Original title: Don’t be afraid of inflation “explosive”!U.S. May CPI hit a 13-year high, and the S&P 500 index hit a new high… Didi officially submits an IPO application

Summary

[Do not be afraid of inflation “explosive”! U.S. May CPI hit a 13-year high, the S&P 500 index hit a new high]The three major U.S. stock indexes closed up across the board, and the S&P 500 index rose to 4249.74 points, a record high in the intraday market. The Nasdaq returned to 14,000 points. Data show that the US May CPI increased by 5% year-on-year, the highest in the past 13 years since the summer of 2008. The U.S. budget deficit so far this fiscal year has exceeded $2 trillion.

On Thursday, Eastern Time, the three major U.S. stock indexes closed up across the board, and the S&P 500 index rose to 4249.74 points, a record high in intraday trading. The Nasdaq returned to 14,000 points.

That day, the United States in MayCPIData release. Data show that the US May CPI increased by 5% year-on-year, the highest in the past 13 years since the summer of 2008.

U.S. stocks closed up across the board, the S&P 500 index hit a record high in intraday

On Thursday, the three major US stock indexes closed up across the board. As of the close, the Dow rose 19.1 points to 34466.24 points, an increase of 0.06%; the Nasdaq rose 108.58 points to 14020.33 points, an increase of 0.78%; the S&P 500 index rose 19.63 points to 4,239.18 points, an increase of 0.47%, a record A new high was closed.

In terms of sector performance, most of the large technology stocks closed up.appleFell 0.80%,MicrosoftRose 1.44%, Facebook rose 0.67%,AmazonUp 2.09%,NetflixUp 0.30%,TeslaRose 1.89%. Financial stocks collectively closed down,Bank of AmericaFell 1.44%,JPMorganFell 1.52%, Berkshire Hathaway fell 1.18%,CitigroupFell 1.63%.

Popular Chinese concept stocks have fluctuated differently.BilibiliUp 4.83%,BaiduUp 1.86%,NetEaseUp 2.53%,IQIYIUp 0.67%,Tencent MusicUp 1.35%,AlibabaFell 0.12%,JingdongFell 1.09%,PinduoduoFell 1.85%. Leading education stocks rose generally,New OrientalUp 7.87%,Good futureIncreased 7.89%.

Popular WSB concepts generally plummeted,Game stationFell 27.16%,AMC CinemasFell 13.23%, Express fell 10.07%,blackberriesFell 8.38%, 3B HomeFell 8.05%.

U.S. CPI rose 5% in May and hit a new high since 2008

According to a report released by the US Department of Labor on the 10th, in the past May, the US consumer price index rose by 5% over the same period last year, which was also the largest increase since the summer of 2008. The data showed that the US economy continued to face severe inflationary pressures.

Another indicator that does not include volatile food and energy prices is that the core CPI rose by 3.8%, higher than the expected 3.5%. This is the fastest growth rate since May 1992.

From a month-on-month perspective, the overall US CPI rose by 0.6% after the May seasonal adjustment, and the core CPI rose by 0.7%.

Among them, the price of second-hand cars and trucks increased by 7.3% month-on-month, accounting for one-third of the increase in all projects; in addition, the prices of furniture, air tickets and clothing also recorded substantial increases in May.

Although inflation data is much higher than the highest level since the financial crisis,MidlandReserve officials still believe that the current rise is caused by temporary factors, which will weaken over time; at the same time, the base effect makes the year-on-year increase look higher.Therefore, the market generally expectsMidlandThe Reserve Bank will not react to the latest data at the Federal Open Market Committee (FOMC) meeting next week.

The U.S. budget deficit so far this fiscal year has exceeded $2 trillion

The U.S. Treasury Department announced on Thursday that the May budget deficit was slightly less than $132 billion, the lowest monthly deficit level in this fiscal year. However, as the financial assistance aimed at providing support for economic recovery continues, the total US budget deficit this fiscal year has exceeded the $2 trillion mark, reaching $2.063 trillion.

There are four months left before the end of fiscal year 2021. Judging from the current situation, the US government’s budget deficit is expected to be close to the 2020 record of 3.13 trillion US dollars.

In order to contain the spread of the new crown epidemic and provide support for the hard-hit economy, the US Congress has allocated more than $5 trillion in stimulus funds. Currently, members of Congress are discussing an infrastructure construction bill that costs or can be as high as trillions of dollars.

Biden’s budget released last month estimates that assuming Congress passes his economic investment and taxation plan, the deficit in fiscal year 2022 is expected to be $1.84 trillion, and the deficit for this fiscal year is expected to be $3.67 trillion.

European Central Bank: Maintain the three keysinterest rateconstant

On June 10, the European Central Bank announced the Juneinterest rateThe resolution is to maintain the main refinancing, marginal lending and deposit mechanism interest rates at 0.00%, 0.25% and -0.50% respectively.

The European Central Bank’s Management Committee expects that the ECB’s key interest rate will remain at the current or lower level until the inflation outlook “strongly converges” to its “close but below” 2% target within its forecast range.

The bank will continue to purchase net assets under the Emergency Anti-epidemic Bond Purchase Program (PEPP), with a total scale of 1.85 trillion euros, until it judges that the crisis phase of the epidemic is over, which is expected to be at least the end of March 2022. Based on a joint assessment of financing conditions and inflation prospects, the European Central Bank predicts that in the next quarter, net purchases under PEPP will continue to be made at a significantly higher rate than the first few months of this year.

Didi officially submits an IPO application

On Thursday, Didi Chuxing formally submitted an IPO application to the SEC. It plans to list on the New York Stock Exchange under the ticker symbol “DIDI”. The underwriters includeGoldman Sachs、Morgan Stanley、JPMorgan, Huaxing Capital. The prospectus shows that the company’s China travel business achieved an adjusted pre-interest and tax profit of 3.84 billion yuan in 2019, 3.96 billion yuan in 2020, and 3.62 billion yuan in the first quarter of 2021.

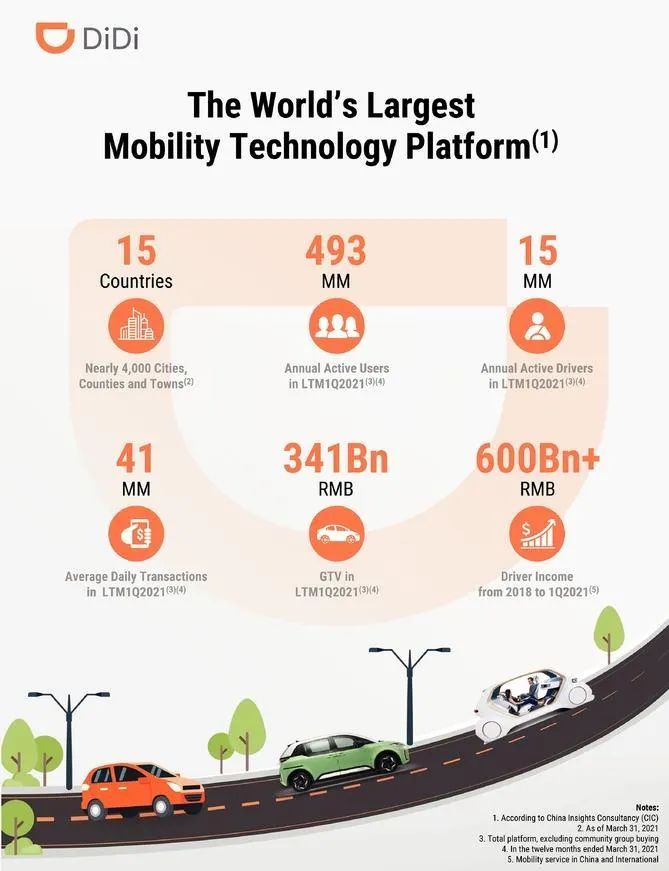

The prospectus shows that Didi provides services such as online car-hailing, taxis, ride-hailing, shared bicycles, shared motorcycles, agent driving, car service, freight, finance and autonomous driving. As of March 2021, Didi has operations in more than 4,000 cities and towns in 15 countries, including China. In the 12 months ending March 31, 2021, Didi had 493 million global annual active users and 15 million global annual active drivers.

Among them, from March 31, 2020 to March 31, 2021, Didi has 377 million annual active users and 13 million annual active drivers in China. In the first quarter of 2021, Didi China Travel has 156 million monthly active users, and the average daily transaction volume of China’s travel business is 25 million. In terms of order volume and transaction volume, in the 12 months ending March 31, 2021, Didi’s global average daily transaction volume was 41 million orders, and the total transaction volume on the entire platform was 341 billion yuan. During the three-year period from January 1, 2018 to March 31, 2021, the total income of platform drivers was approximately RMB 600 billion.

The prospectus also announced the income of Didi’s specific businesses. In 2020, Didi’s three major businesses-China’s travel business, international business and other business revenues will be 133.6 billion yuan, 2.3 billion yuan and 5.8 billion yuan respectively.

In terms of profit performance, China’s travel business achieved an adjusted pre-interest and tax profit of 3.84 billion yuan in 2019, 3.96 billion yuan in 2020, and 3.62 billion yuan in the first quarter of 2021. In addition, the pre-interest, tax and amortization profit rate of China’s online car-hailing business in 2020 is 3.1%.

At the same time, the prospectus shows that before the initial public offering, SoftBankfundHolds 21.5% of the company’s common stock, Tencent beneficially holds 6.8% of the company’s common stock; Uber beneficially holds 12.8% of the company’s common stock. In addition, the company’s founder Cheng maintains 7% of the company’s common stock and 15.4% of the voting rights, and Liu Qing holds 1.7% of the company’s common stock and 6.7% of the voting rights.

In addition, the prospectus shows that the largestshareholderKentaro Matsui, a member of the board of directors appointed by SoftBank, will resign as a director when Didi is listed, which means that SoftBank will withdraw from the board of Didi.

(Source: Securities Times)

(Editor in charge: DF532)

Solemnly declare: The purpose of this information released by Oriental Fortune.com is to spread more information and has nothing to do with this stand.

.