Japan may take “bold action” to boost the yen? Traders beware if they hear this!

2023-06-22 17:35:00 Source: FX168 Global Investment Share to:

Share to WeChat

Open WeChat and scan

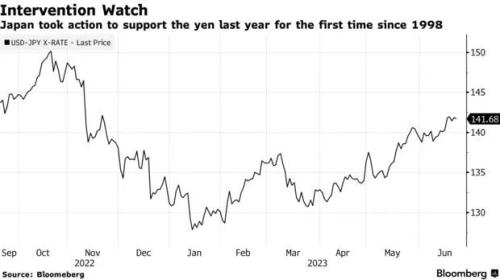

On Wednesday (June 21), the yen fell to a seven-month low against the dollar and slumped to a 15-year low against the euro, reigniting concerns that Japanese policymakers may consider entering the market to boost the yen.

Japan spent about $62 billion in market intervention last year to support the yen. But comments from senior Japanese officials so far this year have not suggested imminent action.

In late May, government officials from the Bank of Japan, Finance Ministry and Financial Services Agency met to discuss topics including the exchange rate. The unscheduled meeting is often seen as the first sign of heightened concern.

Since then, Japan’s Finance Minister Shunichi Suzuki and Japan’s Finance Ministry Deputy Minister for International Affairs Masato Kanda have both said that exchange rates should reflect economic fundamentals. They also warned that they would take appropriate action if necessary.

The remarks sounded like alarm bells, but they did not signal imminent action.

But with the BOJ and Fed still diverging on policy, the yen could weaken further, putting investors at risk of “bold action” by Japanese authorities.

Last week’s central bank decision prompted further yen weakness. Federal Reserve Chairman Jerome Powell (Jerome Powell) once again hinted that the United States may raise interest rates two times.

USD/JPY is hovering around 141.70 during Asian trading hours on Thursday.

(Image source: Bloomberg)

After the end of the Bank of Japan meeting on September 22 last year, when USD/JPY rose rapidly towards 146, the Japanese authorities intervened. On October 21 last year, when USD/JPY was rapidly approaching 152, the Bank of Japan made further purchases of the yen.

Here is an up-to-date guide on how to decipher the language used by Japanese policymakers ahead of possible intervention:

When fluctuations are small:

Japanese officials typically decline to comment.

When volatility persists:

“Stability in the foreign exchange market is important.”

“It is desirable for the exchange rate to reflect Japan’s economic fundamentals.”

“We will continue to monitor the impact of the foreign exchange market on the economy.”

When monitoring increases:

“We are following/monitoring developments in the FX market.”

“We are closely monitoring developments in the foreign exchange market.”

“We are watching the exchange rate closely with great interest.”

When concerns rise:

“Sudden/sudden/rapid changes in exchange rates are undesirable.”

“A foreign exchange market that does not reflect economic fundamentals is undesirable.”

“We’ll be watching the market closely.”

“Excessive movements in exchange rates have adverse/detrimental effects on the economy.

When worrying turns into feeling uneasy:

“Exchange rates do not reflect economic fundamentals.”

“The yen is depreciating rapidly.”

“JPY rise/fall is excessive/one-sided.”

By the time the warning is issued:

“We will not tolerate speculation.”

“We will take appropriate action if necessary.”

“Obviously,” “quite” and “very” are used to describe rapid movements in exchange rates.

When intervention becomes possible:

“We do not rule out any option/means to combat excesses.”

“We are prepared to take decisive/bold action in response to excess/speculative behaviour.”

“We stand ready to act.”

“Then treat us as standby.”

“We can intervene stealthily.”

The Japanese government intervened in the market last September, and two weeks ago, Japan’s finance minister, Makoto Kanda, said he would not rule out any options. A week before the move, the BOJ conducted a rate check on currency prices, another high-level warning to traders.

Last October, a week before the intervention, Masato Kanda warned that he was ready to take bold action. In both interventions, the yen appreciated by more than 2 yen against the dollar in less than a day.

Editor in charge: Zhao Lu RF13155