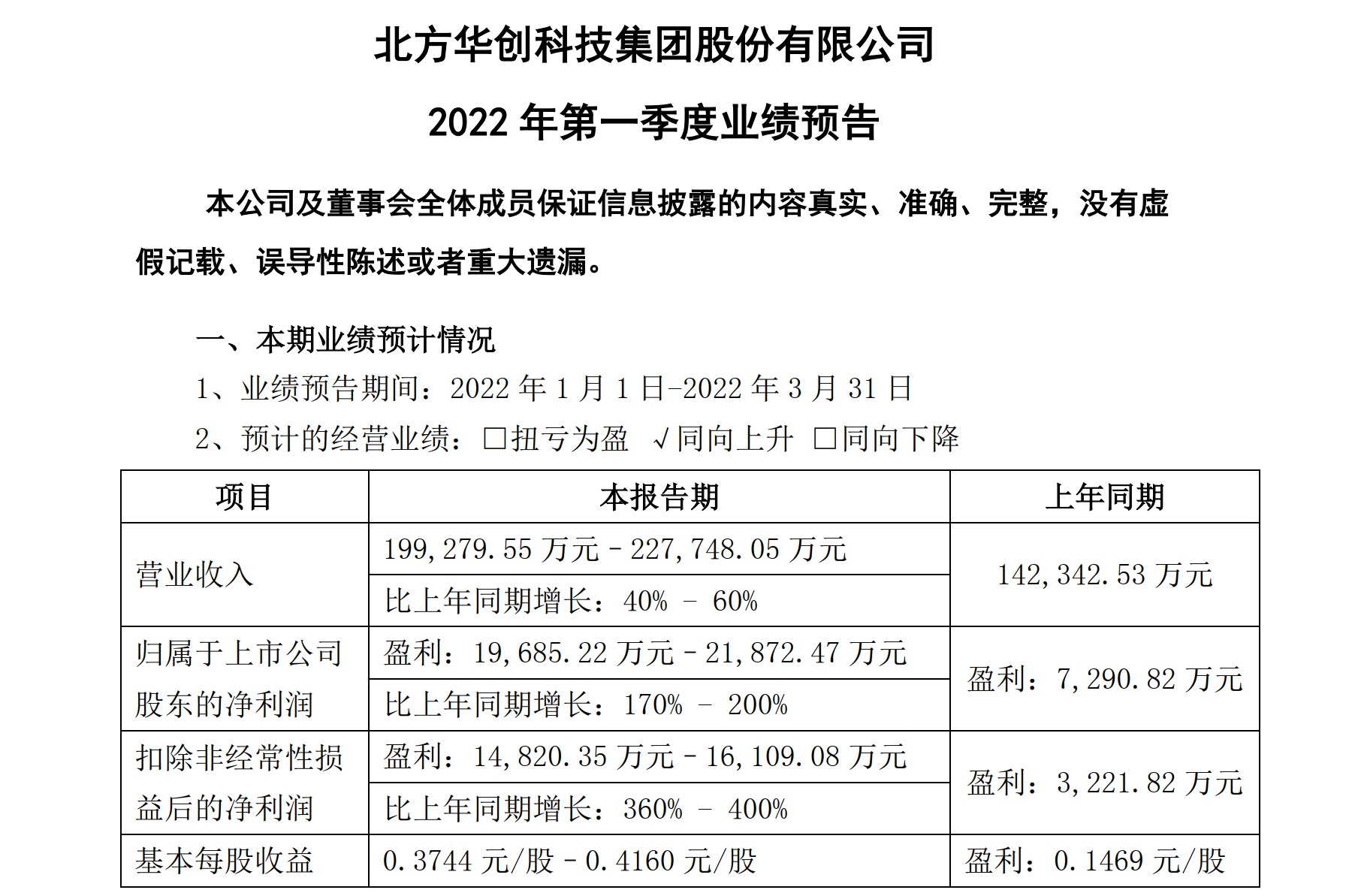

On April 13, North China Creation (002371, SZ) released the first quarter performance forecast for 2022. It is expected to achieve operating income of about 1.99 billion to 2.28 billion yuan in the first quarter of 2022, a year-on-year increase of 40% to 60%; The net profit of shareholders of listed companies is about 197 million to 219 million yuan, a year-on-year increase of 170% to 200%.

Regarding the expected growth in performance in the first quarter, NAURA explained that the main reason is the strong downstream demand.

On the same day, NAURA also released the “2021 Annual Performance Report”, which is expected to achieve an operating income of about 9.683 billion yuan in 2021, a year-on-year increase of 59.9%; the net profit attributable to shareholders of the listed company is about 1.077 billion yuan, a year-on-year increase of 100.66%.

The “Daily Economic News” reporter noted that many research institutions believe that the semiconductor equipment industry is expected to continue its growth trend in 2022, mainly due to the increase in equipment spending in wafer fabs and the acceleration of domestic substitution.

Strong downstream demand

“Compared with the same period last year, due to the strong downstream market demand for the main business, the company’s electronic process equipment and electronic components business continued to grow, resulting in a year-on-year increase in the company’s operating income and net profit attributable to shareholders of listed companies.” Performance growth in the first quarter.

Image source: Screenshot of North Huachuang Announcement

In the “2021 Annual Performance Report” released on the same day, North Huachuang explained the performance growth in 2021 as an increase in sales orders and production scale compared with the previous period, “In 2021, the company’s electronic process equipment and electronic components business are still facing good development. Opportunities, by accelerating technological innovation, gathering development resources, seizing market opportunities, and effectively preventing and controlling risks, the company’s various operations have been carried out smoothly, and operating performance has achieved sustained growth.”

The semiconductor industry has seen strong growth in 2021. According to the 2021 annual report released by China Micro Corporation (688012, SH), citing data from WSTS (World Semiconductor Trade Statistic, a semiconductor industry data statistics company), global semiconductor sales in 2021 will reach $555.9 billion, a year-on-year increase of 26.2%. China remains the largest semiconductor market, with sales totaling $192.5 billion in 2021, an increase of 27.1% year-over-year and a record high.

Benefiting from downstream growth, semiconductor equipment is also showing high growth in 2021. According to SEMI (International Semiconductor Equipment and Materials Industry Association), global semiconductor manufacturing equipment sales will surge in 2021, up 44% from $71.2 billion in 2020, reaching a record high of $102.6 billion. China became the largest market for semiconductor equipment for the second time, with sales rising 58 percent to $29.6 billion, the fourth consecutive year of growth.

Fab equipment spending is expected to continue growing in 2022

“The application of new technologies and new products such as 5G, Internet of Things, big data, artificial intelligence, and automotive electronics will bring huge demand for the semiconductor market. Semiconductor equipment is located in the upstream of the semiconductor industry chain, and its market size will increase with the development of downstream semiconductor technology. It fluctuates with market demand,” said the analysis of China Micro Company.

“With the continued strong market demand driven by new applications, the semiconductor equipment industry will benefit from the development of the semiconductor industry.” China Micro Company believes.

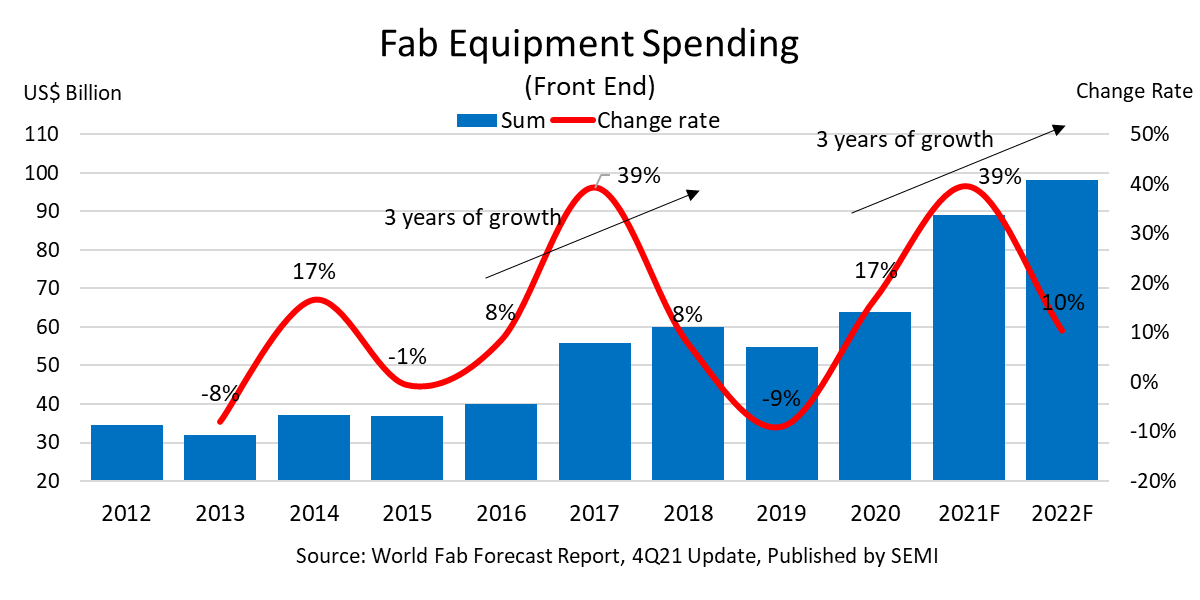

SEMI holds a similar view that the industry boom will continue in the future. In its forecast report in January this year, SEMI believes that global front-end fab equipment spending is expected to increase by 10% year-on-year in 2022, reaching more than 98 billion The dollar’s all-time high, marking the third consecutive year of gains.

Image source: SEMI China official website

Fab equipment spending will continue to grow in 2022, following 17% growth in 2020 and 39% growth in 2021, SEMI said. The last time the industry grew for three consecutive years was from 2016 to 2018, and the last three years in a row was in the mid-1990s.

From a longer-term perspective, China Micro Corporation believes that from 2020 to 2024, global semiconductor equipment procurement spending is expected to maintain a growth trend. According to Gartner’s forecast, the size of the etching equipment market will grow from approximately $12.3 billion in 2020 to approximately $15.2 billion in 2024. According to Yole’s forecast, the market size of GaN-based MOCVD equipment will increase from US$190 million in 2020 to about US$250 million in 2025, and the power device epitaxy equipment market will increase from about US$200 million in 2020 to about US$310 million in 2025.

It is worth noting that in addition to the overall growth of the industry, many institutions believe that the trend of domestic substitution has become another key factor driving the growth of related industries.

China Merchants Securities believes in the research report: “According to the expansion plans of major fabs, the expansion of production in 2022-2023 is still at its peak, and at the same time, it is necessary to pay attention to the impact of external factors such as repeated epidemics and geographical conflicts on the supply and demand sides of wafers. The decline in plant utilization has slowed down capital expenditures, and from a long-term perspective, the construction of domestic wafer fabs has accelerated significantly, which is conducive to the localization of equipment and materials.”

Zheshang Securities believes in the research report: “North China Creation is a leading domestic platform-based semiconductor equipment company. In the next 10 years, it is expected to replicate the market share increase (domestic substitution) and the multi-product platform layout of the leading North American semiconductor equipment companies in the past 10 years. (Platform companies) historical trends.”

“At present, the domestic semiconductor equipment market is mainly occupied by companies from Europe, the United States, Japan and other countries. In recent years, the technical level of my country’s equipment industry has been continuously improved, and the advantages of domestic equipment in terms of product cost performance, after-sales service, and closeness to customers have gradually emerged. As the world‘s largest In the semiconductor consumer market, market demand has driven the gradual transfer of global production capacity centers to mainland China, and the continuous transfer of production capacity has led to the improvement of market size and technical level, and also provides opportunities for the development of the equipment industry.” Zhongwei said.

Cover image source: Visual China