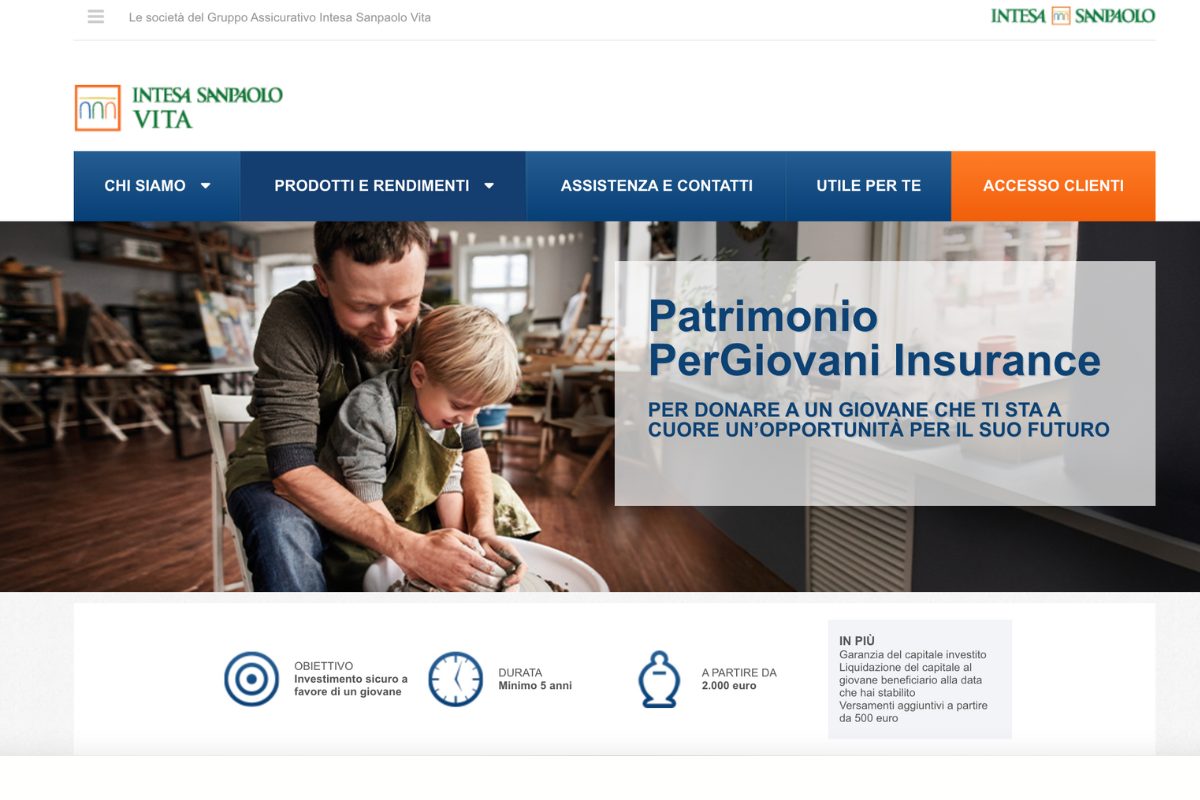

Heritage for young people is a product of insurance investment which is offered by Intesa SanPaolo Vitadesigned for those who want to think about the future of a young person who is close to their heart and at the same time help them carry out their projects and achieve their goals.

If you are looking for information on this specific product you are in the right place because today we will see its information together characteristicsi costsi advantages they disadvantages.

Let’s start!

This article talks about:

A few words about Intesa SanPaolo Vita

Before analyzing in detail all aspects of the contract and the policy, let’s see who is the institution offering the product, to offer a complete overview.

The policy is offered by Intesa SanPaolo Vitai.e. the parent company of the related insurance branch of Banca Intesa.

It was born in 2012, and since 2014 it has enriched its offer thanks to the fact that it has also included pension funds, which were previously managed by Intesa Sanpaolo Previdenza SIM.

The company is currently the leader in Italy in the bancassuranceand also in the field of supplementary pensions.

The products that are offered and distributed by this institute are configured as products that are simple to understand and useful for the customer.

Is Patrimonio PerGiovani a safe product?

First of all, let’s try to understand if it is a safe product or if we are dealing with a risky product. Understand your own risk profile it is in fact the first step in choosing one’s own investment strategy and in understanding how to make the most of one’s savings.

The product is a contract with profit sharing, and is part of the insurance that falls within the Branch I

We can call it a product with a low risk profilesince you can count on the guarantee of the capital invested through the separate management, and also on the liquidation in favor of the young beneficiary at the time established in the contract.

The product is the ideal solution if you want to help a young person build their future and help them realize their projects.

Furthermore, in addition to being a safe investment, it also has tax and legal advantages that are typical of a life insurance policy.

Not sure how to invest?

Find out which investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW! <

Characteristics of Patrimonio PerGiovani

Heritage for young people It is a fixed-term, single-premium life insurance policy.

The contracting party is also the insured: whoever chooses to subscribe to this product has in mind to allocate a capital to the beneficiary, on the expiry date that is established by the customer himself.

Importantly, the young beneficiary at the expiry of the contract, he must be between 18 and 35 years of age.

The performance

Now let’s see what are the benefits that are provided for in the contract. They are adjusted every year on the basis of the returns of the separate management.

We have two possibilities:

- survival benefit: in this case, on the expiry date of the contract, the beneficiary will receive the capital, which will be the greater of the capital insured on the expiry date and the minimum guaranteed capital on the expiry date;

- benefit in the event of death: in the event that the customer dies during the term of the contract, the beneficiary will still be recognized the capital designated to him. However, in the event that the beneficiary also dies, then the capital will be transferred to the testamentary heirs, or to the legitimate heirs of the beneficiary himself.

The prize

The contract provides for the payment of a single prizewhich must have an amount of no less than 2,000 euros.

In addition, it is possible to make some additional paymentsprovided that at least 30 days have passed from the effective date of the contract, and that the amount of each additional payment is equal to at least 500 euros.

There is also a maximum amount, as the maximum invested in the separate management can be 5,000,000 euros.

To the duration

The contract has a duration that goes from the effective date to the expiry date of the contract itself and, as we have seen before, the minimum duration of the contract must be 5 years.

I yields

The returns are linked to the results of the “Fondo Base Sicura” separate management of Intesa Sanpaolo Life.

This management envisages a mainly bond investment which, through the diversification of investments, is able to seize market opportunities and at the same time protect the capital, as envisaged by the contractual guarantees.

Costs

Let’s now sell to the most important and at the same time thorniest part of the contract, namely the one relating to the costs that you will have to support.

I entry costs are applied to each premium paid, as follows:

- up to 499,999.99 euros the cost is 0.50%;

- From 500,000 euros upwards, the cost is 0.25%.

As for i exit costswe have 2% in the event that at least 91 days of contract duration have elapsed, while it drops to 1% in the event that at least 1 year has elapsed and up to the fifth year.

From the fifth year onwards, however, the cost to be applied to the gross amount redeemed is around 30 euros.

Then we also have the management cost which is withheld from the yield achieved by the separate management, and which will be equal to 1.30%.

Revocation and withdrawal

For this contract it is not possible to opt for the right to revokebut you can instead withdraw within 30 days of signing the policy, either by signing the form made available by the intermediary bank, or by relying on a registered letter sent to the company itself.

Ransom

It is also possible to exerciseredemption optionafter at least 90 days from the effective date of the contract.

During the contact they are not allowed partial redemptionsand requests for total redemption are not even admitted in the event that the beneficiary of the benefit on expiry is deceased.

You can also opt for the special ransom: in this case the contract will be terminated following the death of the beneficiary which occurred before the expiry of the contract, and while the customer is still alive. In this case the capital will go to the customer himself.

Tax aspects

The premiums paid on the contract are not subject to insurance tax and are not deductible from personal income tax (IRPEF).

The sums paid by the Company are subject to thesubstitutive tax of 26% applied on a taxable base determined by the difference between capital accrued and premiums paid (yields deriving from Government Bonds at 12.5%).

The effective rate of taxation will therefore be between 12.5% and 26% depending on the nature of the investments that are linked to the contract.

It is also important to underline that, in the event of the client’s death, the capital will not be subjected to any inheritance taxif it will be paid to the beneficiary designated at the time of signing the contract.

Not sure how to invest?

Find out which investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW! <

My Business Opinions on Heritage for young people

We have come to the end of ours reviewand we have seen all the features that distinguish the product and the policy in detail.

If you’re interested Heritage for young peoplefirst of all, I advise you to go further and then either go to the official website to download the information documents, or make an appointment at the branch where you will undoubtedly be able to get more information.

Now let’s just try to reason together, and to understand if it could be a useful or profitable investment for you.

If you are looking for a product to leave a capital to your child, your nephew, or in any case to a young family member or friend, this product can be the solution, even if I personally don’t like similar products too much.

Obviously I’m not telling you that this is a bad investment, I’m just telling you that you could also take alternative routes.

Come costs I can tell you that this branch I policy still defends itself quite well, given that very often similar products have very high costs that erode the investment.

If you really want to put some money away for a boyfriend, you might as well think about starting one accumulation plan: you could opt for a fixed amount to be allocated every month to PAC: in this case you can either choose gods mutual fundswhich of the ETF (which I prefer above all because they have very low costs).

This way, as the years go by, your young beneficiary can end up with a handsome nest egg aside, and most importantly he may have the flexibility to withdraw the money when he wants or when you want him to, since he will not necessarily have to wait for an expiration date as in this case.

Before saying goodbye, I also want to leave you a few resources which you may find very useful in case you are trying to start an investment path designed for hoc for you:

See you soon!

Find out which Investor You are

I have created a short questionnaire to help you understand what kind of investor you are. At the end, I will guide you towards the best contents selected according to your starting situation:

>> Start Now <