Wuhan Huakang Century Medical Co., Ltd. (abbreviation: “Huakang Medical”, stock code: “Securities Code: 301235”) was listed on the GEM of the Shenzhen Stock Exchange today.

Huakang Medical issued 26.4 million shares this time at an issue price of 39.30 yuan and raised 1.038 billion yuan.

The opening price of Huakang Medical was 50 yuan, up 27% from the issue price; the closing price was 46.62 yuan, up 18.63% from the issue price; based on the closing price, the market value of Huakang Medical was 4.923 billion yuan.

“Starting a business is difficult, but it’s worth it! We have created a safe and comfortable environment for medical care, improved doctors’ work efficiency, reduced patient pain, and escorted lives, which is very valuable.” Tan Pingtao, chairman of Huakang Medical, said that the company will Further enhance corporate responsibility and social responsibility, and support and help more people in need.

Huakang Medical is the first company in Hubei Province in 2022, the 54th company in Optics Valley, and the 92nd listed company in Wuhan City.

Huakang Medical is a high-tech enterprise growing locally in Optics Valley. It is mainly engaged in comprehensive services of modern medical purification systems, building operating rooms, various intensive care units, bone marrow transplant blood wards, reproductive medicine centers, negative pressure wards, etc. for various hospitals. The special department has successively served well-known tertiary hospitals inside and outside the province such as Wuhan Union Medical College Hospital. When the epidemic broke out in 2020, it rushed to the Huoshenshan Hospital to contribute to the fight against the epidemic.

During the reporting period, Huakang Medical’s main service targets include Wuhan Huoshenshan Hospital, Union Hospital Affiliated to Tongji Medical College of Huazhong University of Science and Technology, Hubei Provincial People’s Hospital, Central South Hospital of Wuhan University, Zhanjiang Central Hospital of Guangdong Province, and the First Affiliated Hospital of Anhui Medical University. , Southern Hospital of Guangdong Southern Medical University, etc.

According to the prospectus, Huakang Medical’s revenue in 2018, 2019, and 2020 was 427 million yuan, 600 million yuan, and 762 million yuan, respectively; the net profit was 29.72 million yuan, 58.687 million yuan, and 52.6 million yuan, respectively.

Huakang Medical’s revenue in the first half of 2021 was 300 million yuan, with a net profit of 7.83 million yuan and a net profit of 6.92 million yuan after deduction.

Huakang Medical’s revenue in the first nine months of 2021 was 500 million, an increase of 27.3% from 395 million in the same period last year; operating profit was 39.05 million, compared with 3.32 million in the same period last year; net profit after deduction was 32.49 million, compared with 674,400 in the same period last year Yuan.

Huakang Medical expects operating income in 2021 to be 959 million to 1 billion yuan, and net profit attributable to shareholders of the parent company to be 73 million to 82 million.

Fosun Investment and Sunshine Life are shareholders

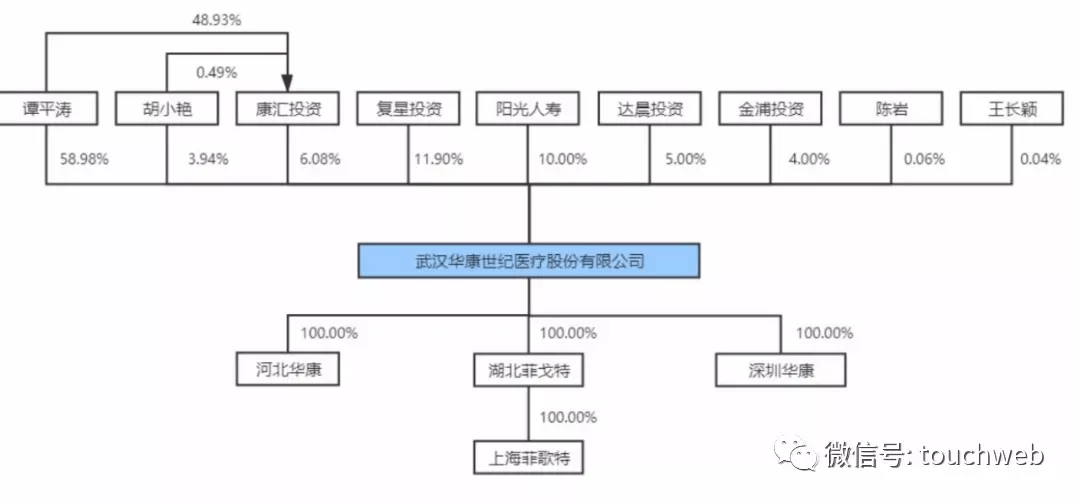

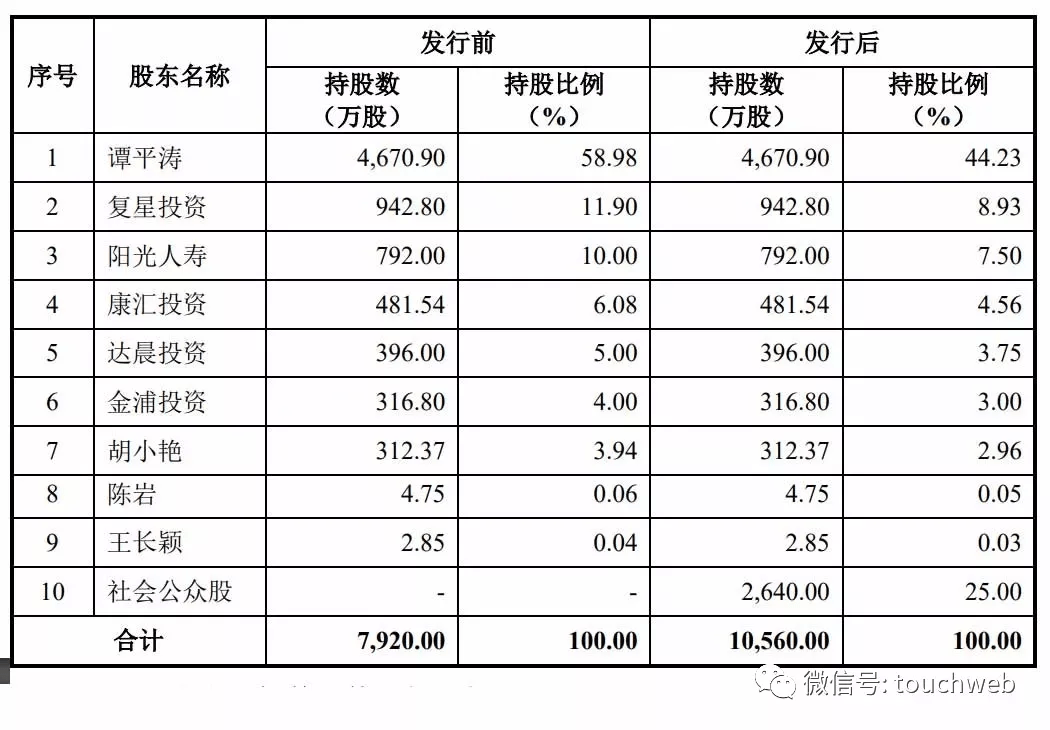

Tan Pingtao directly holds 46.709 million shares of Huakang Medical, accounting for 58.98% of the total shares of Huakang Medical, and is the controlling shareholder of Huakang Medical; Tan Pingtao’s spouse Hu Xiaoyan directly holds 3.1237 million shares of Huakang Medical, accounting for Huakang Medical’s shares 3.94% of the total;

At the same time, Tan Pingtao holds 48.93% of the property share of Kanghui Investment, an employee shareholding platform, and Hu Xiaoyan holds 0.49% of the property share of Kanghui Investment and serves as the executive partner of Kanghui Investment. Tan Pingtao and Hu Xiaoyan indirectly control Huakang through Kanghui Investment. 4,815,400 medical shares, accounting for 6.08% of the total share capital of Huakang Medical.

Tan Pingtao and his spouse control a total of 54.6481 million shares of Huakang Medical, accounting for 69.00% of the total shares of Huakang Medical. Tan Pingtao and Hu Xiaoyan are the actual controllers of Huakang Medical.

Ms. Hu Xiaoyan, born in September 1975, has a high school education. From July 1994 to September 2008, he did business independently; in October 2008, he founded Huakang Co., Ltd., and from October 2015 to July 2017, he served as a director of Huakang Co., Ltd.; in July 2017, he resigned as a director of Huakang Co., Ltd. and served in Huakang Century General Manager Office, concurrently serving as the executive partner of Wuhan Kanghui Investment Management Center (Limited Partnership).

In addition, Fosun Investment holds 11.9%, Sunshine Life holds 10%, Dachen Investment holds 5%, and Gimpo Investment holds 4%.

After the IPO, Tan Pingtao directly held 44.23% of the shares, Fosun Investment held 8.93% of the shares, Sunshine Life held 7.5% of the shares, Kanghui Investment held 4.56% of the shares, Dachen Investment held 3.75% of the shares, and Jinpu Investment held the shares. 3%, Hu Xiaoyan holds 2.96%.

———————————————

Lei Di was founded by senior media person Lei Jianping. If you reprint, please indicate the source.

Wuhan Huakang Century Medical Co., Ltd. (abbreviation: “Huakang Medical”, stock code: “Securities Code: 301235”) was listed on the GEM of the Shenzhen Stock Exchange today.Return to Sohu, see more