Core point of view

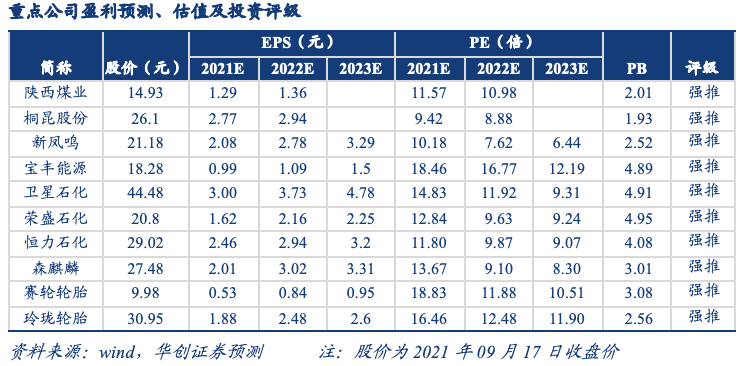

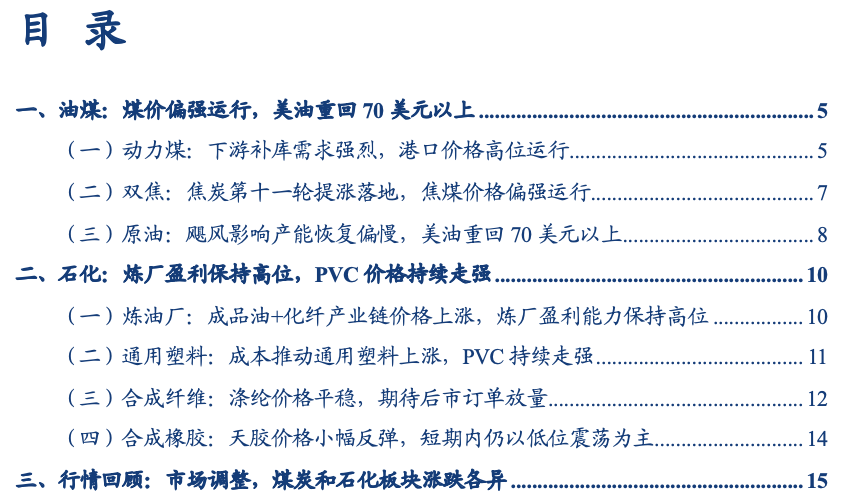

Thermal coal: The demand for replenishment is strong, and the port coal price is operating at a high level.This week, port coal rose by 280 to 1,480 yuan/ton. After the peak of summer coal consumption, downstream replenishment demand strongly pushed coal prices to continue to rise. In the short term, with the marginal increase of the supply side in Shaanxi and Inner Mongolia, the demand side is steadily falling on the basis of daily consumption. The largest gap in the supply and demand of coal may have passed. In the short term, it will still maintain a strong operating state under high replenishment demand.

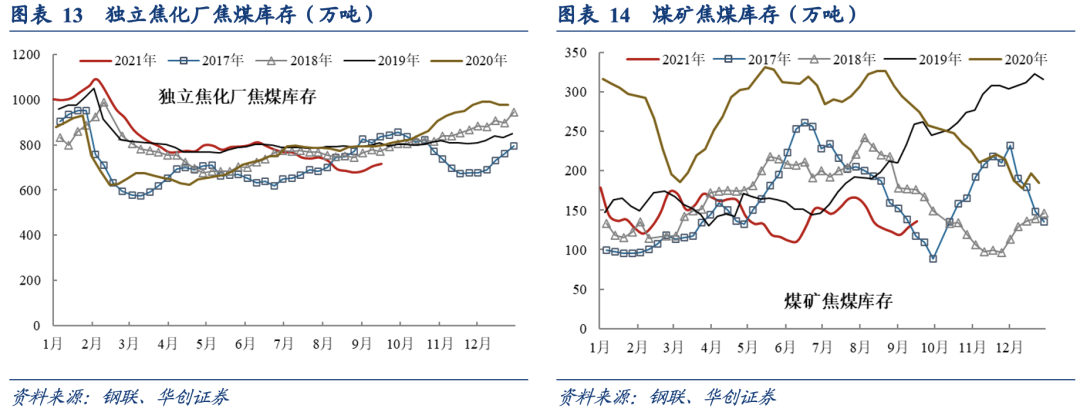

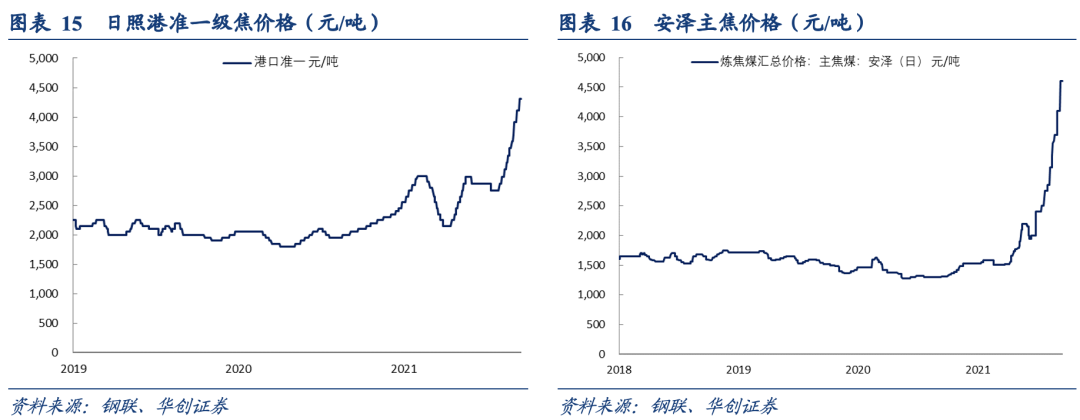

Double coke: The eleventh round of coke rises to the ground, and the coking coal is on the strong side.Coke continued to rise by 200 yuan/ton this week, and the first ten rounds rose by 1560 yuan/ton. The demand side of coke is facing pressure on crude steel production prices, and the supply side Shandong maintains a relatively strong production limit. It is expected that coke will operate strongly under the support of low inventory + cost. The domestic supply of coking coal is tight, and Anze’s main coke has risen to 4,600 yuan/ton. In the short term, it is difficult to change the tight supply of coking coal. However, there are expectations for increase in Mongolian coal in the future.

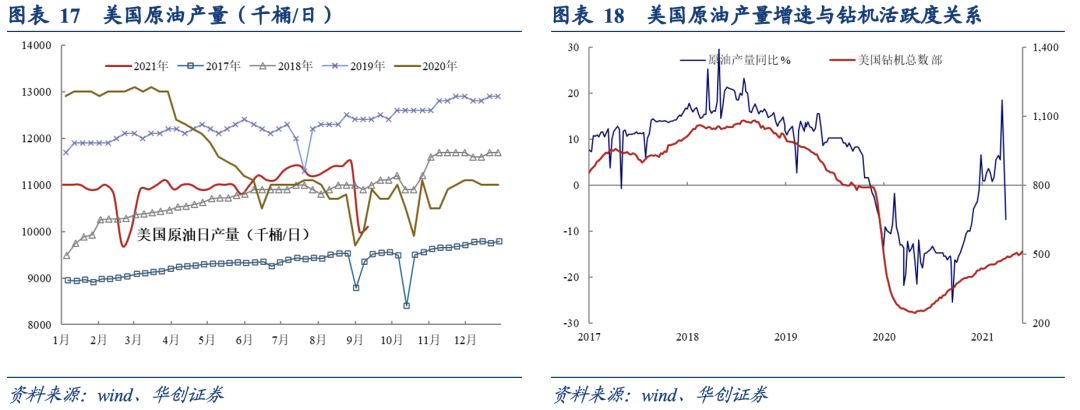

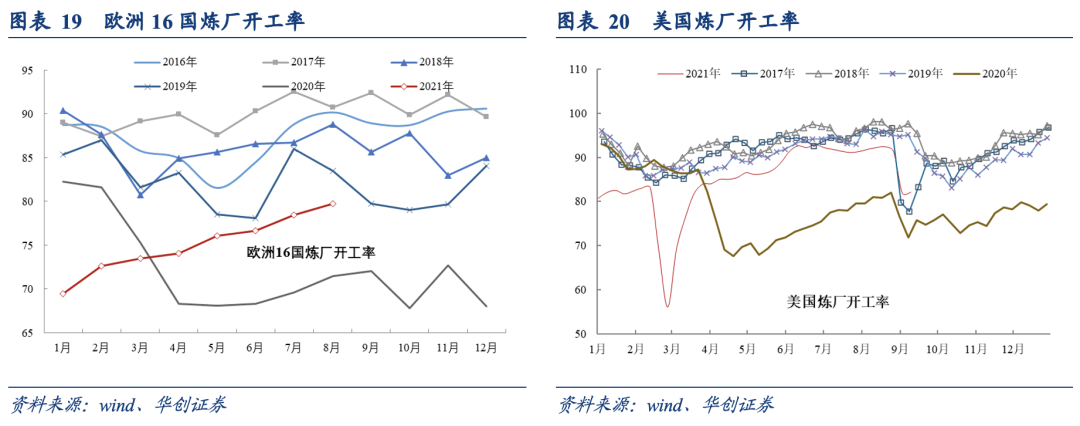

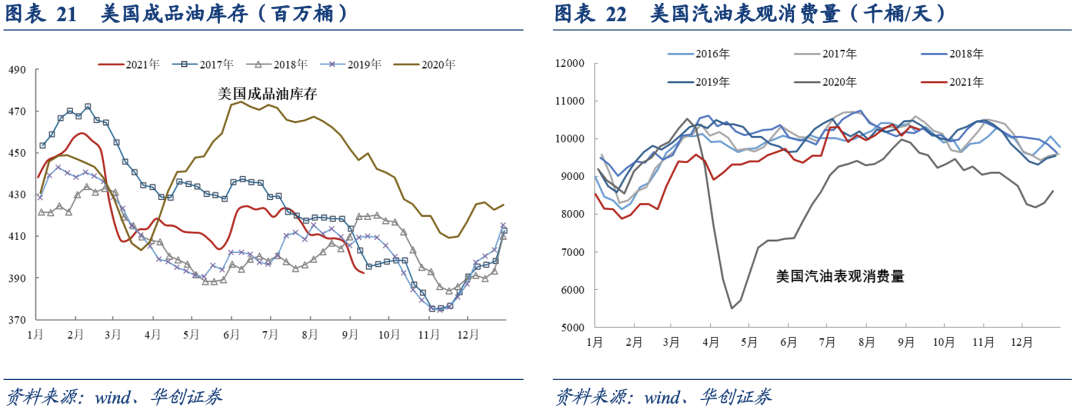

Crude oil: The hurricane affected the slow recovery of production capacity, and U.S. oil returned to more than US$70.After the hurricane passed, the recovery of US crude oil production was slow, and US crude oil production increased by only 100,000 barrels from the previous month. In the week of September 10, EIA crude oil inventories fell by 6.422 million barrels to 417 million barrels, the lowest level since September 2019. Crude oil is expected to continue to fluctuate in the short term.

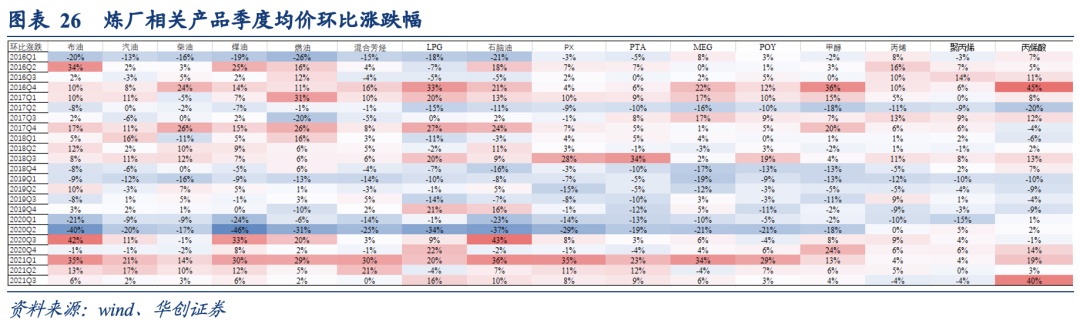

Refinery & Plastics: The profitability of refineries remains high, and the cost boosts the price of plastics.Q3 2021gasoline、diesel fuelAnd coalOil priceThe grid ratio rose by 2%, 3% and 6%, and the refinery was inRefined oilPrices rebounded and the aromatics chain supported huge profits. In terms of general plastics, PP and PE increased by 4% and 1% respectively from the previous month, and rising coal prices and crude oil prices boosted prices. The price increase of calcium carbide slowed down, and PVC fluctuated upwards under the limited supply + strong marginal demand.

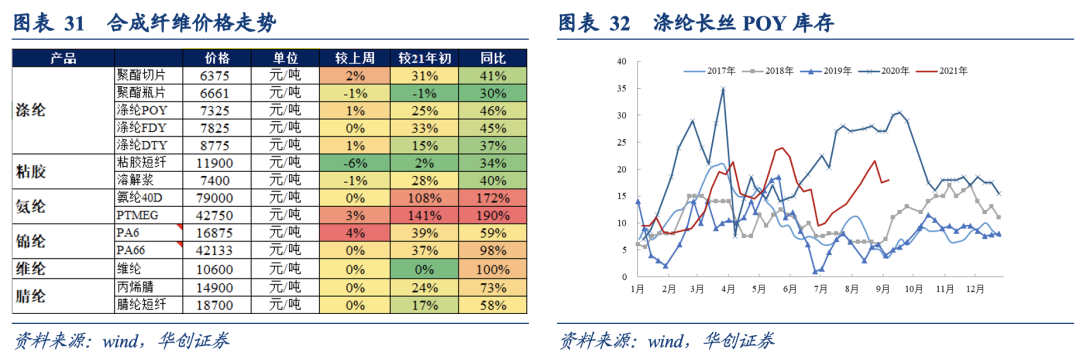

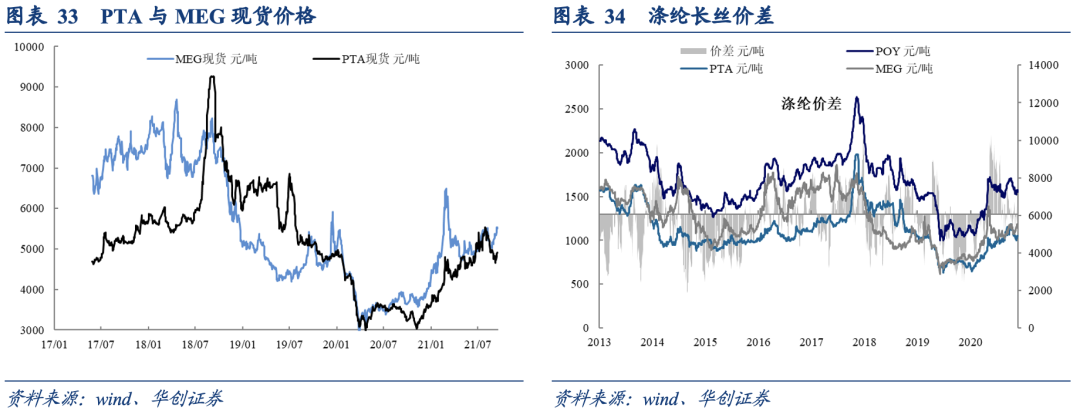

Chemical fiber & rubber: Polyester sales promotion is well received, and natural rubber shocks to find the bottom.This week, polyester POY, FDY and DTY continued to fall by RMB 50, 75, and RMB 50/ton from the previous month under the support of cost. The increase in MEG and PTA prices helped the price of filament rebound. The price of filament is expected to stabilize under the support of cost + marginal growth in demand. Rebound. The price of natural rubber stabilized and rebounded, rising by 400 yuan/ton from the previous month. Domestic tire factory operating rate increased from the previous month. However, the Federation of Passenger Vehicles expects the car sales in September to be 1.580 million, a year-on-year decrease of 17.4%. The second half of the year is still under pressure from a decline in sales. It is expected that natural rubber will continue to fluctuate mainly at a low level in the short term.

Investment Advice:We expect that the main line of cyclical products in the second half of this year will revolve around supply constraints, and the prosperity of related categories is expected to exceed expectations. The varieties that were impacted by ocean freight in the early stage are expected to enter a fundamental turning point at the end of the year.Petrochemical sector continues to push polyester filamentTongkun shares、Xin Fengming; The olefin track continues to pushBaofeng EnergywithSatellite Petrochemical; Refinery track forced pushRongsheng Petrochemical+Hengli Petrochemical;Recommended rubber products trackMori Kirin、Race wheel tireswithLinglong Tire。

risk warning:Demand fell short of expectations, and the progress of production capacity deployment fell short of expectations.

1. Oil and coal:Coal prices are on the strong side, U.S. oil returns to more than 70 US dollars

(1) Thermal coal: Strong demand for downstream replenishment and high port prices

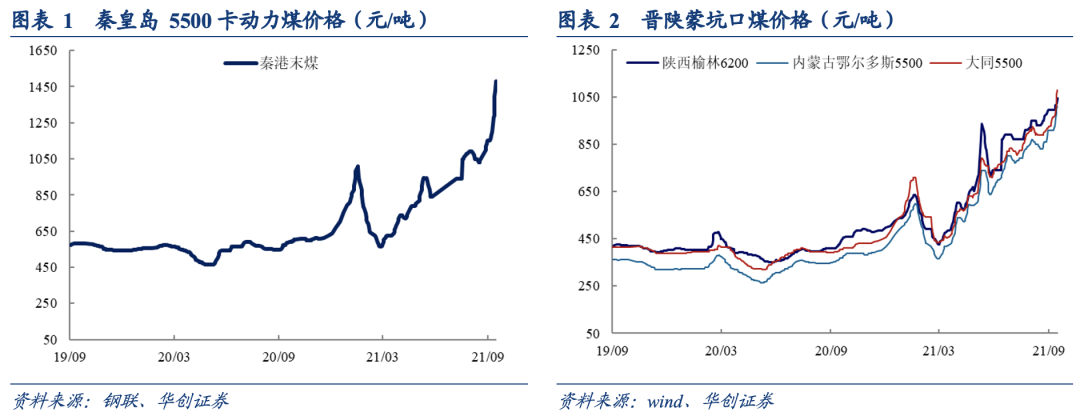

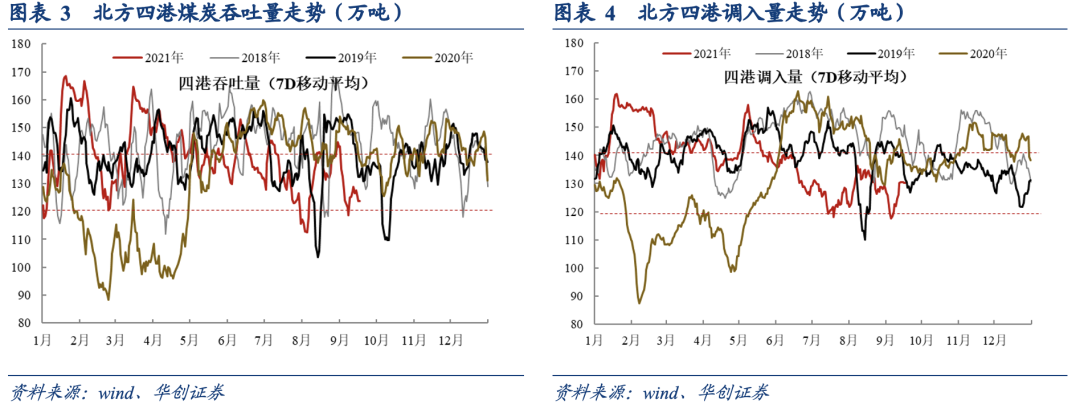

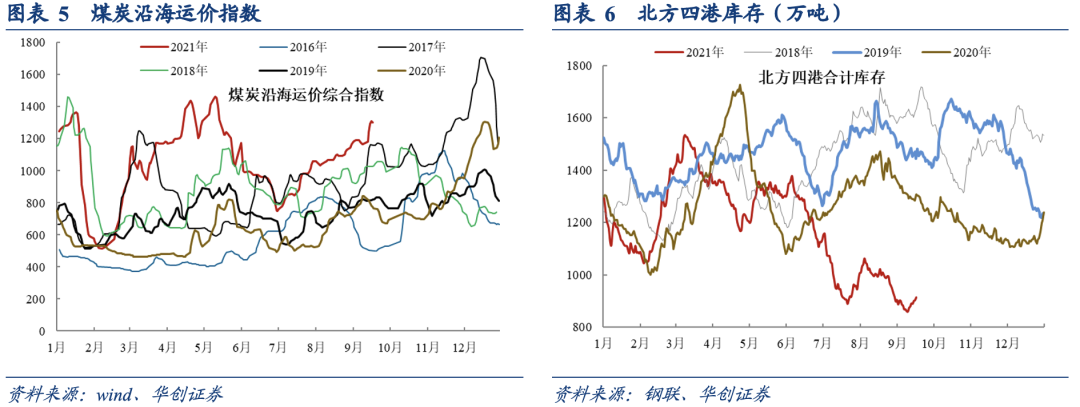

At the end of this week, Qingang coal rose by 280 yuan to 1480 yuan/ton. Under the background of low inventory in the whole market, the demand for coal preparation by downstream power plants increased. In September, when the daily consumption of electricity coal decreased, the peak coal demand remained strong. Regarding pit coal,OrdoswithDatongThe price of 5,500-carriage coal increased by 100 and 115 yuan/ton from the previous month. The price difference between the port and the pithead widened to more than 400. After deducting the freight, there was still a profit of about 200 yuan/ton. There is continued upward momentum. From the perspective of transportation capacity, according to the Taiyuan Railway Bureau, the autumn centralized overhaul of the Daqin Line will be carried out during the National Day and is expected to end on October 25. Under normal operation, the Daqin line can maintain an average daily shipping volume of about 1.25 million tons, and it may drop to around 1 million degrees during the maintenance period.Insufficient capacity during the overhaul period will result in insufficient motor transport. In the near futureOrdosThe freight rate from He Shenmu to the port has risen to varying degrees. In terms of imported coal, the weekly shipping volume of more than 3 million tons is still maintained. Imported coal has risen sharply in the context of increasing overseas demand. The CFR price of 4,500 cards has exceeded 1,000 yuan/ton, and it is difficult to form an effective increase in the short term.

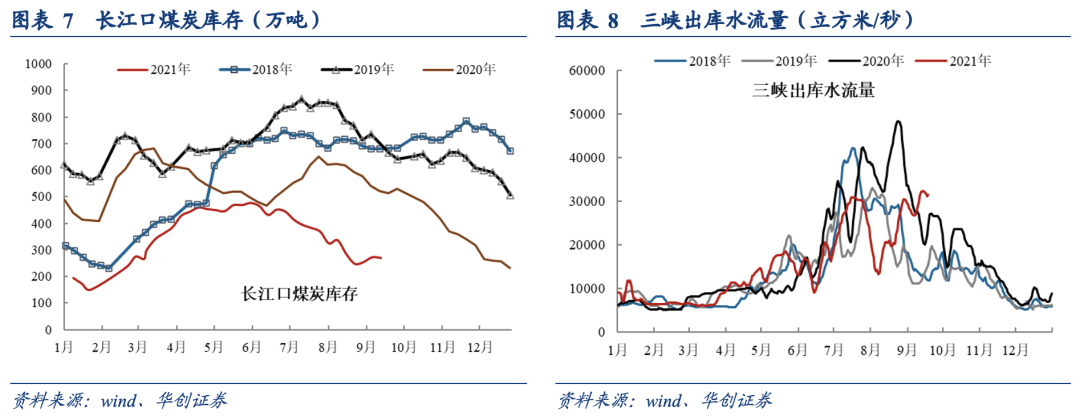

In terms of inventory, the four northern ports’ inventory increased by 410,000 tons from the previous month, and the destocking trend showed an inflection point. On the basis of the steady increase in production areas, Beigang’s inventory was effectively replenished. The coal inventory in the Yangtze River Estuary fell by 30,000 tons from the previous month, but it is expected to continue to increase in the context of Beigang’s continuous increase in shipping and a weaker downstream daily consumption margin.This week the National Development and Reform Commission issued a document requesting that power and heating companies and coal companies have signed a medium- and long-termcontractOn this basis, another batch of medium and long-term contracts will be signed to increase the proportion of medium and long-term contracts for power generation and heating enterprises to 100% of the annual coal consumption. From a mid- to long-term perspective, this will further protect the coal sources of power plants and help stabilize the volatility of coal prices in the market.

The daily consumption has dropped significantly. The daily consumption of the eight coastal provinces has dropped by about 200,000 tons from the previous month, and this week has dropped to around 1.9 million tons. From the perspective of demand, on the one hand, with seasonal factors steadily falling, on the other hand, Jiangsu, Guangdong, and Yunnan have carried out energy consumption dual control work. For soda ash, phosphorous chemical industry, petrochemical, chemical fiber and other industries, there are varying degrees of energy consumption. Limiting production is also a strong constraint on the power demand side. In terms of hydropower, precipitation in Southwest and Central China has increased, and the outflow from the Three Gorges Reservoir is higher than the same period in recent years. Hydropower is expected to supplement the strong demand for electricity. In the short term, with the marginal increase of the supply side in Shaanxi and Inner Mongolia, the demand side is steadily falling on the basis of daily consumption. The largest gap in the supply and demand of coal may have passed. In the short term, it will still maintain a strong operating state under high replenishment demand.

(2) Double coke: the eleventh round of coke rises to the ground, and the price of coking coal is on the strong side

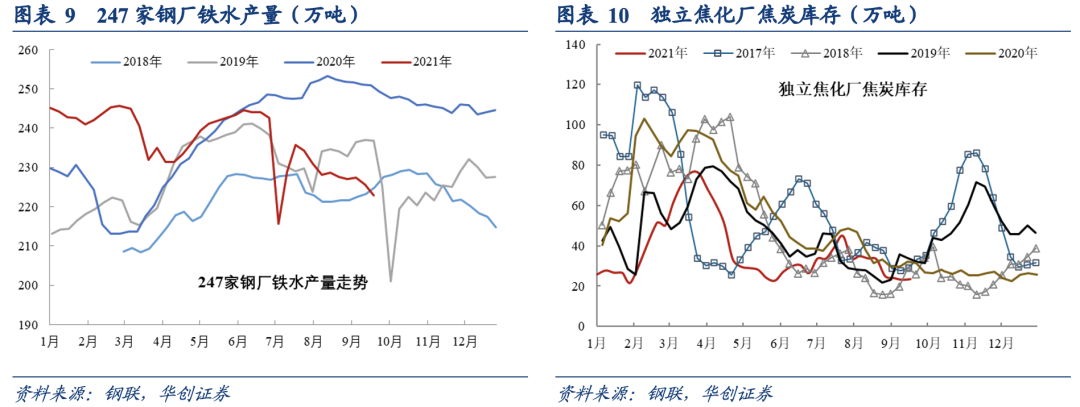

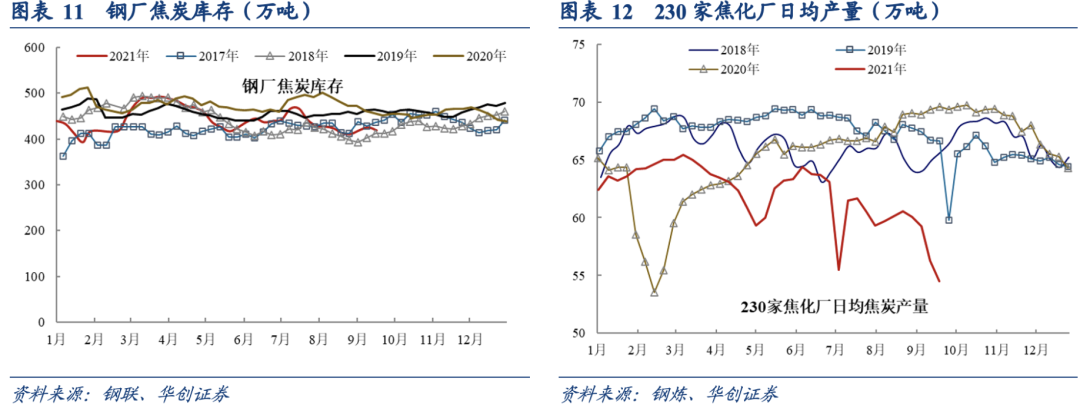

This week, the eleventh round of Coke’s increase of 200 yuan/ton was fully implemented, and the cumulative price increase was 1,560 yuan/ton. Shandong Port’s quasi-first-class coke price is 4310 yuan/ton, and Shanxi Zhunyi’s price is 4060-4200 yuan/ton. In terms of supply, environmental protection restrictions and coking coal inventory problems in Shanxi, Shandong, and Jiangsu have caused the operating rate of sample coking plants to decline by 1.6 percentage points from the previous month. The inventory of coking plants is low, and coke supply pressure still exists in the short term. On the demand side, crude steel production reduction policies have been introduced successively. Jiangsu Province has clarified the production reduction arrangements of various steel mills this week. The production reduction period will start from this week until mid-October. The normal level will be reduced by 2.3-2.4 million tons. From January to August this year, my country’s crude steel output was 730 million tons, an increase of about 37 million tons year-on-year. Assuming that the crude steel output during the year is flat month-on-month, my country’s crude steel output ceiling for September-December is 320 million tons, which is an average of 80 million tons per month, which is about 11.6 million tons lower than the average monthly output from January to August. With the successive introduction of plans to reduce crude steel production in various provinces, the demand for coke is facing a marginal impact in the short term. At present, the profit level of steel mills is rising steadily, and there is still a certain degree of tolerance for upstream price increases. The demand for coke is under pressure, and Shandong on the supply side has also begun to restrict coking production. It is expected that coke will operate strongly under the support of low inventory + cost.

The supply of coking coal was tight this week. The main coking coal and fat coal in Shanxi were raised by RMB 200-450/ton. The price of Anze main coking coal was quoted at RMB 4,600/ton this week, and the price of a single ton of coking coal exceeded the quotation of quasi-level 1 coking coal. In the context of continuous record highs of coking coal prices, coking plants can transmit cost-side pressure through price increases, but in the context of downstream steel production facing depressed, the continued upward momentum has weakened. This week, the coking coal schools in Linfen, Shanxi increased, and the local coal mines with higher prices for coking coal received a decline in new orders. The start of domestic coking coal mines was flat month-on-month, and the increase in coking coal was mainly from Mongolian coal imports. Mongolia plans to put the Gashunsuhaitu port into operation at the end of September. According to the plan, the container freight station of this aircraft can work 24 hours a day, and the annual export capacity can be Up to 8 million tons. In addition, China and Mongolia are discussing the process of optimizing the original ports, with a view to forming an increase in the fourth quarter. In the short term, it is difficult to change the tight supply of coking coal, but there are expectations for an increase in Mongolian coal in the future.

(3) Crude oil: The hurricane affected the slow recovery of production capacity, and U.S. oil returned to over US$70

Crude oil fluctuated upward this week, WTI crude oil rose 3.21%, Brent crude oilMain forceThe futures contract rose 3.5%, and U.S. oil and cloth oil closed at 71.96 and 75.49 US dollars per barrel respectively, returning to more than 70 US dollars. The impact of the hurricane at the beginning of this month on the U.S. Gulf region has not dissipated. As of this Thursday, about 28% of U.S. Gulf of Mexico crude oil production is still closed. As of the week of September 10, crude oil production in the continental United States was 10.1 million barrels per day, an increase of only 100,000 barrels from the previous month. The decline in US crude oil production has significantly supported international oil prices. In terms of demand, we see that the Delta mutant virus has not had much impact on the demand in the United States and Europe. The operating rates of refineries in 16 European countries were 76.68%, 78.43% and 79.72% from June to August, respectively, which continued to rise from the previous month. The U.S. refinery operating rate remained above 91% before Hurricane Ida, and the continuous repair on the demand side has significantly supported international crude oil demand.

On the data side, EIA crude oil inventories fell by 6.422 million barrels to 417 million barrels in the week ending September 10, the lowest level since September 2019; US gasoline inventories fell by 1.857 million barrels, which is expected to decrease by 1.957 million barrels. In the short term, the demand side of the crude oil market has recovered well, and the supply side has stabilized its increment. It is expected that in the short term, strong shocks will prevail.

2. Petrochemical:Refinery profits remain high, PVC prices continue to rise

(1) Refinery: The price of refined oil + chemical fiber industry chain has risen, and the profitability of the refinery remains high

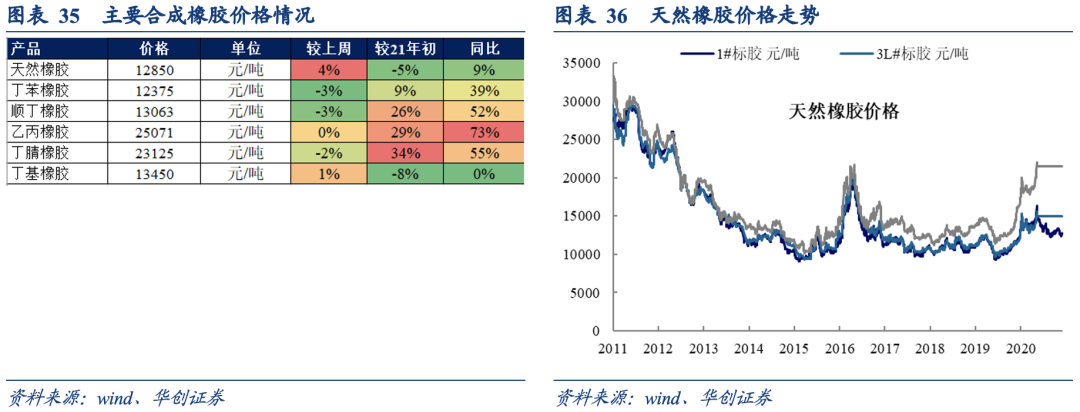

On the quarterly basis, the average prices of crude oil and refined oil products in 2021 Q3 denominated in RMB will continue to rise, and the prices of gasoline, diesel and kerosene will increase by 2%, 3% and 6% month-on-month; benefiting from the rebound of chemical fiber, chemicals downstream The ring-to-ring ratio of aromatics continued to pick up, with the average prices of naphtha and PX Q3 rising by 10% and 8%, respectively, and PTA and MEG rising by 9% and 6% from the previous month. In Q3, crude oil prices rose by 6% month-on-month, refined oil prices rebounded + chemical fiber industry boom + olefin prices rebounded. Due to the continued upward pressure on the cost side, refinery profitability remained high and stable.

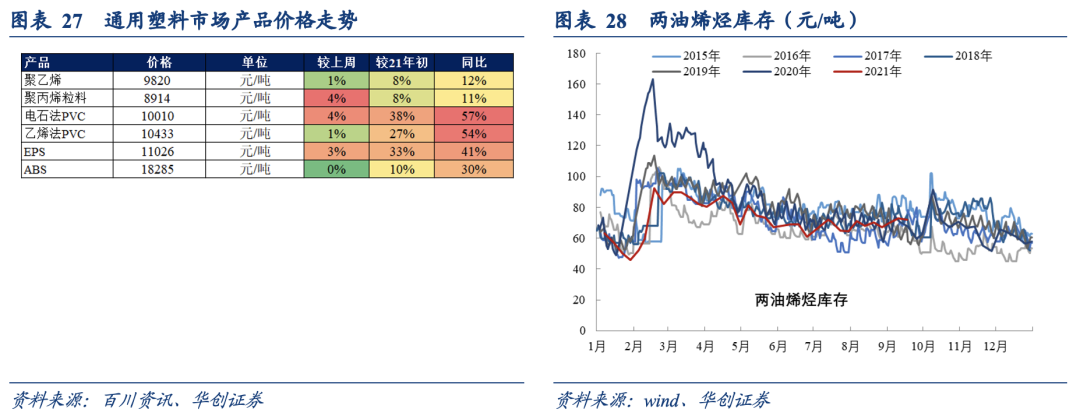

(2) General-purpose plastics: Costs drive general-purpose plastics to rise, and PVC continues to strengthen

There are five main categories of general plastics: PP/PE/PVC/EPS/ABS, according to the statistics of polypropylene pellets, polyethylene, polyvinyl chloride (unpasted), styrene and ABS. The total output in 2020 is 78.78 million tons, of which Polypropylene pellets are 32%, polyethylene 25%, polyvinyl chloride 26%, styrene 12%, ABS 5%, and the domestic self-sufficiency rate is 80%, 52%, 98%, 78% and 68%. According to the production situation of domestic general-purpose plastics, the imports are mainly high-end brands or products with special performance.

From an annual scale, the plastics boom will be suppressed by the supply side compared to other tracks. According to our statistics, it is estimated that in 2020 and 2021, the new capacity of polyethylene will be 3.7 and 4.9 million tons, and that of polypropylene will increase by 4.1 and 7 million tons. The annual growth rate is close to 20%. It shows a trend of rising self-sufficiency rate, and polypropylene, which has a relatively low degree of import dependence, will be relatively loose. PVC is expected to have 1.6 million and 1.7 million tons of new production capacity in 2020 and 2021. The annual compound growth rate of production capacity is 6.5%, which is slightly higher than the 5-year demand growth center of 5.2%. As of January 2021, the capacity utilization rate has reached 90%. The overall supply-demand relationship is relatively healthy. Styrene capacity to be put into operation is close to 3.5 million tons, and the growth rate of capacity in 2021 is also expected to exceed 20%, and the relationship between supply and demand is expected to gradually ease.

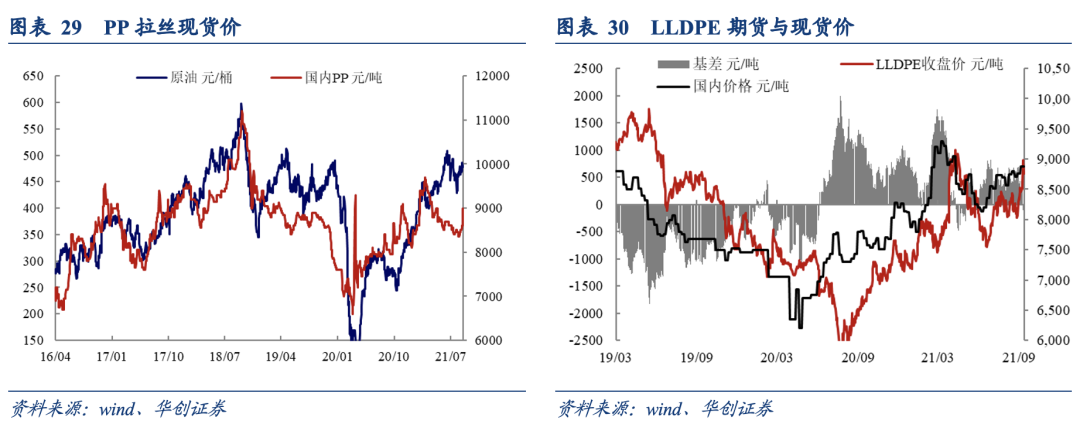

General Plastics rose slightly this week, with polyethylene and polypropylene pellets up 1% and 4% month-on-month, respectively. Petrochemical inventories fell by 10,000 tons from the previous month, and the overall inventory was at a relatively high level in the same period in recent years. Driven by the cost side, the price of general plastics rose significantly this week, especially in the context of the port coal price rose by nearly 400 yuan/ton from the previous month, and coal-to-olefin enterprises had significant pressure on the cost side. In August, the polypropylene plant was overhauled. In August, the loss of polypropylene overhaul reached 332,000 tons, an increase of 18.54% from the previous month. In August, Lanzhou Petrochemical and Dushanzi Petrochemical Tarim Oilfield Company commissioned 1.4 million tons of equipment. Zhejiang Petrochemical and Sino-Korea Petrochemical are expected to start production, and the short-term supply will cause the increase of polypropylene to be greater than that of polyethylene. In the short term, the cost side promotes the continued strong operation of PP+PE supported by the cost of oil and coal prices, and the comparative advantages of oil-based companies are outstanding.

The supply of calcium carbide in the context of dual control of energy consumption and peak power consumption in summer is tight. This week, the arrival price of calcium carbide in the northwest region increased by 90 to 5,765 yuan/ton from the previous month, and the rate of increase began to slow down. Ningxia’s energy consumption has been illuminated with double red lights, and there are still expectations of tightening in the future. The price of calcium carbide is likely to rise but not fall, which has significant support for the price of PVC. The price of PVC has risen from 175 to 9775 yuan/ton, and the price difference of PVC processing has increased. As the country enters the peak construction season for the Golden 9th Silver 10th, and the superimposed pre-export orders have been delivered one after another, it is expected that PVC will continue to operate strongly under the background of cost support + upward demand.

(3) Synthetic fiber: The price of polyester is stable, and we look forward to heavy orders in the market outlook

Synthetic fibers mainly include five types of polyester/nylon/viscose/acrylic/spandex. The total output in 2020 is 64.87 million tons, of which polyester accounts for 83.6%, nylon accounts for 8.7%, viscose accounts for 5.7%, acrylic and spandex each Accounted for 1%. Unlike olefins, most of the synthetic fibers have no import dependence, and even more than 30% of polyester bottle flakes and viscose filaments are exported. Among the 47.74 million tons of polyester, which is the cornerstone of synthetic fibers, polyester filament accounts for 67%.

In the field of chemical fiber, the largest variety is polyester, followed by nylon and viscose. Other small varieties are acrylic and spandex. The main downstream products areTextile and Apparel.existTextile and ApparelIn the industrial chain, about 60% of the country’s demand is domestic, and 40% is used for export. Focusing on polyester filaments and looking forward to 2021, the demand growth rate is expected to fall between 4%-9%. Taking into account the recovery in demand driven by economic repair and the low base, the growth rate is expected to be close to 9%, and the industry capacity growth rate is expected to be 6 %, the supply-demand relationship of filament yarns is improving. As leading indicators, small chemical fibers such as spandex, nylon and viscose have seen large price increases.Textile and ApparelIn terms of industry, domestic retail sales in 2021H1 was 673.8 billion yuan, and exports were US$140.1 billion. Based on 2019H1, they increased by 2.7% and 13% respectively year-on-year. Among them, textile exports were US$68.6 billion, a year-on-year increase of 17% over 2019, and clothing exports were up 9% year-on-year. The sharp increase in textile exports is more driven by epidemic materials, and the demand for traditional non-epidemic materials is in the process of recovery. The increase in chemical fiber prices since the National Day in 2020 is more due to expected changes in the industrial chain and demand restoration. In the second half of 2021, the autumn and winter clothing will enter the stocking season, and the normalization of European and American demand will drive the recovery of the economy.

This Friday, the CCFEI index POY, FDY and DTY were quoted at RMB 7,350, RMB 7,650 and RMB 8,750/ton respectively, up 50, 75 and 50 RMB/ton respectively from the previous month. In terms of demand, Jiangsu Province has a clear plan for dual energy consumption control. A large number of weaving companies in Nantong have shut down a large number of air-jet and rapier looms, and some factories are restricted to 10-20% of the electricity load. The weaving operation rate in Jiangsu and Zhejiang was 67%, a decrease of 1.5 percentage points from the previous month. Some manufacturing enterprises implemented peak power rationing, and the operation rate dropped slightly. The operating rate of printing and dyeing in Jiangsu and Zhejiang was 67%, the same month-on-month. In terms of cost, ethylene glycol was affected by low port inventory, and its price rose from 165 to 5510 yuan/ton from the previous month. PTA rose from 170 to 4905 yuan/ton from the previous month under the joint production restriction of various enterprises. POY inventory remained flat month-on-month. Recently, downstream textile and apparel orders are showing signs of improvement, and some winter orders are gradually placed. In the short term, filament prices are expected to stabilize and rebound under the support of cost + marginal growth in demand.

Spandex was the same month-on-month, the price of 40D specifications remained at 79,000 yuan/ton, the price of spandex raw materials was relatively strong, the price of PTMEG was the same month-on-month, and the spread of spandex processing remained at around 45,000. The overall new production capacity of spandex will be gradually released early next year, and spandex prices are expected to continue to fluctuate in the short term.

(4) Synthetic rubber: The price of natural rubber rebounded slightly, and the short-term fluctuations were still at low levels.

Synthetic rubber has five main products: styrene butadiene rubber, butadiene rubber, ethylene propylene rubber, nitrile rubber, and butyl rubber. In 2020, the total output of the five types of synthetic rubber is 2.8 million tons, and the average capacity utilization rate is 72%. , Nitrile rubber capacity utilization rate exceeds 80%, and butyl rubber capacity utilization rate slightly exceeds 50%. In terms of output share, styrene butadiene rubber accounted for 37%, butadiene rubber accounted for 36%, ethylene propylene rubber accounted for 12%, nitrile rubber accounted for 7%, and butyl rubber accounted for 8%. As the cornerstone varieties, styrene butadiene rubber (about 70%) and butadiene rubber (about 70%), together with No. 20 rubber, are mainly used to make tires. Affected by the sluggish automobile sales, the degree of price recovery is still relatively limited.

From the perspective of demand structure, 70% of natural rubber or the main synthetic rubber styrene butadiene rubber and butadiene rubber are used in tire production. Driven by the triple bottom of tire demand (export bottom + supporting bottom + retail bottom), the relationship between supply and demand All tend to improve. As of the end of 2020, the operating rate of styrene-butadiene rubber is over 70%, the concentration of CR3 is about 40%, and the growth rate of watch demand exceeds 1%; the operating rate of butadiene rubber is 65%, and the concentration of CR3 is about 30%, and the growth rate of watch demand exceeds 14%, low concentration + low operating rate is expected to limit the upward price elasticity of rubber.

Natural rubber rose 4% this week, and the ring ratio of No. 1 standard rubber rose 500 to 12,800 yuan/ton. The August ship schedule delay is more serious, and the arrival volume is relatively small. The market expects to return to normal in October. On the supply side, the domestic production of synthetic rubber in August was 643,000 tons, a year-on-year decrease of 8.9%. China’s cumulative production of synthetic rubber from January to August was 5.215 million tons, a year-on-year increase of 2.8%. In terms of demand, the operating rate of all-steel tires this week was 59%, an increase of 17% from the previous month; the operating rate of semi-steel tires was 60.5%, an increase of 13% from the previous month, and the operating rates of semi-steel tires and all-steel tires continued to improve. The Passenger Association expects that the retail sales of passenger vehicles in the narrow sense are expected to be 1.580 million in September, a year-on-year decrease of 17.4%. The development of the auto market was affected by the insufficient supply of chips, and the uncertainty further increased during the year. The operating rate of natural rubber downstream tire plants has rebounded sharply in the short term. However, from the perspective of automobile sales, the sales volume will still be under pressure in the second half of the year.

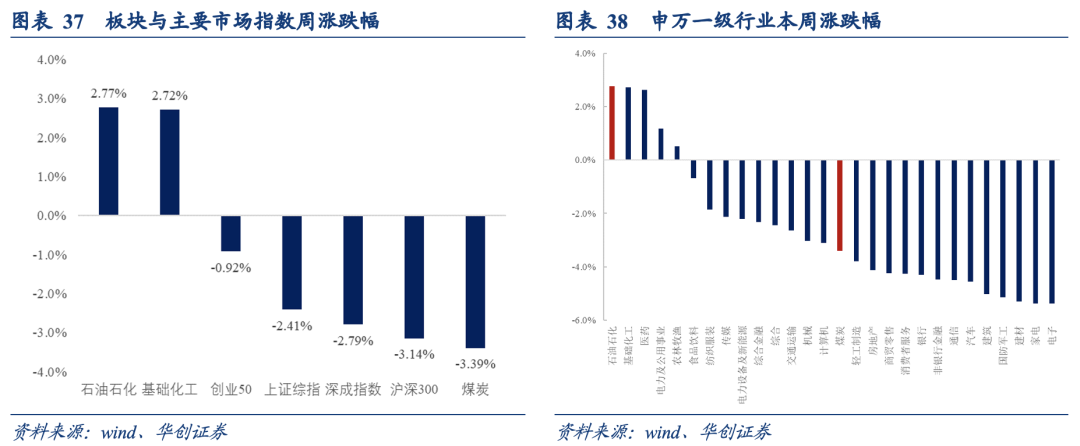

three,Market review:Market adjustment, the coal and petrochemical sectors went up and down differently

The market rose sharply this week,The Shanghai Composite IndexRose 2.41%, the Shenzhen Component Index rose 2.79%,Shanghai IndexFall back to 3600 points.In terms of sectors, the chemical sector led the gains, with pharmaceuticals, power andPublic utilitiesThe sector and the agriculture and animal husbandry sector ranked third to fifth on the list of gains. The coal rebounded with a weekly decline of 3.39; the petrochemical sector rose by 2.77%.

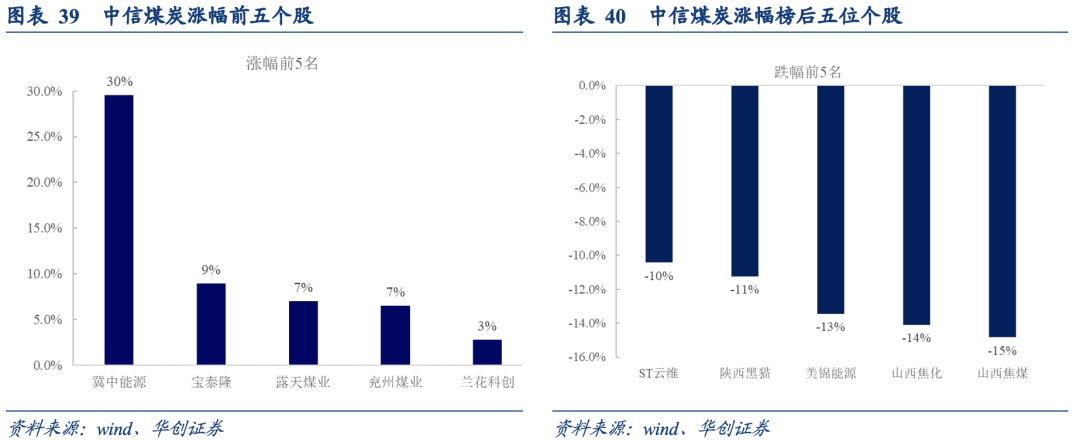

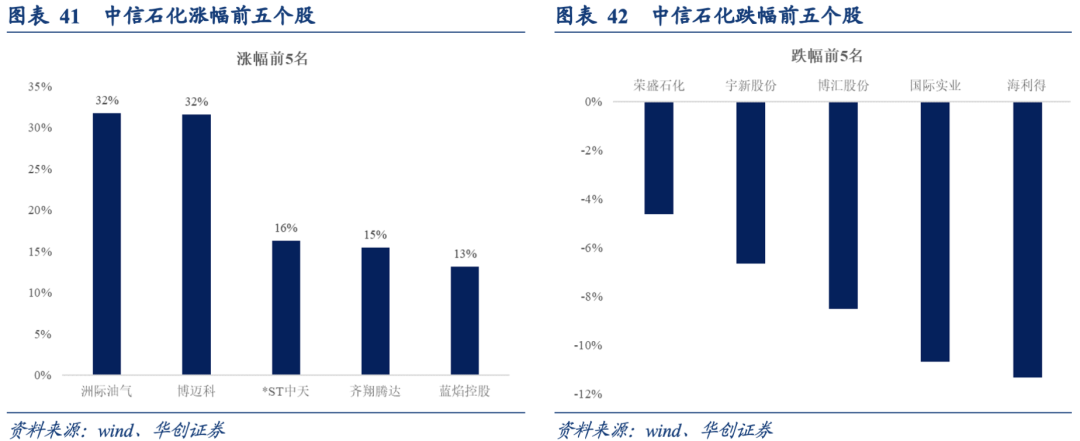

At the individual stock level, the coal sector generally rose.Jizhong EnergyIncreased by more than 30%, ranking first in the industry,Bao Tailong、Open-pit coal industry、Yanzhou Coal IndustrywithOrchid Science and TechnologyRanked 2-5 on the increase list; ST Yunwei,Shaanxi Black Cat、Meijin Energy, Shan Coking andShanxi Coking CoalRanked among the top five decliners. In terms of petrochemicals,Intercontinental Oil and GaswithBomekoIncreased by more than 30%,*ST Zhongtian、Qi Xiang TengdawithBlue Flame HoldingsBy more than 10%,Rongsheng Petrochemical、Yuxin shares、Bohui shares、International IndustrywithHalideRanked among the top five decliners.

(Source: Huachuang Energy and Chemical Industry)

.