The spin-off and listing of Wanwuyun has become a topic in the property industry. But no one thought that this time “the wolf really came”.

On the evening of November 5th, Vanke A issued an announcement stating that it intends to spin off its subsidiary Wanwu Cloud Space Technology Service Co., Ltd. (hereinafter referred to as Wanwu Cloud) to be listed on the Hong Kong Stock Exchange.

What is even more surprising is that a leading company with the most spatial imagination in the real estate industry has suddenly landed in the news of “real estate companies spin-off and listing of real estate companies”. When Yu Liang and Zhu Baoquan, Chairman of Vanke’s board of directors, discussed the topic of Wanwuyun’s listing in the past, there were mainly two core contents: one is that the cake of Wanwuyun needs to be different from other property companies, and the other is that listing is not a necessary action.

“It’s the right time to fight in partnership”-this is the sentiment issued by Zhu Baoquan, CEO of Wanwuyun after Vanke released the announcement of the spin-off and listing. From the outside world, although Wanwuyun’s spin-off and listing is expected, it is unexpected to choose to go public in such a cold winter in the real estate industry.

Image source: Photograph-500850476

“Non-essential” VS “Good Time”

As early as the end of April this year, it was reported that Vanke was preparing for an IPO of its property management business, or raising US$2 billion; Vanke planned to make its property management subsidiary listed as soon as the end of the year. Soon, Zhu Baoquan, CEO of Wanwuyun, personally refuted the rumors in the circle of friends. Wanwuyun also said that Vanke Property has no plans to go public.

Why is Wanwuyun not in demand for listing? Zhu Baoquan’s previous explanation was that the purpose of listing is to be famous, and for financing, it is for market value and market position. “To do everything cloud today has nothing to do with the listing itself. Many property companies have not done ABC rounds of financing, and have directly IPO. If I start the B round of financing today and what is the difference between listing, the core question is whether I lack Lack of money? I can be famous and raise money without going public, so going public is not a necessary action.”

As a leading real estate company that has consistently performed steadily, Vanke is naturally not “lack of money” to spin off properties for listing. “Vanke’s cash flow is not tight, and it is not ruled out that one of the possibilities for Vanke to spin off Wanwuyun is to store food for the winter in advance.” A middle-level person from a TOP10 property company told reporters. Of course, Wanwuyun’s current business structure model It has been stable and can give investors certain expectations. After entering the capital market, it is also conducive to transparent and efficient growth and better business development.

Screenshot of Vanke A announcement

Why did you choose to list on a well-recognized node?

Vanke told the “Daily Economic News” reporter that Wanwu Cloud has shown a good momentum of development in three aspects: residential services, business writing services, and urban services. Deliberation by the General Assembly.

As far as the recent capital market is concerned, whether it is in the A-share or H-share market, the performance of property companies has not been as good as before. Secondly, according to Wanwuyun’s spin-off plan, its main business scope is still a property company. The technological color that has been vigorously promoted before is not obvious. Perhaps Wanwuyun’s prospectus can surprise the outside world by then.

“It is indeed not a particularly good time to go public in the traditional sense. But Vanke has always been known as a stable rather than a speculative company. The change in property PE multiples is not the point of their concern. They pay more attention to the long-term nature of the industry. From this perspective Look, what time Wanwuyun chooses to go public mainly depends on whether he is ready for himself.” The above-mentioned TOP10 property company person continued.

An insider who is familiar with Wanwuyun said that Wanwuyun has always been preparing for listing, but the timing of listing has not been finalized.

City service provider VS property service provider

Looking back at the results, there are traces of the listing of Wanwuyun. In August of this year, Sunshine City strategically invested in Wanwu Cloud Space Technology Service Co., Ltd. with its 100% stake in Sunshine Zhibo, and acquired 4.8% of Wanwu Cloud.

This transaction is an asset swap and does not involve cash transactions. In the large-scale property mergers and acquisitions in the past year, a method that does not involve cash transactions is very rare. In particular, Sunshine City’s third-quarter report showed performance changes and the recent debt crisis.

Another node is at the Vanke business exchange meeting at the end of October this year. Compared with the growth strategy in the past 30 years, Zhu Baoquan talked about the specific development speed of Wanwuyun for the first time-Vanke’s property control growth rate is within 30%, and the growth rate of Wanwu Liangxing At 30%-60%, the growth rate of All Things Cloud City is greater than 60%, but the GROW and TECH sectors are not included.

“If it’s just a traditional property management service, I don’t think it is important to have one more listed company and one less listed company; but if we are a city service provider, I think it will become very important.” This is Yu Liang this year China Vanke’s positioning of Wanwuyun’s listing at the June shareholders’ meeting.

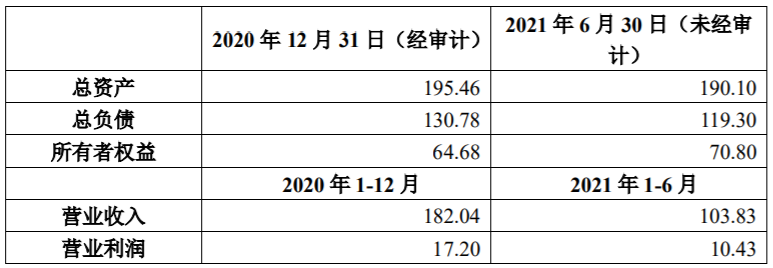

Main financial data of Wanwu Cloud in the most recent year and the first phase (100 million yuan) Data source: Vanke announcement

Has Wanwuyun, which is preparing to pass the form, has become a real “city service provider” rather than a “property service provider”?

Vanke’s 2021 semi-annual report shows that Wanwuyun achieved an operating income of 10.38 billion yuan in the first half of the year (including income from the provision of services to the Vanke Group), a year-on-year increase of 33.3%. Among them, residential property service income is 5.71 billion yuan, accounting for 55.0%; commercial property and facility services are 3.16 billion yuan, accounting for 30.4%; smart city services are 630 million yuan, accounting for 6.1%; community life service income is 560 million yuan, accounting for 5.4%; the growth income of everything is 320 million yuan, accounting for 3.1%.

Take a look at Country Garden Services, another leading property company. Its revenue in the first half of this year was 11.56 billion yuan, a year-on-year increase of about 84.3%. Among them, property management service income was about 5.17 billion yuan, accounting for about 44.7% of total revenue; community value-added service income was about 1.40 billion yuan, accounting for about 12.1%; urban services realized revenue of about 2.10 billion yuan, accounting for about 10.38%; The income of “three supply and one industry” is about 920 million yuan; the income of heating business is about 660 million yuan.

Looking at the city service sector alone, Country Garden’s service revenue is obviously higher than that of Wanwuyun. If the revenue from commercial property and facility services is added, the two sectors of Wanwuyun account for 36.5% of the total.

The two leading property companies are vigorously advancing the city service business and have set no small goals. Country Garden Services will achieve 20 billion yuan in city service revenue by 2025. And Wanwuyun proposed a very “Internet language” goal. In the future, it will focus on the concentration of 1,000 streets in 100 cities in China, of which the concentration in the area with a radius of 3 kilometers will exceed 25%.

An executive of a leading property company once told the reporter of “Daily Economic News” that in the current development of non-residential track of property companies, urban services are the most difficult.

(Original by Maggie Real Estate, if you like, please follow meikedichan on WeChat)

Cover image source: Photograph Network–500850476