Independent Financial Advisor and Co-Founder of Affari Miei

9 Maggio 2024

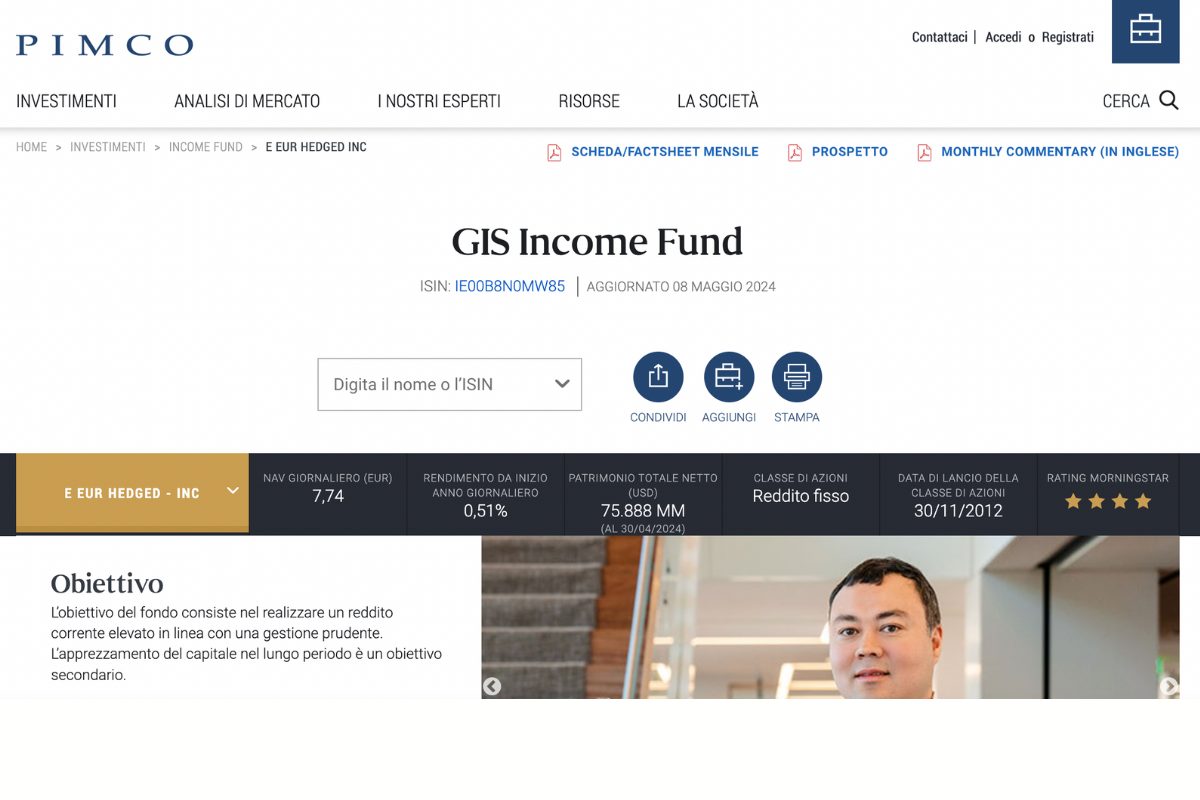

If you are looking for information on mutual funds you have come to the right article! Today I will talk to you specifically about the Income Fund (ISIN: IE00B8N0MW85) one of the funds made available by the Pimco company, one of the main bond investment management companies in the world.

In today’s article we will begin to analyze the fund, its advantages and his disadvantages, i returns eh risks, and at the end of the discussion you will also be able to find mine opinions about the instrument.

This way at the end of the review you will be able to have a little clearer ideas, and consequently perhaps be able to decide whether it is a valid investment for you or not.

First of all, I want to tell you how the Pimco Income fund behaves in broad terms: it is an actively managed fund that uses a wide range of bonds to try to achieve an interesting income, and to maintain a relatively low risk profile. content, with the aim also of increasing the value of the capital.

All you have to do is continue reading to find out more!

This article talks about:

Who is Pimco?

Pimco was born in 1971 and founded in Newport Beach, California. It is a leading investment management company, specializing in bond investments.

It was also the first company to offer investors a total return approach in the bond sector.

Since then, Pimco has helped millions of investors, i.e. its clients, achieve their goals in any market condition.

Portfolio management is based on the combination of top-down and bottom-up analysis which allows you to actively manage portfolios.

The top-down strategy involves the development of long-term secular and short-term cyclical analyzes that contribute to the development of the short-term strategy.

The investment committee deals with the analyzes of various Pimco experts which are summarized in specific investment themes.

The strategia bottom-up instead, it is based on research and analysis, that is, risk management and proprietary analysis that bring to light the risks and investment opportunities.

Just to give you some numbers, Pimco has 3050 employees operating in major financial centers around the world, it has over 270 managers with an average experience of 16 years.

It has 17 global offices including in America, Europe and Asia.

Fund profile GIS Income Fund

Now we can start by analyzing our fund.

Income Fund is an actively managed fund that uses a broad range of debt securities to achieve an attractive level of income and to maintain a relatively low risk profile, pursuing the secondary objective of increasing capital value.

In other words therefore, the objective of the fund is to achieve a high income while maintaining prudent management.

So who is this fund intended for?

The fund is intended for an investor looking for a constant income: in fact the approach adopted is that of an investment in bonds with a high coupon yield.

The investor who chooses this fund aims for a competitive and regular level of income, without compromising long-term capital growth.

The fund also offers daily liquidity.

Don’t know how to invest?

Find out what kind of investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW!

The Benchmark

The fund has a management style activewhich therefore differs from the passive management style typical of an ETF that replicates a reference benchmark.

In this case, however, the Income Fund still follows a benchmark which is used to offer us an overview of its performance. In fact, it is specified that the fund is not managed in relation to a particular benchmark or index, but simply a comparison is made with the benchmark to compare performance and risk.

The benchmark is the Bloomberg US Aggregate Index (EUR Hedged), which represents securities that are SEC-registered, taxable and dollar-denominated.

This index covers the US investment grade fixed rate bond market, and also has index components for government and corporate bonds, mortgage securities, and securitized equity securities.

Furthermore, it is not possible to invest directly in an unmanaged index.

Shares and allocations

The fund was launched in 2012, so we are talking about a fairly mature fund.

The income distribution policy is accumulation, so they are not distributed to investors on a regular basis, but are automatically reinvested in the fund.

The reference currency of the fund is US dollars, while the currency of the share class is the euro.

The sector allocation instead sees instruments related to government, securitisations, investment grade credit, high yield credit, and emerging market securities, finally there are also other net positions in short-term financial instruments.

Among the 10 largest holdings we find the stock of BNP Paribas.

Risk profile

Regarding the risk profile, the fund has a medium riskgiven that the value of shares is subject to upward and downward fluctuations and that the capital invested in the fund may be at risk.

Furthermore, the fund may make investments in non-US securities, and also in securities that do not belong to the Eurozone.

These investments in fact involve potentially higher risks, given by currency fluctuations and political and economic developments.

Risk arising from political developments may be more likely to occur when investing in emerging market securities.

However, if the securities in which you invest have a high yield and a lower rating, they involve a higher level of volatility and risk for your capital compared to investments with a higher rating.

Costs

We have arrived at the part of costsone of the most important parts when it comes to an investment.

In fact, the costs impact the returns on your investment, and can also erode your capital.

The management costs for this fund are 1.45% per year, and it is a unified commission, so you will only have this expense to bear.

I yields

We conclude our analysis of the fund by taking a look at historical returnswhich help us to analyze the performance of the fund itself.

They are not a prediction of what may happen in the future, they only serve to give us a sort of overview of the fund’s performance.

As regards the specific performance of the Income Fund, we can say that in general the fund has almost always outperformed the benchmark, since 2012, i.e. the year in which the fund was launched.

In 2021, compared to a benchmark that achieved a negative performance, the fund instead brought home a positive 0.71%.

Currently, since the beginning of the year, the fund’s performance is -0.92%.

Don’t know how to invest?

Find out what kind of investor you are. Are enough 3 minutes to discover the best strategy for you.

>> START NOW!

My Business Opinions

Now that we have finished our discussion you will surely have a little clearer ideas about Income Fund fund.

It is therefore an actively managed fund, which invests mainly in bonds and seeks to guarantee a constant income to the investor who decides to subscribe to it.

Not knowing your personal and/or financial situation, I cannot give you unequivocal advice, and I cannot tell you what to do or what not to do.

If you have had the opportunity to follow me or read my other content you will have seen that for my personal investments I prefer other instruments, such as passively managed funds, or ETFs.

The ETF in fact offers a passive replication of the reference index, and allows you to invest in a basket of stocks and bonds, being able to choose between the sectors that interest you most.

But another significant advantage that usually makes me lean towards ETFs are the costs: the management costs for this type of fund are in fact all relegated to current expenses, which are often between 0.20% and 0. 80% per year.

If you are interested in understanding more on the topic related to costs, I invite you to download our free report in which we explain the critical issues of mutual funds in detail.

In this case, the Pimco fund has a unified cost of 1.45%, which is not even that high let’s say, as there are funds that have much higher costs and which often also include subscription costs, reimbursement and performance fees.

My advice is to train yourself and acquire some skills greater to be able to invest in the markets with awareness.

Otherwise, if you are interested in this fund in particular, know that it is a fund with good performance, with fairly low costs (compared to other similar funds) and provided by a solid and safe company.

In my opinion, however, to invest in a fund that offers bonds and which has a medium risk profile, you could bet on an ETF.

However, if you have a medium risk profile and don’t have much desire to learn or study, this fund could also be right for you: furthermore, the fact that the fund has always outperformed the benchmark is not a given, on the contrary, it is a good point in favor.

Conclusions

This article is intended as a starting point, while if you are looking for more general advice on investing or starting an investment journey, I will leave you with some ad hoc insights here.

I wish you good continuation on Affari Miei.

Find out what kind of investor you are

I have created a short questionnaire to help you understand what type of investor you are. At the end, I will guide you towards the best contents selected based on your starting situation:

>> Get Started Now