Source of pictures at the event: every photo by reporter Huang Xinlei

On October 13th, the relevant person in charge of the Beijing Stock Exchange stated at the Nanjing North Stock Exchange to promote the listing of specialized special new small and medium-sized enterprises and the Jinyuzui daily road show that the establishment of the Beijing Stock Exchange is a comprehensive upgrade of the NEEQ market. It will be formed on the basis of the selection layer, and the registration system will be piloted simultaneously.

The person in charge stated that the Beijing Stock Exchange will build a set of basic institutional arrangements that fit the characteristics of innovative small and medium-sized enterprises, covering issuance and listing, trading, delisting, continuous supervision, and investor suitability management; unblock the role of Beijing Stock Exchange as a multi-level capital market link , To form a mutually complementary and mutually promoting direct financing growth path for small and medium-sized enterprises; cultivate a group of specialized and new small and medium-sized enterprises, and form a benign market ecology featuring high enthusiasm for innovation and entrepreneurship, active participation of qualified investors, and responsibility of intermediaries.

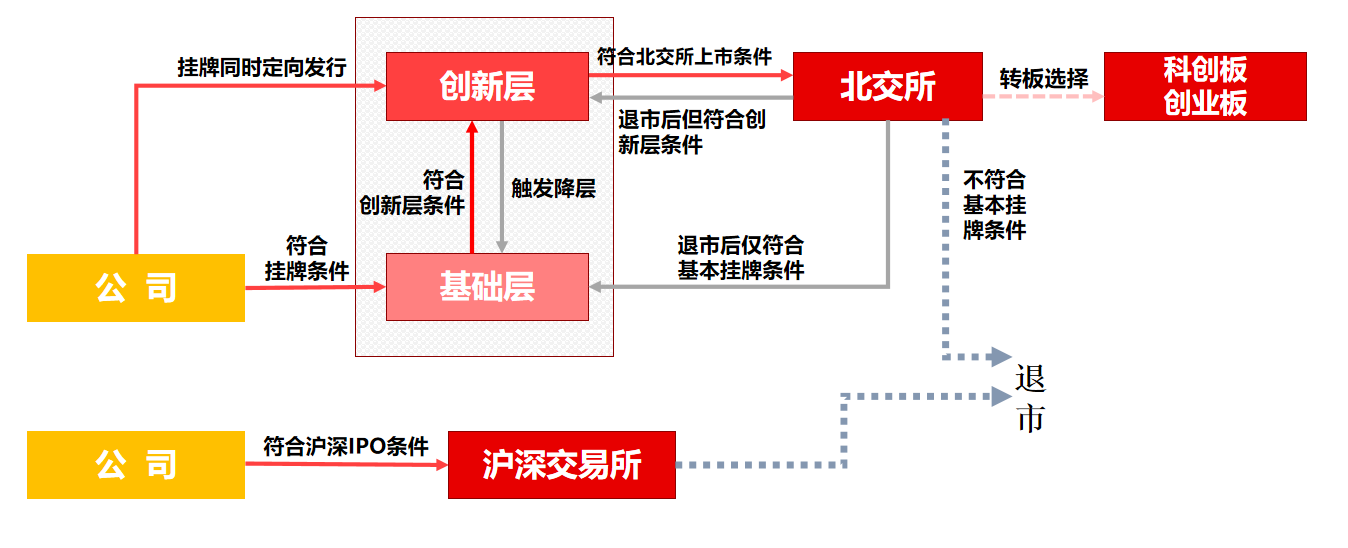

The basic layer, innovation layer of the New Third Board and the Beijing Stock Exchange “progressively”

As my country’s economy enters a new stage of development, the formation of a dual-cycle pattern has accelerated, and the importance of scientific and technological innovation has become prominent. Small and medium-sized enterprises are large in number and broad in scope, strong in resilience and vitality, and are an important force for innovation. Specialized, special new small and medium-sized enterprises have become a key carrier for the implementation of innovation-driven development and a solid guarantee for improving the stability and competitiveness of the supply chain of the industrial chain.

As the main platform for my country’s multi-level capital market to support the innovation and development of small and medium-sized enterprises, the New Third Board has adhered to the positioning of serving innovation and entrepreneurial growth SMEs since its establishment, continued to reform and innovate, market function, level system and national specialization, special new “little giant” high-quality The corporate gradient cultivation system is highly compatible.

The above-mentioned person in charge stated that the Beijing Stock Exchange will stick to its market positioning of serving innovative SMEs, respect the development rules and growth stages of innovative SMEs, and enhance the inclusiveness and accuracy of the system. Persist in the dislocation development and interconnection between the Beijing Stock Exchange and the Shanghai and Shenzhen Stock Exchanges and regional equity markets, coordinate and coordinate with the existing innovation layer and basic layer of the New Third Board, and maintain the “basic layer, innovation layer and Beijing Stock Exchange” layer. The market structure of “gradual progress”.

Screenshot from the organizer’s information

Statistics show that up to now, there are 7,303 companies listed on the NEEQ, including 5,987 at the basic level, 1,250 at the innovation level, and 66 at the selected level, covering 87 industry categories. Among these companies, 48 companies have won the National Science and Technology Awards, and 26 listed companies have been selected as the single champion list of the Ministry of Industry and Information Technology; a total of 783 listed companies have been named “little giants” with specialization and speciality.

The reporter of “Daily Economic News” learned that the Beijing Stock Exchange pilots the registration system, and the arrangements are generally consistent with the science and technology innovation board and the ChiNext. Process.

Among them, the China Securities Regulatory Commission is mainly concerned about whether there are omissions in the content of the CBEX’s issuance and listing review, whether the review procedures meet the requirements, and whether the issuer meets the relevant regulations in major aspects of the issuance conditions and information disclosure requirements; and the CBEX performs its issuance and listing review duties in accordance with the law. , To determine whether the issuer meets the issuance conditions, listing conditions and information disclosure requirements.

The average annual revenue of Jiangsu specializes and new small and medium-sized enterprises exceeds 500 million

According to Qian Zongbao, deputy director of the Jiangsu Securities Regulatory Bureau, there are currently 289 state-level specialized and special new giant enterprises in Jiangsu, 58 of which have been listed, accounting for about 18% of the number of specialized and special new small and medium-sized enterprises in the country, and 11 More than 30 companies are listed on the New OTC Market.

Qian Zongbao, Deputy Director of the Jiangsu Securities Regulatory Bureau Picture source: Picture courtesy of the organizer

“Although more than 30% of the province’s specialized and special new enterprises have entered the support ranks of the multi-level capital market, there is still a lot of room for the capital market to support small and medium-sized enterprises for larger enterprises.” Qian Zongbao said, the next step is the Jiangsu Securities Regulatory Bureau. We will implement the various work arrangements of the China Securities Regulatory Commission, continue to work with local governments to vigorously promote the reform of the capital market, and do a good job of guiding and supporting specialized and new enterprises in the cultivation and guidance link, so as to connect the capital market with high quality and efficiency.

According to Shi Xiaopeng, deputy director of the Jiangsu Provincial Department of Industry and Information Technology, in 2020, the province’s average revenue of specialized and special new small and medium-sized enterprises will exceed 500 million yuan, and the average tax revenue will exceed 12 million yuan, of which enterprises with revenue of more than 100 million yuan It accounts for more than 70%, and the average profit rate of enterprises is as high as 12.6%.

Among them, 58 of the national-level specialized and new giant enterprises are listed on the domestic A-share market, ranking first in the country. Among the 1,374 provincial-level specialized and new giant enterprises, there are 1038 enterprises with more than 10 years of maturity, accounting for The ratio has reached 75.9%. There are 210 companies with a period of more than 20 years, with an average revenue of 680 million yuan. The market share of 171 companies’ leading products ranks among the top three in the industry segment, and 55 companies’ leading product markets The market share ranks first in the domestic sub-industry.

Shi Xiaopeng also introduced that in recent years, the Jiangsu Provincial Department of Industry and Information Technology has actively explored ways to guide and promote high-quality enterprises to promote the capital market, innovate, transform, and become better and stronger. Set up the first specialized special new board, there are already 489 specialized special new small giant enterprises listed, realizing 2.923 billion equity financing.

“For a long time, the reform and development of the New Third Board has received strong support from the Nanjing Municipal Party Committee and the Municipal Government. The Beijing Stock Exchange, in conjunction with the Nanjing Municipal Government and financial regulatory authorities, has carried out a number of training and promotion activities, serving a total of 268 listed companies and providing a total of 9.886 billion in financing. Yuan.” The aforementioned relevant person in charge of the Beijing Stock Exchange introduced.

He also said that in the next step, the Beijing Stock Exchange will take the opportunity of deepening the reform of the New Third Board and the establishment of the Beijing Stock Exchange to continue to deepen the cooperation and docking with relevant parties in Nanjing, and give full play to the coupling effect of an effective market and a promising government. Special new and “little giant” enterprises focus on enterprise cultivation, jointly serve innovative small and medium-sized enterprises in the area to be listed on the NEEQ and listed on the Beijing Stock Exchange, support enterprises to share the NEEQ reform dividend, and inject new ideas into the high-quality development of Nanjing power.

Cover image source: Visual China