Xinhua News Agency, Beijing, March 22. “China Securities Journal” published an article on the 22nd, “Listed companies break through 400 science and technology innovation board growth attractiveness is highlighted”. The article said that on March 22, Junpu Intelligence and Heyuan Bio were listed on the Science and Technology Innovation Board of the Shanghai Stock Exchange. So far, the number of companies listed on the Science and Technology Innovation Board has reached 401, with a total of more than 560 billion yuan in IPO funds and a total market value of nearly 5 trillion yuan.

From the first batch of 25 companies listed on July 22, 2019, to 100 companies on April 29, 2020, 200 companies on December 7, 2020, 300 companies on June 28, 2021, and then breaking through 400 companies today. While the market size of the GEM has grown steadily, the demonstration effect of supporting “hard technology” has continued to emerge, the role of “reform test field” has been well played, the market has been running smoothly on the whole, and various systems have initially withstood the test of the market.

At the same time, investors used “real money” to cast a vote of confidence in the development prospects of the Science and Technology Innovation Board. Since the beginning of this year, the volatility of the A-share market has increased, but investors have continued to increase their positions on the Science and Technology Innovation Board through index funds during the market adjustment.

Growth continues to improve

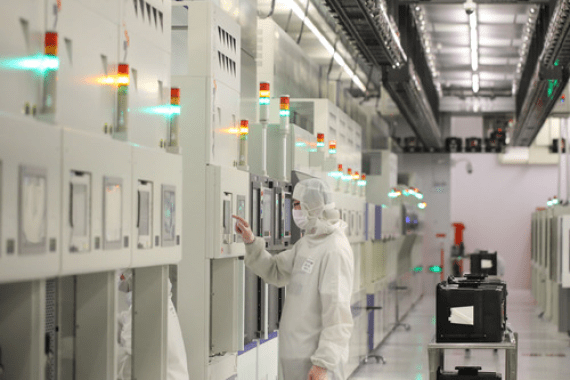

(Photo description) File photo, issued by Xinhua News Agency

As a representative of the industry leaders in high-tech industries and strategic emerging industries, companies listed on the Science and Technology Innovation Board have a unique growth gender.

Data show that in 2021, the overall operating income and net profit of the Science and Technology Innovation Board will increase significantly year-on-year. The 401 companies will achieve a total operating income of 818.434 billion yuan in 2021, a year-on-year increase of 36%; a net profit attributable to the parent company of 92.909 billion yuan, a year-on-year increase of 72%. Among them, nearly 90% of the companies achieved a year-on-year increase in operating income, and 112 companies’ revenue increased by more than 50%; nearly 70% of the companies achieved a year-on-year increase in net profit attributable to the parent, and 55 companies doubled year-on-year.

At the same time, in 2022, some companies on the Science and Technology Innovation Board are off to a good start. On the evening of March 8, the monthly operating data disclosed by SMIC for the first time showed that from January to February this year, SMIC achieved operating income of 1.223 billion US dollars, a year-on-year increase of 59.1%; net profit attributable to the parent was 309 million US dollars, a year-on-year increase of 94.9%. %.

Driven by SMIC, as of March 21, 14 leading companies on the Science and Technology Innovation Board have disclosed their operating data for the first two months of 2022, locking in the first-quarter results in advance. Specifically, Montage Technology, Xinyichang, and Huafeng Measurement and Control have doubled their revenue and net profit in the first two months. Key operating data such as shipments, production and sales disclosed by Daqo Energy, Kede CNC, Funeng Technology and other companies show that capacity expansion is proceeding in an orderly manner. Shanghai Silicon Industry, Zhenhua New Materials, and Hehui Optoelectronics, three unprofitable companies when they were listed, also predicted that their operations were improving in the first two months, and their losses were narrowing sharply.

The proportion of foreign investment continues to increase

In the nearly three years since the opening of the STAR Market, international investors have become increasingly interested in investing in the STAR Market, and the STAR Market is rapidly entering the “shopping basket” of international investors.

On the one hand, international investors actively participated in the issuance of new shares on the Science and Technology Innovation Board. As of the end of November 2021, 38 foreign-funded institutions had participated in the preliminary inquiry of the primary market of the Science and Technology Innovation Board, of which 29 were successfully allocated, with an amount of 774 million yuan. In terms of strategic placement, a total of 4 international investment institutions participated in the strategic placement of 6 companies on the Science and Technology Innovation Board, with a total of 157 million shares allocated, with an amount of 4.484 billion yuan.

On the other hand, with the further expansion of the channels for foreign investment in the Science and Technology Innovation Board, the scale of foreign institutions’ shareholding in the secondary market has continued to increase. As of February 28, the market value of foreign capital held through the secondary market reached 45.7 billion yuan. Among them, 107 companies on the Science and Technology Innovation Board are held by foreign institutions, accounting for 27% of the total number of companies. On average, each company has 7 shares held by foreign institutions. 41 companies such as China Micro and Western Superconductor have more than 41 foreign shareholders. 10.

In addition, in the second quarter of 2021, companies on the Science and Technology Innovation Board were included in the three major index samples for the first time, and the number has continued to expand since then. After just over a year, the number of STAR Market companies included in the MSCI, FTSE and S&P indices is 18, 36 and 24 respectively. Market observers believe that this reflects the continuous improvement of the global influence and attractiveness of the Science and Technology Innovation Board.

A reporter from China Securities Journal learned that in order to improve the sense of gain and participation of international investors, this year’s performance briefing session on the Sci-Tech Innovation Board will invite international investors to participate in a more targeted manner, and encourage companies with high attention from international investors to add English-language interactions Q&A session to effectively improve communication efficiency.

Specialized special new reserve army is sufficient

“Hard technology” is the background color of the Science and Technology Innovation Board. As the main battlefield to support my country’s scientific and technological self-reliance and self-improvement, the Science and Technology Innovation Board is attracting more and more outstanding companies with outstanding scientific and technological attributes.

Specifically, among the 401 listed companies on the Science and Technology Innovation Board, 118 companies were selected into the “Little Giants” list, and 37 companies were rated as single champions in the manufacturing industry. In the eyes of industry insiders, the gathering of “little giants” of specialization, excellence, and innovation highlights the science and technology innovation attributes of companies on the Sci-Tech Innovation Board that focus on market segments, main businesses, strong innovation capabilities, and good growth potential, and play an exemplary role in high-quality development. .

The listed company is the present tense, and the reserve army is the future tense. At present, the Sci-tech Innovation Board has a sufficient reserve army of specialties and new talents. Among the three batches of “little giant” companies announced by the Ministry of Industry and Information Technology from 2019 to 2021, as of the end of 2021, 189 companies have applied for the Science and Technology Innovation Board, accounting for 26.7% of the total. Among them, 45 of the companies accepted in 2021 are “little giants”, and their industries cover the six major sectors of the Sci-Tech Innovation Board, accounting for 25.4% of the total number of companies accepted in 2021.

In addition, after listing, companies on the Science and Technology Innovation Board have continued to increase investment in research and development. According to the third quarterly report of 2021, the total R&D investment of the companies on the Science and Technology Innovation Board reached 37.668 billion yuan, a year-on-year increase of 40%. (over)Return to Sohu, see more

Editor:

Disclaimer: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.