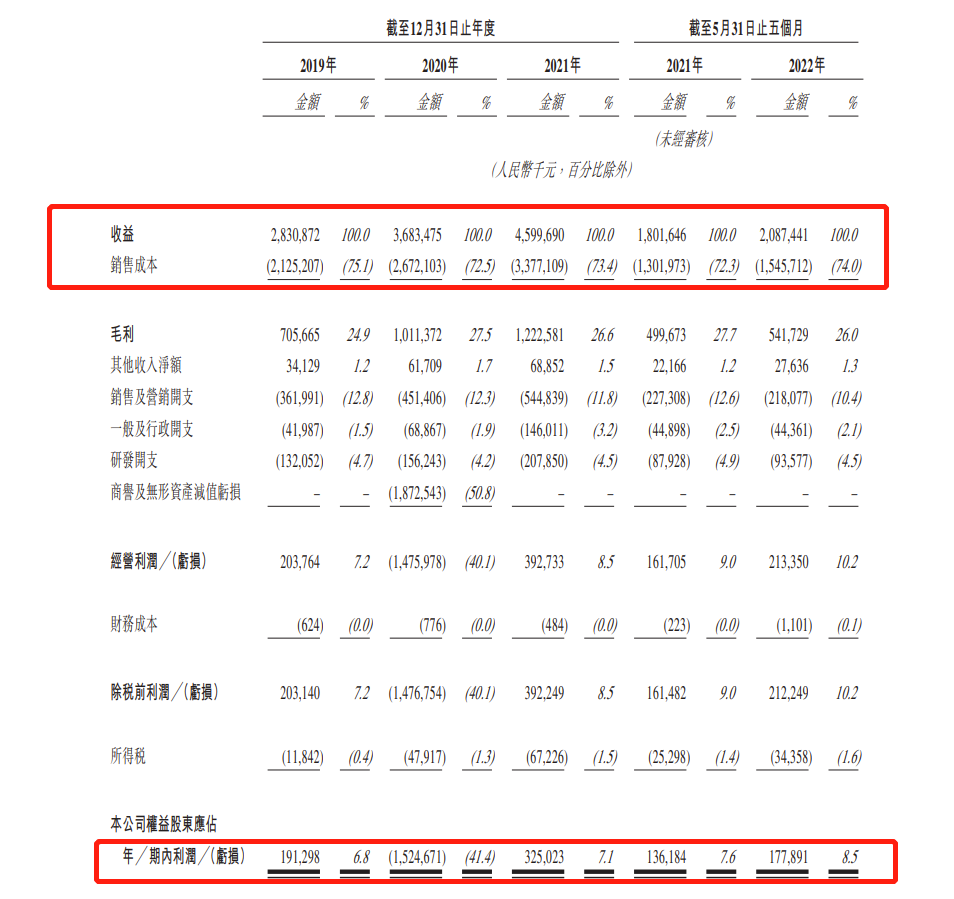

In terms of financial data, in 2019, 2020, 2021 and the five months ending May 31, 2021 and 2022, the revenue of Huafang Group will be 2.831 billion yuan, 3.684 billion yuan, 4.6 billion yuan, 1.802 billion yuan and 2.087 billion yuan respectively. In 2019, 2020, 2021 and the five months ending May 31, 2021 and 2022, the gross profit of Huafang Group will be 706 million yuan, 1.011 billion yuan, 1.223 billion yuan, 500 million yuan and 542 million yuan respectively. 100 million yuan, net profit was 191 million yuan, -1.525 billion yuan, 325 million yuan, 136 million yuan and 178 million yuan respectively.

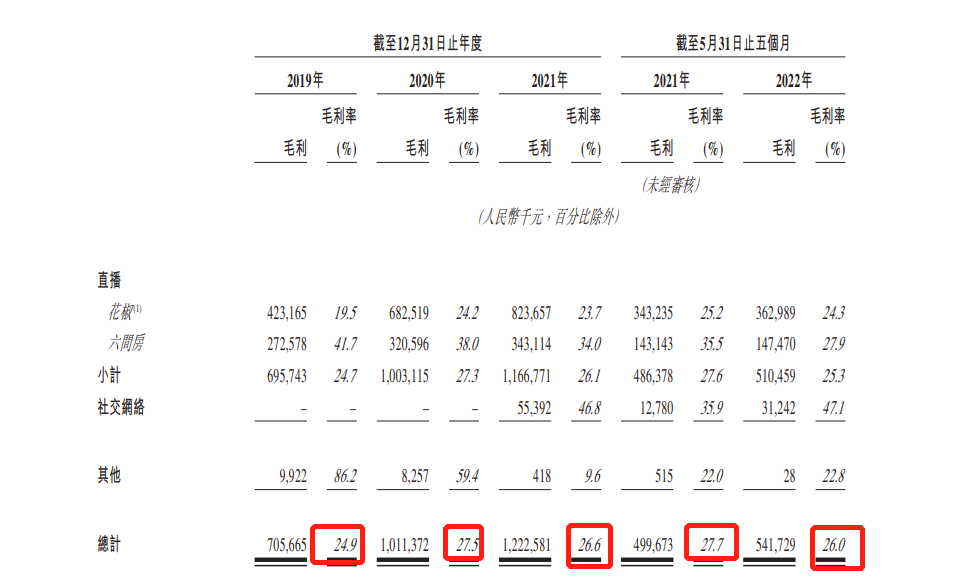

In terms of gross profit rate, from 2019 to 2021, the gross profit rate of Huafang Group was 24.9%, 27.5%, and 26.6% respectively. The gross profit rate in the first five months of this year was 26.0%, compared with 27.7% in the same period last year.

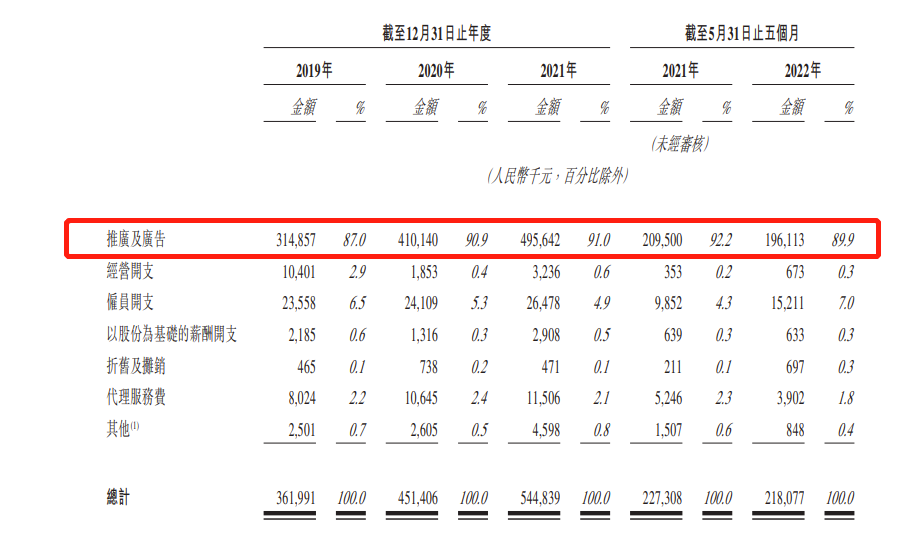

In terms of sales and marketing expenses, in 2019, 2020, 2021 and the five months ended May 31, 2021 and 2022, promotion and advertising expenses will be RMB 315 million, RMB 410 million and RMB 496 million, respectively , RMB 209.5 million and RMB 196.1 million.

In terms of equity, as of the latest practicable date, Zhou Hong