26/05/2022 12:00

Italy towards a recession in the second half of the year. After a quarter of negative GDP, the Italian economy could see another one with a minus sign as well, thus entering what is to come …

Italy towards a recession in the second half of the year. After a quarter of negative GDP, the Italian economy could see another negative one as well, thus entering what is defined by analysts as a “technical recession” in the second half of the year. This is what emerges from the conclusions of the 46th Observatory on Italian accounts from Mazziero Reasearchwhich for the whole year estimates a GDP at 2.2% only thanks to the drag effect of the growth of 2021. And so, considering the continuous increased debtwhich in March set a new record of € 2.755 billion, the target of reducing the debt / GDP ratio from 150.8% to 147.0% may not be achieved.

Italy, what evolution?

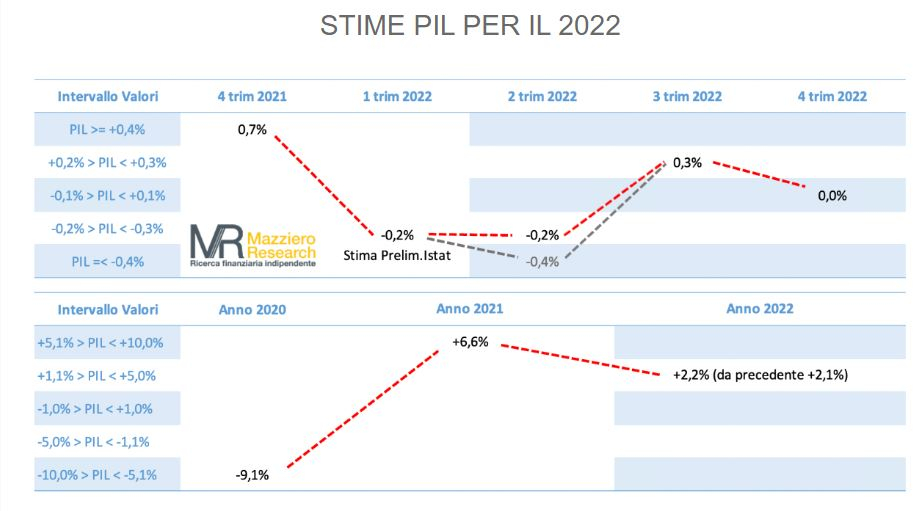

Istat’s preliminary estimate of GDP for the first quarter confirmed Mazziero Research’s forecasts for negative growth, expected at -0.2%. For the future, the forecasts saw a further sharpening of the slowdown with a -0.4%, followed by a + 0.3% and, finally, 0.0% in the last quarter. All this resulted in a growth on an annual basis of 2.1%, positive therefore, but lower than the 2.3% growth acquired as a result of the strong growth of 6.6% from the previous year.

However, according to Mazziero Research, two factors make the view less pessimistic and lead to an upward revision in the second quarter from -0.4% to -0.2%. These two factors are: the evolution of European gas prices which seems to have entered a phase of stability remaining below 100 € / Mwh, and the measures to contrast energy increases by the Government (tax exemption of excise duties until July 8), which brought a real benefit, limiting to some extent the damage suffered by businesses and families.

At this point, with a second quarter at -0.2% and without further variations on the following quarters, we would have an annual growth of 2.2%, only a tenth lower than the growth acquired.

The fact remains that, if indeed the change in GDP were negative as estimated, for two successive quarters, Italy would enter a technical recession at the beginning of the second half of the year with possible worsening of the dynamics of interest on government bonds, raising costs even more.

Debt towards new record, watch out for the BTP movement

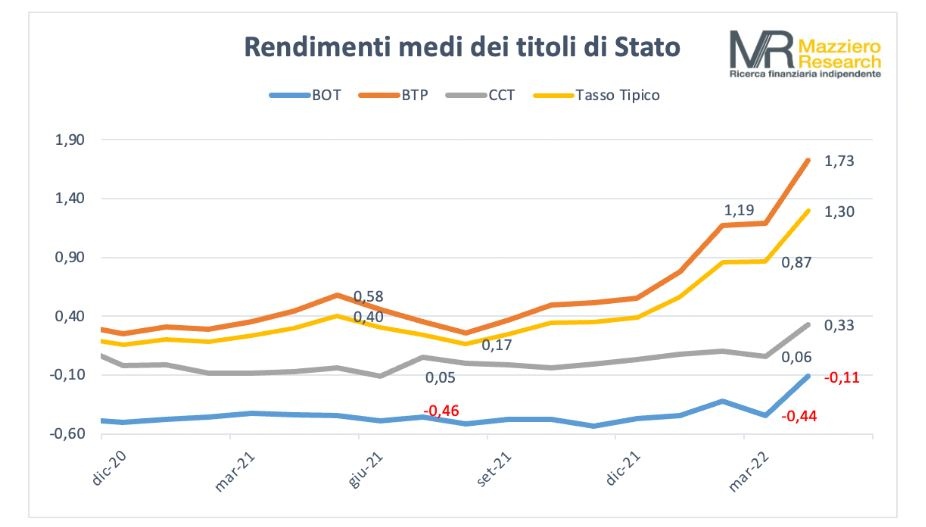

Since the beginning of the year, government bond yields have risen sharply, confirming a trend already underway since the second half of 2021; the BTP-Bund spread has also widened and is around 200 basis points.

“We are facing the effects of lower purchases by the ECB accompanied by the prospect that rates are destined to rise also in the Eurozone – underline by Mazziero Research – At this point, special surveillance becomes the interest expense which could increase by 5-6 billion over 12 months“.

Inflation, the decline is just an optical illusion

In the meantime, the latest inflation data, down from 6.5 to 6.0% on an annual basis, risks not showing the real dynamics of prices according to Mazziero Research experts, given that the only contraction occurred on fuel thanks to the tax exemption imposed by the Government. All other goods, with particular regard to food, maintain their growth unchanged.

The only positive note comes from the labor market, with 168,000 more employed in the 1st quarter and 829,000 more than at the beginning of 2021. Unemployment fell to 8.3%, a level not seen since 2010 , and youth unemployment at 24.5% has also returned to 2009 values.