Are you looking for information about Nordea 1 Stable Return Fund why was it proposed to you by your consultant? Or have you come across this fund and would like to know if it is right for you and if it is an interesting investment?

In any case you are in the right place because today we will analyze the characteristics of this fund, his costsi returnsi advantages they disadvantagesand finally you will also find mine opinions about.

Enjoy the reading!

This article talks about:

A few words about Nordea

Nordea Asset Management is one of the largest asset managers in the Nordic countries, and also has a global presence in Europe, America and Asia.

Just to illustrate the size of the company, we know that it serves about 800 clients institutional worldwide, and serves 16 of the top 20 wealth manager globali. They also serve customers in as many as 20 different countries.

The company offers a broad range of investment solutions, enabling clients to address a variety of market conditions.

The approach pursued is one of stability and consistency, which are fundamental qualities in the investment management sector.

Their strategy is based on a multi-boutique approachby establishing separate teams for each major asset class, and by combining in-depth experience from in-house boutiques with unique expertise from external boutiques to ensure clients benefit from a state-of-the-art investment process across any asset class .

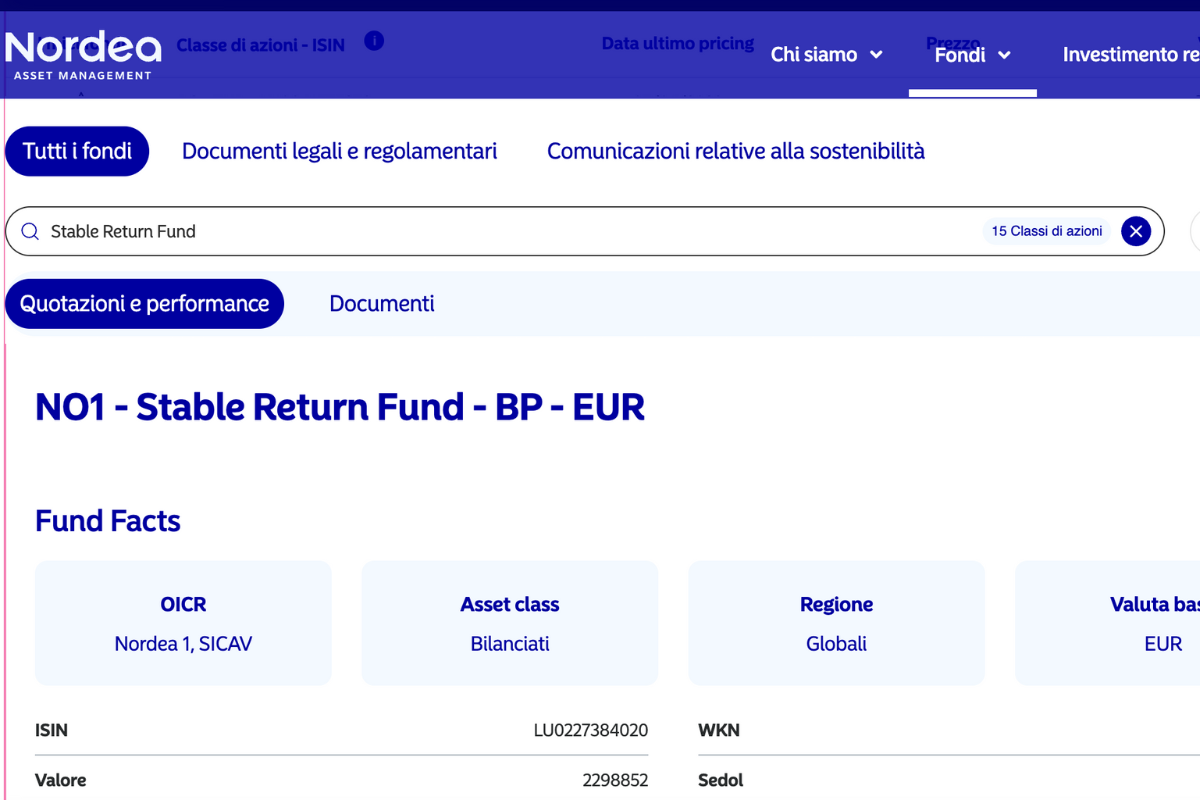

Identikit of the fund

The fund in question is distributed by Nordeaand it is a balanced fund.

The fund is established for an indefinite period, and aims to offer shareholders capital growth, and consequently achieve a relatively stable income.

The fund is actively managed, with the management team applying a process of asset allocation dynamic and balanced risk.

Not sure how to invest?

Find out which investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW! <

What does it invest in?

The fund mainly invests in actions and in several other asset classes, such as bonds issued by companies, financial institutions or public bodies, and in money market instruments and currencies worldwide.

Specifically, the fund may invest in equity and equity related securities, debt and similar instruments and money market instruments.

The fund may invest up to 10% of its total assets in asset-backed and mortgage-backed securities or have a maximum exposure of 10% to such securities. The fund may be exposed (through investments or cash) to different currencies from the base currency.

It can also use i derivatives for hedging, efficient portfolio management and profit generation purposes.

Who is the fund for?

The fund is aimed at investors who accept and understand that the value of the fund is connected to the value of the underlying investments: precisely for this reason it will be subject to fluctuations over time.

The recommended holding period for investment is at least 3 yearsand is largely based on the historical volatility of the underlying investments.

An overview

If we stop to analyze the bottom more, we can see that thegeographic exposure it sees the United States in first place with 71.29%, followed by Western Europe (euro area) with 7.61% and Western Europe (non-euro area) with 6.52%.

As regards instead thesector exposure we see the health sector in first place (21.68%), in second place the technology sector (19.15%) and in third place the defensive consumer goods sector (15.76%).

The top 5 holdings in the portfolio are three bonds, followed by the companies Microsoft and Alphabet.

Its benchmark

The fund was listed in 2005, so it is a mature fund.

His reference benchmarks is theEuribor 1M.

It is only used for performance comparison purposes, as the fund’s portfolio is a active management and therefore does not refer directly to the benchmark. The fund is therefore not tied to the benchmark, also because the benchmark is not aligned with the environmental and social characteristics of the fund.

Risk profile

The fund has an investment risk of 3which on a scale of 1 to 7 makes it a medium/low risk.

Of course it is only one summary risk indicatortherefore an indicative indication of the risk level of the product compared to others.

You may run into exchange rate risk, as you may receive payments in a foreign currency, so you will need to take this into account when calculating your final return.

However, as this is a fairly low risk, it is unlikely that bad market conditions will affect the fund’s ability to pay what is owed.

Proceeds Use Policy

Fund proceeds are not distributed to shareholders, but are instead reinvested back into the fund itself, to harness the power of compound interest. For this reason the policy is ad accumulation.

Costs

We have now come to the main part, namely that of costs.

I costs they are the ones that impact your returns and therefore risk compromising your investment.

Since it is an active management you must already be prepared and take into account some heavy costs, which we will now see together:

- Subscription fee: 3%;

- Exit expenses: not foreseen;

- Management fees: 1.78% of the annual value of the investment;

- Transaction costs: 0.23% of the annual value of the investment;

- Performance fees: not foreseen.

I yields

It is always good to remember that i past returns they are in no way predictive of future ones.

Dal graphic we can see that the fund, since 2019, has never outperformed the benchmark, even if as we have seen before, it should not be used as a comparative index as the investment style is active.

In the first quarter of 2023, on the other hand, we can see how the returns are positive (+1.69%).

How and when to divest

In the event that you should realize that the investment you are implementing should no longer be profitable for you or that it no longer satisfies your initial ideas, then you may want to opt for a divestment.

If you choose to disinvest, you will get all or part of your shares refunded.

The only thing I advise you to do, and on which we say I would like to “warn you”, refers to the fact that the path of disinvestment is not always said to be the best one.

In fact, before choosing this path, I advise you to consider the penalties or exit costs by carefully consulting the KID.

Not sure how to invest?

Find out which investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW! <

Opinions of Affari Miei on Nordea 1 Stable Return Fund

We have now come to the end of the fund analysis Nordea.

At this point you should have all the necessary informationand you can then think about the investment.

At this point I can therefore also try to reason with you and provide you with my opinions on the matter.

First of all I can’t tell you for sure whether this is a suitable investment for you or not, since I don’t know your personal and financial situation so I’m unable to make any judgments.

I can try to make you think with me.

The fund in question is a mutual fundactively managed. Active management allows you to delegate everything to a manager who takes care of your money and to make decisions to get the best results, but at the same time it doesn’t let you participate in what happens to your money.

Many people often tack on active management because they think they don’t have adequate knowledge on the subject, and therefore they don’t feel like investing on their own.

Think about it for a moment: if a pipe breaks in your house you will surely call the plumber because you know nothing about plumbing, and therefore you will opt to get help from a professional.

We can say that the same choice is made by uninformed investors who, not feeling up to it, choose to rely on those who know more than them.

However, this is not always the correct choice, given that the costs will be much higher precisely to remunerate the manager.

As for the costs, I invite you to read the Morningstar report reporting the costs of actively managed funds in Italy.

As you may have understood, my main advice is undoubtedly to study and train youand then to try to make decisions that are useful for your investment.

In fact, by training you will acquire skills that will make you stronger and with which you will be able to implement undoubtedly better strategies for your investments.

Conclusions

Now I really think you have all the tools at your disposal to analyze the Nordea fund.

Before saying goodbye, however, I would like to leave you with some resources that I think will be useful for you to start your investment journey in an informed and effective way:

See you soon!