(Original title: MLF cut interest rate “boots landed”, LPR or asymmetric cut, how will it affect the market?丨Fireline Interpretation)

The agency believes that in the context of the further weakening of high-frequency data in June and the “small-step and fast-moving” reduction of deposit interest rates, the market expects more stimulus policy logic. The interest rate cut may end the policy quiet period, but the reason for the cut may be more to enhance market confidence and guide market expectations.

The June MLF rate cut came as scheduled.

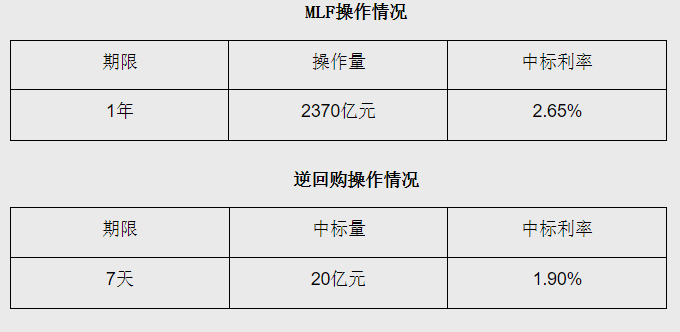

The People’s Bank of China announced on June 15 that in order to maintain reasonable and sufficient liquidity in the banking system, the People’s Bank of China will launch a 237 billion yuan medium-term lending facility (MLF) operation and a 2 billion yuan 7-day reverse repurchase operation on June 15, 2023. , The MLF interest rate was lowered by 10 basis points to 2.65%, and the 7-day reverse repurchase rate was 1.90%. According to Wind data, 2 billion yuan of reverse repurchases and 200 billion yuan of MLFs expired that day, achieving a net investment of 37 billion yuan.

Before the MLF rate cut, on June 13, the 7-day reverse repurchase rate, standing lending facility (SLF) overnight, 7-day, and one-month interest rates were all lowered by 10BP.

Zheshang Securities believes that in the context of the further weakening of high-frequency data in June and the “small-step and fast-moving” reduction of deposit interest rates, the market expects more stimulus policy logic. The interest rate cut may end the policy quiet period, but the reason for the cut may be more to enhance market confidence and guide market expectations.

MLF rate cut in line with expectations

This month’s MLF operating rate was 2.65%, a decrease of 0.1 percentage points from the previous month, the first reduction since August 2022.

Wang Qing, Chief Macro Analyst of Dongfang Jincheng, believes that there are two main reasons for the start of the policy rate cut process: first, the economic recovery momentum has been stable and weak since the second quarter, and the property market has also shown a weakening momentum again, which requires an appropriate monetary policy. Intensify counter-cyclical adjustment. The second is that the recent price level is obviously low. Among them, the cumulative CPI from January to May was only 0.8% year-on-year (0.2% in May). The core CPI, which is more volatile and more reflective of the overall price level, is deducted from food and energy prices. It was 0.7% (0.6% in May), significantly lower than the moderate inflation level of around 3.0%. This provides room for a modest reduction in the policy rate.

Mingming, the chief economist of CITIC Securities, said that the MLF rate cut was in line with expectations, and it was a follow-up reduction after the previous 7-day reverse repurchase rate cut. In this issue of MLF, the “increase in volume and price reduction” shows that the central bank has strengthened counter-cyclical stimulus to support macroeconomic recovery.

Zhou Maohua, a macro researcher at the Financial Market Department of China Everbright Bank, also believes that the continuation of MLF’s “volume increase and price reduction” is in line with expectations. Following the reduction of the reverse repurchase rate, the spread between the reverse repurchase rate and the MLF interest rate will be kept stable, and the monetary policy will flow to the real economy. conduction.

LPR or asymmetric downregulation

Wang Qing believes that after the MLF operating interest rate is lowered in June, the LPR quotations of the two varieties will also be lowered in that month.

“Since the LPR quotation reform in August 2019, during the previous five MLF operation interest rate reductions, the LPR quotations of the month have been lowered. Considering that the current corporate loan interest rate is at a historical low and is significantly lower than the residential mortgage interest rate, Coupled with the recent weakening of the property market, there may be an asymmetric decrease in the quotations of 1-year LPR and LPR with a period of more than 5 years in June, that is, the quotation of 1-year LPR may be reduced by 0.05 percentage points, and the quotation of LPR with a term of more than 5 years may be reduced by 0.15 percentage points “Wang Qing predicts that this will lead to a sharper reduction in corporate and residential loan interest rates, especially residential mortgage interest rates. The data shows that in 2022, the quotation of 1-year LPR will be lowered by 0.15 percentage points, which will drive down the interest rate of corporate loans by 0.6 percentage points; the quotation of LPR with a term of more than 5 years will be lowered by 0.35 percentage points, which will drive down the interest rate of residential mortgage loans by 1.29 percentage points.

The fixed income team of Everbright Securities pointed out that from historical experience, the MLF interest rate often fluctuates in the same direction and at the same amplitude as the OMO and SLF interest rates, which helps to form a normal, upward-sloping yield curve. The same is true this month, and the MLF interest rate has dropped by 10bp as the market wishes. At present, the level of economic prosperity in my country has declined, and the basis for recovery and development still needs to be consolidated. The successive reductions in policy interest rates have clearly released a signal to boost market confidence, strengthen counter-cyclical adjustments, and fully support the real economy.

The agency believes that LPR is formed by adding points based on the MLF interest rate in a market-oriented manner, and the MLF interest rate represents the bank’s average marginal capital cost. Combined with factors such as the reduction of the previous deposit rate and the low CD interest rate, the LPR above 1Y and 5Y may decline in June this year.

How will it affect the market?

Gao Ruidong, chief macro analyst of Everbright Securities, believes that for the stock market, interest rate cuts can reduce the financing costs of the real economy and improve corporate operating cash flow; at the same time, the low interest rate environment can also stimulate corporate investment and market activities, and improve market risk appetite. The interior will have a boosting effect on the stock market. But in the medium and long term, the impact of interest rate cuts on the stock market still depends on the degree of improvement in the real economy after the rate cuts are implemented. As far as the bond market is concerned, lowering the policy interest rate can guide the market interest rate to further decline, thereby opening up the downward space for the yield of government bonds.

Li Chao of Zheshang Securities said that the impact of interest rate cuts on the bond market is more direct. After the open market reverse repurchase operation interest rate cut on June 13, the yield of active 10-year treasury bonds fell rapidly by 4BP to a low of around 2.64%. Based on the judgment of RRR cuts and interest rate cuts, it is expected that the bull market in the bond market is worth looking forward to.

Disclaimer: The Securities Times strives for truthful and accurate information, and the content mentioned in the article is for reference only and does not constitute substantive investment advice, so operate at your own risk

Download the “Securities Times” official APP, or follow the official WeChat public account, you can keep abreast of stock market trends, gain insight into policy information, and seize wealth opportunities.