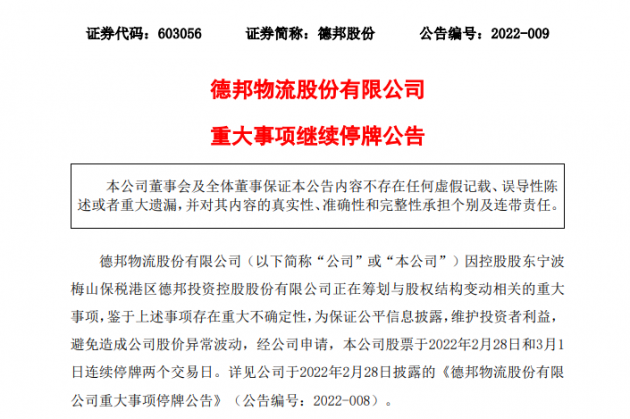

On March 2, Debon shares issued an announcement stating that during the suspension period, the parties to the transaction conducted further communication and negotiation on matters related to the change of the controlling shareholder’s shareholding structure, and the relevant transaction agreement has not been signed. The company is not expected to resume trading from the market opening on March 2 , the stock continues to be suspended, and the suspension is expected to last no more than 3 trading days.

access:

Alibaba Cloud 2022 “Cloud Procurement Season”” Hundreds of cloud products start at 0.26% off

On February 28, Debon shares announced the suspension of trading, and the Office of the Secretary of the Board of Directors said: It will be acquired. Rumored acquirers include JD.com, Yunda, Douyin, etc. However, Douyin e-commerce directly responded to the media saying that it had no plans to acquire Debon Express.

Subsequently, Xinyan Finance reported that JD.com had completed the acquisition of Debon Express. According to the screenshots in the report, Debon has officially announced the acquisition news, Cui Weixing, chairman and general manager of Debon Express, will withdraw, and JD.com will appoint a senior executive to take over. Cui Weixing made the announcement at a breakfast meeting on February 28.

In this regard, Jingdong has not responded yet, and Debon responded that everything is subject to the announcement.

The Qichacha APP shows that Cui Weixing currently holds about 4.19% of the shares directly, and has a controlling stake in Ningbo Meishan Bonded Port Area Debang Investment Holding Co., Ltd., the largest shareholder of Debon, and Cui Weixing owns 70.69% of the voting rights of the listed company. , is the actual controller; Yunda is the second largest shareholder.

Debon Express was listed on the Shanghai Stock Exchange in 2018. It is a third-party comprehensive logistics provider covering multiple businesses such as express, express, warehousing and supply chain, and cross-border. The business model of Debon Express is mainly direct, and then the business partner plan was officially launched in September 2015. As of June 30, 2021, Debon has 30,486 terminal outlets (including 7,285 direct-operated outlets, 2,668 partner outlets, and 20,533 service outlets), with a township coverage rate of 94.8%.

Debon shares released a performance forecast on the evening of January 28. It is expected that the net profit attributable to shareholders of listed companies in 2021 will be reduced by about 378 million yuan to about 491 million yuan compared with the same period of the previous year, a year-on-year decrease of 67% to 87%. %.

It is reported that as early as January this year, it was frequently reported that Debon Express would be acquired. At that time, the rumored acquirers included Jingdong, Yunda, Douyin, etc., but the news was officially denied by Debon Express at the time.