If you are looking for information onETF iShares Core MSCI Worldidentified with ISIN IE00B4L5Y983 e ticker SWDA then you’re in the right place because today I’m going to analyze this fund.

If you are interested in an investment using the passive management then you’ve come to the right place because in this article we are going to analyze this ETFtrying to catch all his features, seeing his own coststhe advantages and disadvantages, and at the end of the article you will also find mine opinions about.

Enjoy the reading!

This article talks about:

A few words about the ETF

L’ETF iShares Core MSCI World it was launched in September 2009, so it’s a fairly mature fund.

The currency of the ETF is the dollar, and it is not currency hedged, so you should be aware of currency risk if you decide to invest in this fund.

Il replication method for this ETF is physical, with optimized sampling.

The fund has a very large size, equal to 38,588 million euros.

The fund is domiciled in Ireland.

The issuer of this ETF is iSharesa collection of exchange-traded funds that are managed by BlackRock, which acquired the brand and business from Barclays in 2009.

iShares is one of the asset managers with the most sustainable fund flows in 2020, with $14.5 billion as of September 2020.

Composition of the ETF

Let us now analyze the background composition.

If we focus on thegeographic exposurethe fund is made up as follows:

- USA: 68,18%;

- Japan: 6.09%;

- United Kingdom: 4.41%;

- Canada: 3.66%;

- France: 3.16%;

- Switzerland: 2.84%;

- Germania: 2,27%;

- Australia: 2,26%;

- Netherlands: 1.16%;

- Sweden: 1%;

- Other countries: 4.97%.

As regards instead thesector allocationin first place we find the information technology sector with 21.27%, followed by the financial sector with 13.76% and the health sector with 13.33%.

They then follow, in order:

- Consumer discretionary sector: 10.70%;

- Industry sector: 9.83%;

- Communication sector: 7.44%;

- FMCG sector: 7.36%;

- Energy sector: 5.35%;

- Materials sector: 4.62%;

- Utility Enterprise Sector: 3.14%;

- Real estate sector: 2.85%;

- Other sectors: 0.36%.

If we analyze the ETF even more in detail, we can see what the top 10 companies present in the portfolio:

- Apple with 4.49%;

- Microsoft with 3.58%;

- Amazon con il 2.03%;

- Alphabet Class A con l’1,27%;

- Tesla with 1.23%;

- Alphabet Class C con l’1,20%;

- Johnson&Johnson con lo 0,88%;

- Unitedhealth Group con lo 0,87%;

- Nvidia Corp with 0.86%;

- Goal with 0.83%.

Trend and returns

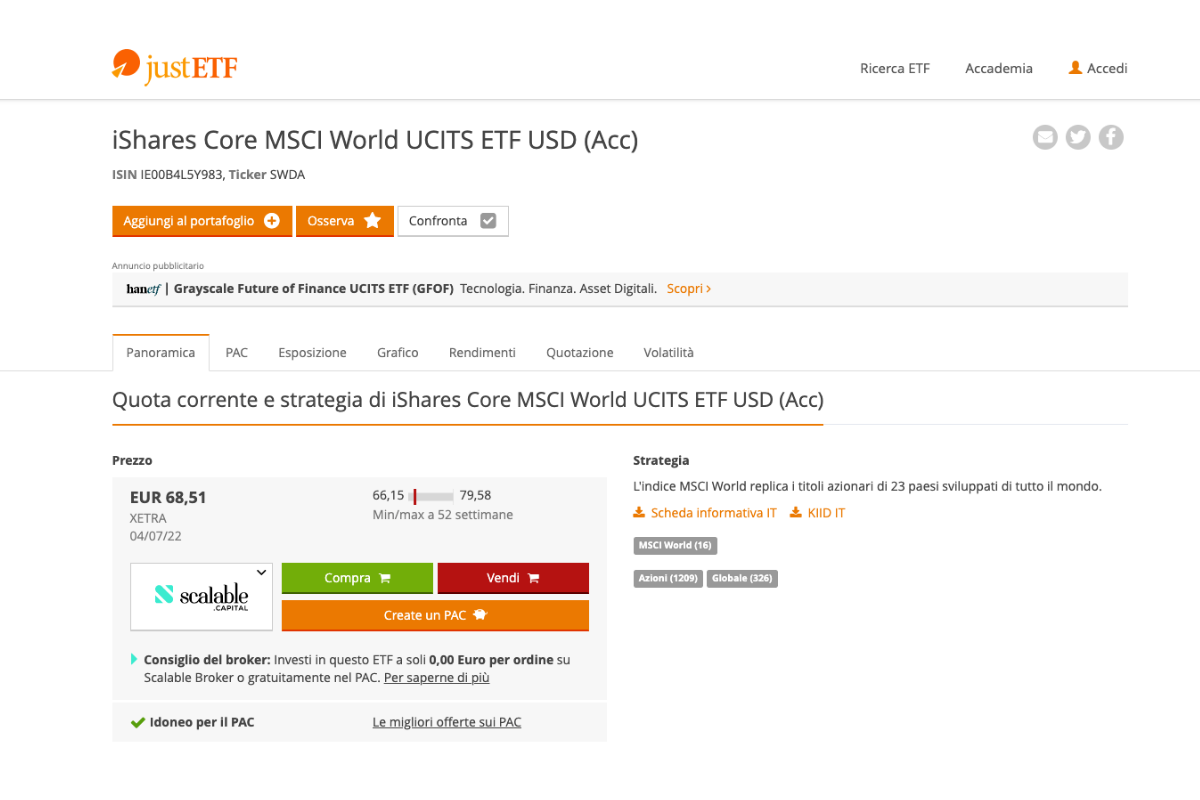

L’MSCI World index it tracks stocks from 23 developed countries from around the world.

Dal graphic we can see what the trend of the ETF is in real time.

Not sure how to invest?

Find out which investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW! <

Costs and dividend policy

I annual management costs amount to 0.20%, and the dividend policy is ad accumulationi.e. the coupons are not distributed to investors, but are reinvested in the fund itself.

How to buy

L’ETF iShares Core MSCI World is listed on Italian Stock Exchangebut not only.

The fund is in fact listed on the London Stock Exchange, the Stuttgart Stock Exchange, the Bolsa Mexicana de Valores, Euronext Amsterdam, and the SIX Swiss Exchange.

To invest in this fund and therefore make an investment in this sense, all you need is a securities account.

Here you will find the best offersso you can choose which platform is best for managing your investments.

We have come to the end of our review.

In this detailed review we have analyzed theETF seeing what it invests in, which companies are part of the fund, in which geographical areas it invests and in which sectors.

We have also seen what are the costs and the dividend policy.

I start by telling you that it is difficult to express anopinion on this fund since I don’t know your personal and financial situation.

Also, there are no gods instruments that are good for everyone, but everyone, according to their own objective, must understand and choose the one that best meets their investment needs.

If you read the KIID you will see that this ETF has a risk profile you seem to 6 on a scale of 1 to 7, so it’s a risky fund.

For this reason it is suitable for an informed investor, who is able to understand the risks associated with the investment and who is also able to bear any losses.

I can tell you that ETFs in general are an interesting tool for an investment, since they replicate a reference index and can count on relatively low management costs.

If you are looking for a guide to investing in ETFs you can start from free report we have prepared for you.

Furthermore, if you are a novice investor and want to understand how to start an informed investment journey, you can start with these resources:

Good continuation!

Find out which Investor You are

I have created a short questionnaire to help you understand what kind of investor you are. At the end, I will guide you towards the best contents selected according to your starting situation:

>> Start Now <